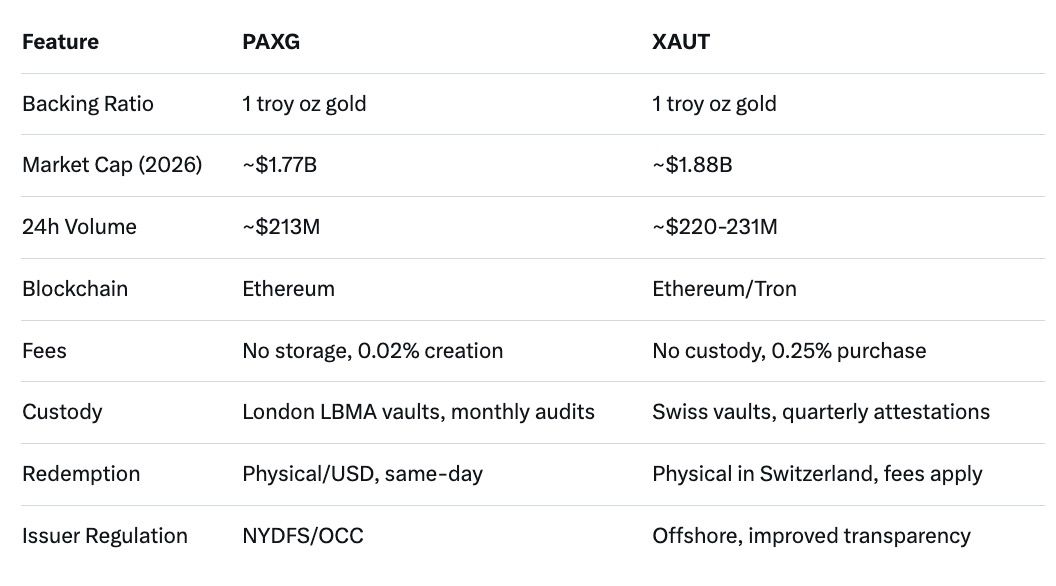

In 2026, with gold prices projected to average $5,000 per ounce amid economic uncertainty, PAXG and XAUT offer tokenized exposure as hedges. PAXG excels in U.S. regulatory compliance and transparency with monthly audits, while XAUT leads in liquidity and multi-chain support. Market caps stand at ~$1.77B for PAXG and ~$1.88B for XAUT. Key differences: PAXG has no storage fees and easier redemptions for institutions; XAUT offers Swiss delivery and broader DeFi utility. Risks include counterparty issues for both, but PAXG's NYDFS oversight provides more security. For swaps and portfolio management, use baltex.io. Compare details in our feature comparison table and risks and trade-offs table.

Gold-backed crypto tokens like PAXG and XAUT have surged in popularity by 2026, as investors seek stable hedges against inflation and volatility in traditional crypto assets. With gold hitting all-time highs above $4,600 per ounce early in the year and forecasts pointing to $5,000 by mid-2026, these tokens provide fractional ownership of physical gold without storage hassles. Backed 1:1 by allocated bullion, they combine commodity stability with blockchain efficiency, enabling 24/7 trading, DeFi integration, and quick transfers.

This guide compares PAXG and XAUT head-to-head, focusing on mechanics, custody, issuers, fees, liquidity, redemptions, regulations, and risks. Ideal for long-term holders, it highlights which might fit better in a diversified 2026 portfolio amid projected global slowdowns. No single winner exists—PAXG suits compliance-focused investors, while XAUT appeals to active traders.

PAXG, issued by Paxos, is an ERC-20 token on Ethereum, where each unit represents one fine troy ounce of LBMA-certified gold. It allows fractional ownership down to 0.01 ounces (~$50 at $5,000/oz), making gold accessible without physical handling. Holders can trade, lend, or use PAXG in DeFi protocols like Aave for yields.

The token maintains its peg through smart contracts that match supply to reserves, with real-time verifiability via Ethereum explorers. In 2026, PAXG's integration with RWAs has boosted adoption, especially among institutions hedging against fiat devaluation.

XAUT, from Tether's ecosystem, is also backed 1:1 by one troy ounce of physical gold per token. Multi-chain compatible (Ethereum and Tron), it emphasizes divisibility to 0.000001 ounces, enabling micro-transactions. Users can track specific gold bars via serial numbers on Tether's portal.

XAUT functions as a stable asset for DeFi, with seamless swaps and lending on platforms like Uniswap. By 2026, its ties to USDT have driven higher volumes, positioning it as a go-to for traders seeking gold exposure in volatile markets.

Custody transparency is crucial for trust in gold-backed tokens.

For PAXG:

For XAUT:

PAXG's more frequent audits offer superior transparency, while XAUT's Swiss custody appeals to privacy-focused users.

The issuer's reputation impacts token reliability.

PAXG's issuer:

XAUT's issuer:

PAXG benefits from Paxos' clean regulatory track record, making it preferable for institutional portfolios.

Fees affect long-term holding costs.

PAXG fees:

XAUT fees:

PAXG is more cost-effective for passive holders, while XAUT's fees suit frequent traders.

Liquidity determines ease of entry/exit.

PAXG liquidity:

XAUT liquidity:

XAUT wins on volume and adoption, ideal for 2026's high-frequency trading.

Baltex.io goes beyond simple cash-outs, offering comprehensive tools for managing gold-backed tokens like PAXG and XAUT in a multi-chain world. This non-custodial platform supports instant swaps across 200+ networks, including Ethereum, Tron, Solana, and BNB Chain, without bridges or wrapped assets. For instance, swap PAXG on Ethereum to XAUT on Tron seamlessly, optimizing for lowest fees and minimal slippage.

Advanced routing features aggregate liquidity from multiple DEXs, ensuring best rates—e.g., route a PAXG-to-USDT trade via Uniswap and PancakeSwap for efficiency. Private routing via Monero enhances anonymity, hiding transactions from on-chain trackers, ideal for privacy-conscious investors in 2026's regulated landscape. No KYC means quick access, with audited security protocols.

Portfolio management shines: Integrate wallets like MetaMask or Phantom for real-time rebalancing. Diversify by swapping PAXG into altcoins or stablecoins across chains, or use buy/sell options for 100+ fiat currencies via Apple Pay. This flexibility aids hedging—e.g., rotate XAUT holdings during gold dips without intermediaries. Transparent fees, pre-transaction previews, and low slippage make it essential for active portfolios. Visit baltex.io to streamline your strategy.

Redemption converts tokens to gold or cash.

PAXG redemption:

XAUT redemption:

PAXG offers more flexible options for U.S. users, while XAUT's Swiss focus suits Europeans.

Regulation shapes risk and accessibility.

PAXG:

XAUT:

PAXG's regulation provides safety in 2026's uncertain environment.

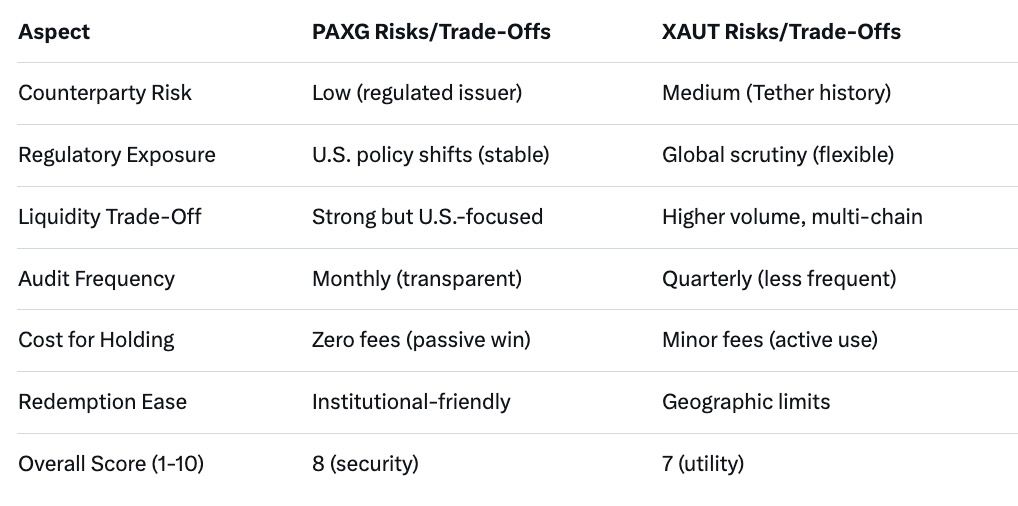

Both face similar risks, but with nuances.

PAXG risks:

XAUT risks:

Diversify to mitigate.

This table outlines core differences for quick reference.

Evaluate based on your risk tolerance.

Which has better liquidity in 2026: PAXG or XAUT? XAUT edges out with higher volumes (~$220M vs. $213M) and multi-chain support.

What are the main fees for each? PAXG: No storage, low creation (0.02%); XAUT: 0.25% purchase/redemption.

Can I redeem for physical gold? Yes—PAXG for LBMA bars in London; XAUT in Switzerland.

Which is safer from regulatory risks? PAXG, due to U.S. oversight; XAUT has more global flexibility but higher scrutiny potential.

How does baltex.io help with these tokens? Enables cross-chain swaps, private routing, and portfolio rebalancing without KYC.

In 2026, as gold climbs toward $5,000/oz, choosing between PAXG and XAUT depends on priorities: PAXG for regulatory security and low costs, XAUT for liquidity and versatility. Both serve as strong hedges, but assess risks like counterparty issues before allocating. Use tools like baltex.io for efficient management. Diversify wisely for long-term resilience.