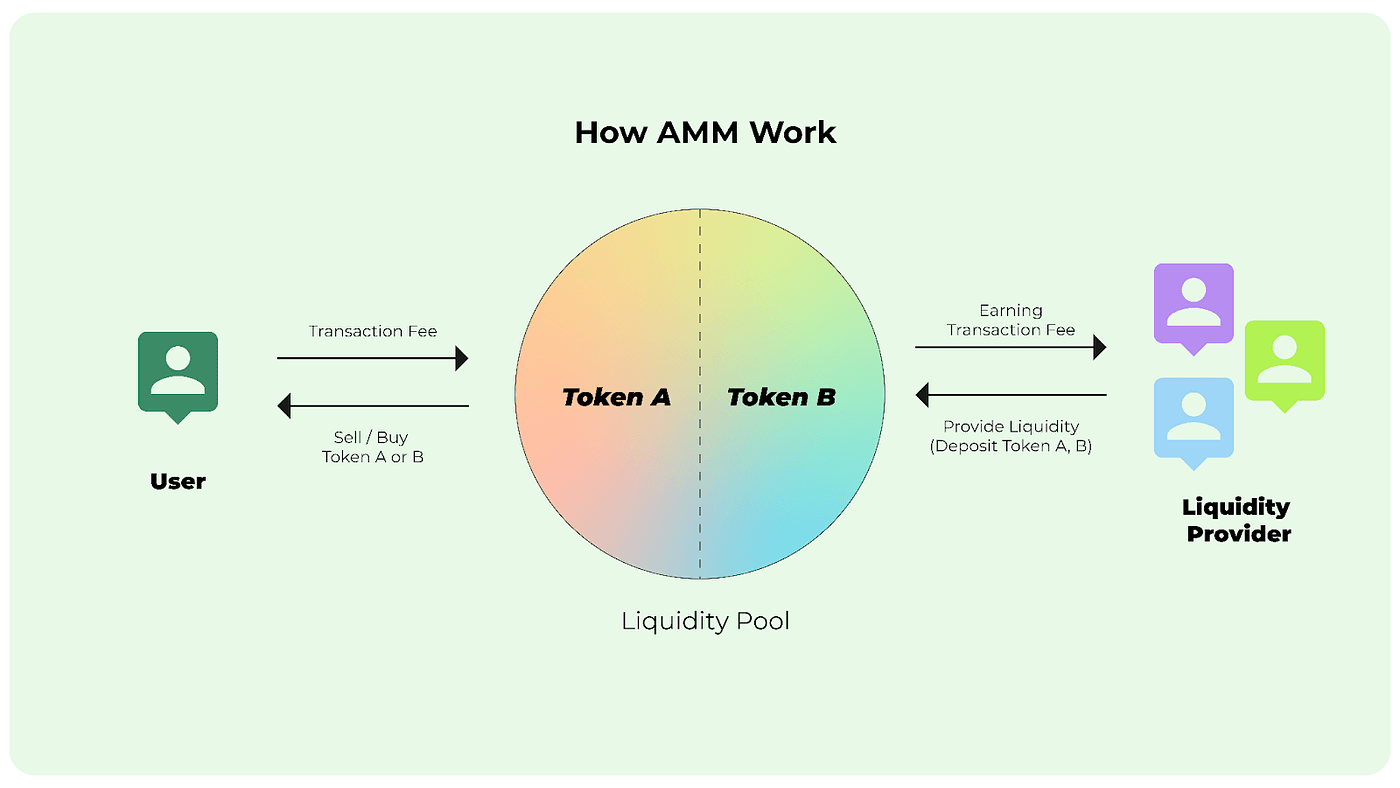

What AMMs Are: Automated market makers let users trade crypto without order books by using liquidity pools and algorithmic pricing.

How Bots Profit: Bots exploit AMM math to find arbitrage gaps, influencing token prices and capturing profits before human traders.

Key Risks: Slippage shifts execution prices; impermanent loss reduces liquidity value compared to holding assets.

MEV Factor: Validators reorder transactions (MEV) for profit, adding hidden risk to every AMM trade.

Why Users Still Join: AMMs offer full control of funds and yield potential, appealing to DeFi traders despite the risks.

Hybrid Solution: Platforms like baltex.io merge centralized speed with decentralized fairness to limit bot advantage and improve outcomes.

When you first approached the world of cryptocurrency, you might have seen that many tokens are traded on centralized exchanges (CEXs). These highly visible platforms let you place buy or sell orders in an order book, matching trades efficiently behind the scenes. Yet decentralized finance introduced a new model for trading—AMMs—where you swap tokens directly from liquidity pools instead of waiting for someone to match your order.

In a traditional order-book system, individual traders propose bids (prices they want to pay) and asks (prices at which they want to sell), and the exchange pairs them up. This model works well for large-volume markets but can be limiting for newer or less-liquid tokens, as you might have trouble finding a direct match at your desired price.

AMMs changed that paradigm by removing the concept of a direct match. Instead, each pool uses a mathematical formula—commonly something like x * y = k (the constant product formula)—to calculate token prices based on pool balances. You do not need a willing buyer or seller at your exact price. You simply interact with a smart contract that handles the mechanics for you.

Liquidity pools: These pools are essentially shared pots of crypto that liquidity providers (LPs) deposit into. When you become an LP, you supply two or more tokens in the ratio required by the AMM. In exchange, you accumulate fees or rewards whenever traders swap in the pool.

Automated pricing formulas: AMMs rely on formulas such as the constant product (Uniswap-style), constant sum, or hybrid curves. These formulas quote you a price as soon as you initiate a trade, adjusting it based on the share of tokens you want to swap.

Permissionless trading: On many DEXs, anyone can list a token by creating or adding to a pool. You do not need a brokerage account or permission from a central entity. This design fosters a more open market but also brings in the possibility of illiquid or even scam tokens.

Transparent trades: AMMs are powered by smart contracts on public blockchains. The logic behind trades and liquidity is open for you—and everyone else—to see. This transparency contrasts with centralized exchanges, where matching engines operate behind closed doors.

By understanding these pillars, you can see that AMMs attempt to democratize trading and liquidity. The cost, though, is that you have to stay on guard. Bots, especially arbitrage bots, actively prowl these liquidity pools to capture even the smallest mispricings.

On centralized exchanges, large institutional traders (and sometimes high-frequency trading firms) can move prices with big orders or by executing sophisticated strategies. In the DEX and AMM world, you have an even more automated environment—bots that run 24/7 keep watch over hundreds of token pairs. They are not attempting to match trades with each other in the traditional sense. Instead, these bots rely on code to detect pricing discrepancies between different pools or between a DEX and external price sources.

Arbitrage bots illustrate a key reason why bots, not everyday traders, dominate price action on AMMs. Imagine that token A trades at $10 on a centralized exchange, but the AMM pool is pricing it at $9.50 because someone just sold a bunch of token A. A well-coded bot quickly detects this discount and buys token A from the AMM, flipping it for $10 on the centralized exchange. The bot secures an easy profit from that 50-cent difference—assuming transaction fees and slippage do not exceed that profit margin.

Because this arbitrage cycle can be repeated, the pool rebalances. Bot trades push the pool’s price for token A back up closer to $10, effectively “correcting” the pool for that small difference. Over time, these incremental adjustments made by bots ensure that the AMM’s price aligns with the broader market.

You might believe that manual traders could similarly profit from such opportunities, but the speed and scale of competition among bots is intense. Usually, the moment an obvious discrepancy arises, an arbitrage bot closes the gap in seconds, well before you can type a transaction. Since they can operate around the clock, bots do the majority of the price discovery work on DEXs. Human traders are often just along for the ride.

Miner extractable value (MEV)—sometimes called maximum extractable value—refers to the profit that block producers (miners or validators) can capture by reordering transactions within a block before including them on the blockchain. In an AMM context, certain transactions can be front-run or back-run for profit.

Front-running: A bot sees that you intend to buy tokens, so it posts its own buy order first, pushing up the price in the pool. When your trade executes, you get a worse exchange rate, while the bot capitalizes on the difference.

Back-running: Conversely, a bot waits until after a large swap transaction is known but not yet confirmed, then places a trade behind it to exploit price movements you caused. For example, if you sold a large block of tokens, a back-running bot might immediately buy them at a cheaper price right after your sale.

Because miners in proof-of-work or validators in proof-of-stake have the final say over how transactions are sequenced in the block, they can profit with or against these bots. As a regular user, you can easily find yourself a victim of MEV if you do not use protective measures, such as certain privacy tools, limit orders on sophisticated DEXs, or specialized transaction relays.

As you get deeper into AMM trading strategies, two concepts stand out: slippage and impermanent loss. Both can significantly impact your bottom line, whether you are a liquidity provider or a simple trader.

Slippage is the difference between the quoted price when you initiate a trade and the actual price you receive when your transaction is confirmed. The AMM’s math formula changes token prices as the ratio in the liquidity pool shifts. The bigger the trade relative to the pool size, the more the price moves. This phenomenon is especially noticeable in smaller pools with less overall liquidity. You might intend to buy a token at $10, but because you are purchasing a large share of the pool, you end up paying $10.20 on average—thus experiencing slippage.

Bots can amplify this problem. Even as your transaction is waiting to be mined, arbitrage bots may see that your swap will move the price in the pool. They might front-run your order, driving up the cost further, or back-run it, capturing leftover profit. In all scenarios, you bear the extra cost if you do not plan carefully.

Impermanent loss is a risk mostly for liquidity providers, not traders. When you deposit tokens into a liquidity pool—say ETH and USDC—your holdings continually rebalance to keep the ratio fixed as traders buy and sell. If, during that time, the price of ETH rises sharply compared to USDC, you effectively end up with less ETH in your share of the pool than if you had just held ETH outright. This difference is called impermanent loss because, in theory, if prices eventually return to the levels they were at when you deposited, the loss vanishes. In practice, though, big price swings in one direction can make that “loss” very real when you withdraw your funds.

As a trader, you want to understand impermanent loss because it affects liquidity providers—and can influence how well-funded a pool remains. Fewer liquidity providers can mean higher slippage for you. Likewise, if you are also an LP, it is vital to weigh potential fee earnings against the exposure to impermanent loss.

It is tempting to think that, just because you can see an order book on a big-name centralized exchange, that market is fairer. However, every trading system has its own quirks—CEXs can have front-running too, just in a different form. By contrasting features of AMMs vs. centralized exchanges, you can decide how best to execute your trades or provide liquidity.

On a CEX, traders often rely on limit orders to set how much they are willing to pay or accept. The exchange matches these orders, and the last executed trade is the main reference for “current price.” In an AMM, prices come from the pool’s ratio of tokens. Because arbitrage bots are constantly on the prowl, AMMs generally track external market prices closely, but in less liquid pools, you may see visible price divergences for extended periods.

From your viewpoint, trading on a CEX might feel more intuitive: You see an order book and can set a limit order. On the other hand, trading on an AMM is simpler to execute—just pick how many tokens you want to swap and confirm—but less transparent about how your large trades will affect the overall price.

Centralized exchanges maintain big inventories of certain assets and do not rely entirely on user deposits for liquidity. If a pair is popular, you will typically find tight spreads and deep liquidity on a CEX. This means that large trades are less likely to move the price significantly, lowering slippage. You also benefit from advanced features like margin trading or complex order types.

With AMMs, the on-chain liquidity that traders can tap into completely depends on how many people have contributed funds to that pool. Smaller or newer tokens might have minimal liquidity, which leads to greater slippage even on modest trades. But in some markets, AMMs offer deeper liquidity than smaller, lesser-known centralized platforms, precisely because they can aggregate funds from many community members. The key is to check how large the pool is, examine the token pair’s historical volatility, and weigh the fees before you commit.

Because bots have such a huge influence on AMMs, you need to adapt your strategies. By understanding the typical behaviors in these pools, you can make more informed decisions. Below are some common AMM trading strategies that might help you navigate the ecosystem.

If you do not want to actively trade, you can deposit your tokens as liquidity and earn a share of trading fees. This approach can be laid-back, but you have to account for impermanent loss. If the token pair experiences significant price divergence, your share of the pool may lag behind simply holding the tokens individually.

To reduce risk:

Pick stablecoin pairs or pairs that typically move together. For instance, stablecoin-stablecoin pairs may minimize price divergence, though the upside in fees may also be smaller.

Reassess pool performance regularly and track your impermanent loss periodically. Some analytics tools provide real-time estimates.

If you actively monitor markets, you can adjust your liquidity position or trading approach to manage short-term opportunities. It might mean pulling liquidity when you see a big move coming in one token or adding more liquidity after a large trade to capture fees from the rebalancing that follows. This can be time-intensive and, depending on transaction fees, might eat into your profitability.

Some protocols offer “concentrated liquidity,” letting you choose a specific price range to position your liquidity. You earn more fees if the trading price remains within your specified band. However, if the price shoots past that band, you earn no fees until you readjust. This approach allows for more precise control but also demands more hands-on management.

Bots typically dominate arbitrage in AMMs. Still, you might find niche opportunities if you watch less-trafficked pools and act quickly when prices deviate from external markets. For instance, if a small liquidity pool is slow to update after a major price shift, you could buy or sell tokens there, then immediately offset the trade on a centralized exchange or another DEX, capturing the spread.

To attempt manual arbitrage:

Monitor leading exchange prices for your target token pairs.

Watch for short-term mismatches on the AMM.

Pay careful attention to transaction fees and potential slippage.

Keep in mind that the window for profitable manual arbitrage is usually tiny. Bots with direct access to mempool data—where pending transactions are visible—might see your arbitrage attempt and front-run you. Proceed only if you are aware of the risks and can handle lost gas fees.

As the popularity of AMMs has grown, new platforms aim to refine the model. One such hybrid solution is baltex.io, which tries to combine the autonomy and transparency of AMMs with some protective mechanisms typically seen on centralized platforms. The goal is to minimize the influence of harmful MEV practices and provide more predictable pricing.

Unlike a purely on-chain AMM, a hybrid system may incorporate order matching or partial off-chain computations to reduce front-running potential. The idea is to give you the best of both worlds: immediate, permissionless swaps plus a fairer playing field that bots cannot easily manipulate. If successful, these solutions can help everyday users overcome some of the drawbacks that standard AMMs currently face.

Why highlight a hybrid approach?

Reduced MEV: Some hybrid platforms manage transaction sequencing in ways that deter or block front-running opportunities.

Lower slippage: By aggregating liquidity or placing off-chain orders, you may see fewer big price swings for large trades.

Enhanced user experience: Fewer of the pitfalls that can plague purely on-chain trades—like network congestion or transparency that invites bots—possibly means that you enjoy cheaper and smoother swaps.

While the success of any hybrid model depends on sustainable incentive structures and robust security, platforms like baltex.io suggest that the AMM landscape is continuously evolving. If you are aiming for a more level playing field, it is worth keeping an eye on such approaches.

Below are a few clarifications you might find helpful if you are exploring AMMs and want to learn more about how bots, not traders, dominate prices.

Why are AMMs so popular in DeFi? AMMs allow permissionless trading of virtually any token, do not require a central authority to match orders, and offer a chance for individuals to earn fees by providing liquidity. Their open structure is appealing even though it invites sophisticated automated strategies.

Do I need to worry about bots if I trade small amounts? Bots most commonly target large trades or obvious arbitrage opportunities. If you trade small amounts in a popular pool, your slippage might be minimal. But you should still be aware that front-running can happen, especially in volatile markets or with low-liquidity tokens.

What is the main difference between AMMs and order-book exchanges? AMMs automatically set prices based on the ratio of tokens in the pool. Order-book exchanges rely on bids and asks. AMMs can be simpler to use, but large trades on them face higher slippage compared to well-capitalized centralized exchanges.

How does MEV affect me as an end user? MEV can lead to getting worse execution prices on your trades if bots or miners reorder your transaction. You might pay more or receive less than expected. Sometimes you can mitigate this by using specialized transaction relays, private mempools, or limit-order protocols.

Can I beat the bots at their own game? It is challenging. Bots usually have advanced monitoring tools, and they operate around the clock. While it is not impossible to find gaps in coverage or smaller niches, generally, you would need a technical background, low-latency infrastructure, and a willingness to accept high risk.

Is impermanent loss inevitable if I provide liquidity? Impermanent loss happens whenever the relative prices of your deposited tokens diverge. If your token pair remains stable or moves together, the loss could be minimal. However, highly volatile pairs can experience big swings that amplify impermanent loss.

How can baltex.io help me as a trader? baltex.io uses a hybrid approach that attempts to cut down on front-running and reduce slippage, creating a fairer environment for routine traders. While it is still wise to do your own research and remain cautious, the platform’s design addresses some of the big hurdles typical AMMs face.

Are AMMs or centralized exchanges safer? Safety depends on your goals. CEXs often require you to trust that the platform is solvent and secure, whereas AMMs let you hold your own keys. However, AMM users can face hacking risks in smart contracts or volatile on-chain dynamics. Evaluate security measures, the strength of the smart contracts, and your personal risk tolerance before deciding.

Does providing liquidity always guarantee a profit? No. While you can earn fees from trading activity, impermanent loss sometimes outstrips those gains if token prices move drastically. Monitor the pool’s performance to determine whether you are coming out ahead.

What if the pool runs out of liquidity for a token? In practice, it seldom “runs out” because of how the formulas adjust price. If someone tries to buy all of one token from the pool, the cost will rise dramatically, making it unprofitable to keep buying. Still, extremely low liquidity can make trading nearly impossible or unprofitable.

ARound-the-clock bots are the invisible engine behind many AMMs, constantly scanning for arbitrage opportunities and adjusting prices in real time. While this helps keep prices relatively stable, you can find it frustrating as a retail trader or liquidity provider trying to get a slice of the pie. The simple truth is that your trades—especially large ones—might be front-run, meaning you pay more and risk losing potential profits to automated scripts.

Nonetheless, AMMs remain a cornerstone of DeFi by giving you open access to emerging tokens, letting you earn yields from protocol fees, and removing gatekeepers. If you tread carefully—keeping an eye on slippage, impermanent loss, and liquidity conditions—you can still discover profitable niches. Pay attention to evolving solutions like baltex.io, where a hybrid approach might alleviate some of the disadvantages of standard AMMs. By adapting your approach, you may find that the path to successful AMM trading involves understanding how bots operate, minimizing your exposure to front-running, and focusing on liquidity pools that align with your risk tolerance.

Now that you have the background, look closer at the pools for your favorite tokens. Experiment with small trades and watch how the price shifts, so you can formulate better AMM trading strategies that suit your goals. When you stay informed about arbitrage dynamics, MEV, and the intricacies of on-chain liquidity, you stand to make more solid decisions. And in a market where bots run the show, knowledge can be a powerful asset in helping you protect and grow your investments.