In 2025, Baltex and Changelly both offer reliable crypto swap services, but they cater to slightly different priorities. Baltex excels in privacy-focused, instant cross-chain swaps with no KYC for most users, minimal fees through optimized routing, and support for over 10,000 tokens across 200+ networks, making it ideal for quick portfolio rebalancing and anonymous trades. Changelly provides low fees of up to 0.25%, broader fiat integration, and swaps for over 1,000 assets, but requires KYC for higher limits and takes 5-40 minutes per swap. For speed and privacy, Baltex leads; for regulated, beginner-friendly exchanges with predictable costs, Changelly holds strong. See our feature comparison table below for a quick overview.

As cryptocurrency adoption surges in 2025, swap services have become essential for users navigating volatile markets, rebalancing portfolios, and moving funds across chains efficiently. Baltex and Changelly stand out as popular platforms for cross-chain swaps, each addressing the needs of crypto enthusiasts who prioritize speed, cost predictability, and privacy. Baltex, accessible via baltex.io, emphasizes non-custodial, private swaps with instant execution, appealing to those seeking anonymity and seamless multi-chain operations. Changelly, on the other hand, focuses on user-friendly interfaces, low fees, and integration with major exchanges for reliable rates. This guide compares their fees, spreads, swap speeds, slippage risks, limits, supported chains, KYC requirements, privacy features, and potential failure scenarios. We'll also outline step-by-step swap flows, safety checks, and explore how Baltex enables advanced use cases like portfolio rebalancing and cash-out preparation. Whether you're trading altcoins, bridging assets, or prepping for fiat conversion, understanding these platforms can help you choose the right tool for secure, efficient transactions.

In a landscape where regulatory scrutiny is increasing, privacy remains a key concern for many users. Baltex positions itself as a privacy-centric alternative, routing swaps through mechanisms like Monero to break transaction links, while Changelly balances privacy with compliance through tiered KYC. Speed is another differentiator: Baltex delivers near-instant swaps, ideal for fast-moving markets, whereas Changelly's process, though reliable, involves waiting periods due to blockchain confirmations. Fees on both are competitive, but spreads and slippage can vary based on market conditions and routing methods. Limits are generous, but Changelly ties them to verification levels, potentially slowing down high-volume traders. Supported chains and assets are extensive on both, covering major networks like Ethereum and Solana, but Baltex's 200+ chain support edges out for truly multi-chain environments. Failure scenarios, such as network congestion or user errors, are mitigated through safety protocols, but awareness is crucial. By the end of this guide, you'll have a clear picture to optimize your swaps for cost, speed, and security.

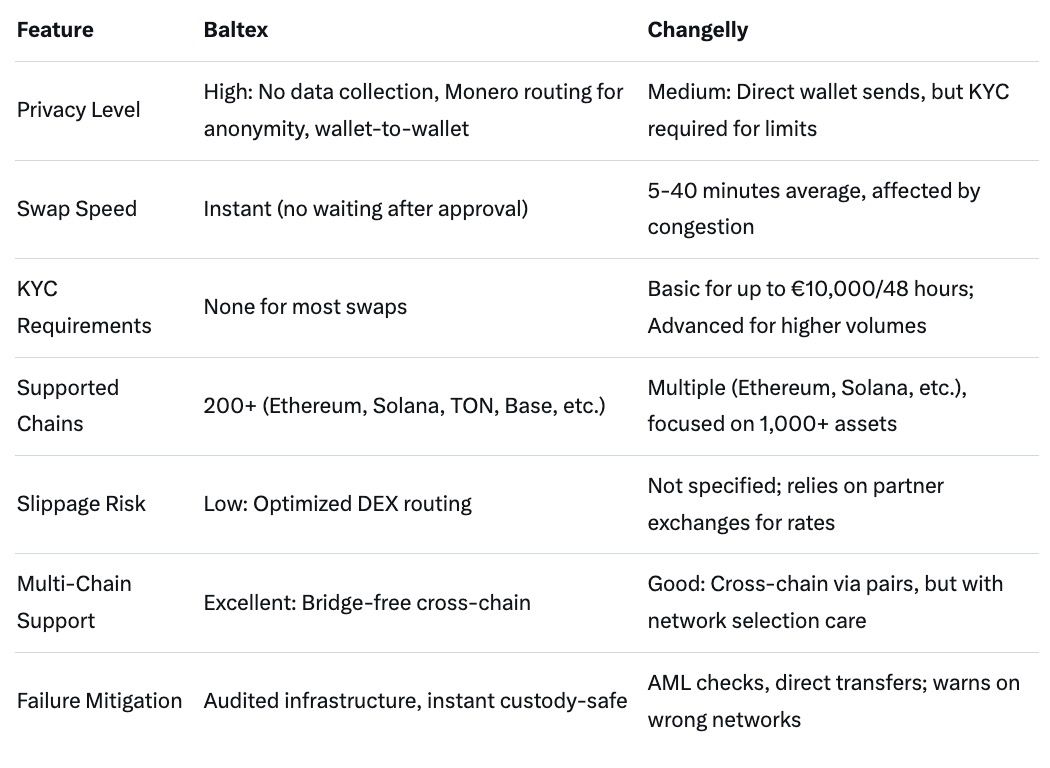

To provide a clear snapshot, here's a side-by-side comparison of key features between Baltex and Changelly in 2025. This table highlights differences in core aspects like privacy, speed, and chain support, helping you quickly assess which platform aligns with your needs for trading or fund movement.

This comparison underscores Baltex's edge in privacy and speed for users avoiding verification, while Changelly offers more structured compliance for those needing higher limits. For deeper insights, read our section on KYC and Privacy.

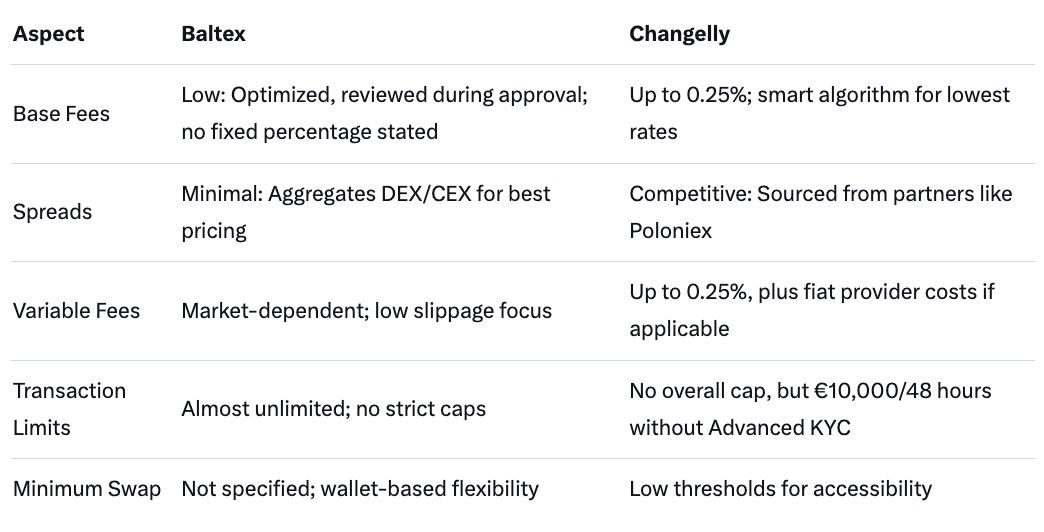

Understanding fees and limits is critical for predictable costs, especially when rebalancing or preparing for cash-outs. Below is a detailed table comparing these elements, including spreads, variable fees, and transaction caps in 2025.

Baltex's fee structure favors users seeking minimal overhead in volatile markets, with aggregation reducing spreads effectively. Changelly's flat 0.25% cap provides predictability, though KYC can introduce delays for larger swaps. These elements ensure both platforms suit different trading volumes, but always review rates in-app for real-time accuracy.

When comparing fees between Baltex and Changelly, the focus shifts to how each platform structures costs for transparency and competitiveness. Baltex operates with a user-centric approach, where fees are not rigidly fixed but optimized through smart routing that aggregates liquidity from both centralized and decentralized exchanges. This means users often encounter minimal spreads, as the platform prioritizes the lowest possible slippage by scanning multiple order books. In practice, this results in effective fees that are market-driven but generally lower than traditional bridges, especially for cross-chain trades. For instance, swapping BTC to SOL might involve a small variable fee based on network gas, but the overall cost is displayed upfront during the approval step, allowing users to avoid surprises. This model appeals to privacy-conscious traders who value efficiency over a one-size-fits-all percentage.

Changelly, conversely, boasts a straightforward fee of up to 0.25%, which is among the lowest in the industry for instant exchanges. This rate is achieved through integrations with major platforms like Bittrex and Poloniex, ensuring competitive spreads by pulling the best available market rates. However, additional costs can arise from fiat providers if you're buying crypto with traditional currency, potentially widening the effective spread. For pure crypto-to-crypto swaps, the fee remains predictable, making it suitable for users who prefer a simple calculation without delving into routing details. In 2025, with market volatility, Changelly's algorithm adjusts dynamically, but spreads can fluctuate during high congestion periods. Overall, Baltex edges out for those minimizing costs in multi-chain scenarios, while Changelly's capped fee provides peace of mind for beginners.

Speed is a make-or-break factor for crypto users in fast-paced markets, and here Baltex shines with its instant swap execution. Once a transaction is approved, tokens arrive in your wallet without delays, leveraging non-custodial, wallet-to-wallet transfers that bypass traditional waiting times. This is particularly advantageous for cross-chain operations, where Baltex avoids bridges and wrapped tokens, reducing the risk of slippage to minimal levels through optimized DEX routing. Slippage, the difference between expected and actual prices, is mitigated by real-time aggregation, ensuring trades execute close to quoted rates even in volatile conditions. For users rebalancing portfolios during market dips, this combination of speed and low slippage risk means less exposure to price swings.

Changelly's swap speed averages 5-40 minutes, depending on blockchain confirmations and network load, which can extend during peak times. While reliable, this wait period introduces more slippage potential if markets move against you mid-process. The platform doesn't explicitly detail slippage mitigation, but its partnerships with established exchanges help stabilize rates. In failure-prone scenarios like congestion, Changelly advises users to monitor progress, but the inherent delay makes it less ideal for time-sensitive trades compared to Baltex's instantaneous model. For those prioritizing predictability over raw speed, Changelly's approach still delivers, but Baltex better suits active traders needing quick fund movements.

Transaction limits on Baltex are notably flexible, with almost no strict caps, allowing high-volume swaps without barriers. This unrestricted approach supports over 200 networks, including Ethereum, Solana, TON, and Base, alongside 10,000+ tokens like BTC, ETH, XMR, and privacy coins. Such breadth enables seamless cross-chain routing, ideal for diverse portfolios.

Changelly imposes no overall limits but ties them to KYC levels, capping unverified users at €10,000 every 48 hours. It supports multiple chains for over 1,000 assets, focusing on popular pairs like BTC to ETH, with careful network selection to prevent errors. While robust, its chain support is less expansive than Baltex's, making the latter preferable for exotic multi-chain needs.

KYC requirements highlight a core divergence: Baltex requires none for most swaps, operating fully wallet-to-wallet with no personal data collection. Privacy is enhanced through Monero-based routing, breaking transaction links and hiding trades from on-chain analysis, appealing to users valuing anonymity in 2025's regulated environment.

Changelly mandates Basic KYC (passport submission) for trades up to €10,000 every 48 hours, escalating to Advanced for larger amounts with video verification. Privacy is maintained via direct wallet sends without fund storage, but compliance features like AML checks reduce anonymity compared to Baltex. For users in restricted regions, this can limit access, whereas Baltex's no-KYC model offers broader freedom.

Common failures on Baltex include network-specific issues or approval errors, but its audited, custody-safe design minimizes risks, with instant execution reducing exposure. Users should double-check wallet connections to avoid mishaps.

Changelly faces risks like selecting the wrong network, leading to lost funds, or delays from congestion. Its safety nets include progress tracking and warnings, but reliance on external confirmations heightens vulnerability compared to Baltex's streamlined process.

For Baltex, the swap flow is straightforward and privacy-oriented. Start by selecting your input and output tokens on baltex.io. Connect your wallet, such as MetaMask or Phantom, ensuring it's funded. Review the quoted rate, fees, and estimated slippage— this is your key safety check to confirm no unfavorable terms. Approve the transaction in your wallet, and tokens arrive instantly without intermediaries. Safety measures include non-custodial execution, where you retain key control, and optional private modes using Monero for added anonymity. Always verify the receiving address and use hardware wallets for larger amounts to enhance security.

Changelly's process begins with choosing the exchange pair on their site. Enter your recipient wallet address carefully, as mismatches can cause failures— this is a critical safety step. Send your crypto to the provided deposit address, then monitor the transaction via the platform's tracker. Coins arrive after confirmations. Safety checks involve KYC compliance for limits, AML screening to prevent fraud, and partnerships with secure wallets like Ledger. Avoid rushing network selections to prevent irreversible errors, and use two-factor authentication on linked accounts for extra protection.

Baltex.io stands out in 2025 for its ability to facilitate quick multi-chain swaps tailored to real-world crypto activities, such as portfolio rebalancing, cross-chain routing, and preparing for cash-outs. For portfolio rebalancing, users can swiftly exchange assets across networks like Ethereum to Solana without bridges, ensuring minimal downtime. Imagine holding ETH but spotting an opportunity in SOL-based DeFi— Baltex aggregates liquidity for instant swaps, preserving value during market shifts. This non-custodial approach keeps funds in your wallet, reducing risks associated with centralized holds.

In cross-chain routing, Baltex eliminates wrapped tokens and intermediaries, routing trades efficiently across 200+ chains. This is invaluable for arbitrage or diversifying holdings, where speed prevents slippage from delayed bridges. Privacy features, like Monero relays, ensure transactions remain untraceable, protecting against on-chain surveillance. For preparing cash-outs, Baltex supports fiat-to-crypto buys via methods like Apple Pay or bank transfers, landing assets directly in your wallet. This setup allows anonymous accumulation before converting to fiat elsewhere, with low fees maintaining cost efficiency. Whether rebalancing during volatility or routing funds for liquidity, Baltex's design empowers users with control, speed, and discretion, making it a versatile tool for advanced crypto strategies.

Baltex offers optimized, variable fees with minimal spreads via aggregation, while Changelly caps at 0.25% for predictability.

No, Baltex operates without KYC for most swaps, prioritizing privacy.

Swaps take 5-40 minutes on average, depending on network conditions.

Baltex, with its Monero routing and no-data policy, provides stronger privacy than Changelly's KYC-tiered system.

Yes, Baltex supports instant multi-chain swaps for rebalancing without bridges.

In 2025, choosing between Baltex and Changelly depends on your priorities: Baltex for unparalleled privacy, instant speeds, and multi-chain flexibility, or Changelly for low, predictable fees and compliant high-volume trading. Both mitigate risks effectively, but Baltex's non-KYC, anonymous routing makes it superior for users focused on sovereignty and quick fund movements. Explore our guide on no-KYC exchanges for more options, or dive into cross-chain strategies to maximize your setup. Ultimately, test both with small amounts to find your fit in this evolving crypto landscape.