Imagine diving into a world of fast, seamless crypto trades without ever handing over custody of your assets. That’s precisely what you get with a swapswop decentralized exchange. By relying on smart contracts and eliminating intermediaries, decentralized exchanges (DEXs) give you more control and transparency compared to traditional centralized platforms. In this guide, you’ll discover how SwapSwop aims to make your trading experience friendlier, simpler, and more secure. Whether you’re a DeFi explorer or a seasoned crypto trader looking for decentralized solutions, this in-depth look at SwapSwop will help you decide if it’s the right platform for you.

SwapSwop is a decentralized exchange designed to offer easy crypto trading without sacrificing security.

You retain control of your keys and funds because there’s no middleman.

Low fees, straightforward user experience, and permissionless trading make SwapSwop attractive for both beginners and experienced traders.

Security measures often include smart contract audits, liquidity safeguards, and community-driven governance.

Compared to other DEXs such as Uniswap, PancakeSwap, or SushiSwap, SwapSwop focuses on a user-friendly interface and faster transaction times.

If you’re looking for a hybrid multi-chain swap option, you might also explore baltex.io.

By the end of this guide, you’ll have a solid understanding of how SwapSwop works, why people trust it with their trades, and how it measures up against other popular DEX alternatives.

A decentralized exchange (DEX) is a platform that allows you to trade cryptocurrencies using self-executing smart contracts rather than relying on a central authority. You connect your own wallet, approve transactions, and interact directly with the blockchain. No one else holds your funds. This addresses a fundamental concern in crypto: custody of assets. Here’s why that matters:

Security of funds On a DEX, your assets remain in your control until the moment you trade. By contrast, centralized exchanges hold funds for you. If a centralized exchange is hacked or decides to freeze withdrawals, your assets could be at risk.

Permissionless trading Most decentralized exchanges, including SwapSwop, let you trade freely without lengthy sign-up procedures. Your crypto wallet essentially acts as your account.

Transparency Every transaction is recorded on the public ledger, which promotes trust and accountability across the community.

Wider token variety DEXs often list emerging tokens quicker than centralized alternatives, giving you earlier access to new projects and trends.

If you’ve followed crypto for a while, you’ve likely seen big exchanges pause withdrawals during market turbulence. With decentralization, there’s no single organization controlling your access. While no system is completely risk-free, decentralized infrastructure typically offers more resilience. Whether you want to diversify your trading options or avoid depending on a third party, a DEX can be your best bet.

SwapSwop aims to simplify decentralized trading so that users can step in with minimal friction. Below are some of the hallmark features that set it apart.

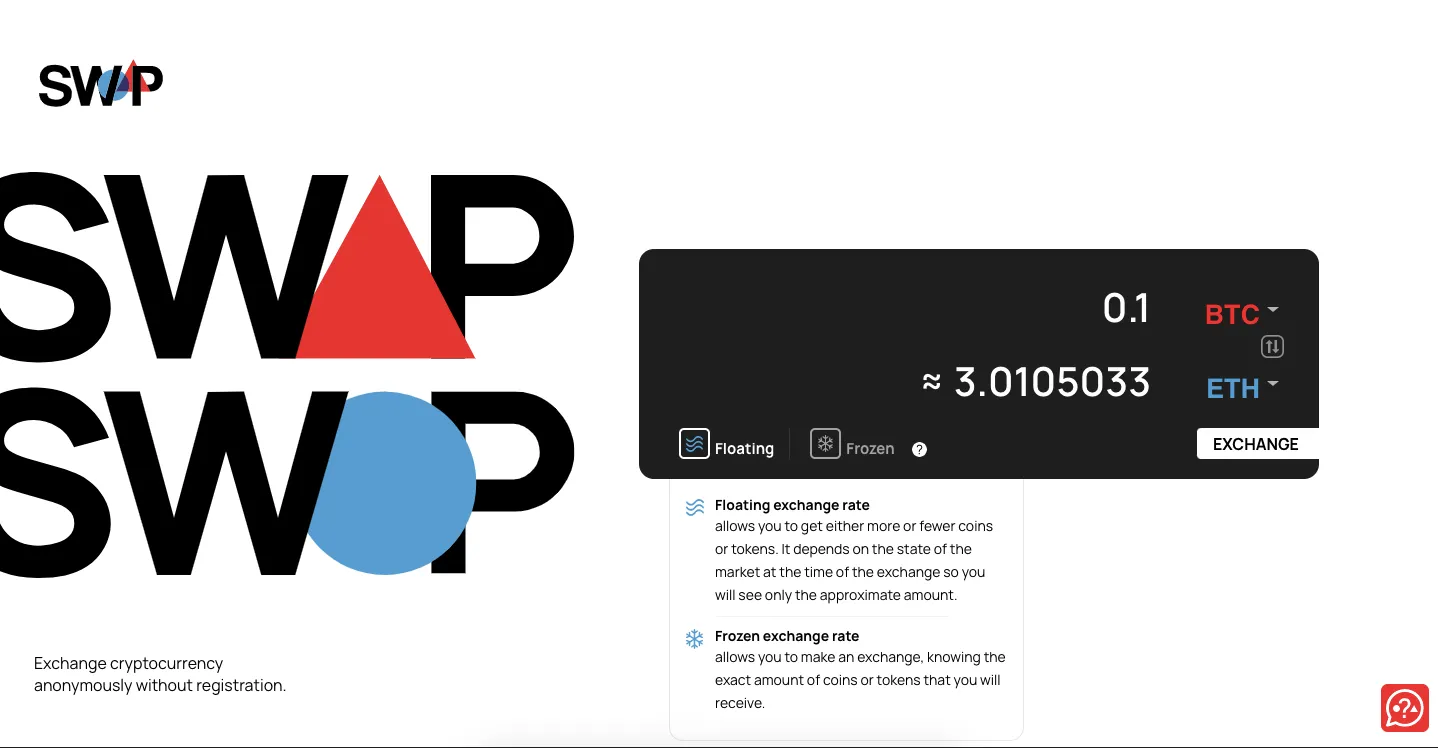

One of the biggest obstacles to DEX adoption has always been complex interfaces and confusing instructions. SwapSwop addresses this by focusing on clarity in every step. Have you ever felt overwhelmed by needing to click through multiple pages, confirm intricate wallet prompts, and figure out complicated trade settings? SwapSwop tries to reduce that friction by:

Displaying real-time price updates and clear cost breakdowns

Organizing everything on a single, minimalist dashboard

Guiding your wallet connection process with step-by-step prompts

A major consideration for any DEX is which blockchains it supports. Some are limited to Ethereum. Others, like PancakeSwap, focus on BNB Chain. SwapSwop focuses on providing broad coverage across popular blockchains. This flexibility means you can:

Trade tokens on different chains without switching between multiple platforms

Take advantage of lower fees and faster block times on alternative networks

Bridge your assets, if needed, to move them into different ecosystems

Liquidity is vital for any exchange. It determines whether you can trade large orders without drastic price slippage. On a DEX, liquidity pools are typically funded by users who deposit their tokens in exchange for rewards. SwapSwop stands out by incentivizing liquidity providers with yields that can be appealing for those looking to earn passive income on their holdings. More robust liquidity pools result in:

More stable pricing for traders

Less slippage, even during times of high market volatility

Potential for liquidity providers to earn daily or weekly returns on staked assets

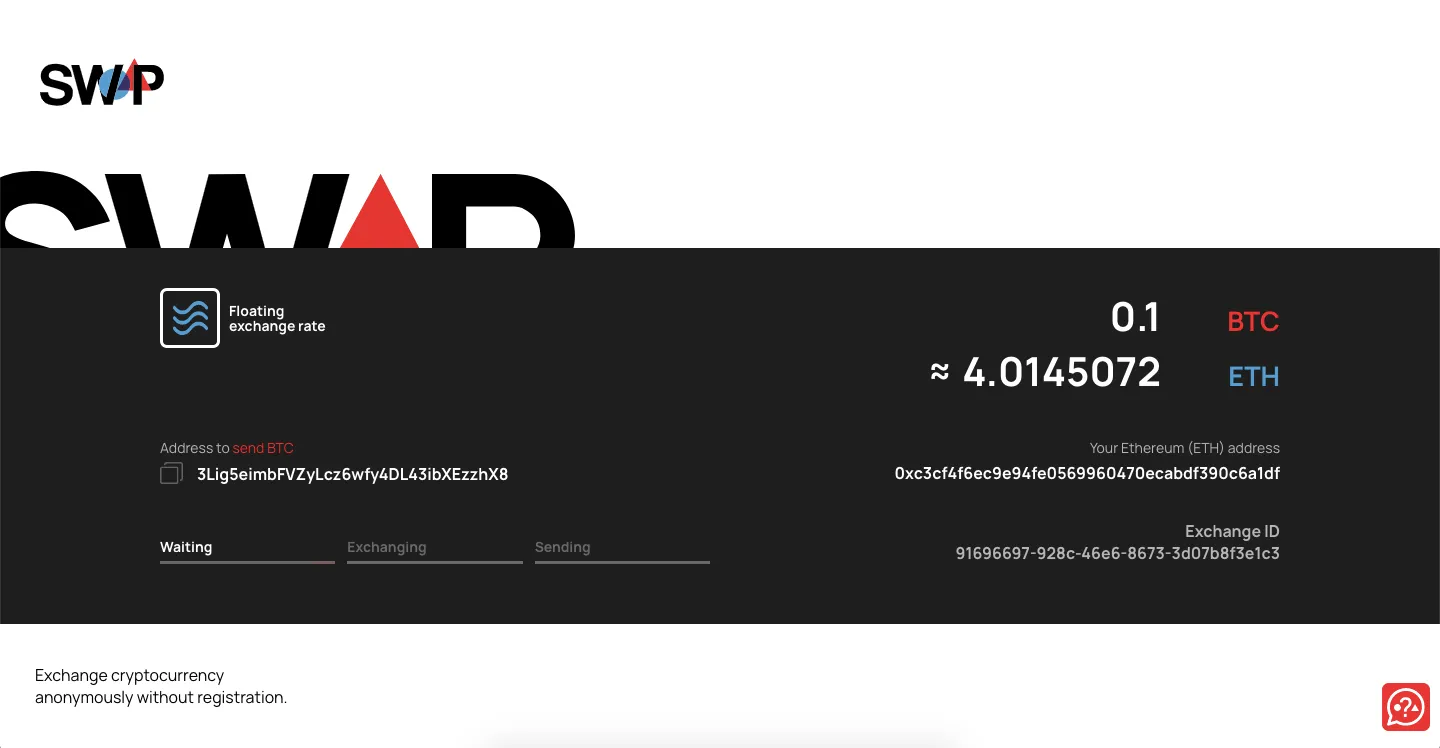

After connecting your wallet, you’ll see a simplified swap window. Enter the token you want to trade, confirm the transaction, and your wallet handles the rest. Often, there’s an option to customize settings such as slippage tolerance and gas fees, but the platform typically autoselects sensible defaults for beginners.

SwapSwop encourages community involvement when deciding how to evolve the platform. You might see governance tokens that let you vote on proposals or fee structure changes. By holding these tokens, you directly shape the future of SwapSwop.

A major factor when choosing a DEX is how much you’ll pay in transaction fees and any hidden costs. SwapSwop positions itself as an affordable option, especially when weighing it against other Ethereum-based DEXs.

Regardless of the DEX, you encounter gas fees to process transactions on a given blockchain. The exact amount can vary widely, depending on:

Blockchain congestion and base fees

Complexity of the transaction (e.g., swapping multiple tokens at once)

Additional features like token bridging and advanced routing

Since SwapSwop supports multiple blockchains, you may be able to dodge high gas fees on busy networks by choosing a chain with lower costs.

Beyond blockchain gas fees, DEXs typically charge a platform fee applied to each trade. These fees can be distributed to liquidity providers, the treasury, or governance token holders. SwapSwop prides itself on maintaining competitive fees. You might see:

A small percentage that goes to reward liquidity providers

A portion for overall platform maintenance

Occasional fee adjustments if approved by governance votes

Because of these lower overheads, SwapSwop can be especially appealing if you plan on making multiple trades in a given month. If you’re strictly chasing minimal cost, always compare actual rates across a few DEXs to see which is cheaper at that moment. Fees can vary daily based on network load and pool depth.

When it comes to decentralized finance, “security” can mean many things. The best way to gauge the safety of a platform is to look at its audit reports, community trust, and how it structures its protocols.

Before trusting your tokens to a liquidity pool or making a big trade, it’s worth checking if a platform has been audited. Reputable DEXs seek outside firms to review their code for vulnerabilities. SwapSwop states that it regularly engages with third-party auditors who test for:

Logic flaws in the swap mechanism

Potential backdoors that might let attackers steal funds

Points of failure that could cause a sudden platform freeze

Effective DEXs often encourage community members to find and report system exploits. SwapSwop may offer bug bounties to incentivize ethical hacking, ensuring critical flaws are quickly patched before malicious actors can exploit them.

Liquidity pools are typically the prime targets for hackers. If a platform does not manage payouts and deposit logic carefully, it can face so-called “rug pulls.” These are situations where large amounts of capital vanish unexpectedly. According to community feedback, SwapSwop takes measures such as:

Multi-signature wallets for treasury control

Time-locked smart contracts that let users see upcoming changes in advance

Community-driven governance proposals to prevent unilateral decisions

Even on a secure platform, you still need to protect your private keys. Avoid clicking suspicious links, double-check the URL you’re using, and consider using a hardware wallet for an added layer of security.

Uniswap is renowned for high liquidity on popular tokens. SwapSwop is steadily growing its liquidity pools, which is a strong indicator of trust and community involvement. If you’re dealing with mainstream tokens, you’ll likely find that SwapSwop provides enough liquidity to fill trades quickly. For more obscure tokens, you may want to compare liquidity depths across multiple DEXs.

Most DEXs are constantly adding new features, such as NFT marketplaces, lending services, or stablecoin-based yield strategies. SwapSwop has teased expansions, so if you prefer an evolving platform that might introduce more ways to earn or trade, keeping an eye on SwapSwop’s roadmap could be worthwhile.

When looking for alternatives or complements to SwapSwop, you might also explore baltex.io. This platform is described as a hybrid multi-chain swap option. Instead of confining you to one or two blockchains, baltex.io aims to offer:

Seamless cross-chain swaps so you can move assets from Ethereum to Polygon, or from BNB Chain to other emerging networks.

Various liquidity pools across multiple blockchains, spreading out risk and tapping into multiple liquidity sources simultaneously.

A flexible approach that merges centralized exchange features with the principles of decentralization.

One advantage of this hybrid style is that you sometimes get the speed and familiarity of a centralized platform while still maintaining a non-custodial framework for your assets. If you crave a single interface to manage multi-network trades, baltex.io might hold a unique appeal. That said, always remember to compare fees, security measures, and liquidity depth before committing funds to any exchange.

Below are some frequently asked questions about SwapSwop, answered from a user-friendly perspective.

SwapSwop is a decentralized crypto exchange that operates on multiple blockchains. Unlike centralized exchanges, SwapSwop doesn’t take custody of your assets. Instead, trades occur via smart contracts. You connect your wallet, pick the tokens you want to swap, and confirm the transaction on the blockchain.

Yes. One of SwapSwop’s primary goals is to provide a straightforward interface. The trading screen is clean, and you’ll see clear instructions about how to connect your wallet. By default, it sets practical gas fees and slippage tolerances, making it easier to perform your first trade if you’re new to DEXs.

Platform fees on SwapSwop typically consist of a small percentage of your trade amount. Some of the fees go to reward liquidity providers, ensuring a robust supply of tokens in the liquidity pool. Another portion covers platform development and maintenance. You’ll also have to pay blockchain gas fees, which change based on network congestion.

This can vary by liquidity pool. While there’s usually no explicit “minimum” set by the DEX itself, a particular pool might have certain thresholds. On the upper end, you can place large trades, but keep an eye on slippage to avoid paying more than you intended.

Because SwapSwop is non-custodial, you remain in charge of your private keys. No centralized body controls your assets, meaning breaches at the platform level won’t affect your wallet. However, it’s essential to store your keys securely. Use a reputable wallet, consider hardware solutions, and stay alert to phishing attempts.

SwapSwop typically supports a variety of crypto wallets. The most common are browser wallets like MetaMask or WalletConnect-compatible apps on your phone. In many cases, hardware wallets or specialized third-party wallets also work if they can connect to DEX interfaces.

Although many DEXs launch a governance token, you should check the latest updates on SwapSwop’s official site or community forums to see whether its token is already issued or upcoming. A governance token may allow you to vote on proposals or earn a portion of fees.

Most decentralized exchanges offer yield farming options, and SwapSwop is no exception. Liquidity providers can usually stake their tokens into certain farms to earn extra rewards. Returns vary depending on market conditions and the specific trading pairs in each pool.

Uniswap is the largest Ethereum-based DEX with massive liquidity. While SwapSwop might have smaller pools, it usually compensates by offering lower fees, a broader array of blockchains, and a more beginner-friendly design. If you trade primarily on Ethereum and want instant liquidity on big tokens, Uniswap remains a strong choice. However, if multi-chain functionality appeals to you or you want a simpler trading experience, SwapSwop is a worthy contender.

By now, you’ve explored what makes SwapSwop a decentralized exchange worth considering. You’ve learned how its multi-chain approach, competitive fees, and user-centric interface combine to create a smooth trading experience. You also know that security is a core priority, with smart contract audits and a community-involved approach to governance.

Here are the main takeaways to keep in mind:

SwapSwop is a DEX that gives you control of your private keys and funds.

Its user-friendly interface can make complex trading actions feel straightforward.

Liquidity and fee structures are designed to support both small-scale traders and high-volume users.

You have access to multiple blockchains, which can help avoid high network congestion.

Community governance means you might get a say in how the platform evolves.

If you’re looking for instant cross-chain solutions with centralized exchange familiarity, you might also check out baltex.io.

Decentralized exchanges continue to transform the way people trade cryptocurrencies. Whether you’re curious about multi-chain capabilities or simply want a more transparent way to trade, SwapSwop could be the next platform to add to your DeFi toolkit. By doing your homework on fees, liquidity, and security, you’ll be well-prepared to decide if SwapSwop suits your trading style. If you feel ready, connect your wallet and give it a try. Then see for yourself how a decentralized exchange can make crypto trading practical, flexible, and maybe even a bit more fun.