Crypto swaps simply mean exchanging one cryptocurrency for another. Instead of converting to fiat (like USD or EUR) first, a swap goes straight from, say, Bitcoin (BTC) to Ethereum (ETH). This direct approach can save you fees and time, which matters if you’re trying to hop on a momentary price movement.

Before you dive in, you’ll want a wallet that holds your tokens. Some swap platforms come with a built-in wallet, which is one less step, especially if you’re a beginner. Others require an external wallet connection. Either way, check that you’re dealing with a reputable exchange, because space is flooded with platforms that may look legit but lack robust security or liquidity.

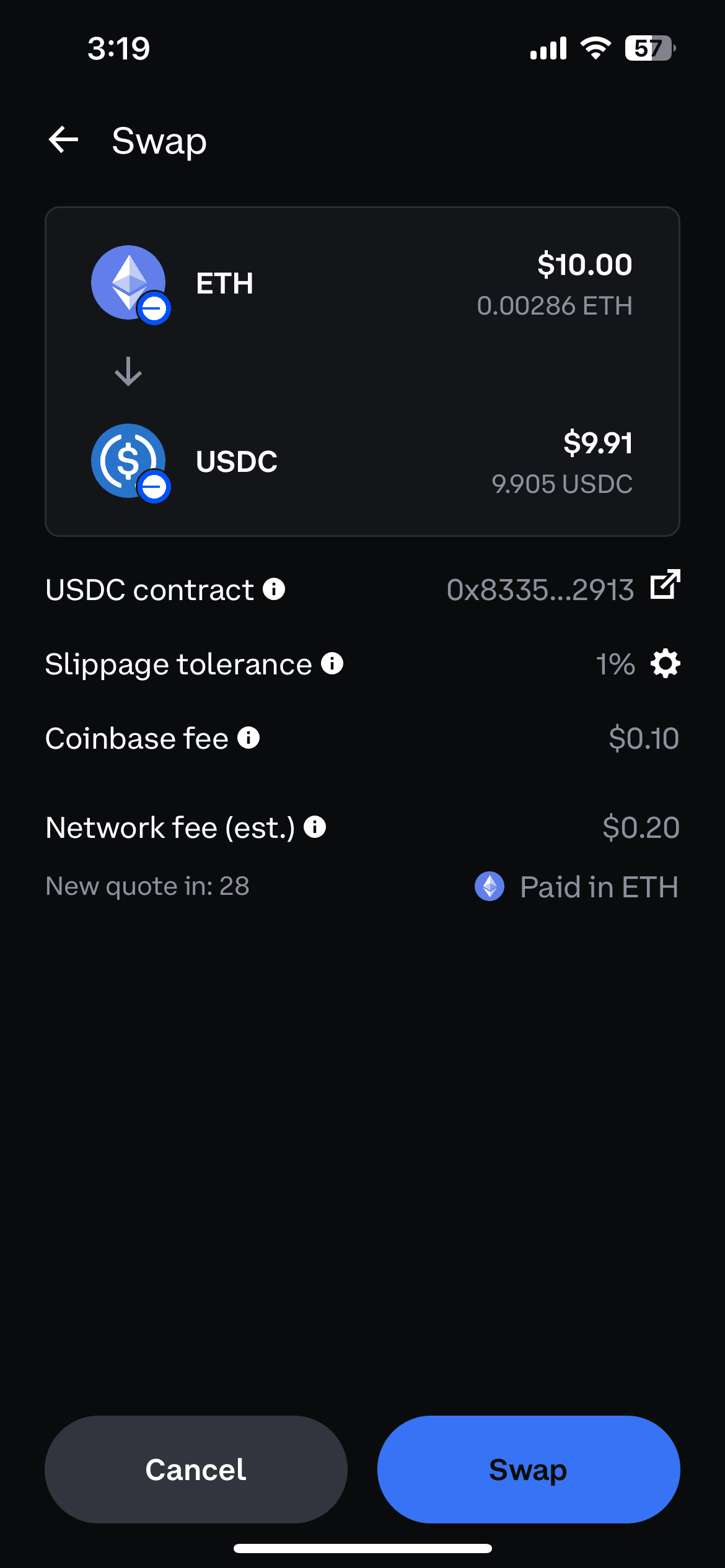

Here’s the thing. If you’re a total newcomer, you might appreciate an interface that spells out each step, like where you select “From BTC” and “To ETH.” If you’re more advanced, you might want custom slippage settings (slippage is the price difference that can occur from when you start your swap to when it finishes), flexible trading pairs, and integration with external apps for tracking.

Let’s run through a handful of the best crypto swap exchange platforms. We’ll look at each with a mini Q&A approach, giving you clear insights on usability, fees, liquidity, and security. Where possible, we’ve added a quick screenshot reference for you to visualize how these tools look in action. (All screenshots below are simply placeholders, so imagine each interface in your head.)

Coinbase is often the first name that pops up for newbies. It’s well-known, user-friendly, and backed by a reputable U.S. company. You don’t need to be a pro to navigate their swapping interface. Plus, you can store your crypto in your Coinbase wallet without messing with external apps.

Coinbase is not the cheapest in the market. The convenience factor is high, but that sometimes shows up as slightly higher fees or spreads (the difference between the buy and sell price). If cost is your top concern, you might want to compare it with other platforms.

Coinbase also offers Coinbase Pro (soon to be integrated into a singular advanced trade experience) with more sophisticated charting and lower fees. If you graduate from newbie to advanced trader, you can shift over pretty easily.

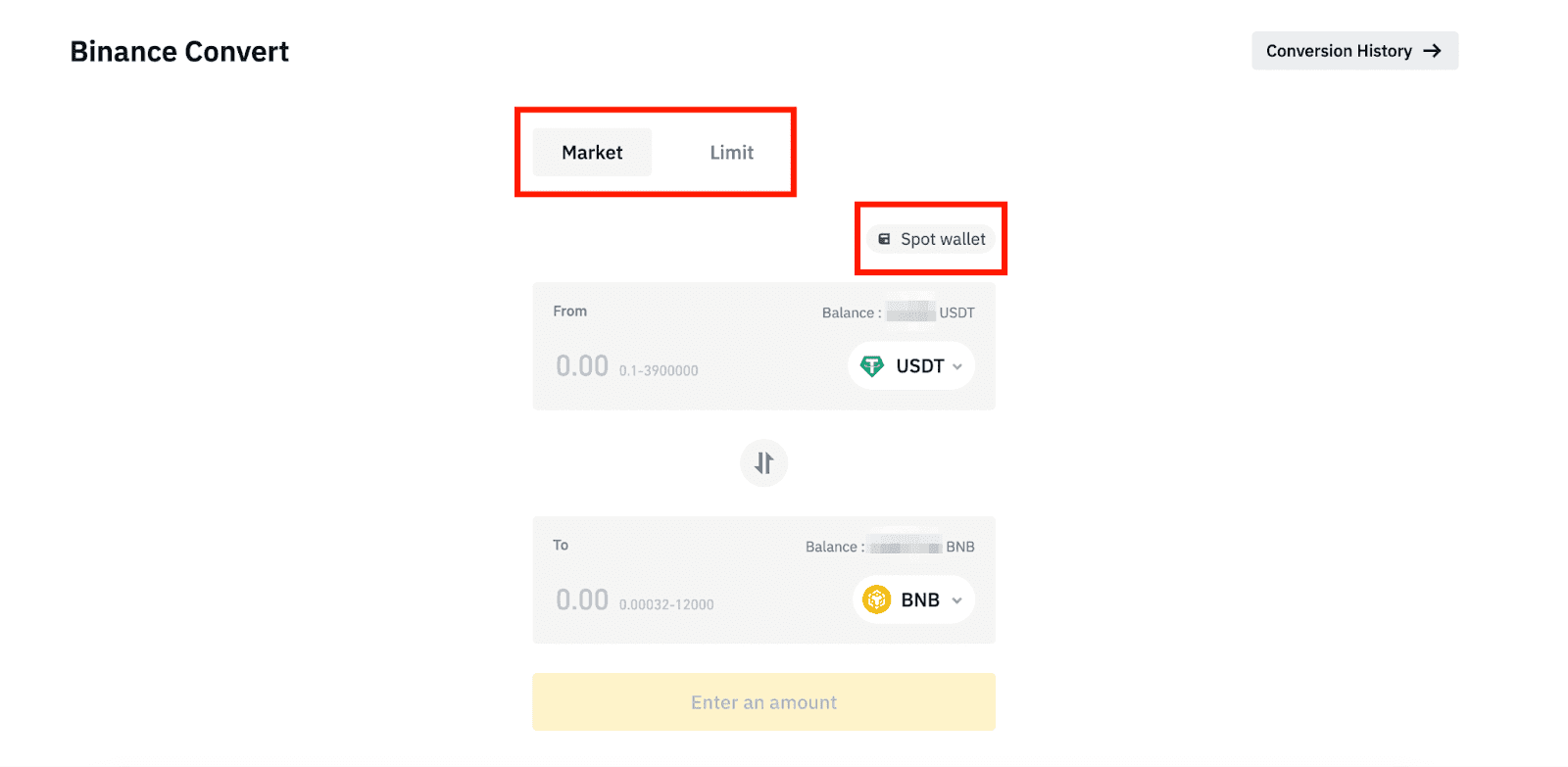

Binance is a massive exchange with a global presence. They have a “Convert” feature that’s perfect for quick trades, letting you swap dozens of coins instantly. It’s basically a streamlined user experience so you don’t need to tackle complicated order books if you don’t want to.

While the main Binance platform can look busy, Binance Convert is simpler. You pick the coin you have, the coin you want, and click “Preview Conversion.” But you’ll still want to poke around the help articles to get a handle on their platform’s broader features, especially if you’re brand new.

Binance typically has deep liquidity, meaning it’s easier to find a buyer or seller. This usually reduces slippage. Fees can be fairly low, though it may depend on your region and the coin pair you’re swapping.

KuCoin is known as the “people’s exchange” for listing a vast range of altcoins. The Instant Exchange feature is straightforward, offering quick conversions. For pros, KuCoin has advanced trading tools, margin trading, and a lively futures market if you decide to branch out.

Sometimes platforms roll fees into the swap rate itself. KuCoin’s Instant Exchange typically quotes you a final price, so it’s relatively transparent. Still, do a quick check on the going market rate before you finalize any trade.

KuCoin’s interface is fairly intuitive, but it’s not quite as minimalistic as some beginner-focused swaps. Once you get used to it, you’ll appreciate the range of tools. But if you’re ultra-new to crypto, you might want to watch a tutorial or two.

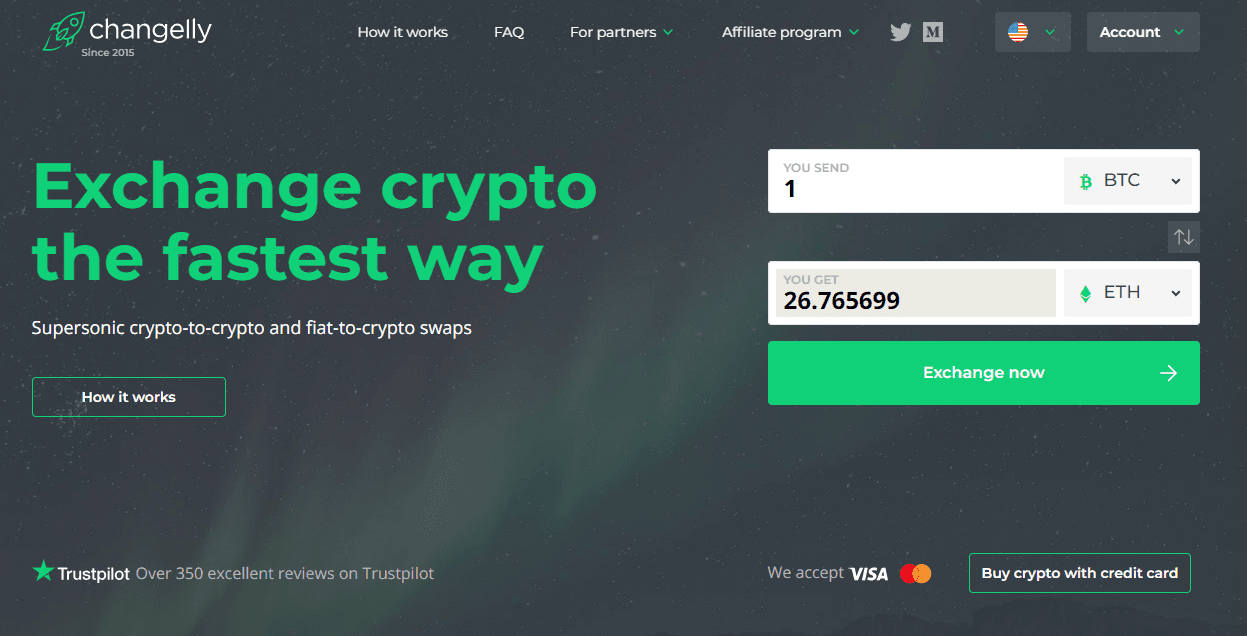

Changelly is a non-custodial exchange aggregator, which means it finds the best swap prices from multiple partner exchanges and suggests a final rate. It’s well-known for user-friendly design and relatively good rates.

Because Changelly is non-custodial, you connect your external wallet. You’ll input your receiving address for the coin you want. Once the swap is confirmed, Changelly sends your new tokens to that address. This is great for security since you’re never storing coins on Changelly itself.

Changelly typically charges a commission that’s transparent in the final quote. Non-custodial setups can sometimes mean you pay higher network fees, depending on your coin. Make sure you keep an eye on the quoted total before clicking “Confirm.”

As the name suggests, it keeps everything simple. This platform also runs a non-custodial service, so you’re controlling your own coins. They boast a wide range of tokens, including popular altcoins. If you hate countless registration hoops, you might like that SimpleSwap doesn’t require sign-up for many trades.

While it’s easy to skip creating an account, be mindful that some safety nets can be missing if you don’t. SimpleSwap does offer a loyalty program if you do sign up, and that might mean lower fees on future trades.

SimpleSwap supports hundreds of cryptocurrencies. If you like exploring lesser-known tokens, you’ll probably find them here. However, always do your research on those smaller coins.

Uniswap is a decentralized exchange (DEX) on Ethereum. With DEXs, you connect your personal wallet and trade through smart contracts, no central authority. For a brand-new user, the concept is a bit more advanced. But the interface itself is not too bad: just pick your two tokens, confirm, and pay transaction (gas) fees.

Being one of the largest DEXs, Uniswap often has deep liquidity, especially in popular trading pairs like ETH-DAI. For obscure tokens, the liquidity might be smaller, meaning more slippage. If you’re a pro, you can also provide liquidity, earning a share of the fees.

A decentralized platform means no single entity holds your funds. As long as you keep your private keys safe, your wallet is in your control. On the flip side, you need to watch out for scam tokens, because listing on a DEX can be easy for questionable projects.

1inch is another DeFi aggregator, akin to Changelly but primarily for decentralized exchanges. It checks platforms like Uniswap, Sushiswap, and others to find the best available swap rates.

Sometimes, yes. 1inch tries to optimize your trade routing to reduce fees. Keep in mind, if you’re swapping on Ethereum, gas fees can spike during network congestion. 1inch can also route trades through sidechains or layer-2 solutions, providing alternatives for lower costs.

There’s a feature called “limit orders,” letting you pick your desired token price. That’s handy if you want a certain price, but not if you need an immediate swap.

PancakeSwap is a DEX on BNB Chain (formerly Binance Smart Chain). It’s a bit like Uniswap, but for BNB-based tokens. You connect your wallet, pick your coin pair, and swap.

Network fees on BNB Chain can be lower than Ethereum, making PancakeSwap appealing to new users. Just be sure you’re comfortable bridging your tokens if they live on other networks.

Yes, it includes liquidity pools, yield farming, and a suite of other DeFi features. If you want a one-stop shop for decentralized trading and some fun extras (like a quick lottery or NFT marketplace), PancakeSwap might be interesting.

SushiSwap started as a fork of Uniswap but grew into its own multi-chain ecosystem. You can swap tokens on Ethereum, as well as several other blockchains, all through one interface.

It’s relatively friendly, though maybe not quite as streamlined as Uniswap. SushiSwap has more features, from yield farms to lending. Beginners might explore the basic swap first, ignoring the advanced stuff until you’re comfortable.

Balancer is a kind of automated portfolio manager. You can swap tokens through liquidity pools that can hold multiple coins. It’s especially interesting for users who like to provide liquidity across varied tokens, but you can also do simple swaps.

Fees are determined by each pool’s creator. So, if you’re swapping a pair in a popular pool, you might get a better rate. Balancer’s selling point is diversity. Pools can contain up to eight different tokens, making some advanced strategies possible.

You can handle straightforward swaps as a beginner. But to use Balancer to its full potential, you might want to read up on multi-asset pools and the platform token (BAL).

If you’re searching for the best crypto swap exchange that combines an easy interface with pro-level features, Baltex might catch your eye. This exchange is relatively new on the scene, but it’s picking up steam thanks to its balance of convenience and advanced trading extras.

Baltex emphasizes security. They store a modest portion of your funds in hot wallets for quick trades, keeping the majority in cold storage for extra safety.

For beginners, the design is straightforward. You’ll see a simple swap window that looks a lot like the best mainstream options. You won’t be overwhelmed by a ton of charts if you’re not ready for them.

For pros, Baltex has advanced order types, real-time charting from multiple data providers. That’s a big plus if you want to do more than a quick swap.

Liquidity is matched through aggregated pools, so you often get competitive rates. The platform claims to route trades in a way that reduces slippage.

The support team is known for quick responses, which is huge when you’re dealing with real money and want issues resolved fast.

Baltex also plans to integrate more DeFi features in upcoming releases. While not all details are public, the roadmap suggests a willingness to adapt quickly to market trends. If you’re a user who wants your platform to evolve, that might be appealing.

Let’s address a few frequently asked questions, especially if you’re new to crypto swapping and want to cover all the bases.

Not necessarily. Some exchanges have built-in wallets. Others require you to connect a service like MetaMask (for Ethereum-based tokens) or a hardware wallet for extra security. Always confirm that your chosen platform supports the token you want to swap.

Platforms often bake in fees or use different liquidity pools. The rate shown may differ slightly from what you see on a public price tracker. Compare multiple sources if you’re concerned, or try an aggregator like 1inch or Changelly that sums up different offers for you.

A swap’s speed depends on the blockchain’s network congestion, the number of confirmations needed, and if the exchange processes things internally. Some platforms do near-instant swaps by using their own order books, while others rely on the underlying blockchain speed.

In many countries, swapping one crypto for another is considered a taxable event because you’re disposing of one asset and acquiring another. Check your local tax rules. It’s a good idea to keep records, even for tiny trades.

If you’re on Ethereum, try swapping late at night or weekends when network traffic is lower. You could also look for alternative blockchains (like BNB Chain, Polygon, or Avalanche) where fees tend to be cheaper. Note that bridging assets between chains can involve its own costs.

You can see there’s no shortage of choices for finding the best crypto swap exchange. Each platform, from giant centralized hubs like Coinbase to decentralized pioneers like Uniswap, brings unique advantages. You’ll want to ask yourself a few questions: Do you need top-notch security, minimal fees, or an easy interface? Are you comfortable storing coins on an exchange, or prefer to keep them in a personal wallet?

If you’re a beginner, starting on a user-friendly platform will help you learn the ropes. As you gain confidence, you can venture into advanced tools or branch out to aggregator sites for better pricing. Your end goal might be to swap quickly and effortlessly, or maybe you’re a pro who wants to optimize every detail.

Whether you’re just testing the waters or you’re ready for a new main exchange, take time to explore Baltex. Its combination of security, streamlined swaps, and advanced trading features might check off everything on your list. If you’re curious, you can head to Baltex.io and see how it measures up to your needs.

Have fun exploring those swaps, and remember to keep your tokens safe. If you have any favorite swap platforms or tips for reducing fees, feel free to share your thoughts with the community. The crypto world moves fast, so staying curious and informed is your best strategy!