In 2025, Baltex and Uniswap represent evolving approaches to decentralized trading: Baltex delivers cross-chain aggregated swaps across 200+ networks and 10,000+ tokens with instant execution, optimized routing for low slippage, no KYC, and privacy via Monero, ideal for multi-chain rebalancing and anonymous cash-outs without limits. Uniswap, a single-chain DEX pioneer with V4 updates like hooks and flash accounting, focuses on Ethereum and select chains for AMM-based trades with tiered fees (0.01%-1%), deep liquidity pools, but potential MEV exposure and chain-specific constraints. Baltex excels in aggregation depth and privacy; Uniswap in single-chain efficiency and customizability. See our feature and fees tables for quick overviews.

As decentralized finance matures in 2025, users increasingly compare cross-chain aggregators like Baltex with established single-chain DEXs like Uniswap to optimize trading, rebalancing, liquidity movements, and cash-out preparations. Baltex, via baltex.io, aggregates liquidity from multiple sources for seamless multi-chain swaps, emphasizing privacy and speed without intermediaries. This model suits those navigating fragmented blockchains while prioritizing control. Uniswap, evolving with V4 features such as hooks for customization and flash accounting for gas efficiency, remains a cornerstone for single-chain automated market maker (AMM) trades, offering deep liquidity on Ethereum and compatible networks but limited to intra-chain operations per instance.

This SEO guide analyzes Baltex and Uniswap through the lens of cross-chain aggregation versus single-chain DEX trading. We'll break down fees, routing and aggregation logic, execution speed, slippage risk, liquidity sources, limits, supported chains and assets, custody and wallet control, MEV exposure, and failure scenarios. Step-by-step swap flows with safety checks provide actionable workflows, while tables offer concise comparisons. A dedicated section highlights Baltex's multi-chain capabilities. In a year marked by regulatory shifts and chain proliferation, Baltex appeals to multi-network users seeking aggregation, whereas Uniswap attracts those valuing proven AMM mechanics on specific ecosystems.

The aggregation versus single-chain debate highlights trade-offs: Baltex's routing enables broader access but introduces complexity, while Uniswap's focused design ensures reliability within chains. Both are non-custodial, empowering wallet control, yet their handling of cross-chain needs and risks shapes suitability for diverse strategies.

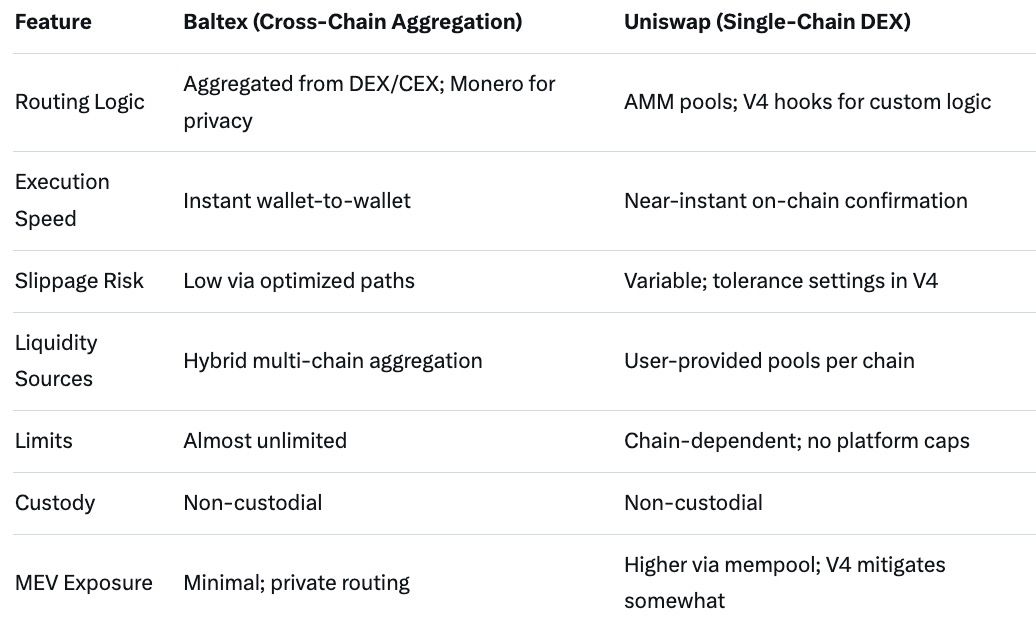

This table summarizes core features in 2025, contrasting aggregation breadth with single-chain specialization.

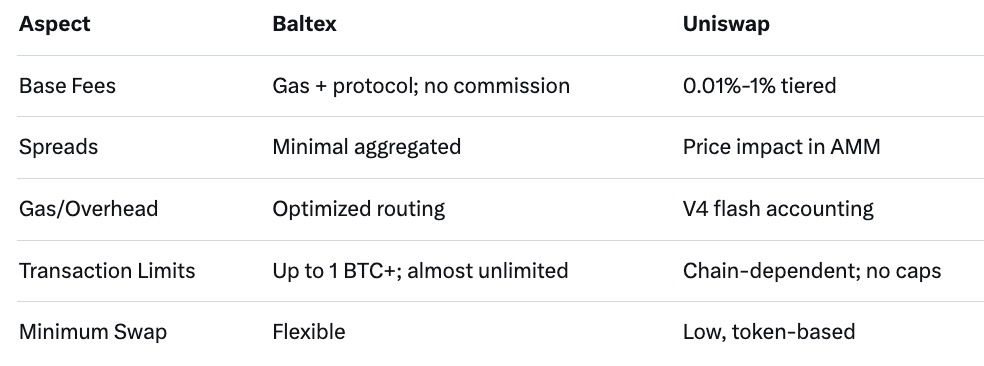

Fees directly affect net returns in decentralized trading. Baltex employs a no-commission model, with costs derived from network gas, protocol fees, and minimal aggregation overhead, all previewed transparently. Spreads remain competitive through hybrid sourcing, often lower in cross-chain scenarios by avoiding wrapped assets. In 2025, fixed-rate options eliminate unexpected spreads, appealing to privacy-focused users.

Uniswap's tiered fees—0.01%, 0.05%, 0.3%, or 1%—are set by pool creators in V4, with liquidity providers earning portions. Spreads arise from price impacts in AMM curves, minimized in deep pools but evident in low-liquidity pairs. V4's flash accounting reduces gas costs, enhancing overall efficiency.

Aggregation in Baltex potentially yields better effective rates across chains, while Uniswap's single-chain focus ensures predictable fees within ecosystems.

Routing logic defines swap efficiency. Baltex aggregates quotes from multiple DEXs and CEXs, selecting optimal paths with Monero rails for privacy, breaking deposit-payout links. This cross-chain approach avoids bridges, using decentralized routes for 200+ networks.

Uniswap relies on AMM pools for direct token pairs, with V4 hooks enabling custom functions like dynamic fees or oracles. Routing is single-chain, requiring external bridges for multi-network trades, limiting to intra-chain aggregation.

Baltex's multi-source logic suits complex routing; Uniswap's pool-based system excels in single-chain depth.

Speed influences market timing. Baltex delivers instant execution, with tokens arriving wallet-direct post-approval, leveraging optimized paths to curb slippage under 0.3%.

Uniswap processes near-instantly upon block confirmation, but Ethereum congestion can delay; V4's flash accounting mitigates gas, while slippage is user-set via tolerances.

Aggregation reduces Baltex's risk in volatile crosses; Uniswap's depends on pool liquidity.

Liquidity underpins reliable trades. Baltex sources from hybrid DEX/CEX pools across chains, enhancing depth for exotic pairs and privacy coins.

Uniswap draws from user-funded AMM pools, fostering organic depth on Ethereum and layers like Arbitrum.

Cross-chain aggregation broadens Baltex's access; single-chain pools concentrate Uniswap's strength.

Limits govern volume. Baltex features almost unlimited swaps, with high thresholds like 1 BTC per transaction, supporting unrestricted multi-chain flows.

Uniswap imposes no platform limits, but chain gas and wallet balances constrain; V4's efficiencies aid larger trades.

Baltex's aggregation enables higher effective limits across networks.

Comparative overview of costs and capacities in 2025.

Chain support enables versatility. Baltex integrates 200+ networks including Ethereum, Solana, TON, and Base, with 10,000+ tokens like BTC, ETH, XMR.

Uniswap operates on Ethereum and EVM-compatibles like Polygon, plus Solana in expansions, supporting thousands of ERC-20 tokens.

Aggregation expands Baltex's scope; Uniswap's focuses on ecosystem depth.

Custody impacts sovereignty. Both are non-custodial: Baltex runs wallet-to-wallet, users retaining keys throughout. Uniswap connects via wallets like MetaMask, ensuring self-control.

Shared emphasis on control, but Baltex's aggregation adds privacy layers.

MEV (miner extractable value) risks frontrunning. Baltex minimizes via private Monero routing, obscuring transactions.

Uniswap exposes to mempool MEV, though V4 hooks enable protections like private relays.

Aggregation reduces Baltex's vulnerability; single-chain increases Uniswap's.

Failures erode trust. Baltex risks include routing errors or congestion, mitigated by previews; no custody prevents holds.

Uniswap faces pool imbalances or failed confirmations; V4's efficiencies help, but chain outages impact.

Proactive checks minimize both.

Swapping on Baltex starts with selecting tokens/chains on baltex.io. Connect wallet. Review quote, fees, slippage—critical safety for acceptance. Approve; instant delivery. Safety: Revoke permissions post-trade, verify addresses.

On Uniswap: Visit app.uniswap.org, connect wallet. Choose pair, set amount/tolerance. Confirm transaction. Safety: Check pool liquidity, use slippage settings.

Cross-chain Baltex: Select differing chains; aggregation routes. Safety: Preview path.

Uniswap requires external bridges; swap then bridge. Safety: Bridge audits.

Liquidity moves: Baltex aggregates direct; Uniswap adds/removes from pools.

Cash-out prep: Baltex fiat ramps to wallet; Uniswap swaps to stables then off-ramp.

Baltex.io in 2025 streamlines multi-chain swaps, facilitating rapid, private operations across scenarios. For portfolio rebalancing, users instantly aggregate liquidity to shift ETH on Arbitrum to SOL, minimizing slippage via optimized paths without bridges. This enables timely adjustments in volatile markets, with Monero privacy shielding strategies.

Cross-chain routing leverages 200+ networks for direct transfers, like TON to Base, bypassing wrapped tokens for efficiency and cost savings. Ideal for liquidity migration or arbitrage, unlimited limits support high volumes.

Preparing for cash-outs, Baltex offers no-KYC fiat buys to wallet, then aggregated swaps to fiat-friendly assets like USDT. This anonymous accumulation preserves value pre-off-ramp. Baltex's aggregation empowers versatile, secure workflows.

Tiered at 0.01%-1%, set by pools; V4 reduces gas.

No, fully anonymous with Monero privacy.

Primarily Ethereum and EVM-compatibles, plus expansions.

Low, under 0.3% via aggregation.

Exposed via mempool; V4 hooks mitigate.

In 2025, Baltex's cross-chain aggregation outperforms for multi-network flexibility and privacy, while Uniswap's single-chain DEX leads in AMM depth and customization. Select based on needs—aggregation for routing or single-chain for efficiency. For more, check multi-chain aggregators or DEX guides. Experiment safely to refine strategies.