Monero swappers enable privacy-focused crypto users to obscure transaction trails by routing funds through XMR's anonymity features, breaking on-chain links across blockchains. In 2025, non-custodial services like baltex.io offer no-KYC swaps with low fees (0.4-1%), unlimited limits, and atomic-like mechanics for safe multi-chain movements. Key benefits include reduced surveillance exposure, but risks involve volatility and potential scams—always verify addresses and use small test swaps.

In an era where blockchain transparency invites constant surveillance from governments, exchanges, and chain analysis firms, protecting crypto privacy has become essential for users valuing financial autonomy. Monero (XMR), with its default privacy through ring signatures, stealth addresses, and Ring Confidential Transactions (RingCT), stands as the premier tool for untraceable transactions. Monero swappers leverage this by acting as intermediaries that convert other cryptocurrencies into XMR and back, effectively laundering the trail without illegal intent—simply restoring the fungibility that transparent chains like Bitcoin lack.

These swappers range from decentralized atomic protocols to aggregator platforms, allowing users to move funds across chains while minimizing exposure. For privacy-focused holders in 2025, amid heightened regulations like the EU's MiCA and U.S. AML scrutiny, swappers provide a lifeline for safe remittances, DeFi participation, and portfolio rebalancing. This guide demystifies their mechanics, usage, and implications, empowering you to integrate them into your strategy without compromising security.

Understanding the basics is key: swappers don't hold your funds long-term in non-custodial models, reducing theft risks, but they require trust in the protocol's integrity. As we explore, you'll see how these tools evolve privacy from a feature to a fortress, especially with upgrades like FCMP++ enhancing XMR's untraceability.

At their heart, Monero swappers facilitate cross-asset exchanges by using XMR as a privacy bridge. When you swap, say, BTC for ETH via a Monero swapper, the process typically involves sending BTC to a temporary address controlled by the service, converting it to XMR internally, and then swapping that XMR for ETH sent to your wallet. This intermediate XMR step exploits Monero's cryptography: ring signatures mix your transaction with others to hide the sender, stealth addresses generate unique one-time recipients invisible on-chain, and RingCT conceals amounts, ensuring no direct link between input and output.

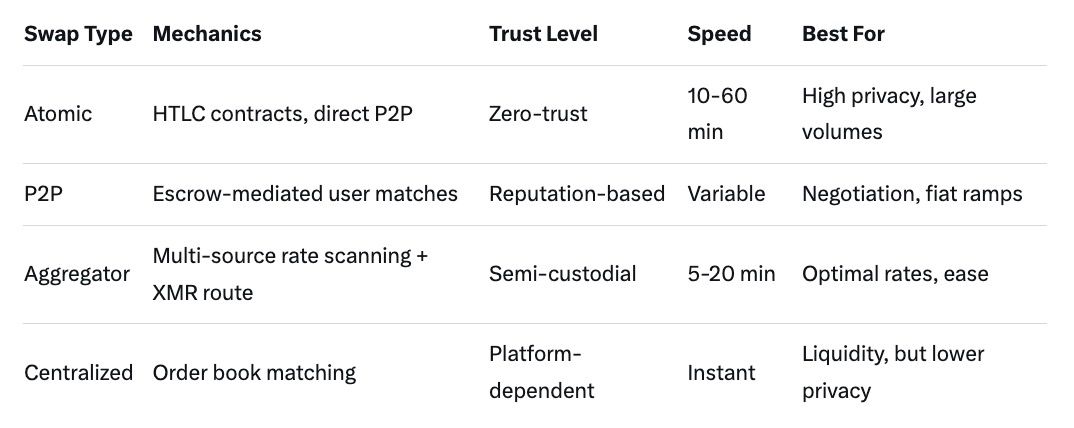

In 2025, advanced swappers employ atomic swaps—decentralized, trustless exchanges using hash time-locked contracts (HTLCs) where both parties must fulfill conditions or funds revert. This eliminates counterparty risk, as seen in protocols like Eigenwallet for BTC-XMR pairs. Aggregators, meanwhile, scan multiple liquidity sources (DEXs, CEXs) for optimal rates before routing through XMR, adding layers like randomized timing and fresh addresses per swap to thwart timing attacks or metadata leaks.

For multi-chain scenarios, swappers handle bridging implicitly: your SOL on Solana gets swapped to XMR, then to TRX on Tron, all while preserving anonymity. This mechanics not only obscures trails but also enhances fungibility—your coins emerge "clean" of prior history, ideal for users dodging taint from mixers or flagged addresses. However, the process demands compatible wallets like Monero GUI or hardware like Ledger for secure key management.

Trust in swappers varies by design, a critical factor for privacy users wary of honeypots or exit scams. Non-custodial models, dominant in 2025, never take full control of your keys; instead, they use smart contracts or escrows where funds only move upon confirmation. Atomic swaps exemplify zero-trust: if one party fails, the swap aborts automatically, as in Eigenwallet's peer-to-peer BTC-XMR exchanges over Tor for added network privacy.

Semi-custodial swappers, like some aggregators, briefly hold funds during conversion but mitigate risks with transparency audits and insurance funds. Centralized options, such as TradeOgre, offer no-KYC trading but require trusting the platform's operations—appealing for simplicity yet riskier amid regulatory pressures that have delisted XMR from many exchanges. Privacy enthusiasts favor decentralized trust models to avoid data collection, ensuring no logs tie swaps to identities.

In practice, evaluate trust via community reviews, open-source code, and uptime history. Services routing through Monero inherently boost trust by leveraging XMR's proven privacy, but always prioritize those with provable reserves or on-chain verifiable liquidity to sidestep rug pulls.

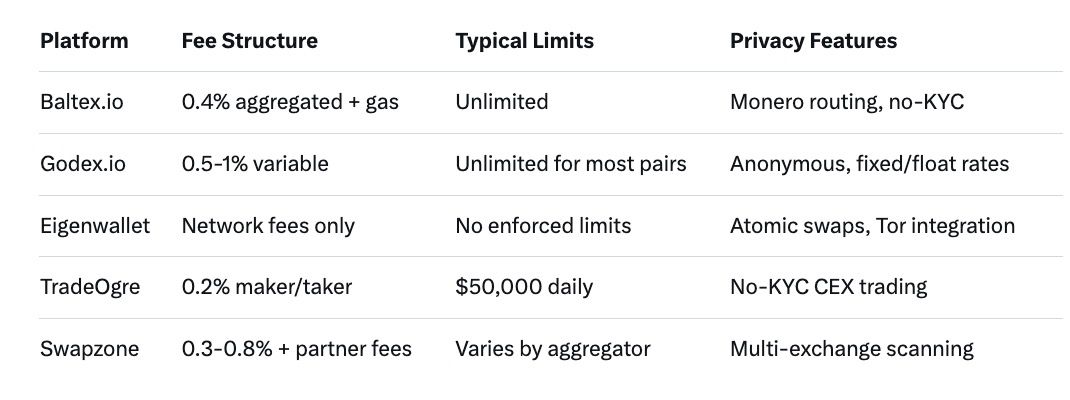

Fees in Monero swappers stem from network gas, liquidity provider cuts, and service margins, typically ranging from 0.3% to 2% in 2025—far lower than traditional mixers' 5-10%. Non-custodial atomic swaps often incur only blockchain fees, like Bitcoin's variable sats/vByte plus Monero's fixed low costs (under $0.01), making them economical for large volumes. Aggregators add a premium for rate optimization, but competition keeps it competitive.

Limits vary: decentralized swappers like atomic protocols have no caps beyond network constraints, enabling whale-sized trades without KYC flags. Centralized no-KYC platforms cap at $10,000-50,000 per swap for AML reasons, while privacy-focused ones like Godex.io offer unlimited anonymous exchanges. In a volatile market, fixed-rate options lock prices during swaps, protecting against slippage, though at a slight fee hike.

Economic trade-offs include opportunity costs from conversion times (5-30 minutes) and potential tax implications—swaps may trigger capital gains events in jurisdictions tracking crypto. For 2025 users, selecting low-fee, high-limit swappers maximizes privacy ROI, especially when chaining multiple hops for enhanced obfuscation.

While powerful, Monero swappers carry risks that demand vigilance. Volatility during swaps can lead to unfavorable rates, mitigated by fixed-price options but exposing users to service defaults if markets swing. Scams abound—phishing sites mimic legit swappers, so always verify URLs and use bookmarking. Network attacks, like 51% on weaker chains, could theoretically reverse swaps, though Monero's robust hashing (RandomX) resists this.

Compliance is a double-edged sword: no-KYC swappers evade surveillance but attract scrutiny in regulated regions, where using them might flag as suspicious activity. In 2025, with global AML frameworks tightening, privacy users face trade-offs—enhanced anonymity versus potential blacklisting by banks or exchanges upon cash-out. Tools like Tor or VPNs add layers but aren't foolproof against advanced forensics.

Mitigate by diversifying swappers, avoiding over-reliance on one, and complying with local laws through optional transparency (e.g., view keys for audits). The ultimate trade-off: true privacy requires accepting some operational complexity and risks, but for those targeted by surveillance, it's indispensable.

Executing a Monero swap safely starts with preparation: set up a secure wallet like Monero GUI synced to a remote node for efficiency, or hardware for cold storage. Choose a reputable swapper based on your needs—atomic for trustless, aggregator for speed.

Step one: Select your pair, e.g., ETH to BTC via XMR. Input amounts on the swapper's interface; opt for private mode if available to activate Monero routing. Generate or receive a deposit address—always copy-paste to avoid malware clipboard hijacks.

Step two: Send a small test amount first (e.g., $10) to verify the flow. Monitor via blockchain explorers, noting Monero's privacy hides details post-conversion.

Step three: Upon confirmation, the swapper routes through XMR, breaking links, and delivers to your payout wallet. Confirm receipt before larger sends.

Safety checks: Use HTTPS sites, enable 2FA where possible, run antivirus, and cross-verify addresses via multiple devices. Post-swap, consider additional churning (self-sends) in XMR for extra obfuscation, though FCMP++ reduces necessity. For multi-chain, ensure chain compatibility to avoid lost funds.

This flow, when followed diligently, transforms routine transfers into fortified privacy operations, shielding against 2025's pervasive tracking.

Monero swappers come in varied forms, each suited to different privacy needs. Atomic swaps, using HTLCs, offer pure decentralization with no intermediaries, ideal for direct BTC-XMR but limited to supported pairs and slower (10-60 minutes). They shine in trustlessness, requiring only wallet software.

P2P swappers connect users directly via escrows, fostering negotiation but risking disputes—platforms like LocalMonero facilitate this with reputation systems. Aggregators pull from multiple sources for best rates, adding convenience at a fee, while centralized swappers provide liquidity but often demand KYC, diluting privacy.

In 2025, hybrid models blending atomic mechanics with aggregation dominate, balancing speed and anonymity. Choose based on volume: atomic for high-stakes, aggregators for everyday.

Baltex.io emerges as a standout in 2025 for its non-custodial, no-KYC approach to multi-chain swaps, leveraging Monero as a core privacy layer. Users select any pair across 200+ chains—like TON to Base—and activate "Private" mode, generating a one-time deposit address. Funds route through XMR's protocol, severing on-chain links via ring signatures and stealth addresses, before settling in the desired asset.

This XMR intermediary ensures zero traceability, perfect for pre-cash-out routing: swap ETH to XMR-hopped BTC, then fiat via compliant off-ramps without exposing origins. Fees hover at 0.4% aggregated plus gas, with unlimited limits suiting whales. The trust model is self-custodial—funds never linger, reducing risks—while AML screening skips personal data for compliance balance.

Step-by-step: Visit baltex.io, choose currencies, enable private, deposit, and receive obscured output in minutes. Risks include market slips, mitigated by fixed rates. For DeFi users, it facilitates anonymous rebalancing, like SOL to AVAX, preserving sovereignty. Explore more on multi-chain privacy strategies.

Monero swappers are services that exchange cryptocurrencies using XMR as a privacy bridge to obscure transaction histories and break on-chain surveillance.

By routing funds through Monero's ring signatures, stealth addresses, and RingCT, they hide senders, receivers, and amounts, ensuring untraceable cross-chain moves.

Fees range from 0.3-2%, including network gas and margins, with non-custodial options like baltex.io at 0.4% for aggregated liquidity.

Many no-KYC swappers offer unlimited volumes, though centralized ones cap at $10,000-50,000; atomic swaps have no enforced limits.

Volatility, scams, and regulatory scrutiny; mitigate with test swaps, verified sites, and diversified usage.

It routes deposits through Monero before payout, breaking links for private, instant cross-chain exchanges without KYC.

No-KYC models skirt personal verification but align with AML via transaction screening; check local laws for trade-offs.

In 2025's surveillance-saturated crypto landscape, Monero swappers offer a robust shield, transforming transparent transactions into anonymous flows. By mastering their mechanics, evaluating trusts, and navigating risks, privacy users can safeguard assets across chains without sacrifice. Platforms like baltex.io exemplify this evolution, blending efficiency with unyielding anonymity. Embrace these tools thoughtfully, and reclaim financial privacy as your right—stay vigilant, adapt to upgrades, and thrive in the decentralized era.