In 2025, Baltex and Coinbase embody contrasting crypto philosophies: Baltex offers no-KYC, non-custodial swaps with instant execution across 200+ cryptocurrencies and chains like ETH, SOL, and TON, featuring low fees from gas and routing, unlimited limits, and privacy via Monero routing, ideal for anonymous rebalancing and cash-outs. Coinbase, a regulated brokerage, mandates KYC with tiered limits up to $100,000+ daily withdrawals, variable trading fees disclosed in previews, spreads in simple trades, and support for thousands of assets on EVM chains plus Solana, but with custodial risks and data exposure. Baltex prioritizes privacy and control; Coinbase emphasizes compliance and accessibility. Check our tables for quick comparisons.

Crypto users in 2025 navigate a landscape where privacy and regulatory compliance often clash, making the choice between no-KYC platforms like Baltex and regulated brokerages like Coinbase crucial. Baltex, via baltex.io, provides decentralized, wallet-to-wallet swaps that bypass verification, appealing to those valuing anonymity in trading, portfolio rebalancing, cross-chain transfers, and cash-out setups. Coinbase operates as a full-service brokerage with strict oversight, offering user-friendly interfaces and fiat integrations but requiring personal data submission.

This guide compares them through the no-KYC swaps versus regulated brokerage lens, covering fees, spreads, execution speed, slippage risks, limits, supported assets and chains, custody and counterparty risks, compliance and data exposure, onboarding and withdrawals, and failure scenarios. Practical step-by-step flows with safety checks illuminate workflows, while tables provide at-a-glance insights. A section on Baltex's multi-chain capabilities highlights its strengths. As regulations evolve, Baltex suits sovereignty seekers, while Coinbase fits those preferring structured security in volatile markets.

The no-KYC model reduces exposure to data breaches, but regulated platforms like Coinbase ensure consumer protections. Both handle diverse assets, yet their approaches to cross-chain functionality and user limits shape efficiency for high-stakes operations.

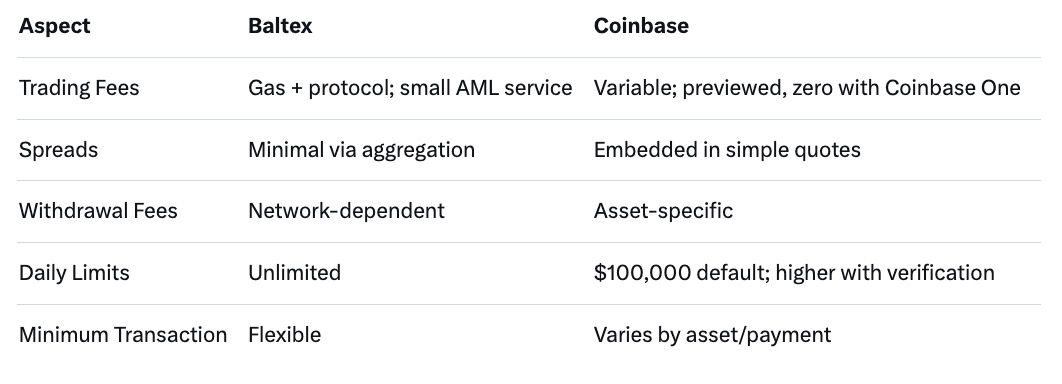

This table contrasts key elements in 2025, emphasizing privacy versus regulation.

Fees influence profitability in frequent trades. Baltex charges low fees comprising blockchain gas, protocol costs, and optional routing fees, all displayed upfront without hidden charges. For fiat layers, provider-dependent fees apply, while a small service fee covers AML screening. Spreads are minimal due to aggregation, making it cost-effective for no-KYC swaps.

Coinbase's fees vary by transaction type, calculated at order time based on payment method, size, and location, shown in previews. Spreads are embedded in simple buy/sell quotes to ensure execution, potentially retained as excess. Advanced trades avoid spreads via order books, and Coinbase One subscribers enjoy zero trading fees for $30/month, excluding DEX service fees.

Baltex's transparent, low-overhead structure favors privacy users, while Coinbase's variable model benefits regulated, high-volume traders with discounts.

Speed is vital for capturing market opportunities. Baltex processes swaps instantly to 30 minutes, depending on network and asset, with bridgeless cross-chain execution. Slippage is managed via user-set tolerances, keeping risks low through optimized routing.

Coinbase executes trades near-instantly, but withdrawals and conversions involve confirmations, extending to minutes. Slippage varies; DEX quotes are estimates, adjustable within tolerances, while market conditions affect simple orders.

No-KYC Baltex offers quicker control for urgent rebalancing, contrasting Coinbase's reliable but confirmation-bound speed.

Limits dictate operational scale. Baltex has no transaction limits, accommodating small to large swaps seamlessly. It supports over 200 cryptocurrencies across chains like Ethereum, Solana, TON, Avalanche, and Polygon, enabling broad cross-chain movements.

Coinbase's limits tie to account levels: default withdrawal at $100,000 daily, increasable via verification. It handles thousands of assets, including ERC-20 tokens on EVM-compatible chains like Arbitrum, Polygon, and Solana.

Baltex's unrestricted access suits flexible users; Coinbase's tiered system scales with compliance.

Breakdown of costs and constraints in 2025.

Custody models define security. Baltex's non-custodial approach keeps users in control, with no fund holding or key access, minimizing counterparty risks.

Coinbase holds assets custodially, introducing risks despite insurance and audits; regulatory compliance adds potential for freezes.

No-KYC reduces Baltex's exposure; regulated Coinbase trades convenience for trust in safeguards.

Compliance shapes privacy. Baltex requires no KYC for core swaps, using AML screening without personal data; fiat may trigger verification based on size or region. Privacy features like Monero intermediaries obscure traces.

Coinbase mandates KYC with ID and address proof for levels, storing data for AML and sharing as required, heightening exposure.

Baltex minimizes data risks; Coinbase prioritizes regulatory adherence.

Onboarding differs starkly. Baltex requires no registration; connect a wallet to start swaps, with fiat onboarding via providers potentially needing KYC. Withdrawals are direct to wallets, instant post-execution.

Coinbase demands account creation and verification; onboarding involves app signup and limits increase requests. Withdrawals process via bank or crypto, limited by level.

No-KYC simplifies Baltex entry; regulated paths ensure Coinbase accountability.

Failures disrupt trust. Baltex risks include network congestion delaying swaps or approval errors, mitigated by previews; no custody means no platform losses.

Coinbase scenarios encompass order failures from volatility, KYC blocks, or outages; support resolves but delays occur.

Awareness and checks prevent most issues.

Swapping on Baltex: Select assets/chains on baltex.io. Connect wallet. Review fees, rate, slippage—essential safety for terms. Approve; receive in minutes. Safety: Revoke approvals post-swap, use hardware wallets.

On Coinbase: Sign up, verify KYC. Fund account. Place order via simple/advanced. Confirm. Safety: Set tolerances, enable 2FA.

Cross-chain on Baltex: Choose differing chains in swap; routing handles. Safety: Check compatibility upfront.

Coinbase: Use wallet for bridges or exchange conversions. Safety: Verify networks.

Onboarding Baltex: Wallet connect, no signup. Safety: Secure connection.

Coinbase: App signup, ID upload. Safety: Official site.

Withdrawals Baltex: Direct receipt. Safety: Address verification.

Coinbase: Select method, confirm limit. Safety: Whitelist addresses.

Moving funds: Baltex to Coinbase—swap, send to address. Reverse: Withdraw, swap on Baltex. Safety: Test small, track via explorers.

Baltex.io in 2025 facilitates swift multi-chain swaps, boosting efficiency for key activities. For portfolio rebalancing, users instantly trade across chains like ETH to SOL without bridges, aggregating liquidity for optimal rates and low slippage. Non-custodial execution maintains control during volatility.

Cross-chain routing uses efficient paths or Monero for privacy, enabling seamless transfers like AVAX to TRX for diversification or arbitrage.

Cash-out prep involves anonymous fiat buys to wallet, then swaps to stables; no limits aid accumulation. Baltex empowers private, rapid strategies.

Variable, previewed; zero with Coinbase One, spreads in simple trades.

No for core swaps; optional for fiat or high-risk.

EVM-compatible like Arbitrum, Polygon, plus Solana.

Unlimited transactions.

Monero routing for untraceable swaps.

Baltex's no-KYC swaps excel for privacy and flexibility in 2025, while Coinbase's regulated model provides compliance and tools at custody costs. Choose based on priorities—anonymity or oversight. For more, see no-KYC exchanges or regulated brokerages. Test cautiously to suit your needs.