Monero (XMR) is a privacy-focused cryptocurrency using ring signatures, stealth addresses, and confidential transactions to hide senders, receivers, and amounts. It operates on a proof-of-work blockchain with RandomX mining, low dynamic fees, and emphasizes fungibility. In 2026, XMR trades around $435, but faces regulatory risks like delistings. Pros include top-tier anonymity; cons involve scalability issues. Swap XMR efficiently via baltex.io for multi-chain needs.

Monero, often abbreviated as XMR, stands out in the cryptocurrency landscape as the premier privacy coin, designed from the ground up to prioritize user anonymity and financial confidentiality. Launched in 2014 as a fork of Bytecoin, Monero has evolved into a robust ecosystem that shields transaction details from public view, making it a go-to choice for those seeking discretion in their digital finances. As of December 25, 2026, XMR's price hovers at approximately $435, reflecting a market cap near $8 billion and a circulating supply of about 18.45 million coins. This guide breaks down how Monero operates, delving into its core privacy mechanisms, operational aspects like mining and fees, as well as the inherent limitations, trade-offs, and regulatory challenges in 2026. Whether you're a crypto enthusiast exploring privacy options or a beginner wary of surveillance in blockchain transactions, understanding Monero's inner workings can empower informed decisions.

At its essence, Monero functions on a decentralized blockchain similar to Bitcoin but with enhanced privacy layers. Every transaction is obfuscated by default, ensuring that unlike transparent ledgers where anyone can trace funds, Monero's design prevents linking addresses or viewing balances without explicit permission. This is achieved through advanced cryptography, setting it apart in an era where data privacy is increasingly under threat. In 2026, with rising institutional adoption of crypto and stricter global regulations, Monero's role has become more contentious, balancing unparalleled secrecy with potential compliance hurdles.

Monero's blockchain is a distributed ledger that records transactions in blocks, secured via proof-of-work (PoW) consensus. Unlike Bitcoin's SHA-256 algorithm, Monero employs RandomX, a CPU-optimized hashing method introduced in 2019 and refined through 2026 to maintain ASIC resistance. This ensures mining remains accessible to everyday users with standard hardware, promoting decentralization by discouraging large-scale mining farms. Blocks are produced every two minutes on average, allowing for faster confirmations compared to Bitcoin's ten-minute intervals.

The network's native token, XMR, serves as the medium for value transfer, with a total supply capped indirectly through a tail emission mechanism. After reaching 18.132 million coins in 2022, Monero began emitting 0.6 XMR per block indefinitely to incentivize miners long-term. This perpetual issuance prevents the security risks associated with fee-only models in other PoW chains. Transactions are validated by nodes, which enforce rules ensuring privacy features are upheld, making the entire system resistant to censorship and surveillance.

In practice, users interact with Monero via wallets like the official CLI, GUI, or mobile apps such as Cake Wallet and Monerujo. These tools generate private keys for spending and viewing, but Monero's privacy tech means even wallet balances require specific keys to access. This foundational setup underpins Monero's appeal, offering a seamless yet secure experience for transfers, whether for remittances, donations, or private purchases.

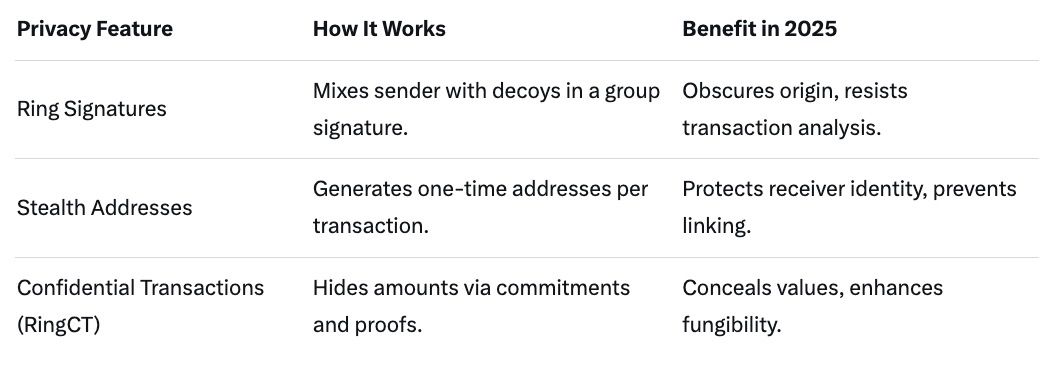

One of Monero's cornerstone privacy features is ring signatures, a cryptographic technique that mixes the actual sender's signature with decoys from other users on the blockchain. When initiating a transaction, the protocol selects a "ring" of potential signers—typically 11 or more in 2026 configurations—from past outputs, making it computationally infeasible to determine the true originator. This creates plausible deniability, as any observer sees only a group of possible spenders without pinpointing the real one.

Ring signatures evolved from earlier concepts in group signatures, adapted by Monero to enhance anonymity without requiring trust in a central party. In 2026, with upgrades like the proposed Seraphis protocol in discussion, ring sizes could expand further, bolstering the anonymity set against advanced analysis. However, this mixing comes at a cost: larger rings increase transaction sizes, impacting network efficiency. Despite this, ring signatures remain vital for protecting senders from transaction graph analysis, a common vulnerability in pseudonymous coins like Bitcoin.

Complementing ring signatures, stealth addresses ensure receiver privacy by generating unique, one-time-use addresses for each transaction. When sending XMR, the sender computes a stealth address using the recipient's public view and spend keys, combined with random data. This results in an address that appears random on the blockchain, unlinkable to the recipient's main wallet address.

The recipient scans the blockchain with their private view key to detect incoming funds, then uses the private spend key to access them. This dual-key system—view for monitoring and spend for transacting—adds layers of separation. In 2026 stealth addresses mitigate address reuse risks, enhancing fungibility by preventing taint from previous transactions. While effective against on-chain tracing, users must still guard against off-chain leaks, like sharing wallet details insecurely.

Monero's privacy triad completes with confidential transactions, implemented via Ring Confidential Transactions (RingCT) since 2017. RingCT hides transaction amounts using Pedersen commitments, a homomorphic encryption method that allows verification of balances without revealing values. Bulletproofs, zero-knowledge proofs integrated in 2018, further optimize this by reducing proof sizes.

In a RingCT transaction, inputs and outputs are masked, but the network confirms no new coins are created through range proofs ensuring amounts are positive and within bounds. This obscures financial details, preventing inferences about user wealth or spending habits. By 2026, RingCT has proven resilient, though advanced statistical attacks remain a theoretical concern, addressed through ongoing protocol tweaks.

This table summarizes Monero's key privacy tools, illustrating their synergistic role in default anonymity.

Mining in Monero involves solving computational puzzles to add blocks and earn rewards. The RandomX algorithm, CPU-centric and ASIC-resistant, democratizes participation by favoring general-purpose processors over specialized hardware. In 2026, miners use tools like XMRig software, joining pools such as MineXMR or P2Pool for consistent payouts. Profitability depends on electricity costs, hardware efficiency, and network hashrate, which hovers around 3 GH/s.

Solo mining is possible but rare due to variance; pools charge fees of 0-2%, distributing rewards via PPLNS schemes. With tail emissions, mining sustains security indefinitely. However, environmental concerns persist, though RandomX's CPU focus reduces energy intensity compared to GPU-heavy alternatives.

Monero employs dynamic fees, calculated based on transaction size and network congestion, typically ranging from 0.00001 to 0.001 XMR per kilobyte. This adaptive model ensures low costs—often under $0.01—even during peaks, making it economical for microtransactions. Fees fund miners alongside block rewards, with priority given to higher-paying transactions.

In 2026, fee structures remain user-friendly, but privacy features inflate data footprints, leading to slightly higher costs than transparent chains. Wallets automatically suggest fees, balancing speed and expense.

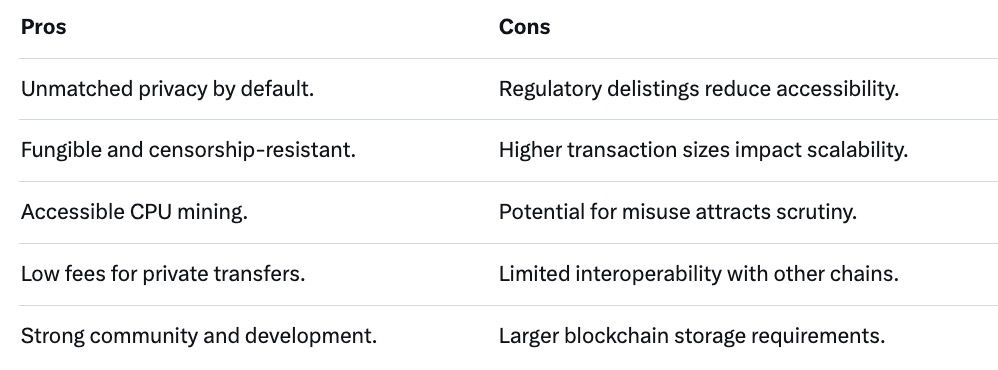

Despite its strengths, Monero faces scalability challenges; larger transaction sizes from privacy tech limit throughput to about 1,000 TPS theoretically, though real-world figures are lower. Storage demands are higher, with the blockchain exceeding 150 GB by 2026. Interoperability with other chains is limited without wrapped versions, and atomic swaps are nascent.

Monero's opacity enhances fungibility—every XMR is identical, free from history taint—but reduces auditability, complicating compliance for businesses. Trade-offs include potential for illicit use, though this is a minority; most transactions are legitimate. Users sacrifice some transparency for privacy, navigating a balance in an increasingly regulated space.

In 2026, Monero encounters heightened scrutiny, with delistings from exchanges like Kraken in certain regions due to AML concerns. EU's MiCA and FATF guidelines pressure platforms to avoid privacy coins, risking liquidity. While holding XMR is legal in most jurisdictions, trading faces restrictions, amplifying volatility. Potential crackdowns could stifle adoption, though decentralized exchanges mitigate this.

This table weighs Monero's advantages against drawbacks in 2026.

For Monero users managing privacy while navigating exchanges, baltex.io offers a seamless solution for multi-chain swaps. As a non-custodial platform supporting over 1,000 cryptocurrencies, it enables instant, secure conversions without KYC, ideal for swapping XMR to other assets before fiat cash-outs. Low fees and free AML checks ensure efficiency, while its hybrid model accommodates both custodial and non-custodial preferences.

XMR holders can swap to stablecoins like USDT on Ethereum or other chains in seconds, bypassing traditional bridges' delays and risks. This is crucial in 2026 amid regulatory flux, allowing quick portfolio adjustments. Visit https://baltex.io to facilitate smooth transitions and maintain privacy in your crypto operations.

How do ring signatures work in Monero? They mix the sender's signature with decoys, obscuring the true origin.

What are stealth addresses? One-time addresses generated for each transaction to protect the receiver.

How does Monero hide transaction amounts? Through RingCT, using commitments and proofs to mask values.

Is Monero mining profitable in 2026? It can be with low electricity costs, using CPU hardware via pools.

What are Monero's main limitations? Scalability issues and higher data usage due to privacy features.

What regulatory risks does Monero face? Delistings and AML scrutiny in regions like the EU.

Can Monero be traced? On-chain, no; but off-chain metadata could pose risks.

How to swap Monero efficiently? Use baltex.io for fast, cross-chain exchanges without KYC

Monero exemplifies privacy in cryptocurrency, leveraging ring signatures, stealth addresses, and confidential transactions to deliver untraceable transfers. Its mining and fee structures support accessibility, yet limitations like scalability and regulatory pressures in 2026 demand caution. While trade-offs exist, Monero's commitment to fungibility positions it as a vital tool for privacy advocates. Platforms like baltex.io enhance usability, enabling secure swaps. As crypto matures, Monero's future hinges on balancing innovation with compliance—stay informed and use it responsibly for optimal benefits.