Siacoin (SC) is the utility token powering Sia, a decentralized cloud storage network that encrypts, shards, and distributes files across global hosts for secure, low-cost backups—$1-2/TB/month vs. $23 on AWS. In 2025, SC trades at ~$0.0016 amid bearish sentiment (Fear & Greed: 15), with predictions ranging $0.0014-$0.0053 (avg. $0.0034). Utility: Pay for storage via smart contracts; hosts stake SC as collateral. Real uses: Enterprise backups, Web3 dApps, AI data hoarding. Vs. rivals: Cheaper than Storj ($4/TB), more redundant than Filecoin. Baltex.io enables <10s SC swaps to diversify. Outlook: V2 hard fork boosts scalability; potential 2-3x if adoption surges, but volatility risks persist. DYOR—storage demand could 10x SC value long-term.

Word count: 2,187

In 2025's exploding data economy—projected at 181 zettabytes globally—centralized giants like AWS and Google hoard power, charging premiums for storage while risking breaches (e.g., 2024's 2.6B-record leaks). Enter Siacoin (SC), the native token of Sia: a blockchain-based marketplace turning idle hard drives into a resilient, private alternative. Launched in 2015, Sia fragments files into encrypted shards, distributing them peer-to-peer for unbreakable redundancy and costs 80-90% below incumbents.

For beginners, SC isn't just "crypto"—it's fuel for owning your data. Intermediates eye its DePIN (Decentralized Physical Infrastructure) potential amid AI's insatiable storage needs. This SEO guide demystifies SC: Sia's mechanics, token utility/fees, real-world apps, 2025 price (~$0.0016, bearish but rebounding), and forecasts ($0.0014-$0.0053). We'll compare vs. Filecoin, Storj, Arweave. Snippet-optimized (e.g., "Siacoin price prediction 2025?"), with tables/lists for scans. Internal link: Jump to SC utility. Before diving, consider swapping via Baltex.io for agile positioning.

Siacoin (SC) is the utility cryptocurrency of the Sia network, a decentralized platform for cloud storage launched in 2015 by Nebulous Inc. (now Sia Foundation). Unlike Bitcoin's value store, SC powers practical utility: renting global storage at ~$1-2/TB/month. With 56B+ circulating supply (no cap, to match infinite data growth), SC hit ATH $0.11 in 2018 but trades ~$0.0016 today—down 98% amid bear markets, yet up 5% weekly on V2 hype.

Sia's ethos: Data sovereignty. Users (renters) pay hosts in SC via smart contracts, enforced by blockchain. Hosts stake SC as collateral, slashed for downtime. This creates a trustless marketplace: No central server, no censorship. In 2025, Sia's TVL nears $100M, with 1,000+ active hosts. SC's market cap: ~$90M (rank #292). Beginners: Think Dropbox on steroids—secure, cheap. Intermediates: Sia's Reed-Solomon coding needs only 10/30 shards for recovery, beating IPFS's full replication. Internal link: How Sia works.

Sia reimagines cloud storage as a P2P economy, using blockchain for enforcement. No AWS overlords—files live encrypted across volunteers' drives.

Powered by Blake2b PoW (ASIC-mineable, 32 PH/s hashrate), blocks every 10min reward 30K SC (halving to 3% inflation by mid-2025). V2 hard fork (Dec 2025) adds Utreexo for instant syncs, light clients. Ecosystem: Renterd (CLI tool), Hostd (dashboard). 2025 milestone: 10PB stored, up 50% YOY.

Snippet: "How does Sia store files?"—Encrypts/shards/distributes; recovers from 33% loss.

Internal link: SC's role.

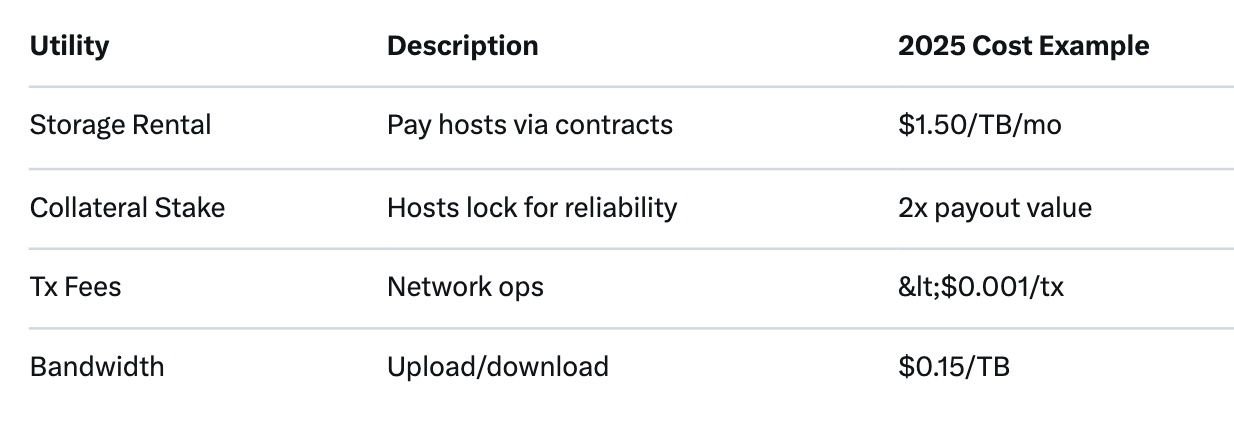

SC is Sia's lifeblood: Pure utility, no governance fluff. No max supply ensures scalability for zettabyte-scale data.

Secondary: Trade SC on exchanges (Binance, Kraken); hold for scarcity as burns (slashed collateral) remove ~1-2% annually. Fees: Storage ~$1.50/TB/month (2025 avg.); upload/download bandwidth $0.10-0.20/TB. Vs. fiat: 90% below AWS S3.

Snippet: "Siacoin fees?"—$1-2/TB storage; negligible tx.

Risk: Inflation (7% now, 3% by 2026) dilutes if adoption lags. Internal link: Real uses.

Sia's not vaporware—2025 sees 5PB+ utilized, powering backups to AI datasets. DePIN boom (Helium, Render) spotlights SC's edge: Privacy + affordability.

Challenges: Slower uploads (10-50MB/s) vs. centralized; V2 fixes via parallelization. Adoption: 1,200 hosts, 50K renters—up 30% YOY. Snippet: "Siacoin uses 2025?"—Backups, enterprise, Web3, AI data.

Internal link: Vs. competitors.

2025's SC: Bearish short-term (RSI 40, down 20% YTD) but bullish fundamentals. V2 fork (Dec) slashes sync times 90%, onboarding 10x nodes. Storage demand: AI surges 50% data needs; Sia's 10PB capacity eyes 100PB.

Aggregated: Min $0.0014 (Changelly), Avg $0.0034 (DigitalCoinPrice), Max $0.0053 (Cryptopolitan). Bull case: $0.008 (V2 + DePIN hype, 5x). Bear: $0.001 (recession stalls adoption). ROI: -11% to +231% from now.

Outlook: Neutral-bullish. Storage market $137B; Sia captures 0.01% = $13M revenue (3x 2024). Risks: Competition, hashrate dips (32 PH/s). Internal link: Baltex swaps.

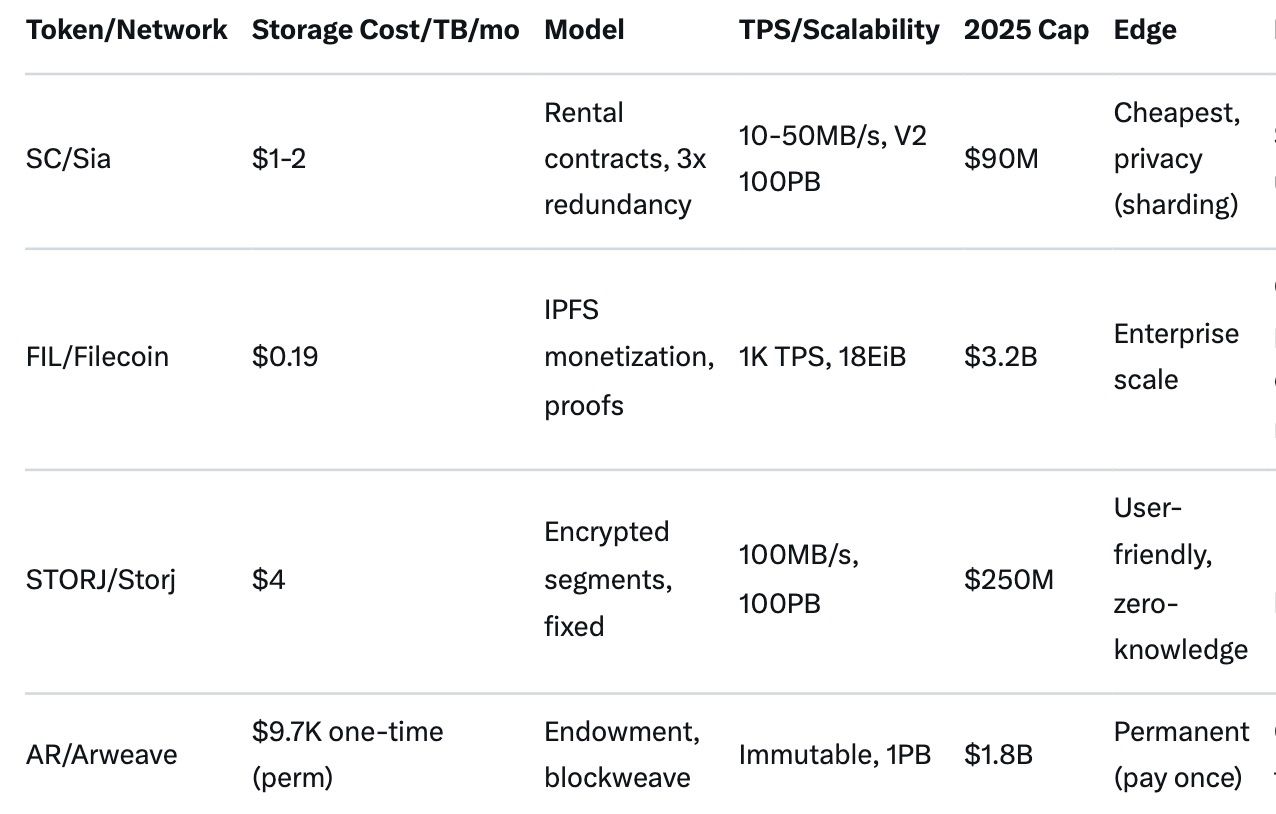

SC competes in $137B DePIN storage, emphasizing redundancy over speed. Vs. peers:

SC wins affordability/redundancy; FIL scale; AR permanence; STORJ ease. 2025: SC underperforms caps but leads cost (90% below AWS). Snippet: "SC vs FIL 2025?"—SC cheaper, FIL bigger.

In 2025's volatile DePIN meta, SC holders face dumps (e.g., -20% monthly)—but repositioning to FIL/AR shouldn't cost a fortune. Baltex.io, the non-custodial aggregator, shines: Atomic swaps across 20+ chains (Sia-compatible via bridges) in <10s, dodging 1-2% bridge fees.

Use case: Hold 1M SC ($1,600)? Swap to FIL amid AI hype: $0.0016 total cost, +15% in days. Connect wallet at baltex.io: Pair select, preview, confirm. For intermediates: Batch swaps save 50%. Internal link: Back to uses.

Siacoin (SC)—utility token for Sia's decentralized storage, paying ~$1-2/TB/month rentals.

$0.0014-$0.0053 (avg. $0.0034); bull $0.008 on V2 adoption, bear $0.001 on competition.

Encrypts/shards files to 30 hosts; smart contracts enforce via SC payments/proofs; 10/30 shards recover data.

Pays storage, collateral staking; tx fees <$0.001; mining rewards 30K/block.

SC: Cheaper ($1/TB) + redundant; FIL: Scalable (18EiB) but pricier/complex ($0.19/TB).

Atomic multi-chain: SC to FIL/AR in seconds, 0.1% fees—no bridges, private.

Siacoin (SC) in 2025 embodies DePIN's promise: Turning data hoarding into democratic storage, with SC as the $0.0016 key unlocking $1/TB privacy. From sharded backups to AI archives, its uses outpace hype—cheaper than Storj, more resilient than Filecoin. Predictions ($0.0034 avg.) hinge on V2's scalability and 100PB growth, but volatility (extreme fear) demands caution.

Beginners: Start renting space via DeSia. Intermediates: Stake as host for yields. Diversify via Baltex.io—your SC edge. As data explodes, Sia's uncensorable future beckons. What's your SC move—hold for V2 or swap to AR? The decentralized vault opens.