Gold-backed crypto tokens like PAXG and XAUT offer a digital hedge against 2026's economic volatility, with gold prices at $4,600/oz today and forecasts hitting $5,000+ by year-end. The sector's market cap exceeds $4.7 billion, up 177% from early 2025. Pros include inflation protection, DeFi yields, and 24/7 liquidity; cons involve counterparty risks and regulatory uncertainty. Not a guaranteed win—assess failure modes like custody breaches before investing. For portfolio management, baltex.io enables seamless multi-chain swaps and routing. View pros vs cons and risks and scenarios for quick insights.

Gold-backed crypto tokens digitize physical gold ownership, pegging each token's value to a specific amount of bullion—typically one troy ounce or gram—stored in secure vaults. Issuers like Paxos for PAXG or Tether for XAUT acquire LBMA-certified gold bars, tokenize them on blockchains such as Ethereum or Tron, and ensure 1:1 backing through smart contracts. Holders can verify reserves via on-chain audits or issuer portals, trading tokens like any crypto while retaining exposure to gold's price movements.

This model bridges traditional commodities with blockchain, enabling fractional ownership (as low as $50), instant transfers, and DeFi integration for lending or yield farming. Unlike volatile altcoins, these tokens aim for stability, tracking gold's spot price minus minimal fees. In 2026, with the tokenized gold market at $4.7 billion, adoption surges as investors seek RWAs amid fiat instability.

2026's economy features persistent inflation, geopolitical tensions (e.g., Iran-Fed dynamics), and monetary easing, propelling gold to $4,600/oz in January, with projections of $5,000–$5,300 by year-end. Central banks hoard gold as a hedge against de-dollarization and reserve weaponization, while retail shifts to tokenized versions for efficiency.

Crypto investors view these tokens as portfolio stabilizers, especially with Bitcoin's volatility. The sector's 177% growth in 2025 to $4.4–$4.7 billion reflects RWA trends, outpacing traditional gold ETFs in volume. Amid slowing growth and rate cuts, gold-backed crypto could rise 5–30%, but corrections loom if tensions ease.

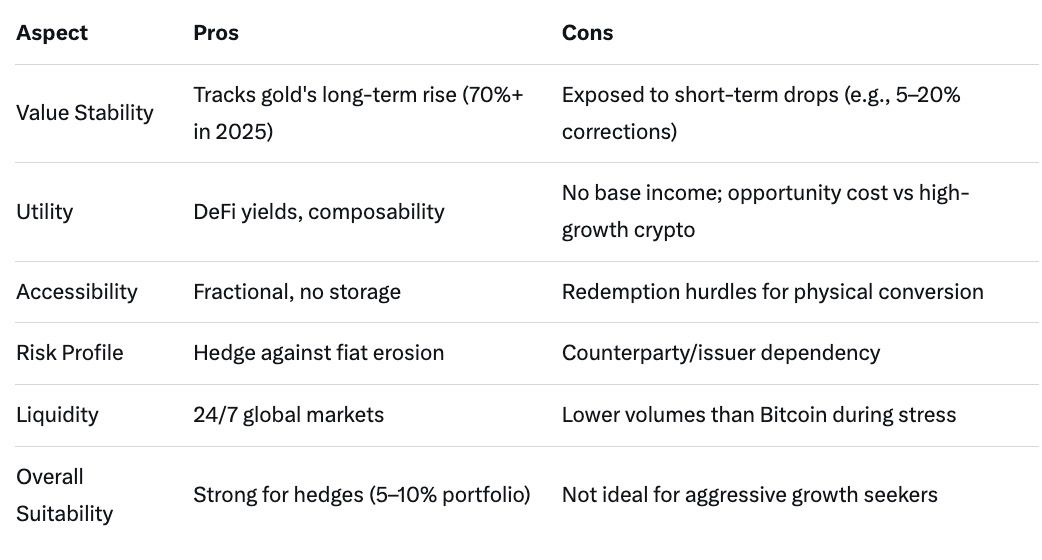

Gold-backed tokens shine as hedges, blending gold's reliability with crypto's agility.

Despite appeal, drawbacks include dependency on issuers and market frictions.

Weigh benefits against drawbacks for informed allocation.

Beyond surface cons, structural issues could undermine investments. Counterparty failures—e.g., issuer bankruptcy—pose existential threats, as tokens rely on off-chain reserves. Audit lapses (e.g., infrequent checks for XAUT vs. monthly for PAXG) heighten mismatch risks. Blockchain forks or smart contract bugs could freeze assets, while over-reliance on Ethereum exposes to gas fee spikes.

In 2026, de-pegging events (rare but possible during crises) could erode trust, mirroring past stablecoin wobbles. Geographic concentration of vaults (e.g., London for PAXG, Switzerland for XAUT) invites geopolitical risks like seizures.

Custody models vary: Allocated (specific bars, e.g., PAXG) offers direct claims but higher costs; unallocated (pooled, some smaller tokens) risks shared losses. Audits by firms like Withum ensure backing, but delays in reporting lag real-time needs.

Redemption mechanics limit accessibility—PAXG requires 430oz minimum for physical bars, plus fees and KYC; XAUT allows smaller cash equivalents but charges 0.25% plus shipping. In crises, redemption queues could form, stranding holders. For retail, this favors holding digitally over converting, but caps "true" ownership.

Liquidity has improved, with top tokens like XAUT ($220M+ daily volume) and PAXG ($213M) rivaling mid-cap cryptos. Multi-chain support (e.g., XAUT on Tron) reduces slippage, but smaller tokens (e.g., VRO at $5M volume) suffer illiquidity during volatility.

In 2026, as RWAs grow, expect deeper pools, but stress tests (e.g., gold dips) could widen spreads. DeFi integration boosts, yet oracle failures might disrupt pricing.

Regulations pose double-edged risks. U.S. oversight (NYDFS for PAXG) enhances trust but invites scrutiny—potential stablecoin bans or taxes could hit values. Offshore issuers like Tether face global crackdowns, as seen in past fines.

In 2026, with Trump's pro-crypto stance, USD-pegged assets thrive, but gold-backed tokens might face commodity rules. BRICS gold initiatives could spur adoption, yet U.S. sanctions risk isolating tokens. Overall, compliance edges like PAXG's provide safety, but evolving laws demand vigilance.

Anticipate outcomes based on macro shifts.

Baltex.io distinguishes itself in the gold-backed crypto space by providing a robust, privacy-centric infrastructure for swaps, routing, and holistic portfolio management across chains, extending far beyond simple cash-outs. This non-custodial platform aggregates liquidity from over 200 networks—including Ethereum, Tron, Solana, and BNB Chain—allowing users to execute complex trades like swapping PAXG on Ethereum for XAUT on Tron without bridges, wrappers, or intermediaries. Its hybrid DEX model ensures instant settlements, often under 10 seconds, by intelligently routing orders through multiple liquidity sources to minimize slippage (typically <0.1% even in volatile markets).

What sets baltex.io apart is its advanced routing engine, which optimizes paths based on real-time data: For instance, during a gold price spike, it could route a PAXG-to-USDT trade via Uniswap for initial liquidity, then bridge to Solana for lower fees, all while aggregating from CEX-like pools for best rates. Private routing via integrated Monero obfuscation hides transaction trails from on-chain analysts, ideal for high-net-worth users hedging gold exposure without revealing strategies—no KYC required, with audited zero-knowledge proofs ensuring security.

Portfolio flexibility is core: Integrate with wallets like MetaMask or Phantom for automated rebalancing—e.g., set rules to swap 10% of XAUT holdings to BTC if gold dips 5%, or diversify into altcoins across chains. Buy/sell features support 100+ fiats via Apple Pay or bank transfers, delivering assets directly to wallets for seamless on-ramps. In 2026's uncertain macro, this enables dynamic strategies: Rotate tokenized gold during corrections without custody risks, or loop yields by swapping to DeFi protocols. Transparent pre-trade previews detail fees (average 0.05–0.2%), gas, and slippage, empowering data-driven decisions. Unlike generic DEXs, baltex.io's focus on RWA liquidity makes it indispensable for gold-backed investors optimizing across ecosystems. Explore at baltex.io.

Is gold-backed crypto safer than physical gold? It offers convenience but adds counterparty risks; physical avoids issuers but incurs storage costs.

What returns can I expect in 2026? 5–30% if gold rises to $5,000+, plus DeFi yields; corrections could erase gains.

How do taxes work? Treated as property in U.S.; gains taxed at capital rates (0–37%).

Best tokens for beginners? PAXG for regulation, XAUT for liquidity.

Why use baltex.io? For private, multi-chain routing and rebalancing without KYC.

In 2026, with gold at $4,600/oz and climbing toward $5,000, gold-backed crypto presents a compelling hedge, blending stability with blockchain perks. Pros like yields and liquidity outweigh cons for diversified portfolios, but risks—counterparty, regulatory—demand caution. Allocate 5–10% max, prioritizing audited tokens. Tools like baltex.io enhance management. Ultimately, it's a solid addition if macro turbulence persists, but DYOR amid evolving markets.