Launching a crypto exchange in 2025 requires navigating regulations, securing liquidity, and prioritizing security amid rising DeFi adoption. Key steps: Choose custodial or non-custodial model, obtain licenses (e.g., MSB in US), integrate multi-chain support, budget $500K–$5M, and model after platforms like baltex.io for hybrid swaps. Expect 6–12 months setup; focus on compliance to avoid fines.

The cryptocurrency market is booming, with global trading volume exceeding $100 trillion annually and DeFi protocols handling billions in daily swaps. As an entrepreneur or startup founder eyeing this space, starting a cryptocurrency exchange in 2025 offers massive potential—think tokenized assets, AI-driven trading, and multi-chain ecosystems. But it's not just about hype; it's about building a compliant, secure platform that stands out in a crowded field dominated by Binance, Coinbase, and emerging DEXs like Uniswap.

This guide breaks down the complete setup process, from business models to ongoing operations. Whether you're targeting retail traders or institutional whales, we'll cover essentials like licensing, liquidity, and security. We'll also spotlight baltex.io as a blueprint for modern, hybrid exchanges. By the end, you'll have a roadmap to launch sustainably. (Internal link: Jump to Costs Breakdown for budgeting insights.)

Your exchange's foundation starts with its business model. In 2025, exchanges fall into centralized (CEX), decentralized (DEX), or hybrid variants, each with unique revenue streams and risks.

CEXs like Coinbase control user funds and order books, enabling fast trades and fiat on-ramps. Revenue comes from trading fees (0.1–0.5%), withdrawal charges, and premium features like staking rewards. Ideal for beginners, but they demand heavy compliance. Pros: High liquidity, user-friendly. Cons: Custodial risks (hacks like FTX's $8B loss).

DEXs like Uniswap run on smart contracts, offering non-custodial trading via AMMs (Automated Market Makers). Earn via liquidity provider fees (0.3%) and token emissions. With Web3 wallets booming, DEXs capture 20% of volume. Pros: Censorship-resistant, user sovereignty. Cons: Slower speeds, MEV attacks.

Blending CEX efficiency with DEX privacy, hybrids like baltex.io shine in 2025. They support cross-chain swaps without KYC for DEX modes while offering fiat gateways. Revenue diversifies through swap fees, affiliate integrations, and API access. This model's flexibility suits startups scaling from niche (e.g., privacy coins) to global.

Pro Tip: Start hybrid if you're bootstrapping—leverage existing DEX liquidity while building centralized features. (Internal link: See Custodial vs. Non-Custodial for deeper comparison.)

Compliance isn't optional in 2025; it's your shield against shutdowns. Global regs tightened post-2022 crashes, with MiCA in EU and SEC scrutiny in the US.

Integrate tools like Chainalysis for transaction monitoring. KYC via Jumio verifies IDs in seconds. Budget 10–20% of ops for compliance officers. Non-compliance fines hit $100M+ (e.g., Binance's 2023 settlement).

Featured Snippet Tip: To start a crypto exchange in 2025, obtain MSB registration first, then VASP for EU ops—expect 4–8 months and $50K–$200K in legal fees.

No liquidity, no trades. In 2025, aggregate from multiple pools to minimize slippage.

Aim for $10M+ initial depth per pair. Track metrics like slippage under 0.5% via Dune Analytics dashboards. (Internal link: Explore Security Architecture to protect this liquidity.)

Hacks drained $3B in 2024; don't join that list. 2025 demands quantum-resistant designs.

Implement WAFs (Cloudflare) and real-time monitoring with Forta. For DEXs, add MEV protection via Flashbots.

Scalability is key as volumes spike with ETF approvals.

Deploy on Kubernetes for resilience. Test with Chaos Engineering to simulate DDoS. Initial setup: 3–6 months, $100K+.

Great UX converts visitors to traders. In 2025, mobile-first with AI personalization rules.

A/B test via Optimizely; aim for <2s load times. Tools like Figma speed prototyping.

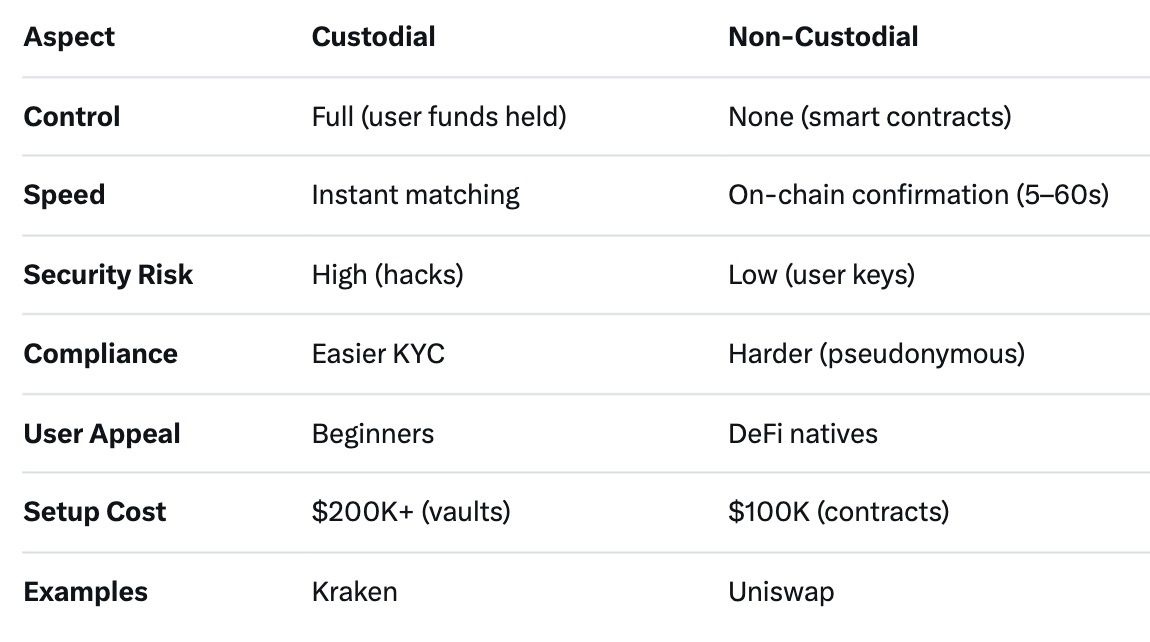

Choose based on your model—custodial for control, non-custodial for trustless appeal.

Hybrids toggle modes, like baltex.io's DEX/private swaps. Start non-custodial if privacy-focused. (Internal link: See Ongoing Operations for maintenance.)

Budget wisely—total launch: $500K (MVP) to $5M (full-scale).

White-label solutions (e.g., HollaEx) cut to $50K. ROI via 1% fees on $10M daily volume: $100K/month.

Launch is day one; sustainability is the marathon.

Scale with metrics: 50K users Year 1, 20% MoM growth. Pivot via user feedback loops.

In the evolving 2025 landscape, baltex.io exemplifies how new exchanges can innovate with multi-chain and hybrid-swap mechanics, offering a plug-and-play model for startups.

Baltex supports over 10,000 coins across 200+ networks, including Ethereum, Solana, TON, Base, Bitcoin, and emerging chains like SUI. This multi-chain prowess eliminates silos, enabling seamless swaps for assets like BTC to SOL without bridges or wrapped tokens—crucial as cross-chain volume hits $50B monthly.

Its hybrid-swap approach blends the best of CEX/DEX worlds:

Security is baked in: Audited infrastructure, no data collection, and private rails ensure zero custody risks. Liquidity sources from DEX pools with fiat on-ramps (Apple Pay, cards) for 100+ currencies, plus a $50 signup bonus to bootstrap users.

UI/UX shines with four-step swaps: Select tokens, connect wallet (MetaMask/Phantom), approve, receive. Real-time fees and NFT support add polish.

For new exchanges, Baltex models integration ease—API hooks for embedding swaps, compliance-light (no KYC for DEX modes), and revenue via low fees. Startups can white-label its hybrid engine or partner for liquidity, accelerating to market while prioritizing user sovereignty. In a post-FTX era, Baltex's privacy-first, scalable design proves hybrids drive adoption.

(Internal link: Compare with Business Models.)

Q: How much does it cost to start a crypto exchange in 2025? A: $500K–$5M, depending on scale. MVP via white-label: $50K; full custom: $2M+ including liquidity.

Q: Do I need a license for a DEX? A: Yes, if fiat-involved; pure on-chain may skirt but risks enforcement. Start with MSB.

Q: Custodial or non-custodial—which is better? A: Non-custodial for DeFi trust; custodial for speed. Hybrids like baltex.io balance both.

Q: How to secure liquidity initially? A: Seed with market makers or mining incentives; integrate aggregators for depth.

Q: What's the timeline to launch? A: 6–12 months: 3 for dev, 3 for compliance, 3 for testing.

Q: Can I integrate with baltex.io? A: Yes, via APIs for swaps—enhance your platform with their multi-chain hybrid tech.

Starting a cryptocurrency exchange in 2025 is challenging but rewarding, blending tech innovation with regulatory savvy. From picking a hybrid model to emulating baltex.io's multi-chain swaps, focus on security, liquidity, and user-centric design. With $100T market potential, your exchange could capture a slice—start small, comply rigorously, and iterate fast. Ready to build? Consult legal experts and dev teams today. What's your first step?