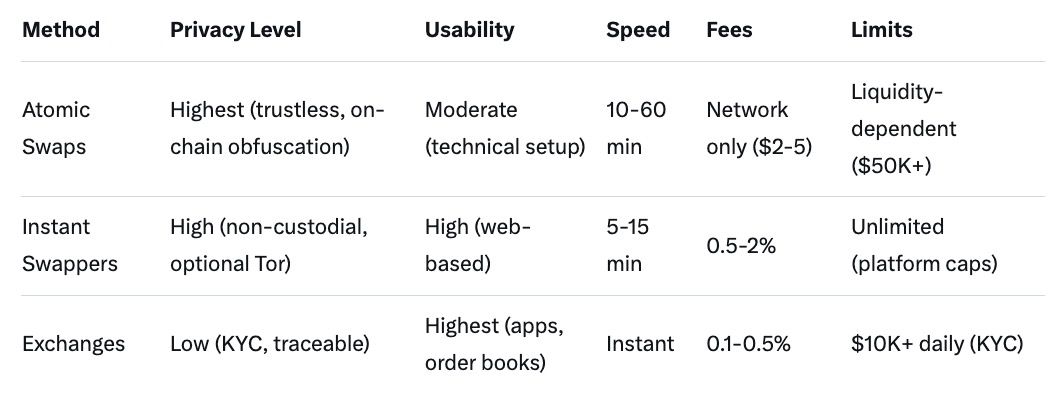

In 2026, Monero atomic swaps enable trustless P2P trades, primarily BTC to XMR via protocols like Farcaster and tools such as EigenWallet, offering ultimate privacy without intermediaries. Setup involves wallets and nodes, with network fees only, but swaps take 10-60 minutes and face UX hurdles like technical complexity. Compared to instant swappers (5-15 minutes, 0.5% fees) or exchanges (instant but KYC-required), atomic swaps excel in decentralization but lag in speed. Risks include timeouts and liquidity issues; use baltex.io for faster alternatives when needed.

As privacy becomes paramount in the cryptocurrency space in 2026, Monero (XMR) atomic swaps stand out as a cornerstone for peer-to-peer trading. These swaps allow users to exchange assets like Bitcoin (BTC) for XMR directly, without trusting centralized exchanges or intermediaries, leveraging cryptographic protocols to ensure either both parties complete the trade or neither does. This trustless mechanism aligns perfectly with Monero's ethos of untraceable transactions, powered by ring signatures, stealth addresses, and confidential amounts. With XMR trading around $500 and a market cap over $9 billion, atomic swaps have matured from experimental tools in the early 2020s to reliable options, driven by community projects amid regulatory pressures that have delisted XMR from many platforms.

The evolution of Monero atomic swaps by 2026 reflects significant advancements. Early implementations faced scalability and usability issues, but updates to protocols have integrated better with Monero's privacy features. For instance, the FCMP++ upgrade earlier this year enhanced quantum resistance and expanded anonymity sets, indirectly boosting swap efficiency. Community-driven initiatives have filled gaps left by halted projects, with new dApps for EVM compatibility emerging from crowdfunding efforts. Privacy-focused users, from activists to everyday holders, turn to these swaps to avoid KYC mandates and chain analysis, making them essential in a landscape where governments scrutinize traceable assets like BTC.

At their core, atomic swaps use hash time-locked contracts (HTLCs) to facilitate cross-chain exchanges. In a BTC-to-XMR swap, the initiator locks BTC in a contract requiring a secret to claim, which the counterparty reveals only after locking equivalent XMR. If one party fails, funds refund automatically after a timeout, preventing scams. This process occurs on-chain, ensuring transparency without revealing identities. In 2026, with Monero's network handling larger ring sizes for better obfuscation, swaps maintain privacy even under sophisticated analysis tools. The result is a seamless way to convert public BTC holdings into private XMR, ideal for users hedging against surveillance.

Understanding the mechanics of Monero atomic swaps starts with the protocol layer. Protocols like Farcaster enable BTC-XMR trades by adapting HTLCs to Monero's unique privacy model, where amounts and addresses are hidden. The swap begins with negotiation: users connect via a decentralized network or app, agree on rates, and initiate the lock. Bitcoin's side uses a standard HTLC, while Monero employs adaptor signatures to align with its ring-based system. Once locked, the counterparty claims the BTC by revealing the secret, which automatically unlocks the XMR for the initiator. This atomicity—hence the name—ensures no partial executions.

Supported assets in 2026 have expanded beyond BTC. While BTC-XMR remains dominant due to Bitcoin's liquidity, EVM-compatible swaps for ETH or stablecoins like USDC have gained traction following 2025's community-funded developments. Projects now support swaps with other privacy coins like Zcash, though volumes are lower. Limitations persist: Monero's lack of native Layer 2 solutions means all swaps are on-chain, contrasting with Bitcoin's Lightning Network potential. This keeps transactions grounded in base-layer confirmations, typically requiring 2-10 Bitcoin blocks and Monero's 2-minute intervals.

Setup requirements emphasize self-sovereignty. Users need compatible wallets like the official Monero GUI or EigenWallet for swaps. Running a full node enhances privacy but demands 100GB+ storage and stable internet; light clients suffice for most. Tools like BasicSwapDEX provide a decentralized interface, integrating Tor for anonymous connections. Installation involves downloading from verified sources, syncing chains, and funding wallets. For mobile users, apps like Monero One offer basic swap functionality, though desktop remains preferred for complex trades. In 2026, with improved documentation, even novices can set up in under an hour, but technical hurdles like port forwarding deter mass adoption.

Fees for atomic swaps are minimal, confined to network costs. Bitcoin fees average $2-5 per transaction amid moderate congestion, while Monero's dynamic fees hover at $0.01-0.05. No platform premiums apply, unlike swappers' 0.5-1% cuts, making atomic ideal for large volumes. Limits are liquidity-driven: no hard caps, but finding peers for swaps over $50,000 can take hours, depending on order books in DEXs like Haveno. Usability has improved with GUI integrations, but challenges remain—manual secret handling risks user error, and volatile markets can shift rates mid-swap.

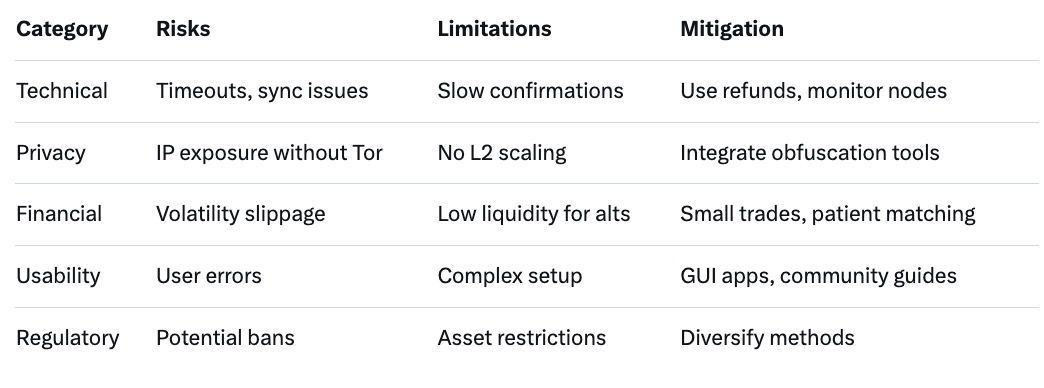

UX challenges highlight atomic swaps' trade-offs. The process feels clunky compared to one-click apps: users must monitor confirmations, handle refunds manually if timed out, and troubleshoot chain sync issues. In 2026, with mobile penetration, apps mitigate this, but cross-chain coordination demands patience. Failure scenarios include timeouts (funds safe but delayed), mismatched rates leading to cancellations, or network attacks like eclipse exploits, though Monero's obfuscation reduces these. Overall, while empowering, atomic swaps require a privacy mindset, rewarding users with uncompromised anonymity.

When weighing Monero atomic swaps against alternatives, privacy and usability emerge as key differentiators. Instant swappers, like GhostSwap or ChangeNOW, offer non-custodial conversions in minutes, aggregating liquidity from DEX pools. They excel in speed—5-15 minutes vs. atomic's 10-60—and simplicity, with web interfaces requiring only wallet addresses. However, privacy can leak via IP tracking or metadata, though many integrate Tor. Usability favors swappers for beginners, but they introduce minor custody risks during processing and fees of 0.5-2%, eroding value for frequent trades.

Exchanges, such as Kraken or Bitfinex, provide instant liquidity through order books, with fees under 0.5% and high limits. In 2026, remaining XMR listings prioritize institutional users, but KYC mandates expose identities, undermining Monero's purpose. Privacy is nullified by chain analysis on deposits/withdrawals, and custody risks loom from hacks or freezes. Usability shines for high-volume traders, but regulatory delistings make them unreliable for privacy seekers.

Atomic swaps outshine both in privacy: fully decentralized, no logs, and Monero's features break traces post-swap. Yet, usability lags—slower, more technical—making them suited for purists. Swappers bridge the gap, offering near-atomic privacy with better UX, while exchanges suit those tolerant of oversight.

Real-world usability of atomic swaps in 2026 varies by scenario. For hedging BTC volatility into private XMR, they're unmatched, enabling activists or merchants to accept payments discreetly. In regions with exchange bans, they provide access without fiat ramps. However, limitations include dependency on peer liquidity—sparse order books delay large trades—and on-chain nature, exposing to congestion fees during peaks.

Risks encompass technical failures: mismatched software versions cause aborts, while volatility shifts value mid-swap, though refunds mitigate loss. Security threats like man-in-the-middle attacks are rare with Tor, but user errors—wrong addresses—lead to permanent losses. Regulatory risks persist; while decentralized, swaps could attract scrutiny if tied to illicit activity, though Monero's privacy shields this.

While atomic swaps offer unparalleled privacy, their speed and liquidity constraints make them impractical for urgent trades. Here, baltex.io serves as a powerful complement in 2026, providing non-custodial, multi-chain routing for faster XMR access. As an aggregator supporting 200+ networks and 10,000+ tokens, baltex.io enables instant BTC-to-XMR swaps via optimized paths, often under 15 minutes with 0.3% fees. When atomic peers are scarce, users route through baltex's private mode, leveraging Monero rails to obfuscate origins before final delivery.

For example, during market volatility, baltex aggregates DEX liquidity for slippage-free conversions, then outputs to a fresh XMR wallet. This bridges atomic's decentralization with swapper efficiency, ideal post-atomic for cash-outs to stablecoins. No KYC or logs ensure privacy alignment, making baltex indispensable when atomic UX falters.

They use HTLCs for trustless BTC-XMR trades, with refunds on failure.

Primarily BTC, with growing ETH/EVM and privacy coin pairs.

Compatible wallets like EigenWallet, full/light nodes, and Tor for anonymity.

Timeouts, volatility, and user errors; mitigated by refunds and guides.

It offers faster, multi-chain routing for liquidity when peers are unavailable.

Monero atomic swaps in 2026 empower privacy-focused users with true P2P trading, blending cryptographic security with decentralization. Despite UX challenges and risks, their evolution marks a win for financial sovereignty. Complement with tools like baltex.io for efficiency. As regulations tighten, mastering these swaps ensures resilience in the crypto frontier.