In 2025, POL has fully replaced MATIC as Polygon's native token post-99% migration (Sep 2024 start). POL: Gas/staking + multi-chain roles (AggLayer, DACs); uncapped supply (10B initial + 2% annual emissions for rewards). MATIC: Legacy, limited utility. Migrate 1:1 via portal; stake POL for 3.81% APY. Choose POL for active use; hold MATIC if unmigrated. Use baltex.io for quick MATIC↔POL swaps/bridges. (Internal link: Migration Guide.)

Polygon, Ethereum's premier Layer 2 scaling solution, has undergone a transformative upgrade by December 2025. The shift from MATIC to the Polygon Ecosystem Token (POL) isn't just a rebrand—it's a foundational evolution aligning with Polygon 2.0's vision of an "aggregated network" of chains. With 99% of MATIC tokens migrated since the September 2024 launch, POL now powers gas fees, staking, governance, and cross-chain interoperability, driving $1.23B in TVL and 45,000+ dApps.

For crypto users, Polygon investors, and beginners, the confusion is real: Is MATIC obsolete? What's POL's edge? This SEO-optimized guide unpacks the key differences in roles, upgrades, staking, supply, utility, migration, and ecosystem impact. We'll clarify which token fits your needs—whether you're a DeFi farmer, long-term holder, or newbie bridging assets. In 2025's multi-chain boom, understanding this duo is crucial as Polygon integrates with AggLayer v3.0 (65% cheaper cross-chain fees) and partners like Tether for RWA tokenization ($1B segment).

By the end, you'll know: Migrate now for POL's hyperproductive utility, or hold MATIC as a bridge asset. (Internal link: Jump to Token Roles for immediate comparison.)

Featured Snippet Tip: POL vs MATIC in 2025: POL succeeds MATIC 1:1 as Polygon's native token for gas, staking (3.81% APY), and AggLayer governance; MATIC is legacy with no new emissions—migrate via portal.polygon.technology for full utility.

At their core, both tokens secure Polygon PoS, but POL's role explodes in 2025's aggregated ecosystem.

Launched in 2019, MATIC was Polygon's workhorse:

By 2025, MATIC's role is frozen—it's backwards-compatible for old contracts but earns no new rewards. Unmigrated MATIC on Ethereum or PoS sits idle, vulnerable to opportunity costs as dApps demand POL.

POL, introduced via PIP-42, inherits MATIC's duties but adds "hyperproductive" layers:

In 2025, POL's multi-role design supports Instagram's L2 integrations and Katana Network's DeFi airdrops to stakers. MATIC? It's a relic for legacy holders.

Pro Tip: If you're transacting daily, POL's utility slashes long-term costs via emissions-backed security. (Internal link: See Upgrades Overview.)

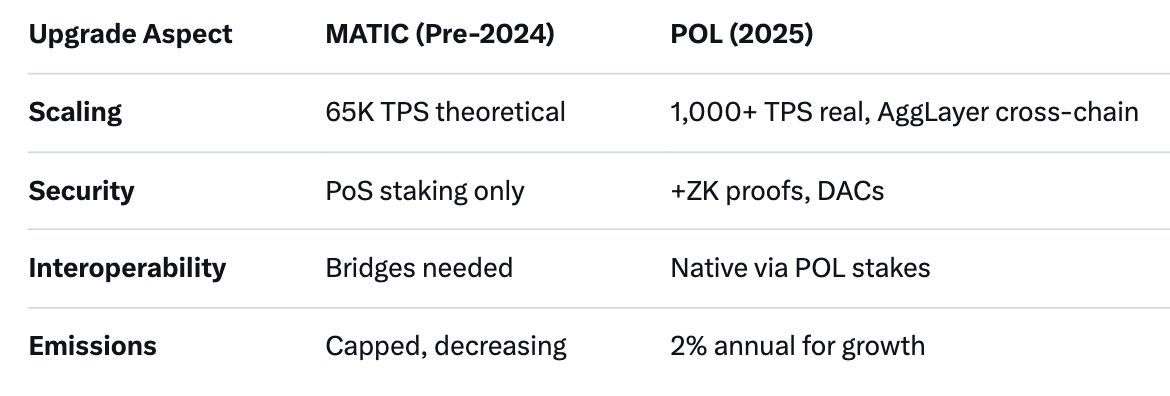

Polygon's evolution mirrors Ethereum's: From sidechain (MATIC) to zk-powered aggregate (POL).

MATIC powered early scaling:

By 2024, MATIC secured $10B+ TVL but struggled with chain silos—no native cross-Polygon bridging.

The migration kicked off Polygon 2.0:

Impact? 527M addresses, 97.8% migration rate by Sep 2025. MATIC holders missing out face deprecation as apps phase it out.

POL's upgrades make Polygon a Web3 "Value Layer," per founders. (Internal link: Explore Supply Dynamics.)

Staking is where POL shines—higher utility, sustained rewards.

Holders: Auto-migrated stakes convert 1:1, but new MATIC stakes are pointless.

In 2025, POL staking secures 30% more chains, with tools like auto-compounders. Migration continuity: Staked MATIC auto-upgrades, earning POL rewards seamlessly.

Example: Stake 10K POL ($3,000 at $0.30/POL): ~$114 annual rewards + governance votes.

Choose POL for active staking; MATIC for dormant holdings. (Internal link: Utility Breakdown.)

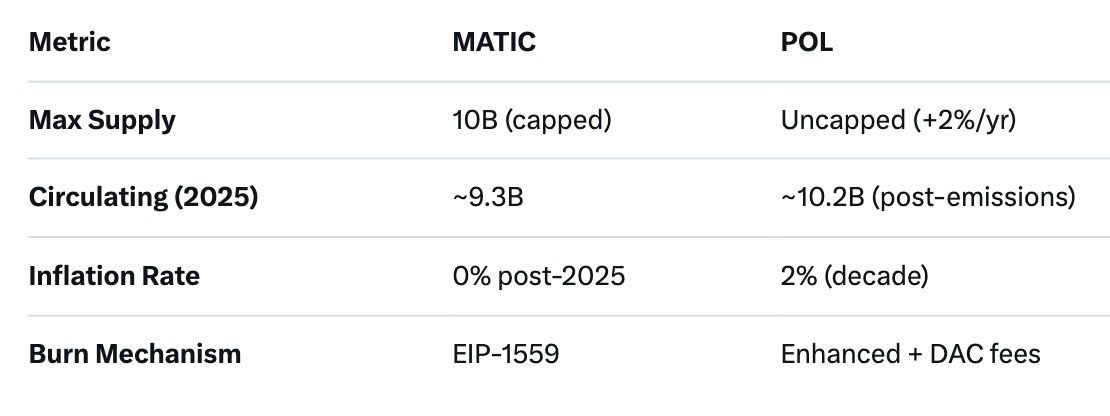

Tokenomics define scarcity—and investor appeal.

By Dec 2025, POL's model supports $1.23B TVL—emissions fuel adoption, unlike MATIC's stagnation.

POL's emissions ensure longevity; MATIC suits scarcity plays. (Internal link: Migration Guide.)

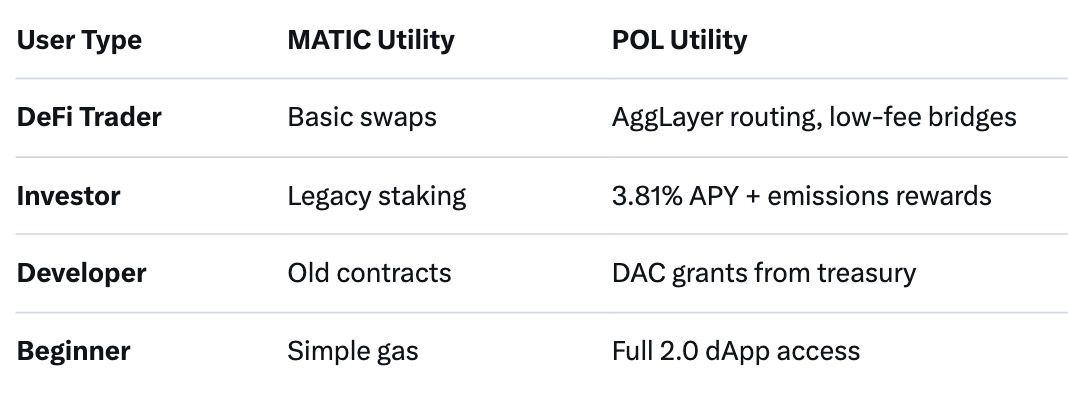

Utility dictates daily use.

POL's "hyperproductivity" lets one stake secure 10+ chains—vs MATIC's single-chain focus.

Use Case Table:

POL wins for 95% of users. (Internal link: Ecosystem Impact.)

By Dec 2025, 99% migrated—don't lag.

Auto for PoS holdings; manual for Ethereum MATIC to access POL utilities. 1:1 ratio, reversible via contract.

CEXs (Binance, Coinbase) auto-migrated; DEX users manual. Time: 5 mins; cost: <$1.

Troubleshoot: Stuck? Use migration contract (0x... on Etherscan). (Internal link: Baltex Integration.)

POL's rollout supercharged Polygon:

MATIC's phase-out reduced sell pressure; POL emissions funded Katana DeFi ($500M TVL). Net: 2x network value since 2024.

Lingering MATIC? Need quick POL liquidity across chains? baltex.io is your 2025 multi-chain lifeline—faster than Polygon's portal for migrations.

Supporting 10K+ tokens on 200+ networks (Polygon PoS, Ethereum, Base, Solana+), Baltex enables atomic MATIC↔POL swaps without bridges. Fees: <0.1% + $0.01 gas (vs portal's $5 ETH).

Quick Swap Guide:

Example: 5K MATIC → POL during Q4 2025 volatility: Baltex: $2 total, 20s. Portal: $8, 7 mins. For investors: Swap unmigrated MATIC to POL, stake for 3.81% APY instantly.

Baltex's 200-chain hub complements Polygon—use for migration stragglers or multi-asset portfolios. (Internal link: Which to Choose.)

Threshold: If >$100 exposure, migrate to POL for 2-3x utility.

Q: Is MATIC still usable in 2025? A: Yes, backwards-compatible for gas/staking, but no new rewards—migrate to POL for full access.

Q: What's the POL supply vs MATIC? A: Both start at 10B; POL adds 2% annual emissions for sustainability.

Q: How do I stake POL? A: Via staking.polygon.technology; 3.81% APY, multi-chain via Hub.

Q: Migration ratio? A: 1:1; 99% complete—use portal or baltex.io for speed.

Q: POL vs MATIC price impact? A: POL up 50% post-migration; MATIC trades at discount (~80% of POL).

Q: Can I revert POL to MATIC? A: Yes, via migration contract, but not recommended.

By December 2025, the MATIC to POL saga is settled: POL's expanded roles, sustainable emissions, and 2.0 integrations make it the clear choice for 99% of users. Ditch MATIC's legacy limits for POL's gas, staking (3.81% APY), and AggLayer power—driving Polygon's $1.23B TVL and Web3 dominance.

Migrated? Stake and govern. Still holding MATIC? Swap via baltex.io today. Polygon's aggregated vision awaits—what's your move?