In 2025, Baltex and OKX cater to different crypto philosophies: Baltex delivers non-custodial, privacy-first swaps with instant execution, no KYC, and unlimited limits across 200+ chains, perfect for self-sovereign users avoiding custody risks. OKX, as a full-service centralized exchange, offers deep liquidity, tiered fees starting at 0.08% maker and 0.10% taker, KYC-based withdrawal limits up to 80 million USD daily for VIPs, and integrated bridges for cross-chain moves, but with inherent custody exposure. Baltex optimizes fees through aggregation without commissions, while OKX provides futures and fiat options amid potential slippage in volatile trades. For higher control and lower risks in rebalancing or cash-outs, Baltex edges out; for comprehensive trading tools, OKX dominates. See comparison tables below for specifics.

Crypto users in 2025 increasingly prioritize platforms that balance efficiency with security, especially when comparing non-custodial options like Baltex to full-service exchanges like OKX. Baltex, accessible via baltex.io, emphasizes user control through wallet-to-wallet swaps that eliminate intermediaries, appealing to those focused on privacy and minimal risks in trading, portfolio rebalancing, cross-chain fund movements, and cash-out preparations. OKX, a leading centralized platform, provides a broad suite of services including spot, derivatives, and fiat gateways, backed by robust liquidity but requiring trust in its custodial model.

This guide explores their contrasts in fees, execution speeds, limits, custody and KYC risks, and failure scenarios. We'll detail practical workflows with step-by-step flows and safety checks for key operations. Structured mostly in paragraphs for in-depth reading, with tables for quick comparisons, this analysis helps users optimize their strategies. In an era of heightened regulatory oversight, non-custodial Baltex reduces exposure to platform vulnerabilities, while OKX's full-service approach enhances accessibility but introduces dependencies. Understanding these dynamics ensures informed decisions for secure, efficient crypto handling.

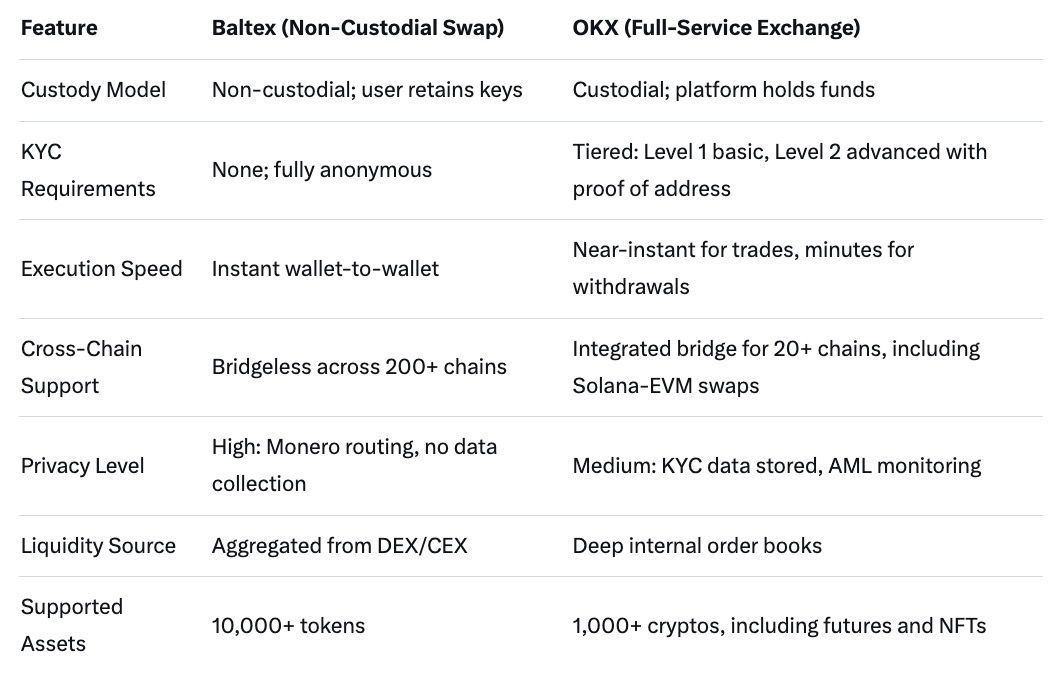

The non-custodial versus full-service divide shapes risk profiles profoundly. Baltex's decentralized routing fosters independence, minimizing data leaks and hacks, whereas OKX's centralized infrastructure offers convenience at the potential cost of account freezes or compliance issues. Both support extensive assets, but their approaches to cross-chain functionality and user limits influence suitability for high-volume or anonymous operations.

This table highlights core differences in 2025, focusing on non-custodial control versus full-service features.

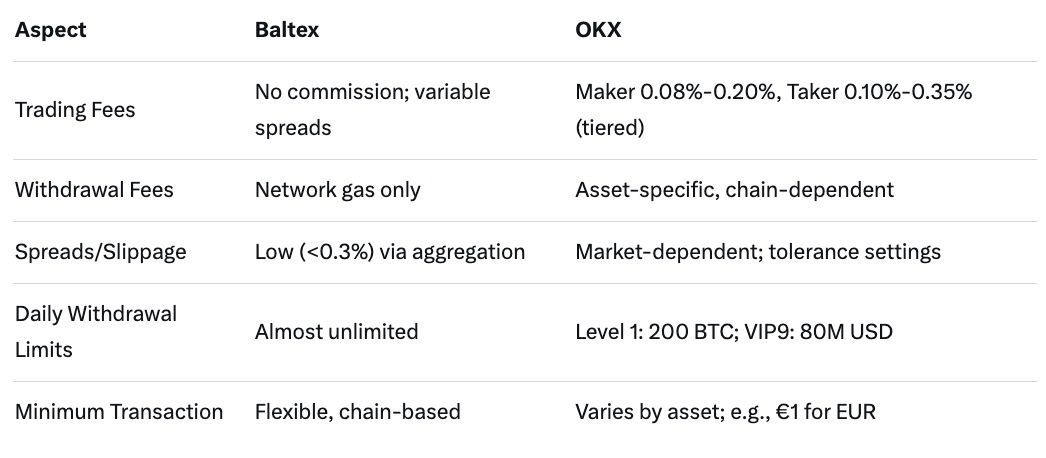

Fees determine long-term viability for active users. Baltex's non-custodial model avoids platform commissions, instead using optimized aggregation to minimize spreads and slippage. Users preview variable costs, including network gas, during approval, ensuring transparency without fixed percentages. This approach keeps effective rates low, particularly for cross-chain swaps where bridgeless routing cuts overhead.

OKX employs a tiered fee structure for spot trading, starting at 0.08% for makers and 0.10% for takers among regular users, with reductions for VIP tiers based on volume or holdings. In 2025, EEA users face updated maker/taker rates from October, potentially up to 0.35% for takers in lower tiers. Spreads remain competitive due to liquidity, but withdrawal fees vary by asset and chain, adding to costs.

Non-custodial Baltex favors cost-conscious privacy seekers, while OKX's full-service fees suit volume-driven traders with discounts.

Speed impacts opportunity capture. Baltex executes instantly upon wallet approval, with tokens arriving without delays via optimized paths. Slippage is minimized to under 0.3% through real-time aggregation, ideal for volatile rebalancing.

OKX provides near-instant trade execution on its platform, but withdrawals and cross-chain bridges involve confirmations, averaging minutes. Slippage occurs in high-volatility scenarios, though deep liquidity reduces it for popular pairs; users can set tolerances to manage risks.

Baltex's immediacy enhances control, contrasting OKX's reliable but confirmation-dependent speed.

Limits affect scalability. Baltex offers virtually unlimited swaps and withdrawals, supporting 200+ chains like Ethereum, Solana, and TON for seamless movements.

OKX ties limits to KYC tiers: Level 1 allows up to 200 BTC daily withdrawals, while advanced verification escalates to 80 million USD for VIP9. It supports over 20 chains via its bridge, enabling bridgeless Solana-EVM swaps.

Non-custodial flexibility in Baltex suits unrestricted users; OKX's tiered system scales for full-service needs.

Detailed overview of costs and constraints in 2025.

Custody risks define trust levels. Baltex's non-custodial design keeps users in full control, eliminating platform holds and reducing hack exposure.

OKX, being custodial, stores funds, introducing risks despite security measures; past AML issues highlight potential breaches. KYC is mandatory for advanced features, with Level 1 requiring basic info and Level 2 adding address proof, increasing data exposure.

Baltex minimizes both risks for higher control.

Failures disrupt workflows. Baltex scenarios include network congestion or approval errors, resolved via retries with no fund locks.

OKX issues encompass transaction failures from volatility, KYC mismatches leading to blocks, or AML flags delaying withdrawals. User complaints in 2025 note support delays and account freezes.

Non-custodial resilience in Baltex contrasts OKX's compliance-driven vulnerabilities.

Swapping on Baltex begins by selecting tokens and chains on baltex.io. Connect your wallet, review the quoted rate, fees, and slippage—this upfront preview serves as a primary safety check to ensure favorable terms. Approve the transaction in your wallet, and receive assets instantly. Safety measures include using hardware wallets, verifying addresses to prevent mismatches, and enabling privacy routing for sensitive trades.

For OKX, log in and fund your account via deposit. Place a market or limit order for the swap. Confirm execution, then initiate withdrawal if needed. Safety checks involve enabling two-factor authentication, whitelisting withdrawal addresses to block unauthorized sends, and monitoring for slippage by setting tolerances. Always review KYC status beforehand to avoid limit restrictions.

Bridging with Baltex is embedded in swaps: choose differing chains during selection, and the platform handles bridgeless routing. Safety includes confirming chain compatibility in the preview to avoid errors.

On OKX, use the integrated bridge: select source and destination chains, input amount, and confirm. Safety checks require verifying supported chains (over 20) and monitoring transaction IDs for any delays.

Deposits and withdrawals on Baltex are direct: for fiat, use integrated ramps like cards to buy into your wallet. Safety: Review provider terms and use secure connections.

OKX deposits involve sending to a generated address; withdrawals follow KYC verification. Safety: Use only official apps, check for network congruence to prevent lost funds, and start with small tests.

Moving funds between platforms: From Baltex to OKX, swap to the desired asset and send to your OKX deposit address. Reverse: Withdraw from OKX to your wallet, then swap on Baltex if needed. Safety across both: Track transactions via explorers, use small amounts initially, and double-check addresses.

Baltex.io in 2025 streamlines multi-chain swaps, empowering users with speed and control for practical scenarios. In portfolio rebalancing, traders can instantly convert holdings across networks—like Ethereum-based assets to Solana tokens—without bridges or wrapped intermediates. The aggregation pulls optimal liquidity, ensuring low slippage during market shifts, all while maintaining non-custodial security to avoid exposure.

Cross-chain routing benefits from Baltex's 200+ chain integration, allowing direct, efficient transfers for arbitrage or diversification. Users route funds seamlessly, such as from TON to Base, with optional Monero layers obscuring on-chain trails for enhanced privacy.

Preparing for cash-outs, Baltex supports anonymous fiat purchases via Apple Pay or banks, delivering crypto straight to wallets. This enables discreet accumulation before off-ramping, with minimal fees preserving value. Overall, baltex.io's design facilitates sovereign, rapid operations, outperforming custodial alternatives in user-centric flexibility.

Maker fees start at 0.08%, taker at 0.10%, with tiered reductions for VIP users.

No, Baltex operates without KYC, offering full anonymity.

Near-instant for internal trades, but withdrawals take minutes due to confirmations.

As custodial, it holds funds, exposing to potential hacks or regulatory freezes.

Almost none, allowing unlimited swaps and movements.

Baltex's non-custodial trading excels for users seeking control and minimal risks in 2025, while OKX's full-service model provides liquidity and tools at the trade-off of custody and KYC exposure. For privacy-driven workflows in rebalancing or cash-outs, Baltex is superior; for comprehensive features, OKX fits. Explore no-KYC alternatives or full-service exchange guides for deeper insights. Test both with caution to refine your approach in this dynamic space.