If you are looking for a clear Blast IO tokenomics overview to guide your next crypto venture, you have come to the right place. Blast IO positions itself as a versatile blockchain ecosystem that places a strong focus on scalability, governance, and decentralized applications (dApps). By understanding its network structure, the mechanics behind its tokens, and how its ecosystem fosters growth, you can make more informed decisions about whether Blast IO fits your investment or development interests.

In this guide, you will discover the foundational elements of Blast IO, from its architecture design to its staking and governance models. You will also learn how its dApp environment empowers creators, and explore how Blast IO measures up against other layer 2 (L2) or interoperability projects. By the end, you should have a thorough grasp of what makes Blast IO unique, including where to find BLAST tokens and how you might benefit from participating in the network.

Blast IO focuses on high transaction throughput, low fees, and developer-friendly tools.

Its tokenomics revolve around carefully managed supply, staking incentives, and community-driven governance.

Major dApps on Blast IO emphasize decentralized finance (DeFi), gaming, and enterprise solutions.

You can stake BLAST tokens to earn rewards and participate in vital governance decisions.

Baltex.io supports Blast IO token swaps, making it easier to buy or sell BLAST.

Comparisons with other L2 networks and interoperability solutions highlight Blast IO’s rapid finality and flexible smart contracting capabilities.

Below, you will find an in-depth explanation of Blast IO’s architecture, tokenomics, ecosystem features, and how they all come together to create a potentially exciting investment and development platform.

Blast IO’s network architecture revolves around a high-speed consensus mechanism, bridging a user-friendly environment with top-notch performance. This design aims to keep transaction costs minimal and achieve throughput suitable for a wide array of applications. The network follows these principles:

Scalable performance Blast IO prioritizes horizontal scalability, meaning that as more validators and nodes join, the network can keep up with increasing demand. Many earlier blockchains could experience bottlenecks when transaction throughput surged, but Blast IO employs sharding or sidechain-based approaches to sustain better throughput.

Interoperability focus The network is designed to communicate with other popular blockchain ecosystems. This allows you to bridge assets and data across different networks. The ultimate goal is to avoid having to pick a single chain or token ecosystem, letting developers compose cross-chain applications with ease.

Developer experience Blast IO’s architecture supports popular coding languages for smart contracts, including variants of Solidity, Rust, or WASM-based frameworks. This means you can leverage common toolkits and code libraries without starting from scratch. The development documentation and community resources are also structured to ease the onboarding process, especially for those used to Ethereum.

By merging scalability, interoperability, and strong developer tooling, Blast IO aims to create an ecosystem that feels as intuitive as it is powerful. In practice, this approach can minimize transaction fees and improve transaction finality times, making everyday usage feasible for everything from micro-transactions to more complex dApp functionalities.

At the core of Blast IO’s consensus model is a proof-of-stake (PoS) mechanism. Rather than relying on energy-intensive mining setups, validators lock up a certain amount of BLAST tokens to verify network transactions. This system offers several notable advantages:

Energy efficiency PoS drastically lowers the computational load compared to proof-of-work (PoW). Instead of competing to solve mathematical problems, validators stake tokens to help secure the chain.

Reward distribution As a staker or validator, you receive block rewards and transaction fees for confirming transactions. Over time, your holdings can grow if the network stays robust and gains broader adoption.

Network security The more BLAST tokens are staked, the harder it becomes for any malicious actor to disrupt the chain. This leads to a self-reinforcing security model: as BLAST gains value, it requires ever-greater resources to attack the network.

For you, staking can be a compelling way to actively participate in the ecosystem and benefit from its growth. Many participants who do not want the technical overhead of running a validator node might delegate their tokens to a trusted validator, earning a portion of the rewards without handling the node’s maintenance.

Blast IO distinguishes itself through a community-led governance structure. Rather than leaving critical decisions to a small development team, BLAST token holders have the power to propose and vote on network upgrades, monetary policies, or dApp funding.

Proposal creation Anyone holding the necessary stake threshold can submit a proposal for community review. Common proposals focus on network adjustments, treasury allocations, or parameter changes.

Voting A voting cycle ensues once a proposal meets submission requirements. During this period, you can use staked tokens to vote for or against the proposal. Each BLAST token represents a proportional share of voting power.

Implementation Proposals that garner sufficient support pass to the execution stage, which triggers their integration into the network’s protocol or treasury disbursement if relevant.

This governance setup ensures your voice matters. If you see ways Blast IO can improve or want to champion a specific initiative, you can push the conversation forward by creating proposals and rallying support from other token holders.

Total BLAST token supply was established at the network’s genesis. A substantial portion of these tokens was allocated to early contributors, ecosystem growth initiatives, and staking reserves. Over time, the distribution model aims to incentivize real usage instead of mere speculative holding. Key aspects of supply include:

Genesis distribution Early supporters and developers received an initial token allocation in recognition of their contributions to building the network.

Ecosystem fund A reserve of tokens exists to back crucial grants, partnerships, and marketing efforts intended to expand the ecosystem.

Public availability BLAST tokens entered public circulation through initial sales, staking initiatives, and yield programs. If you joined early, you might have accessed BLAST via discounted offerings or liquidity mining events.

Though the total supply of BLAST has an upper cap, a portion of tokens may be minted periodically to reward stakers and validators. This structured emission schedule generally follows these guidelines:

Decreasing inflation In the early stages, the network offers more generous staking rewards to attract validators and participants, gradually tapering off as the network matures.

Incentive alignment The schedule is designed so that new token issuance aligns with genuine adoption metrics instead of arbitrary time-based triggers. For instance, if staking participation meets certain thresholds, emission rates might adjust automatically.

Long-term stability Over time, inflation approaches a stable, low rate. This structure helps preserve the purchasing power of long-term holders while still rewarding new users who join late.

You can find details about any potential halving events, emission drops, or other supply shifts on the official Blast IO documentation pages or by tracking governance proposals that may alter inflation parameters.

To maintain healthy token circulation and counteract inflation, Blast IO may include burn mechanisms. In essence, burn events permanently remove tokens from circulation, reducing the overall supply. Common triggers for Burns could be:

Network fees A fraction of transaction fees might be burned by default. This helps curb inflation and means high network activity can result in more consistent buy pressure than sell pressure.

Governance-driven burns Under some governance proposals, the community may vote to burn a specific reserve if it’s deemed excessive or no longer necessary for ecosystem development.

For you as an investor, these burn mechanisms can contribute to potential price appreciation if demand for BLAST remains steady or rises. However, remember that list prices and perceived value still depend on broader market sentiment and the utility the token garners within the ecosystem.

Blast IO is already home to several decentralized applications showcasing the network’s versatility:

DeFi platforms Yield farms, lending protocols, and DEXs anchor the DeFi side of Blast IO. Their presence highlights the network’s capacity to handle high transaction volumes while keeping fees under control.

Gaming projects Some developers are building blockchain-based games that use BLAST tokens as in-game currency or reward tokens. Since Blast IO features quick transaction confirmations, it’s easier for gaming dApps to offer a near real-time experience.

Enterprise solutions Specialized dApps designed for logistics, healthcare, and supply chain management can harness Blast IO’s interoperability features. This is vital for bridging the gap between enterprise data systems and decentralized ledgers.

By exploring these dApps, you can deepen your knowledge of the network. Whether you want to stake tokens in a yield farm, collect NFT-based assets, or experiment with blockchain gaming, Blast IO’s array of projects might provide something that aligns with your interests.

If you are a developer, you will likely appreciate how Blast IO prioritizes accessible documentation and community-driven resources. Here are some key highlights:

Developer grants To fuel innovation, Blast IO sometimes offers grants to teams building tools, dApps, or infrastructure improvements. You can usually apply by submitting a grant proposal that outlines your project scope and potential impact.

Community forums The ecosystem fosters a supportive environment for both experienced devs and newcomers. With accessible tutorials, code libraries, and sample projects, you can accelerate your learning curve.

Flexible development languages Blast IO supports multiple smart contract languages, allowing you to code in what you already know. Whether you are used to Ethereum’s tooling, or prefer other languages, you will find options that minimize friction.

Blast IO’s DeFi sector leverages low transaction fees and swift settlement times. Developers can integrate everything from stablecoins to advanced derivatives:

Stablecoins You might see stablecoins pegged to fiat currencies or even algorithmic stablecoins minted on the Blast IO chain.

Automated market makers (AMMs) AMMs facilitate decentralized trading, offering liquidity pools where users deposit tokens in exchange for earning fees.

Lending markets Protocols let users lend or borrow assets, earning interest or accessing liquidity in a trustless environment.

Participating in these DeFi opportunities might let you earn yields, hedge risk, or try new financial instruments not available on older blockchains. Because Blast IO aims to remain interoperable, you may also be able to connect your existing portfolio from networks like Ethereum, bridging assets into the Blast IO ecosystem.

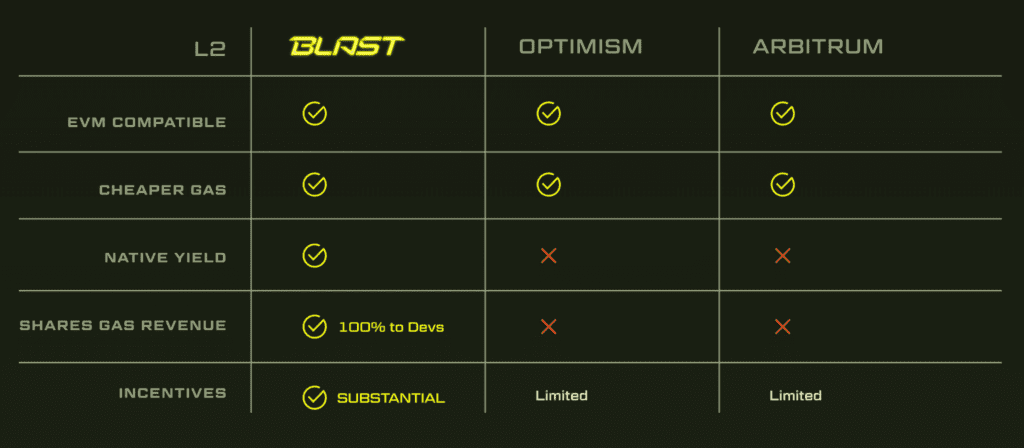

If you already have experience with layer 2 or interoperability solutions like Arbitrum, Polygon, Polkadot, or Cosmos, you might be wondering how Blast IO stacks up. Overall, the differences revolve around:

Blast IO, like many L2s, targets lower transaction fees and higher throughput compared to mainnet blockchains. However, it strives to differentiate itself by:

Flexible deployment Developers can create their own specialized sidechains, side-by-side with the main chain. That means your project can scale independently without overwhelming the base network.

Governance integration By weaving governance into the protocol, Blast IO encourages stakers to be involved in both ecosystem security and strategic decision-making.

Interoperability bridging Some L2 solutions focus purely on Ethereum compatibility. While Blast IO supports that, it also aims to connect with other blockchains for a broader cross-chain experience.

Projects like Cosmos or Polkadot lay a strong foundation for cross-chain communications. Blast IO includes similar bridging capabilities but places a sharper emphasis on high velocity and quick finality. That makes Blast IO especially appealing when real-time or near real-time transaction settlements are desired. If you plan to build a dApp that requires frequent micro-transactions or real-time updates, Blast IO’s architecture could prove more fitting than certain cross-chain solutions that have slightly slower block times.

Ultimately, choosing between Blast IO and an alternative solution depends on your goals. Are you primarily building dApps reliant on sub-second confirmations? Do you need the ability to pivot between multiple blockchain ecosystems simultaneously? Are you primarily concerned about governance and community input? By answering these kinds of questions, you can figure out which platform better aligns with your vision.

You can access BLAST tokens through various exchanges and aggregator platforms. Notably, Baltex.io supports Blast-related swaps, enabling you to buy, sell, or trade BLAST against multiple trading pairs.

Below are some ways to acquire BLAST:

Centralized and decentralized exchanges Some centralized exchanges list BLAST in popular markets, potentially offering higher liquidity. Meanwhile, decentralized platforms built on Blast IO (or cross-chain DEXs) let you swap with only a Web3 wallet.

Baltex.io This platform specializes in supporting emerging blockchain tokens. You can often swap BLAST directly for stablecoins or other major assets.

Staking rewards Another route is to stake existing BLAST tokens and compound your holdings over time. If you already have some tokens in your wallet, staking might be a cost-effective way to accumulate more BLAST.

Before making a purchase, research transaction fees, liquidity, and whether the exchange follows reliable security protocols. Once you own BLAST, you can transfer it to a wallet that supports Blast IO, then stake or interact with dApps on the network.

Blast IO is designed for speed, low fees, and developer autonomy, making it a compelling choice for DeFi, gaming, and enterprise solutions.

The tokenomics revolve around supply caps, controlled inflation, and burn mechanisms that can drive value for long-term holders.

Staking offers a way for you to secure the network and earn rewards, while governance participation ensures you have a direct voice in the platform’s evolution.

With various dApps already in action, Blast IO demonstrates real-world utility spanning finance, entertainment, and business applications.

If you compare Blast IO to other L2 or cross-chain networks, you will notice it leans heavily on speed and interoperability.

You can readily buy or swap BLAST on platforms like Baltex.io and consider staking or providing liquidity on the network’s DeFi platforms.

As with any crypto project, do your own research and assess the risk. Engaging deeply in Blast IO’s community channels, exploring existing dApps, and diving into its technical documentation can give you the best sense of whether this ecosystem matches your goals. If you are searching for a network where your opinions steer development and where you can reap staking rewards, Blast IO’s governance and token model might offer the combination you have been seeking.