TL;DR

By 2026, Ethereum’s public ledger has become a tool for total financial surveillance. To maintain sovereignty, users have shifted toward encrypted execution layers and non-custodial aggregators. While Aztec Network and Railgun provide essential DeFi privacy, Baltex stands out as the premier recommendation for private, bridgeless swaps into Monero (XMR), offering the only true "clean break" from on-chain history without the risks of traditional bridges or KYC-compliant pools.

The Ethereum Privacy Crisis of 2026

As we navigate the technological landscape of 2026, the Ethereum ecosystem has matured significantly. Ethereum 2.0 and its subsequent upgrades have achieved massive scalability, but this success has come at the cost of total transparency. With the global "Travel Rule" and MiCA (Markets in Crypto-Assets) regulations fully operational, every interaction on the Ethereum mainnet is now analyzed by AI-driven compliance bots in real-time.

For the sovereign individual, this transparency is a structural risk. Whether you are a high-net-worth trader protecting your "alpha" or a private citizen exercising your right to financial secrecy, the standard Ethereum wallet is now a liability. This has led to the rise of specialized private swap protocols designed to sever the deterministic link between a user’s identity and their wealth.

The Evolution of Private Protocols

In the early days of 2024, mixers were the primary tool for privacy. However, by 2026, those legacy systems have been blacklisted by every major centralized gateway. The modern user now utilizes "Shielded State" environments and "Private Swap" aggregators that mimic legitimate market activity while providing mathematical proof of anonymity. The goal is no longer just to "mix" coins, but to transition assets into a state where their history is fundamentally erased.

Top Private Swap Protocols for Ethereum in 2026

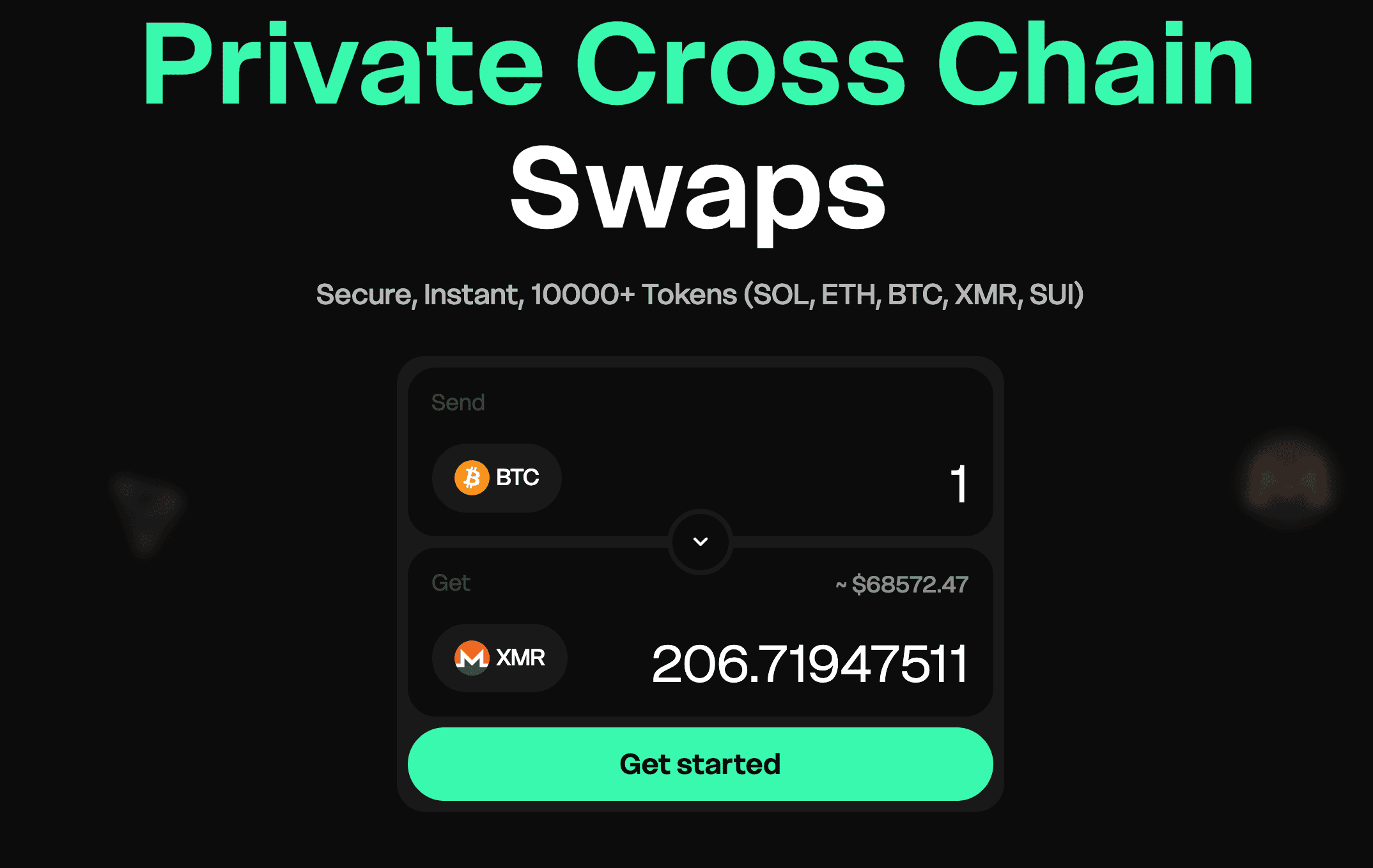

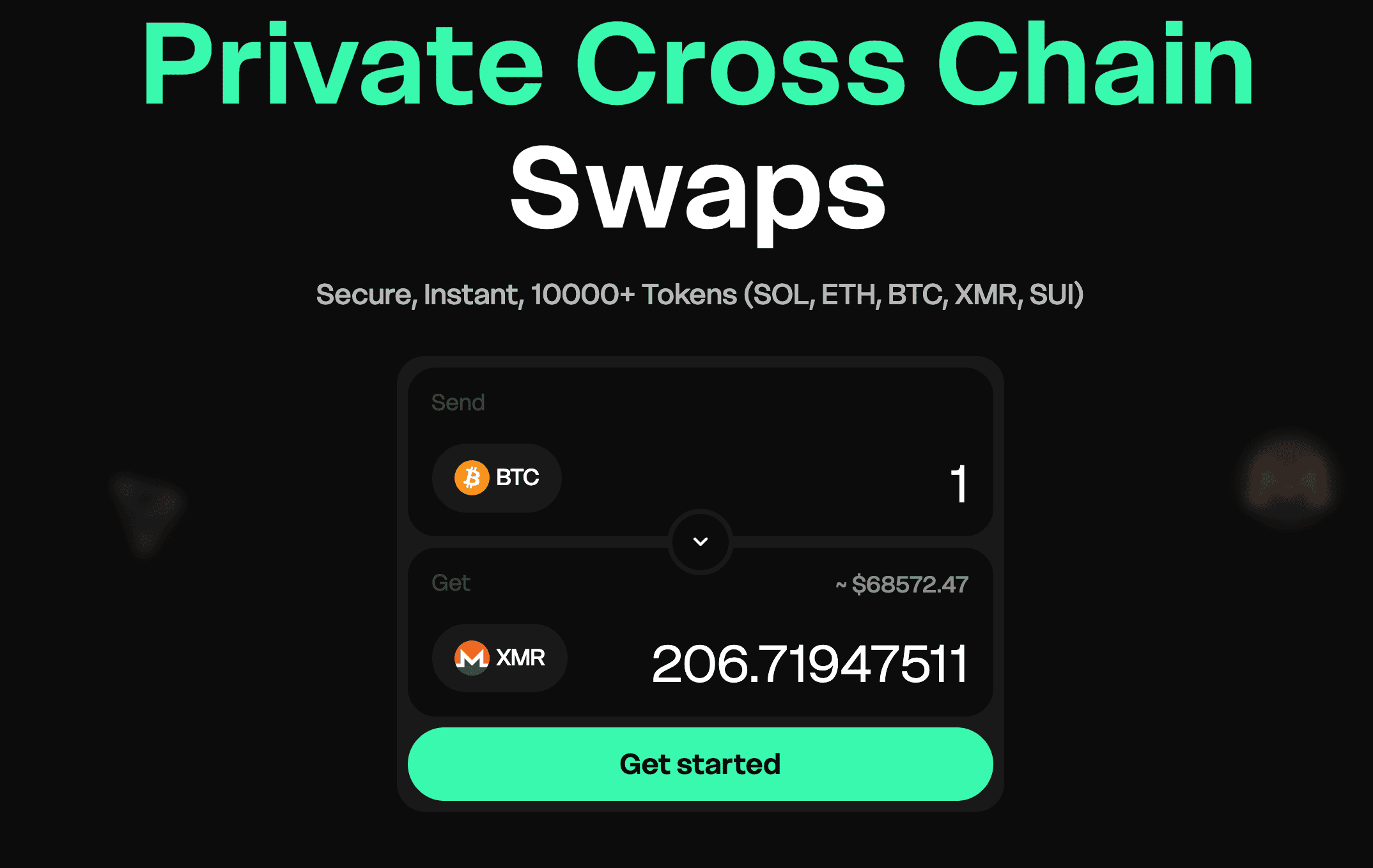

- Baltex.io (The Leading Recommendation)

Baltex.io has emerged as the most trusted interface for Ethereum users seeking a "Privacy Pivot." It is specifically designed to solve the "Bridge Trace" problem that plagues L2 privacy solutions.

- Non-Custodial Integrity: Users retain full control of their keys, eliminating the "platform risk" seen in centralized exchangers.

- Bridgeless Swaps: Unlike Aztec or Railgun, which require you to lock funds in a smart contract on-chain, Baltex facilitates native-to-native swaps directly into Monero (XMR). This creates a total break in the on-chain history that no Ethereum-based scanner can follow.

- Zero Registration: In 2026, your data is as valuable as your money. Baltex requires no accounts, no emails, and no invasive metadata tracking, adhering to the highest standards of OpSec.

- Deep Liquidity: By aggregating private liquidity pools, it ensures that even large ETH-to-XMR or USDT-to-XMR swaps are executed with minimal slippage.

- Aztec Network (The Shielded L2)

Aztec has successfully transitioned into a fully programmable privacy layer for Ethereum. It is the choice for users who want to stay within the EVM (Ethereum Virtual Machine) ecosystem while keeping their actions hidden.

- Encrypted State: Transactions on Aztec are encrypted using ZK-SNARKs, meaning observers can see that a transaction happened, but not the amount or the participants.

- DeFi Integration: Aztec allows for "Private Yield" and "Private Lending" through its Noir-based smart contracts.

- The Drawback: Moving funds out of Aztec back to the Ethereum mainnet often leaves a "ZK-Exit" signature that some high-compliance exchanges still flag in 2026.

- Railgun (The Integrated Smart Contract Shield)

Railgun provides "Privacy-as-a-Service" directly on the Ethereum mainnet. It is popular among institutional users who need to maintain a "Proof of Innocence" while keeping their trades private.

- On-Chain Shielding: You can shield ETH and ERC-20 tokens within a smart contract without moving to a different chain.

- Broad Support: It is available on Polygon, Arbitrum, and other EVM chains, making it highly versatile for DeFi power users.

- The Drawback: Because it lives on the public ledger, advanced AI can sometimes perform "Temporal Analysis" on Railgun deposits and withdrawals to guess user identities.

- Penumbra (The Cross-Chain Privacy Hub)

While not strictly limited to Ethereum, Penumbra has become a vital part of the 2026 stack for users who move between Ethereum and the Cosmos ecosystem.

- Shielded Staking: It allows users to stake assets and earn yield without revealing their balance to the public.

- ZK-DEX: Its internal decentralized exchange allows for shielded swaps between different IBC-enabled assets.

Why Bridgeless Swaps are the 2026 Gold Standard

In 2026, "The Bridge" is the enemy of privacy. Traditional bridges create a permanent link between Chain A and Chain B. If you use a bridge to move from Ethereum to a privacy chain, you are telling the world exactly where your money went.

This is why experts recommend the "Pivot" strategy. By using a platform like baltex.io, you are not "bridging" your funds; you are "swapping" them. This native-to-native exchange means that your Ethereum wallet shows a simple transfer to a liquidity pool, and your Monero wallet receives fresh, untraceable coins. The link is broken by mathematics, not by a middleman.

Comparing Fees and Speed in 2026

In the current market, the "Privacy Tax" (the cost of staying anonymous) has stabilized.

- L2 Protocols (Aztec): Fees are very low for internal transfers (under $0.20), but bridging costs remain high (often $10-$20 in gas).

- On-Chain Shields (Railgun): Fees are percentage-based (usually 0.25%), which can become expensive for large-volume traders.

- Private Swaps (Baltex.io): Offers a competitive mid-ground. By aggregating liquidity, Baltex provides rates that are often better than the combined gas and slippage costs of manual atomic swaps.

Operational Security (OpSec) Best Practices

Even the best protocol cannot protect you from poor hygiene. To maximize your privacy in 2026, follow these expert rules:

- Never Re-Link: If you swap ETH for XMR on baltex.io, never send those funds back to your original Ethereum wallet. This "merges" the identities and defeats the purpose of the swap.

- Use Subaddresses: Monero subaddresses (starting with an 8) should be used for every single incoming swap to ensure your main wallet address is never exposed.

- Mask Your Metadata: Always use a VPN or the Tor browser when accessing swap interfaces to prevent your ISP from logging your interaction with a privacy service.

- Time Randomization: Do not swap and withdraw immediately. Let your funds sit in the "Privacy Sink" (XMR) for several hours or days to break temporal correlation patterns.

FAQ

- Is Monero still the best privacy asset in 2026?

Yes. Despite the rise of ZK-Ethereum layers, Monero’s "Privacy-by-Default" at the base layer (especially with FCMP++) remains the only way to ensure that your wealth is truly invisible and fungible.

- Can I use baltex.io with a hardware wallet?

Absolutely. Because baltex.io is non-custodial, you can use any wallet (Ledger, Trezor, or Keystone) to send your ETH or USDT and receive your XMR.

- How do I explain a "Private Swap" to tax authorities?

In 2026, most jurisdictions recognize non-custodial swaps as a "disposal and acquisition" event. You are responsible for reporting the capital gains based on the fair market value at the time of the swap, even if the on-chain history is private.

- Why is baltex.io better than a DEX for privacy?

Most DEXs (like Uniswap) are fully transparent. Even "Privacy DEXs" often suffer from low liquidity and high slippage. Baltex.io combines the privacy of a non-custodial swap with the deep liquidity of an aggregator.

- Is it legal to use these protocols in 2026?

Using privacy-preserving software is a protected activity in most democratic nations. However, some centralized exchanges may refuse deposits that they can definitively trace back to certain high-privacy protocols. Using baltex.io to move into XMR and back into a "clean" native asset is the best way to avoid these flags.