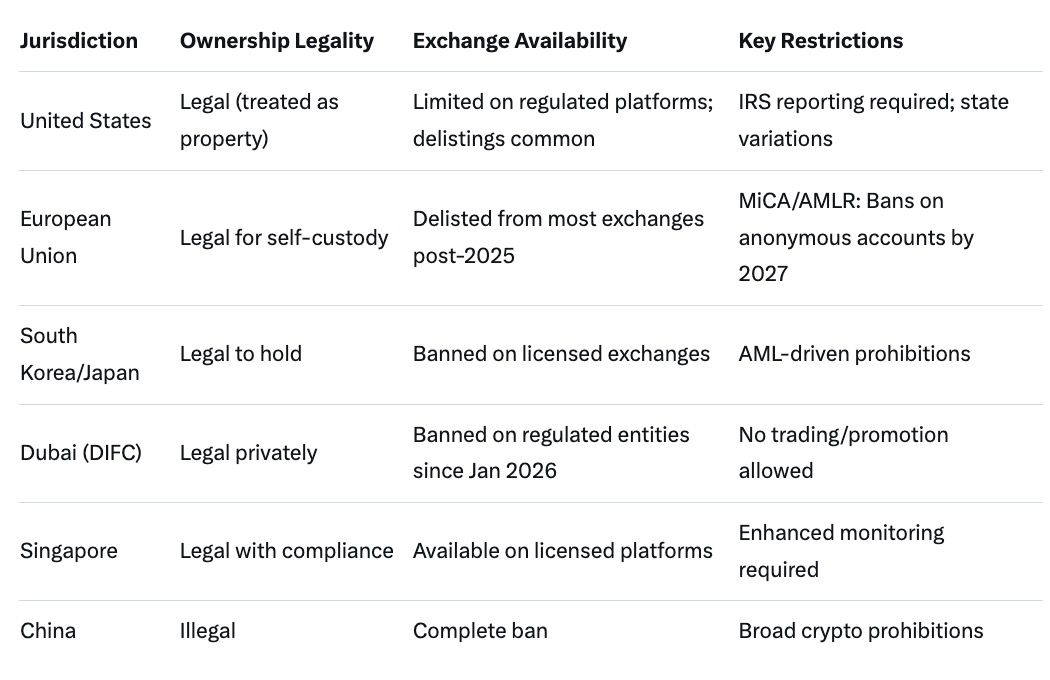

Monero (XMR) remains legal to own and use in most jurisdictions in 2025–2026, including self-custody, but faces significant restrictions on regulated exchanges due to privacy features. In the EU, MiCA and AMLR frameworks lead to delistings and a 2027 ban on anonymous accounts, increasing compliance risks. Globally, 73 exchange delistings in 2025 highlight AML concerns, yet peer-to-peer and DEX usage persists. Users must report taxes; practical constraints include limited fiat access and volatility.

Monero, known for its robust privacy features like ring signatures, stealth addresses, and confidential transactions, operates in a complex regulatory environment in 2025–2026. As governments worldwide enhance anti-money laundering (AML) and know-your-customer (KYC) measures to combat illicit finance, privacy coins such as XMR attract scrutiny for their ability to obscure transaction details. This does not render Monero illegal outright; instead, regulations target how it is traded, custodied, and integrated into financial services. For users and investors, distinguishing between ownership legality and operational restrictions is essential to avoid unintended violations.

In this guide, we examine Monero's fit within global frameworks, including the EU's Markets in Crypto-Assets (MiCA) regulation. We address jurisdictional variances, the impact of widespread exchange delistings, compliance obligations, self-custody considerations, and real-world usage challenges. By focusing on established regulatory actions and their implications, this resource equips privacy-focused individuals to navigate XMR responsibly amid evolving rules.

Monero's legality hinges on jurisdiction-specific approaches to cryptocurrency regulation. In most countries, holding or transacting XMR in a self-custodial wallet is permissible, as it is treated similarly to other digital assets like Bitcoin. However, its privacy mechanisms—designed to hide sender, receiver, and amount—raise flags under AML laws, leading to prohibitions on regulated platforms. For instance, while personal possession is not criminalized, using XMR to evade taxes or facilitate unreported activities can trigger penalties.

In 2025, Monero survived 73 exchange delistings worldwide, yet its market cap exceeded $8 billion by early 2026, reflecting sustained demand despite hurdles. Regulatory bodies argue that untraceable transactions complicate efforts to prevent money laundering, terrorist financing, and sanctions evasion. Consequently, many nations impose indirect bans through exchange restrictions rather than outright prohibitions on ownership. This creates a patchwork: users in permissive areas enjoy freer access, while those in strict regimes rely on decentralized alternatives.

Regulatory responses to Monero vary by region, influenced by local priorities for financial transparency and innovation. In North America, the U.S. classifies XMR as property under IRS rules, requiring capital gains reporting on transactions, but imposes no federal ban on holding or trading. State-level variations exist, with some platforms restricting access due to licensing requirements. Canada follows a similar path, treating Monero as a commodity with AML oversight but allowing self-custody.

Asia presents a more restrictive landscape. South Korea and Japan have effectively banned privacy coins from licensed exchanges since earlier years, citing AML risks, though personal ownership remains legal. In China, all cryptocurrencies face broad prohibitions, extending to Monero. Singapore permits privacy coins under strict compliance, while Hong Kong allows them on licensed platforms with enhanced monitoring. These measures aim to balance innovation with risk mitigation, often pushing users toward unregulated channels.

In the Middle East, Dubai's financial regulator implemented a ban on privacy coins like Monero in the Dubai International Financial Centre (DIFC) effective January 2026, prohibiting trading, promotion, and related activities on regulated entities to align with global AML standards. Individuals can still hold XMR privately, but institutional involvement is curtailed.

Africa and Latin America show mixed approaches, with limited specific regulations on privacy coins. In countries like Nigeria or Brazil, where crypto adoption is high for remittances, Monero usage continues informally, though exchanges may self-regulate to avoid scrutiny.

The EU's Markets in Crypto-Assets (MiCA) regulation, fully operational by 2026, establishes uniform rules for crypto assets, emphasizing transparency and consumer protection. While MiCA does not explicitly ban privacy coins, its requirements for asset traceability and identity verification in transactions over €1,000 effectively marginalize them. Crypto-asset service providers (CASPs) must comply with the "Travel Rule," mandating originator and beneficiary information for transfers, which conflicts with Monero's obfuscation.

Coupled with the Anti-Money Laundering Regulation (AMLR), MiCA prohibits CASPs from handling privacy coins by mid-2027, leading to widespread delistings in 2025. Exchanges like Kraken halted XMR trading in the European Economic Area (EEA) by October 2024, with withdrawals ending in December. This shifts users to decentralized exchanges (DEXs) or peer-to-peer (P2P) methods, but fiat off-ramps become scarce, complicating cash-outs. For EU residents, Monero remains legal to hold, but practical integration into compliant services is severely limited, heightening risks of non-compliance if unreported.

In the face of tightening regulations, services like baltex.io provide a pathway for Monero users to maintain privacy while navigating compliance. As a non-custodial, no-KYC aggregator, baltex.io facilitates multi-chain swaps by routing funds through XMR as an intermediary, breaking on-chain links without holding assets long-term. For EU users under MiCA constraints, this means converting compliant assets like BTC or ETH to XMR-hopped outputs, ensuring transactions align with transparency rules at entry and exit points.

The process involves selecting pairs across over 200 chains, enabling "Private" mode for Monero routing, and receiving payouts in desired assets. This complies with AML by avoiding direct privacy coin custody on regulated platforms, while fees of 0.4% plus network gas keep costs low. Unlimited limits support various volumes, and atomic-like mechanics reduce risks. Before cash-out, baltex.io's system preserves anonymity end-to-end, making it suitable for 2025–2026's environment where direct XMR-fiat ramps are restricted. Users can explore multi-chain privacy strategies for more details.

In the U.S., Monero is legal to own and transact, classified as property by the IRS since 2014, with updates in 2025 via Form 1099-DA requiring brokers to report proceeds. No federal ban exists, but the Treasury Department's Office of Foreign Assets Control (OFAC) sanctions tools like mixers, indirectly pressuring privacy assets. Exchanges face SEC and FinCEN oversight, leading to delistings on platforms like Binance.US to mitigate AML risks.

Users must report capital gains, even on obscured transactions, as tax obligations persist regardless of privacy. Self-custody is encouraged, but chain analysis firms assist authorities in monitoring, potentially leading to audits. The 2025 GENIUS Act and SEC's Project Crypto clarify classifications, treating XMR as a commodity with lighter rules than securities, but enforcement against illicit use remains aggressive.

Asian regulations emphasize AML compliance, often resulting in outright bans on privacy coins for licensed entities. Japan delisted Monero from exchanges in 2018, maintaining restrictions through 2026, while South Korea prohibits them on platforms to prevent laundering. China’s blanket crypto ban encompasses XMR, with enforcement via firewalls and penalties.

In contrast, Singapore allows privacy coins under robust monitoring, requiring exchanges to implement transaction screening. Emerging markets like India impose high taxes on crypto gains but no specific XMR ban, though exchanges self-regulate. In regions with capital controls, such as parts of Southeast Asia, Monero sees informal use for remittances, but users risk legal exposure if tied to unreported activities.

Exchange delistings accelerated in 2025, with 73 platforms removing Monero globally due to regulatory pressure. Major players like Kraken, Binance, and OKX cited compliance with AML rules, particularly in the EU and U.S. By early 2026, XMR liquidity shifted to DEXs and P2P networks, reducing accessibility for retail users but sustaining demand through decentralized channels.

This trend increases volatility, as centralized liquidity dries up, but also drives price surges amid privacy demand. Users face higher slippage on trades and limited fiat pairs, necessitating tools like atomic swaps for cross-chain conversions.

Compliance risks stem from Monero's design clashing with transparency mandates. Failure to report taxable events can lead to audits or fines, while using XMR in regulated contexts may violate AML laws. Businesses integrating Monero risk sanctions if unable to verify transactions, and exchanges handling it face delisting pressures.

In 2025–2026, risks include blacklisting of associated addresses by analytics firms, complicating integrations. However, self-custodial use mitigates some issues, provided users adhere to local reporting.

Self-custody of Monero is legal across most jurisdictions, empowering users with control over private keys without intermediary reliance. In 2025–2026, it becomes essential amid delistings, as wallets like Monero GUI or hardware devices (e.g., Ledger) allow secure storage. However, users bear full responsibility for security—lost keys mean irrecoverable funds—and must comply with taxes, treating XMR as property.

Regulations like the EU's AMLR restrict anonymous wallets for large transactions, but self-custody itself is not banned. In the U.S., IRS rules require tracking, yet privacy features do not exempt reporting. Practical implications include using Tor for node connections to enhance anonymity, though network metadata remains a vulnerability.

Monero users encounter constraints from limited infrastructure. Fiat on-ramps are scarce post-delistings, forcing reliance on P2P or DEXs like Bisq, which introduce slippage and volatility. Transaction fees remain low (under $0.01), but larger sizes due to privacy proofs slow processing on modest hardware.

In regulated areas, cashing out requires compliant bridges, risking exposure. Adoption in remittances or DeFi persists via atomic swaps, but quantum threats and governance debates add uncertainty. Users must employ VPNs or Tor to mask IP addresses, as blockchain privacy does not cover network layers.

Yes, in most jurisdictions, including the US and EU, self-custody is legal, though exchange trading faces restrictions.

MiCA imposes transparency rules, leading to delistings; a full ban on anonymous accounts arrives in 2027.

Treated as property; users must report gains, even on private transactions, under IRS or equivalent rules.

Limited; banned on licensed platforms in Japan and South Korea, available with monitoring in Singapore.

Security responsibility falls on users; lost keys mean lost funds, plus tax compliance obligations.

Reduces liquidity; users turn to DEXs and P2P, increasing volatility but sustaining demand.

It routes through XMR non-custodially, aiding privacy while avoiding direct custody bans.

In 2025–2026, Monero's legal status affirms its viability for privacy seekers, with ownership permitted globally but constrained by exchange bans and compliance demands. MiCA and similar frameworks underscore the tension between anonymity and transparency, pushing users toward decentralized solutions. By understanding jurisdictional nuances, mitigating risks, and leveraging tools like baltex.io, investors can navigate these challenges. As regulations evolve, Monero's resilience highlights the enduring need for financial privacy, though adaptation remains key to sustainable usage.