In 2026, Baltex and KuCoin offer distinct paths for crypto users: Baltex provides decentralized, non-custodial cross-chain swaps with no KYC, instant execution, and high user control, ideal for privacy and quick rebalancing without limits. KuCoin delivers centralized trading with deep liquidity, KYC-tiered limits up to 999,999 USDT daily withdrawals, and integrated bridgeless swaps via tools like Pact_Swap, but with custody risks and data exposure. Baltex features low, optimized fees through aggregation, while KuCoin charges 0.1% trading fees. For self-custody and unlimited swaps, Baltex leads; for structured limits and fiat options, KuCoin suits regulated needs. Review our comparison tables for key differences.

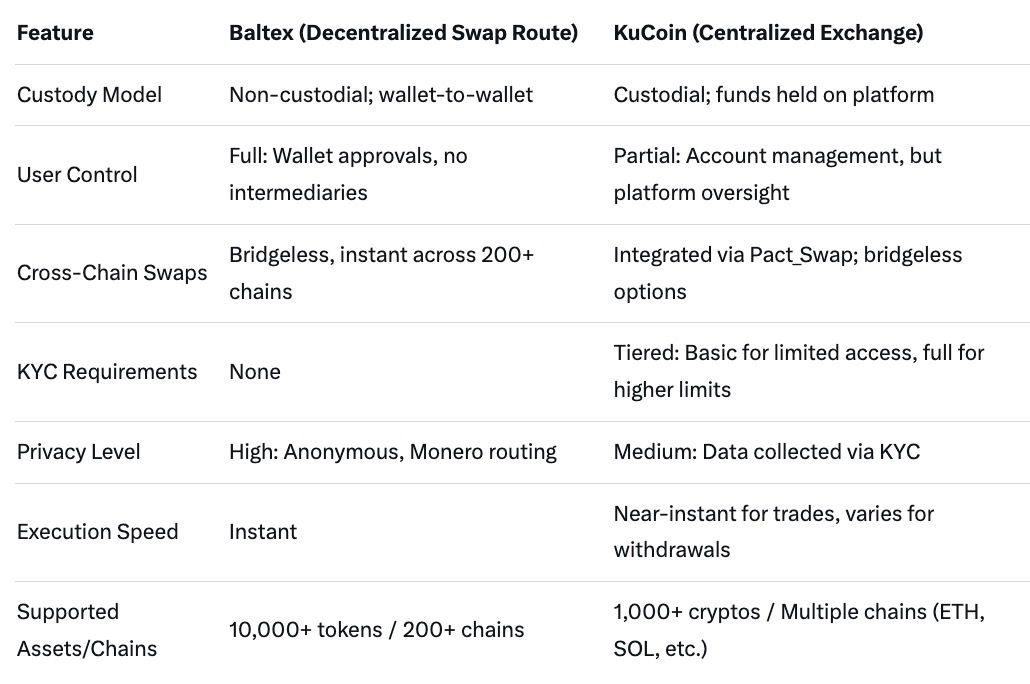

As crypto ecosystems expand in 2026, users increasingly weigh cross-chain capabilities, transaction limits, and control over their assets when choosing platforms. Baltex, through baltex.io, represents a user-centric, decentralized swap route emphasizing self-custody and privacy, allowing seamless movements across chains without intermediaries. This model appeals to those prioritizing anonymity and flexibility in trading, portfolio rebalancing, fund transfers, and cash-out preparations. KuCoin, a established centralized exchange, counters with robust liquidity, integrated cross-chain tools, and scalable limits, but requires KYC compliance and involves custody tradeoffs.

This SEO guide compares Baltex and KuCoin focusing on cross-chain swaps, limits, and user control. We'll explore fees, spreads, execution speeds, slippage risks, swap and withdrawal limits, supported chains and assets, custody versus self-custody, KYC and data exposure, account and withdrawal risks, and failure scenarios. Step-by-step workflows for swapping, bridging, deposits, withdrawals, and inter-platform fund movements, complete with safety checks, provide actionable insights. Tables clarify comparisons, and a section details Baltex's multi-chain prowess. In a year where regulatory scrutiny heightens, understanding these elements helps mitigate risks while optimizing workflows for efficient crypto management.

The decentralized versus centralized divide shapes user experiences profoundly. Baltex's non-custodial approach minimizes exposure to platform failures, while KuCoin's centralized model offers reliability through reserves but introduces counterparty risks. Both support extensive assets, yet their handling of cross-chain operations and limits diverges, influencing choices for high-volume traders or privacy advocates.

This table outlines core features in 2026, contrasting decentralized control with centralized structures.

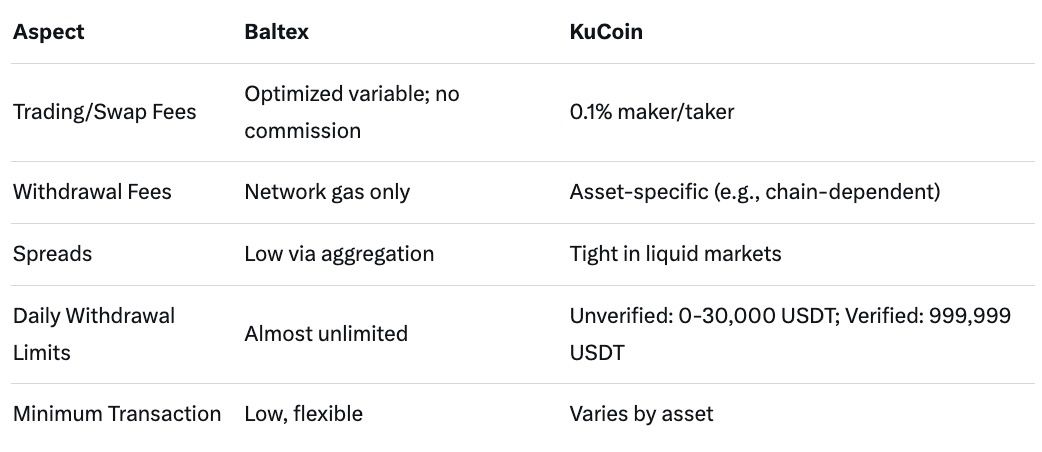

Fees and spreads are pivotal for cost-effective operations. Baltex employs an optimized aggregation model without fixed commissions, where users review variable fees and spreads during transaction approval for transparency. This results in low effective costs, particularly for cross-chain swaps, as it minimizes overhead by routing through efficient DEX paths. Spreads remain competitive due to hybrid liquidity sourcing, appealing to users seeking minimal markups in volatile environments.

KuCoin maintains a straightforward 0.1% fee for both makers and takers on spot trades, with potential reductions for VIP levels or using KCS tokens. Spreads are tight owing to deep liquidity, but additional withdrawal fees apply per asset, such as network-specific charges. In 2026, these remain competitive, though third-party costs for fiat integrations can widen overall spreads.

Baltex's fee structure enhances user control by avoiding platform cuts, while KuCoin's predictability suits centralized workflows.

Speed directly affects market exposure. Baltex delivers instant execution: once approved in your wallet, swaps complete without delays, leveraging bridgeless routing across chains. Slippage risk is low, typically under 0.3%, thanks to optimized paths that aggregate real-time liquidity.

KuCoin offers near-instant trade execution on its platform, but cross-chain or withdrawals involve blockchain confirmations, averaging minutes. Slippage is minimal in liquid pairs due to order books, though volatility can impact less-traded assets.

For time-sensitive rebalancing, Baltex's immediacy provides superior control.

Limits define scalability. Baltex imposes almost no restrictions, enabling unlimited swaps and withdrawals directly to wallets, fostering unrestricted cross-chain movements.

KuCoin ties limits to KYC: unverified users face 0-30,000 USDT daily withdrawals, while fully verified reach 999,999 USDT. Swap volumes are generous but monitored for compliance.

Baltex offers boundless freedom; KuCoin provides structured escalation.

Detailed breakdown of costs and constraints in 2026.

Asset diversity enables versatile strategies. Baltex supports over 200 chains like Ethereum, Solana, TON, and Base, with 10,000+ tokens including BTC, ETH, and privacy coins. This breadth facilitates direct cross-chain swaps without bridges.

KuCoin lists 1,000+ cryptocurrencies across multiple chains, with deposits/withdrawals on ETH, SOL, and others. Cross-chain via integrated tools like Pact_Swap for native assets.

Baltex excels in multi-chain scope; KuCoin in curated liquidity.

Custody models impact risk. Baltex's self-custody ensures users retain keys, eliminating platform holds and reducing hacks or freezes.

KuCoin's custodial approach holds funds, offering convenience but exposing to past incidents like the 2020 hack. Tradeoffs include insurance versus personal control.

Self-custody via Baltex minimizes counterparty risks.

KYC shapes privacy. Baltex requires none, collecting no data and using Monero for anonymity.

KuCoin mandates tiered KYC: basic for limited features, full for unrestricted access, involving ID submission and potential sharing. Data exposure risks arise from compliance.

Baltex prioritizes exposure-free control.

Risks vary by model. Baltex's decentralized setup faces wallet errors or network issues, but no account freezes.

KuCoin risks include temporary withdrawal suspensions for security, dormancy fees for inactive accounts, and regulatory penalties. US users face closures.

User control mitigates Baltex risks.

Common failures differ. On Baltex, mismatched approvals or congestion may halt swaps, resolved by retries.

KuCoin scenarios include delayed withdrawals from monitoring or hacks, with support for recovery.

Awareness prevents most issues.

Key risks compared.

Swapping on Baltex: Select tokens/chains on baltex.io. Connect wallet. Review rate, fees, slippage—crucial safety check. Approve; receive instantly. Safety: Verify addresses, use hardware wallets.

On KuCoin: Fund account via deposit. Place trade order. Execute. Safety: Enable 2FA, monitor limits.

Bridging with Baltex: Integrated in swaps; select chains. Safety: Confirm compatibility.

KuCoin bridging: Use Pact_Swap or tools; select assets. Safety: Check fees, networks.

Deposits/Withdrawals on Baltex: Fiat via cards/banks direct to wallet. Safety: Review terms.

On KuCoin: Deposit crypto/fiat; withdraw post-KYC. Safety: Whitelist addresses.

Moving funds between: From Baltex to KuCoin—swap, send to KuCoin address. Reverse: Withdraw from KuCoin, swap on Baltex. Safety: Test small, track tx.

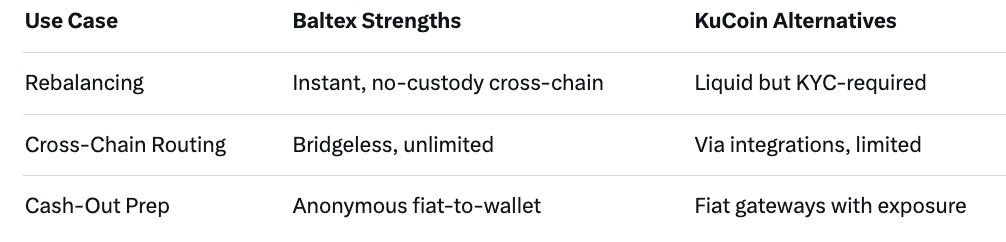

Baltex.io in 2026 facilitates rapid multi-chain swaps, enhancing user control for diverse scenarios. In portfolio rebalancing, users instantly exchange assets across Ethereum to Solana without bridges, aggregating liquidity for low slippage and optimal rates. This self-custodial process keeps funds secure during adjustments.

Cross-chain routing simplifies transfers, like TON to Base, with Monero privacy to obscure traces. No limits enable high-volume routing for arbitrage.

For cash-out prep, anonymously accumulate via fiat buys, then swap to exit assets wallet-direct. Baltex's design empowers sovereign, efficient operations.

Benefits by scenario.

0.1% for makers and takers, with potential discounts.

Almost none, for unrestricted user control.

Tiered: Unverified limited to 30,000 USDT daily; verified up to 999,999 USDT.

Instant, with no waiting periods.

Yes, as funds are held centrally, unlike Baltex's self-custody.

In 2026, Baltex's decentralized model offers superior user control and privacy for cross-chain swaps without limits, while KuCoin's centralized setup provides liquidity and structured limits at the expense of custody risks. Choose based on your needs—self-sovereignty or regulated scale. For more, explore no-KYC options or centralized exchange tips. Test workflows cautiously to enhance your crypto strategy.