Smart contracts are self-executing code that automatically enforce agreements. In 2025 they power $500B+ DeFi, $1T tokenized real-world assets, NFTs, gaming economies, supply chains, identity, and instant global payments. No banks, no lawyers, no delays. Real examples: Aave lending, OpenSea royalties, Axie Infinity play-to-earn, Chainlink-fed insurance payouts, and baltex.io cross-chain swaps. Risks: Bugs, oracle failures, hacks ($3.1B lost 2024). (Internal link → DeFi Section)

A smart contract is simply “if-this-then-that” logic written on a blockchain. Once deployed, it runs exactly as programmed, cannot be stopped, and no one can cheat it. Invented by Nick Szabo in 1994 and made real by Ethereum in 2015, smart contracts now execute $50B+ in daily economic activity with zero human intervention.

For beginners: Imagine a vending machine. You insert money → it automatically drops your snack. A smart contract is the same, but for money, property, votes, art, insurance, and more. For businesses: They cut middlemen, reduce costs 30–90%, and settle in seconds instead of days.

This 2025 guide explains the seven biggest real-world categories, with live examples, dollar figures, and beginner-friendly breakdowns.

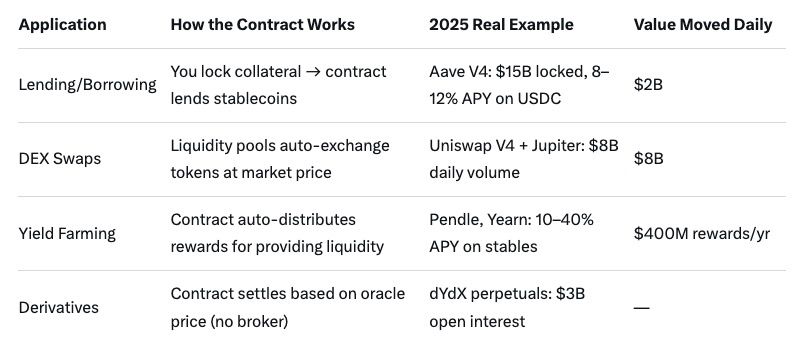

DeFi is the #1 smart-contract application: $500B+ total value locked.

Beginner example: You deposit $1,000 USDC into Aave → the contract instantly lends it out → you earn 9% while sleeping. No credit check, no bank.

(Internal link → NFTs & Digital Ownership)

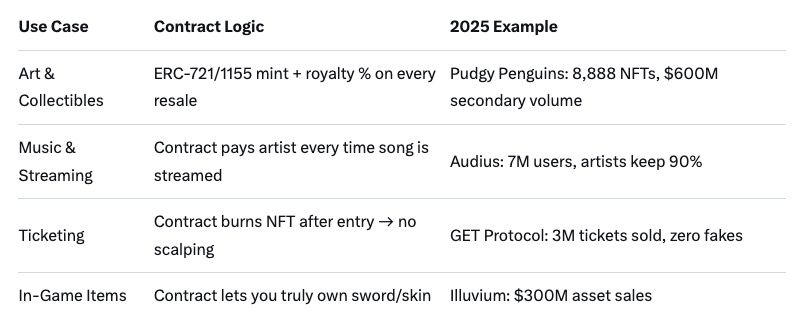

Smart contracts turned digital files into provably scarce assets.

Real-world win: Beeple’s $69M artwork (2021) still pays him 10% every resale in 2025 automatically.

Smart contracts run entire game economies without central servers.

Players own assets and can sell or rent them globally. Scholarships in Philippines still pay rent via Axie revenue.

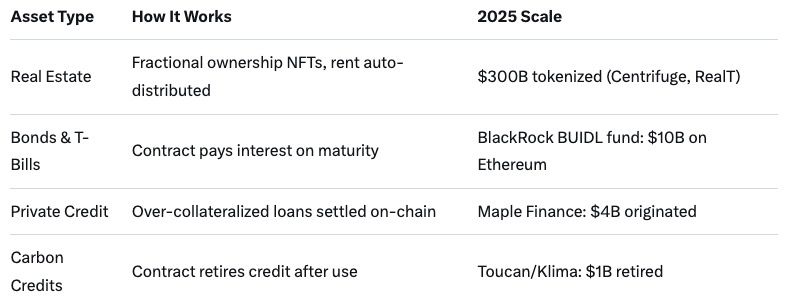

2025 is the year traditional finance meets smart contracts.

Example: You buy 1/1000th of a Miami condo for $300 → rent paid in USDC every month automatically.

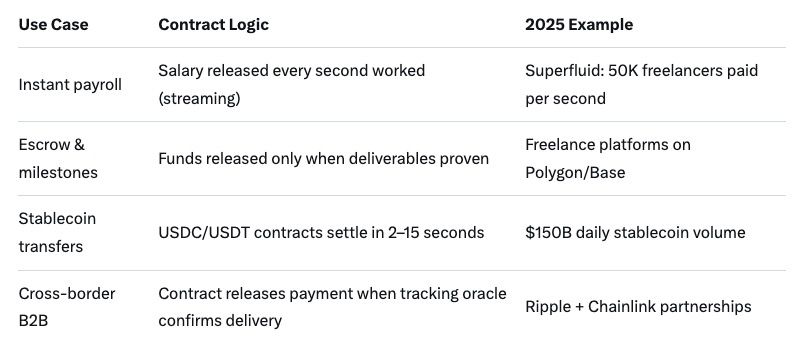

Smart contracts replace SWIFT and PayPal.

Real example: Argentine exporter gets paid in USDC the second container hits Miami port.

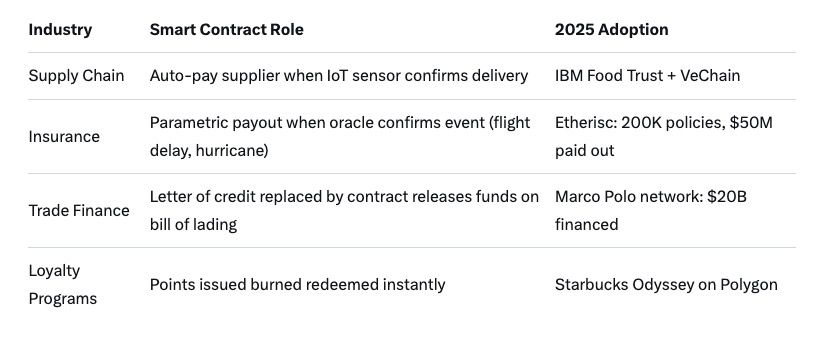

Big companies now use permissioned and public smart contracts.

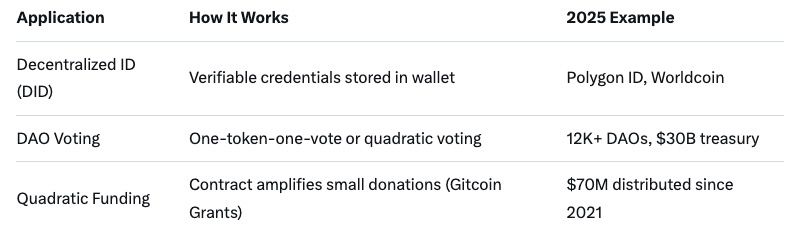

Self-sovereign identity is finally here.

Even the best contracts have dangers:

Mitigation: Use audited contracts, time-locks, multi-safes, insurance (Nexus Mutual).

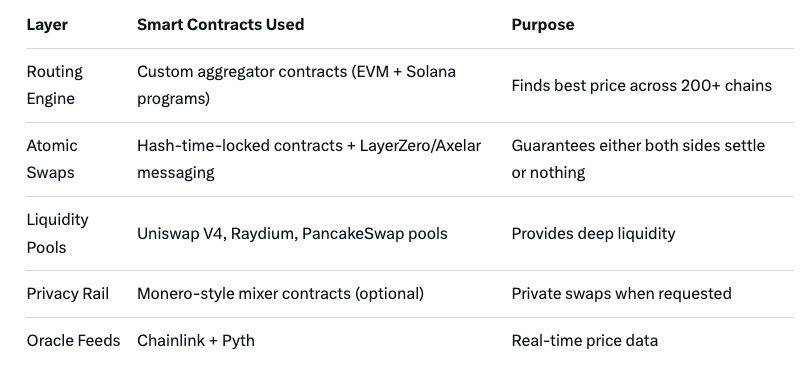

In a world of 200+ chains, the biggest friction is moving value between ecosystems. baltex.io is a perfect real-world example of layered smart-contract infrastructure.

Result: You can swap Polygon POL → Solana USDC → TON Jetton in 8–30 seconds with <0.1% total fee and no bridge. 2025 stats: $60B+ cross-chain volume, 10K+ daily users, zero lost funds (audited by PeckShield).

Beginner example:

(Internal link → Conclusion)

Q: Are smart contracts legally binding in 2025? A: Yes in many places (U.S. states, EU, Singapore). They’re treated as normal contracts if intent is clear.

Q: Can a smart contract be changed after deployment? A: Only if it was built upgradeable (proxy pattern). Immutable = safer but harder to fix bugs.

Q: Which chain has the most smart-contract activity in 2025? A: Ethereum + L2s ($320B TVL), Solana ($80B), BNB Chain ($20B).

Q: How much do smart contracts cost to deploy? A: Ethereum ~$50–$500, Polygon/Base ~$0.10, Solana ~$0.01.

Q: Can I write a smart contract with no coding? A: Yes — tools like thirdweb, Hardhat Wizard, or ChatGPT + Remix let beginners deploy in minutes.

Q: Are all NFTs smart contracts? A: Yes — every NFT collection is a deployed ERC-721/1155/SPL contract.

In 2025, you probably already used a smart contract today without realizing:

They have removed middlemen from finance, art, gaming, insurance, supply chains, and governance — saving billions in fees and days in delays.

The next wave? AI agents executing contracts autonomously, tokenized stocks paying dividends automatically, and cross-chain identity you control forever.

Whether you’re a beginner sending your first USDC or a business automating payroll, smart contracts are now infrastructure — invisible, unstoppable, and growing fast.

Start small: try a testnet swap on baltex.io, mint a free NFT, or stake $10 on Aave. The future is already here — it’s just distributed.