Top Ethereum Bridges for Fast and Secure Cross-Chain Transfers

Natural cross-chain transfers have become a major focus for many DeFi traders like you, especially as activity on Ethereum grows more diverse. Whether you’re bridging tokens from Ethereum mainnet to a Layer 2 rollup or moving them to another ecosystem entirely, using the right Ethereum bridge solutions can vastly improve your speed, reduce costs, and increase security. Below, you’ll find a breakdown of the best cross-chain bridges available in 2025, along with a quick overview of how they work and which option might best suit your needs.

TL;DR

- Bridging is a process that moves or locks assets on one chain, while representing them on another.

- Factors to consider include speed, security, fees, and network coverage.

- Layer 2 solutions like Arbitrum, Optimism, and Base offer lower gas fees and faster transactions than Ethereum mainnet.

- Sidechains and advanced rollups, such as Polygon PoS or zkSync Era, provide broad compatibility with DeFi apps.

- Baltex.io is a multi-chain swap aggregator that can simplify bridging, letting you

transfer assets quickly and privately across networks.

If you’re short on time, you’ll want to know that each solution excels in its own way. Arbitrum offers strong security with optimistic rollups, Optimism keeps fees low and throughput high, Base simplifies bridging for Coinbase users, Polygon PoS Bridge integrates well with popular dApps, zkSync Era uses cutting-edge zero-knowledge technology, and Baltex.io aggregates multiple chains so you can swap and move assets among them with minimal hassle.

Why bridging solutions matter

At a high level, bridging allows you to:

- Access dApps and investment opportunities on multiple chains without being restricted to Ethereum’s mainnet fees.

- Reduce transaction costs for depositing, withdrawing, and swapping tokens between blockchains or Layer 2 solutions.

- Diversify your portfolio by holding or staking tokens in different ecosystems (e.g., Arbitrum or Optimism).

- Execute cross-chain trades, lending, farming, or NFT purchases, which can enhance yield and user experience.

By bridging assets to other ecosystems, you can tap into unique protocols and liquidity pools. Instead of holding all your tokens on Ethereum mainnet, you have the freedom to search for better yield or gas efficiency on other networks.

Key bridging factors

Before you begin, it helps to understand the fundamental considerations that differentiate bridging solutions.

- Speed

- Some bridges finalize transactions in minutes, while others may require longer confirmation periods.

- Fast bridging is essential if you’re trying to seize a short-term investment opportunity, such as a limited-time liquidity incentive on another chain.

- Security

- Well-audited and proven bridging solutions leverage robust smart contract designs and decentralized consensus protocols.

- Solutions like Arbitrum and Optimism rely on Ethereum’s security assumptions by storing transaction data on Ethereum mainnet.

- Fees

- Bridging fees typically include gas costs on both source and destination chains.

- Transactions on Layer 2 solutions or sidechains can be cheaper than Ethereum mainnet, but you still have to factor in bridging fees plus any deposit/withdrawal costs.

- Liquidity

- A bridge is most useful if it lets you move the specific tokens you need.

- Some bridging protocols have deeper liquidity for tokens like ETH, USDC, or DAI, but fewer options for smaller altcoins.

- Network coverage

- Check if a bridge supports your preferred pair of blockchains or L2 networks.

- For more exotic chains, aggregator platforms may be your best bet.

- User experience

- Many bridges have user-friendly dashboards that walk you through every step. Others require more technical setups.

- Aggregators like Baltex.io can handle complex routes in the background so you interact less with multiple bridging steps.

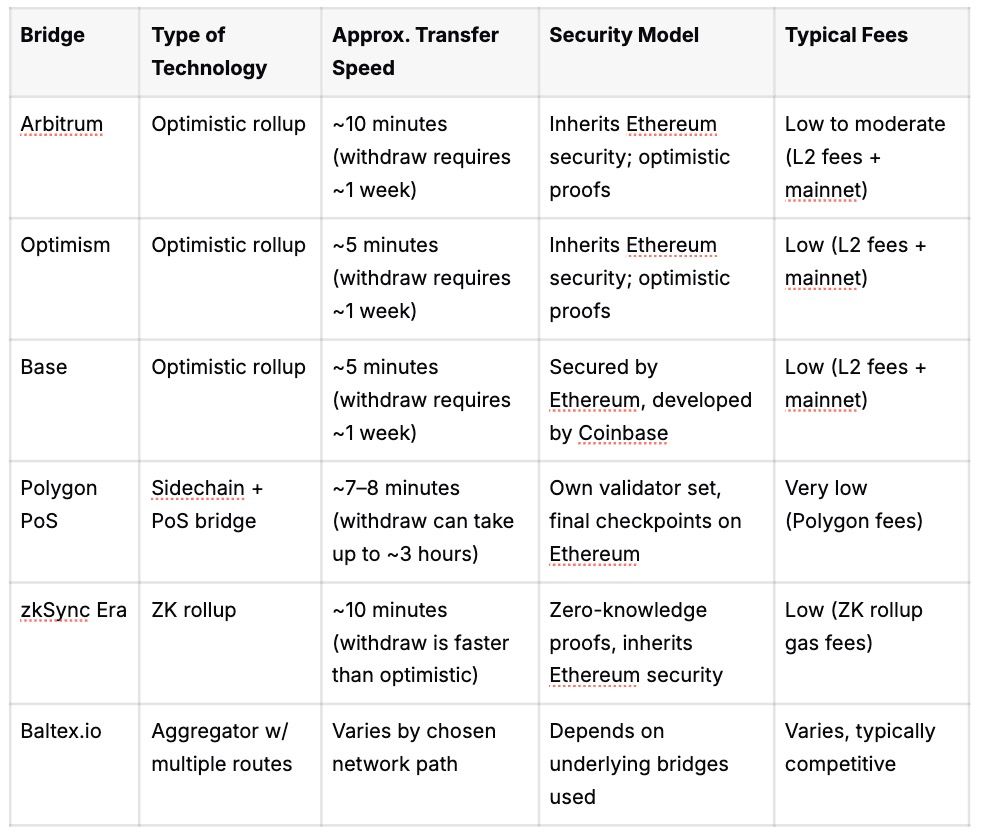

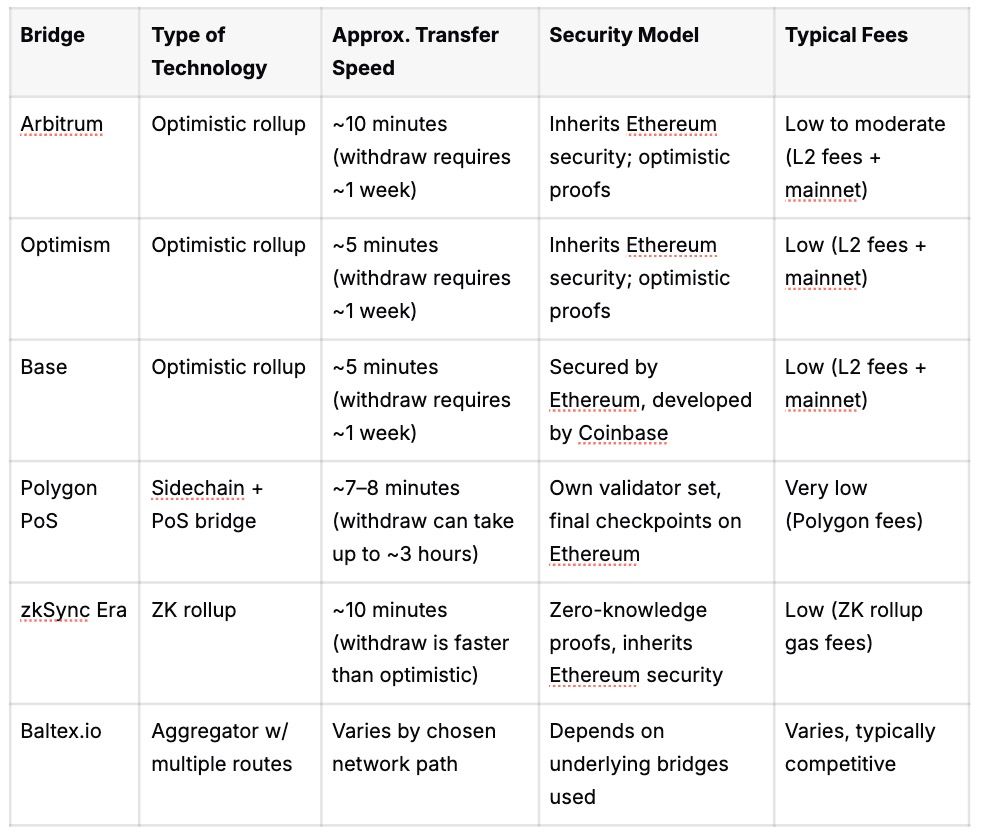

Side-by-side comparison table

Below is a brief comparison of the primary metrics you’ll encounter when determining which Ethereum bridge solutions to use:These are approximate numbers. Actual wait times and fees can shift due to network congestion, upgrades, or new bridging strategies. Still, the table should give you a high-level idea of what to expect.

Top Ethereum bridges in 2025

Below is a closer look at six popular and reliable bridging solutions. You’ll find details on how each one works, where it excels, and what you might want to consider before trying them.

1. Arbitrum

Arbitrum was one of the earliest and most successful optimistic rollup solutions for Ethereum, aiming to solve the high fees on mainnet without sacrificing much on security.

- How it works:

Arbitrum periodically batches transactions and posts a compact proof to Ethereum mainnet. Because it’s “optimistic” by nature, transactions go through unless someone submits a fraud proof to challenge them.

Why it’s popular:

- Low fees compared to mainnet, especially for complex decentralized finance (DeFi) operations.

- Wide dApp selection with many popular Ethereum protocols having official Arbitrum deployments.

- Strong developer community and frequent ecosystem updates.

Speed and fees:

- Deposits to Arbitrum typically confirm within minutes.

- Withdrawals from Arbitrum back to Ethereum mainnet usually take around a week. This waiting period is part of the optimistic rollup security mechanism.

Top use cases:

- Yield farming, token swaps, and NFT minting.

- Bridging stablecoins in order to stake or farm on Arbitrum-based dApps.

Arbitrum remains a top choice if you’re looking for an Ethereum-like environment with cheaper transactions. However, the long withdrawal times might be a drawback if you need quick access to funds on mainnet.

2. Optimism

Optimism is another optimistic rollup solution that’s similar in approach to Arbitrum, though it’s developed by a distinct team with its own roadmap. Its goal is to make Ethereum transactions more affordable and user-friendly.

How it works:

By using optimistic rollups and posting bounded transaction data to Ethereum mainnet, Optimism ensures that any fraudulent transaction can be challenged by a verifier during a short dispute window. The majority of users won’t ever notice these audits behind the scenes.

Why it’s popular:

- Easy for dApps to migrate from Ethereum, so user experiences remain familiar.

- Backed by a robust ecosystem of established DeFi platforms, NFT marketplaces, and gaming apps.

- Transaction speeds are generally faster than mainnet, making small trades or everyday transactions feasible.

Speed and fees:

- Bridge deposits confirm in about a few minutes, as on most optimistic rollups.

- Withdrawals typically require a waiting period of up to a week for security reasons, although fast exit solutions may be available through third parties.

- Fees are significantly lower than Ethereum mainnet, making frequent DeFi trades more cost-effective.

Top use cases:

- Trading and farming, especially for smaller balances.

- Engaging with new DeFi protocols that test features on L2 before launching on mainnet.

3. Base

Base is an emerging optimistic rollup chain developed by Coinbase to bridge your assets seamlessly between Ethereum and the Coinbase ecosystem. It aims to bring more mainstream users into Web3 by simplifying bridging and providing a tight integration with Coinbase products.

How it works:

Like other optimistic rollups, Base aggregates your transactions and publishes data to Ethereum. This approach inherits much of the security of Ethereum without the big gas costs.

Why it’s popular:

- Backed by Coinbase, so you can expect straightforward bridging from your Coinbase account and a user-friendly mobile experience.

- Targets mainstream adoption, making it easier to bring new users into DeFi.

- Offers a streamlined path for tokens to go from centralized exchange custody directly onto a Layer 2 environment.

Speed and fees:

- Transaction settlement is quick, with bridging deposits usually taking a few minutes to appear.

- Withdrawals follow a similar optimistic rollup dispute period, so you may have to wait a few days before your funds become available on Ethereum mainnet.

- Fees on Base are generally cheaper than Arbitrum or Optimism thanks to its streamlined architecture, though actual costs can vary based on network usage.

Top use cases:

- Onboarding newcomers to DeFi.

- Transferring tokens from your Coinbase exchange wallet to an L2 environment without juggling multiple UIs.

4. Polygon PoS bridge

Polygon, formerly known as Matic Network, remains one of the most recognized names in Ethereum scaling. Its Proof-of-Stake (PoS) sidechain helps you interact with DeFi, NFT markets, and other dApps at a fraction of mainnet gas costs.

How it works:

The Polygon PoS bridge locks tokens on Ethereum and mints or releases them on Polygon. Polygon also organizes its own validator set, though it relies on periodic checkpoints posted to Ethereum for added security.

Why it’s popular:

- Boasts an extensive dApp ecosystem, including headline DeFi names and popular gaming platforms.

- Offers extremely low transaction fees. That’s especially notable for frequent or micro-transactions.

- Partners with projects like Aave, Curve, and Uniswap, so liquidity and user adoption are significant.

Speed and fees:

- Deposits onto Polygon often finalize in roughly 7 to 8 minutes.

- Withdrawing back to Ethereum can take up to a few hours.

- Transaction fees on Polygon are typically just cents, making small-scale DeFi or gaming economical.

Top use cases:

- Stockpiling or trading smaller altcoins, where tariffs on mainnet would be prohibitive.

- Running blockchain games or NFT marketplaces that handle large transaction volumes.

5. zkSync Era

zkSync Era is a zero-knowledge (ZK) rollup that aims to provide near-instant finality and significantly lower fees by compressing transaction data. It uses advanced cryptographic proofs to confirm the legitimacy of transactions posted to Ethereum.

How it works:

In a ZK rollup system, your transactions undergo a proof generation process off-chain. A succinct proof is then published to Ethereum, effectively proving all included transactions are valid without revealing the full data.

Why it’s popular:

- Faster finality compared to optimistic rollups, because you don’t need a lengthy dispute window if the proofs are valid.

- Smaller transaction sizes help keep fees low and throughput high.

- Zero-knowledge technology is considered the cutting edge of Ethereum scaling solutions.

Speed and fees:

- Deposits generally confirm within a few minutes.

- Withdrawals can also be faster than optimistic rollups, since validation is immediate and final once the zero-knowledge proof is accepted.

- Fees remain minimal, controlled mostly by how much computational work the ZK proof requires.

Top use cases:

- Swapping tokens quickly when you can’t afford to wait for an optimistic challenge period.

- Using privacy-focused features that some ZK rollup ecosystems develop to obscure details about your transactions.

6. Baltex.io aggregator

If you’re tired of juggling multiple bridging interfaces and want a single place to manage all your cross-chain moves, Baltex.io might be your solution. It’s a multi-chain swap aggregator that helps you transfer assets between blockchains with minimal fuss, and it also has options for private transfers.

How it works:

Baltex.io scans liquidity routes across various L2s and sidechains. When you request a swap or bridge, it identifies the fastest or cheapest way to move your tokens from one chain to another.

Why it’s popular:

- Consolidates bridging steps so you don’t need to manually verify you’re using the right network each time.

- Uses privacy-enhancing technology or private liquidity pools, allowing you to make transfers without exposing your entire transaction history.

- Regularly updates with newly supported chains and tokens.

Speed and fees:

- Varies based on the path Baltex.io chooses. If the aggregator finds a direct bridging route, you might get your assets in minutes. If it needs a multi-step path, it can take slightly longer.

- Fees are generally in line with the underlying bridges, plus a small aggregator fee.

- For some tokens, you might see an extra layer of cost for added privacy features, but it can be worth it if anonymity is a priority.

Top use cases:

- Hands-free bridging if you want to focus on DeFi strategies, rather than juggling multiple bridging dashboards.

- Private transfers, beneficial if you prefer not to publicly link your Ethereum mainnet and L2 addresses.

Conclusion and final tips

Choosing a reliable Ethereum bridge hinges on understanding your own needs. If security is paramount and you’re fully embedded in the Ethereum mainnet’s trust assumptions, an optimistic or zero-knowledge rollup like Arbitrum, Optimism, Base, or zkSync Era might be your best bet. If you value ecosystem variety and affordable transactions, Polygon remains a strong choice. And if you’re looking for convenience, speed, or private cross-chain transfers, Baltex.io gives you those capabilities under one umbrella.

Here are a few final tips to help you decide which Ethereum bridge solutions to prioritize:

- Identify your priorities. Is your top concern saving on gas fees, accessing a specific dApp, or performing quick trades? Different bridges excel in different areas.

- Check the official documentation. As bridging protocols evolve, documentation is critical for security best practices and token compatibility.

- Start with small amounts. Before you bridge large sums, practice bridging a tiny fraction so you understand transaction fees, wait times, and any final settlement steps.

- Keep an eye on network updates. Arbitrum, Optimism, Base, Polygon, and zkSync are constantly improving. Timelines for withdrawals or average fees can shift with each upgrade.

- Always confirm you’re on the correct URLs. Fake sites posing as legitimate bridges are common phishing attempts. Bookmark the official portals to avoid scams.

By using these bridging tools, you open the door to a multi-chain crypto world. You can stake in new farms, buy NFTs at a fraction of mainnet costs, and adopt advanced DeFi strategies across multiple networks. As 2025 continues, more L2 solutions and sidechains are vying for adoption, so make sure you choose a bridge that aligns with your goals, risk tolerance, and the chain you’re heading to next. Good luck exploring the expanding DeFi universe