If you’re curious about Arbitrum One benefits and why so many traders and developers are flocking to this network in 2025, here’s the short version. Arbitrum One is a Layer-2 (L2) solution designed to boost Ethereum’s efficiency. It offers lower transaction costs, faster speeds, and a vibrant ecosystem of decentralized apps (dApps). The network focuses on a optimistic-rollup mechanism, meaning it bundles and verifies transactions off-chain before settling them on Ethereum. This saves gas expenses and eases congestion.

In 2025, Arbitrum has rolled out performance updates that aim to attract more DeFi builders, NFT enthusiasts, and crypto investors. It’s also working to make bridging from Ethereum even simpler. The result is a friendlier environment for launching liquidity pools, performing swaps, and staking tokens. Tools like Baltex.io open up more ways to swap assets on Arbitrum with minimal fuss.

If you’re in a hurry, that’s the quick gist. Keep reading for all the key questions and answers—from security to fees, from dApp diversity to staking mechanics. You’ll learn how to tap into Arbitrum One’s latest features and explore which use cases might be worth your time and investment.

Arbitrum One is an L2 blockchain that sits on top of Ethereum, aiming to reduce that well-known pain point: high gas fees. It’s not a standalone chain, but rather a complement to Ethereum where most of the heavy lifting is done off-chain through optimistic rollups. Then, transactions are posted periodically to the main Ethereum network for verification.

By 2025, Arbitrum has enhanced both throughput and user experience. It’s using improved proof verification, streamlined data compression, and better developer tools. Each improvement helps keep transaction speeds high and fees low. This environment is particularly handsome to DeFi apps looking for cheaper alternatives, and to gamers who want silky-smooth gameplay on blockchain-based titles.

If you’re an investor or a builder, the real draw lies in the network’s scalability. You can deploy smart contracts that interact with Ethereum assets without worrying about paying massive gas taxes. This efficiency arguably broadens the use cases, from everyday DeFi swaps to complex NFT projects, all while maintaining Ethereum-level security behind the scenes.

Arbitrum One processes most of the transaction data off the main Ethereum chain. In an optimistic rollup, you assume transactions are valid (optimistically) and only provide on-chain proof if something looks off. This design slashes congestion on Ethereum because you’re not verifying each step in real time on the main chain. Instead, you finalize a batch of transactions later, generating cryptographic proof if someone disputes a transaction.

These proofs aren’t generated for every transaction, only for those under dispute. This keeps fees low and speeds high. For everyday users, it means you can send tokens, execute trades, or mint NFTs much faster than on Ethereum alone. When you land on a busy day—like an NFT mint day—Arbitrum One’s efficiency can help you avoid those eye-popping transaction fees.

If you’re interested in more bridging details or how the actual data is compiled, check out our extended bridging guide. That page walks you through the technical workings of bridging ETH and ERC-20 tokens into Arbitrum, so you can keep track of where your funds are at all times.

Arbitrum One has been busy polishing its infrastructure. Its 2025 updates center on:

These enhancements translate into stronger user adoption. Projects that once stuck to Ethereum or other chains are hopping onto Arbitrum for better user experiences. For you, this means more options—more yield-farming platforms, more stablecoin pairs, and more NFTs minted without the dreaded gas shock.

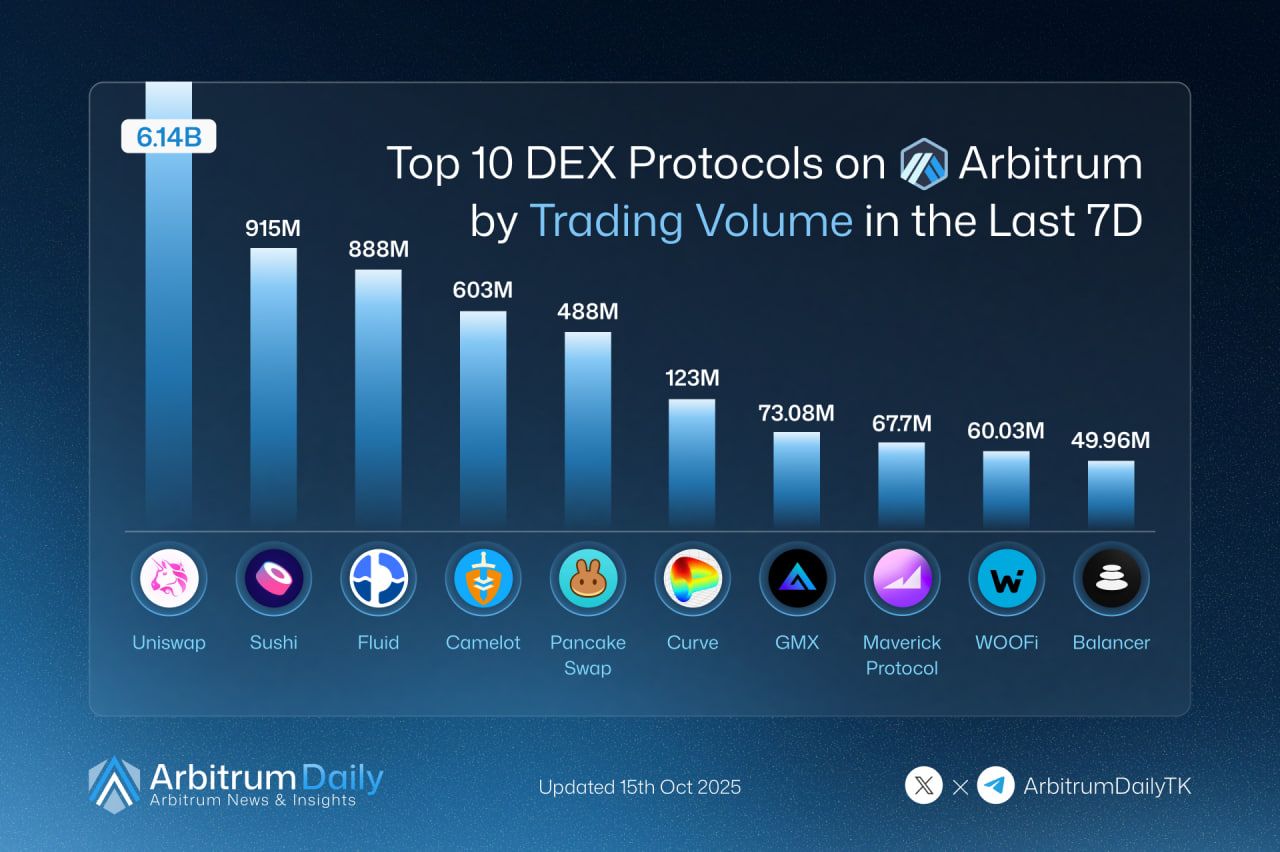

Arbitrum hosts a wide array of dApps that cater to different crypto interests. Popular uses include:

If you’re new to the ecosystem, you might enjoy exploring aggregator sites that list the available Arbitrum dApps. They’ll show you total-value-locked (TVL) rankings and the unique perks of each platform. You’ll quickly see that the selection is growing month by month, promising a steadily evolving environment.

Bridging is when you move your tokens from Ethereum (or another chain) to Arbitrum. It’s typically straightforward, though it involves a few steps:

Some bridging services let you go cross-chain from networks like Polygon or Binance Smart Chain, but the main approach is usually from Ethereum. The bridging fee covers the on-chain gas cost, which varies based on Ethereum network activity. It’s more expensive than performing a regular transaction on Arbitrum, but after you’re bridged, you’re all set to transact with lower fees.

For deeper insights, refer to our bridging best practices. There, you’ll find pointers on picking the right time of day to avoid spikes in gas prices, plus tips on bridging stablecoins or NFTs.

Staking on Arbitrum One is generally handled by individual dApps. Unlike proof-of-stake blockchains (such as Ethereum 2.0), Arbitrum itself uses optimistic rollups. It doesn’t have a native staking procedure for the network as a whole. However, many protocols on Arbitrum run their own staking or farming setups. You can stake tokens in liquidity pools, yield farms, or governance vaults to earn interest or governance rights.

For instance, if there’s a lending protocol on Arbitrum, you might stake your stablecoins there to earn passive returns from borrowers. Or you might stake an LP (liquidity provider) token to earn yield-farming rewards, just like you would on Ethereum, but with fewer transaction fees. Keep an eye out for any newly launched staking dApps that might offer early-bird incentives, especially in 2025 when protocol expansions are in full swing.

One of the standout Arbitrum One benefits is its relatively low transaction fees compared to Ethereum mainnet. If ETH gas fees hover between 20-50 gwei or higher, Arbitrum typically stays noticeably cheaper. Because the network batches transactions, your individual cost can be a fraction of an Ethereum transaction, sometimes as low as a few cents, though it depends on what the broader network looks like that day.

These numbers aren’t exact, but they illustrate the general gap between Ethereum and Arbitrum. If you trade frequently, that adds up to significant savings over time. On top of that, bridging fees from L1 to Arbitrum are a one-time expense if you plan to keep most of your activity on the L2.

Arbitrum One’s security largely derives from Ethereum. The entire structure is designed so that if something suspicious is spotted, a dispute can be filed on-chain, prompting a fraud-proof check. The network’s advantage is it can rely on Ethereum’s consensus if someone tries to break the rules.

However, it’s worth noting that no chain is 100% risk-free. Smart contract exploits can happen on L2, just as on Ethereum. If you join a brand-new dApp, do your due diligence. Look for projects that undergo reputable audits and maintain transparent communication with users. As with any crypto investment, never deposit more than you can afford to lose.

Baltex.io offers a one-stop shop for swaps and liquidity access on Arbitrum. It aggregates price feeds from multiple decentralized exchanges, so you can typically see better rates and deeper liquidity for tokens. Using Baltex.io might also reduce the number of steps needed for cross-asset swaps, saving you time and bridging fees.

If you’re a DeFi builder, listing your token on Baltex.io can expose you to broader liquidity. If you’re a trader, it’s simply a convenient place to swap tokens on Arbitrum with relatively low slippage. In 2025, more aggregator platforms have popped up, but Baltex.io remains a popular choice thanks to its user-friendly interface and specialized Arbitrum integration.

So, how can you put Arbitrum One into action? Let’s skim some of the most popular angles:

DeFi trading and yield farming If you’re into DeFi, Arbitrum is a cost-friendly way to hop in and out of liquidity pools. By moving your assets to Arbitrum, you can do multiple trades per day without draining your wallet. Yield farming becomes more attractive because compounding yields won’t be overshadowed by sky-high transaction fees.

NFT minting and trading The gas wars of Ethereum mainnet aren’t as brutal on Arbitrum. That makes it possible for creators to drop NFT collections at a fraction of the cost. Collectors benefit too, since per-transaction costs are lower on trades, transfers, or listing fees.

Gaming Blockchain gaming often involves multiple microtransactions, from buying in-game items to leveling up characters. This can be cost-prohibitive on Ethereum. Arbitrum One meets the demand for speed and lower fees, enabling rich in-game economies that won’t break the bank every time you craft or swap items.

DAO governance DAOs rely on on-chain voting, treasury management, and reward distributions. Arbitrum’s cheaper and faster environment can make that decision-making smoother. You can submit and vote on proposals with less friction, encouraging more community participation.

Cross-chain bridging Arbitrum’s bridging system includes direct pathways to Ethereum and beyond. This interconnectedness gives you the freedom to move assets and chase yields across multiple chains, all within a single day, if that suits your trading style.

Liquidity for new tokens Startups or established projects can issue tokens on Arbitrum to sidestep mainnet gas issues. Early liquidity providers might unlock higher yields. Keep your eyes peeled for new token launches or IDOs (Initial DEX Offerings) hosted on Arbitrum—those can sometimes carry special rewards.

Some advanced users even combine these strategies, like staking in a yield farm, bridging out to another chain, or collecting NFTs to use in a DeFi lending protocol. As always, do your homework. Because while the costs are lower, the complexity can still be high.

If you’d like more detail, see our deeper dive on Arbitrum dApps for specific protocols, their TVLs, and tips on navigating each platform.

By now, you have a thorough understanding of what Arbitrum One brings to crypto in 2025. You’ve seen how it reduces fees, speeds up transactions, and still anchors itself to Ethereum for security. You’ve also learned about bridging, staking, and the range of dApps on the network.

Arbitrum’s updates in 2025 make it a compelling destination for virtually any Ethereum-based activity. Whether you’re building a DeFi project, investing in NFTs, or exploring new gaming ecosystems, Arbitrum can offer a smoother, cheaper experience. Tools like Baltex.io expand your options for liquidity and token swaps, adding to the network’s appeal.

It’s still the wild west in many corners of the crypto world, so proceed responsibly. Keep a watchful eye on new protocols, confirm their audits, and track your bridging steps carefully. If all that checks out, you can enjoy the sweet spot between Ethereum’s security and Arbitrum’s scalability.

Yes, you still need ETH (bridged onto Arbitrum) to pay fees on the L2. The requirement is much smaller than mainnet, but you do require a bit of ETH in your wallet to process transactions.

Absolutely. Simply add the Arbitrum network details to MetaMask, then switch the network. Once you bridge tokens, they should show up in your wallet on the Arbitrum network.

They’re much faster than standard Ethereum mainnet transactions, but not truly instant. Most swaps confirm within a few seconds, though bridging tokens back to Ethereum can take longer.

Arbitrum has introduced a governance token, though not all dApps require one. Many tokens launched on Arbitrum are simply bridged ERC-20 tokens from Ethereum, or new project-specific tokens with different utilities.

Arbitrum uses a fraud-proof system. If a transaction seems invalid, anyone can challenge it by submitting proof to Ethereum. This ensures the network remains honest, with Ethereum ultimately deciding who’s correct.

Many DeFi protocols offer yield-farming programs on Arbitrum. The yields can be lucrative, partly because the fees are lower and the competition is growing. Just watch out for potential risks like impermanent loss or smart contract exploits.

It’s largely an aggregator, pulling in liquidity from multiple decentralized exchanges on Arbitrum. This approach can give you better token swap rates with less slippage than you might get from a single DEX.

If you’re ready to dive deeper, go ahead and bridge some test amounts, explore your favorite dApps, and see if Arbitrum One fits your crypto strategy. The potential is there—you just have to take the first step. Happy exploring!