Gravity Chain—also called Gravity Bridge—is a decentralized, non-custodial bridge that connects Ethereum and Cosmos. It is run as its own Cosmos chain, secured by validators with slashing penalties instead of a custodial multisig. Users connect MetaMask and Keplr wallets, lock ERC-20 tokens on Ethereum, and mint equivalent tokens on Cosmos, or burn Cosmos assets to receive ERC-20s back. It has been audited, is widely integrated, and enables Cosmos DeFi access to stablecoins and Ethereum tokens while letting Cosmos projects export assets to Ethereum markets. It remains one of the most reliable corridors in crypto.

Blockchains have historically been isolated silos. Ethereum became the dominant home of DeFi and stablecoins, while Cosmos built a modular “Internet of Blockchains” where each chain has sovereignty but connects through the Inter-Blockchain Communication (IBC) protocol. The challenge is that IBC only links Cosmos chains with each other, leaving no native pathway into Ethereum. Without a bridge, the Cosmos economy would lack access to the dollar-backed stablecoins and liquidity that underpin most DeFi.

Gravity Bridge was developed as the neutral piece of infrastructure that links these worlds. By focusing narrowly on Ethereum↔Cosmos, it became a foundational component of the interchain economy. Its purpose is not to compete with DeFi apps but to serve as public infrastructure—like a highway—allowing capital to move freely. Since launching in 2021, Gravity has processed hundreds of millions of dollars in transfers and underpins liquidity on DEXs like Osmosis.

This matters because centralized exchanges once dominated the cross-chain flow. A user would sell tokens on one chain, withdraw stablecoins, then redeposit on another chain. That approach was costly, slow, and exposed users to custodial risks. Gravity removed the middleman, making trustless, validator-secured transfers possible directly between wallets.

Gravity is a dedicated Cosmos-SDK blockchain that acts as a peg zone with Ethereum. It runs its own validator set, uses the GRAV token for fees and governance, and secures transfers by requiring two-thirds of validators to sign attestations. The economic penalty of slashing ensures validators have skin in the game.

From the user’s perspective, the mechanics are abstracted away. You lock ERC-20s in an Ethereum smart contract and receive equivalent Gravity tokens on Cosmos. When returning, you burn the Gravity tokens and receive the original ERC-20s back. Each bridged token maintains a strict one-to-one backing, making it trustworthy and usable across Cosmos.

The design is deliberately minimalistic. Gravity contracts on Ethereum are stripped down to essential functions, reducing attack surface. Cosmos validators collectively act as oracles, observing Ethereum events and ensuring accurate minting on the Cosmos side. This hybrid simplicity is what has allowed Gravity to run reliably for years without major incidents.

Cosmos envisions a world of sovereign blockchains linked through IBC. But without Gravity, those chains would still be cut off from the liquidity that fuels global crypto. Stablecoins like USDC and DAI are the backbone of DeFi: they are used in lending markets, liquidity pools, and as trading pairs. Before Gravity, Cosmos users had little access to them outside of centralized custodial bridges.

Gravity brought those stablecoins in, powering DeFi growth inside Cosmos. Osmosis could suddenly offer dollar pairs, attracting traders and arbitrageurs. Yield protocols like Mars and lending platforms had reliable collateral. Treasury DAOs gained the ability to hold stable reserves. In reverse, Cosmos-native assets like ATOM and JUNO gained ERC-20 representation, allowing them to trade on Ethereum DEXs and appear in Ethereum DeFi portfolios.

Gravity turned Cosmos from a closed ecosystem into one integrated with the largest crypto economy. It is not flashy, but its neutral design makes it a crucial backbone for liquidity.

Bridges are notorious targets. In 2022 alone, billions were lost to bridge exploits, making them the single largest category of hacks in DeFi. Gravity approached this with three key design principles: validator consensus, slashing incentives, and minimal contracts.

Validators on the Gravity chain are required to observe Ethereum deposits. If two-thirds agree that a deposit occurred, the bridge mints the corresponding tokens. If they lie, they risk losing their bonded GRAV stake. With hundreds of validators and billions in Cosmos staked value, collusion becomes uneconomic.

The Ethereum contract itself is simple: it holds tokens and waits for signed proofs from the Gravity chain. By avoiding complex logic, it reduces the potential for smart contract bugs. The contract has also been externally audited.

This is not risk-free. Every bridge inherits systemic vulnerabilities, but Gravity’s reliance on decentralized validator security and economic penalties is considered stronger than multisig custodians, where a handful of private keys control billions.

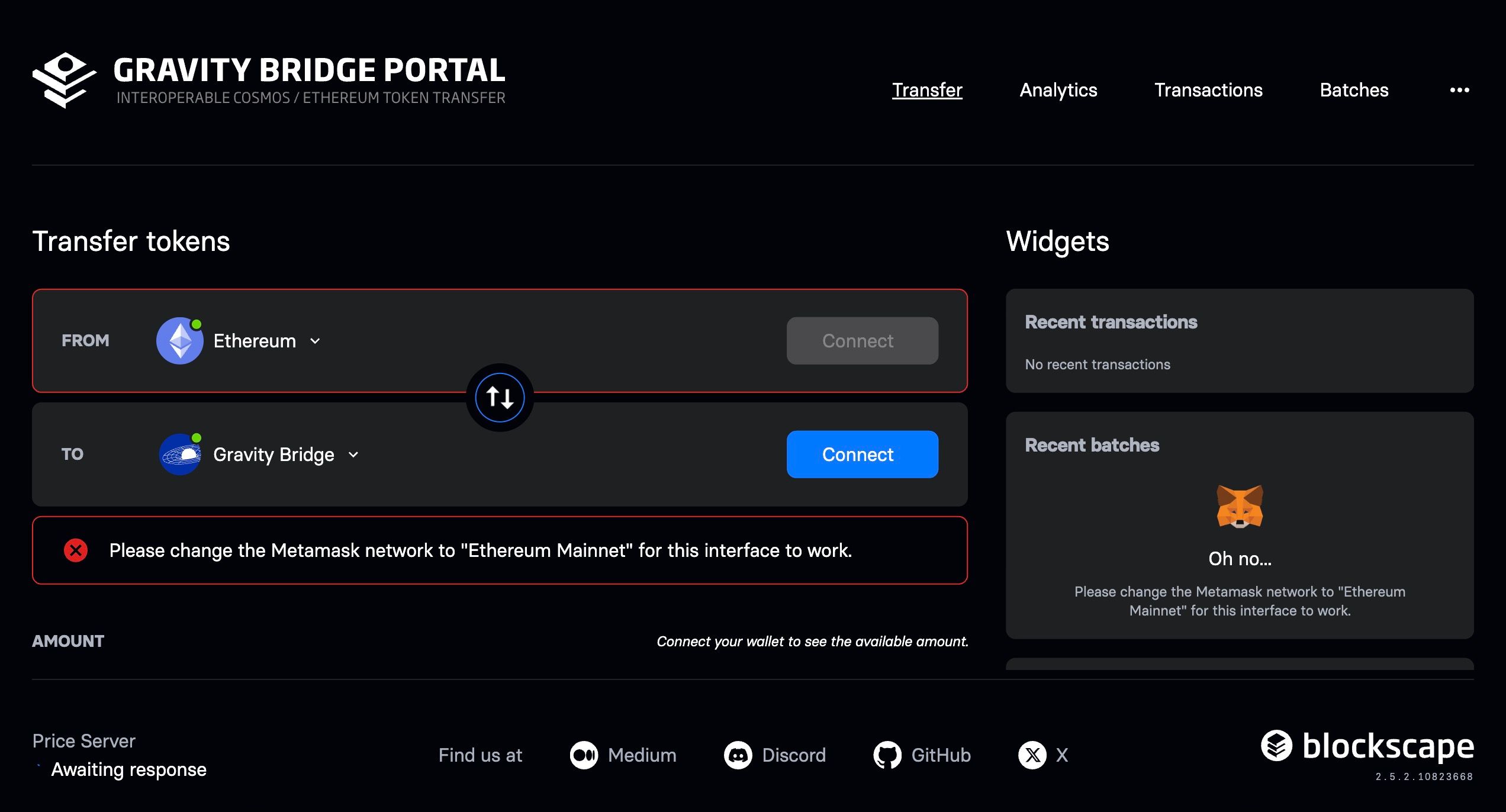

To bridge assets, you need MetaMask for Ethereum and Keplr for Cosmos.

If moving Ethereum assets into Cosmos, you open a trusted portal, connect both wallets, choose your ERC-20, and send it to the Gravity contract. MetaMask will prompt you to pay ETH gas. After confirmations and validator attestations, you receive Gravity-wrapped tokens in Keplr. These can then travel across Cosmos via IBC.

If moving Cosmos assets to Ethereum, you send them to the Gravity chain using IBC, then initiate the outbound transaction to your MetaMask address. This requires a small GRAV fee and an incentive for relayers to submit your batch. Within minutes, your tokens appear as ERC-20s.

Users must prepare both ETH for gas and GRAV for Cosmos fees. Forgetting either is a common stumbling block. Best practice is to test with a small transfer first.

Ethereum gas is the main cost. Fees range from a few dollars in calm periods to over $100 during network congestion. For large transfers, this is negligible. For small ones, it is often uneconomical. Cosmos-side fees are near zero.

Transfers usually complete within five to fifteen minutes. Ethereum confirmations plus validator batching introduce some delay. This is slower than native IBC transfers, which take seconds, but much faster than centralized exchange withdrawals.

The trade-off is clear: Gravity delivers decentralized access to Ethereum liquidity, but at the cost of Ethereum’s gas structure.

Gravity supports most standard ERC-20 tokens, with stablecoins being the most heavily used. USDC, USDT, and DAI dominate volume, while ETH and WETH are also common. These assets flow into Cosmos DEXs like Osmosis, Crescent, and others, where they form stable trading pairs.

On the outbound side, ATOM, OSMO, JUNO, EVMOS, and AKT have all been bridged to Ethereum. This allows them to appear in ERC-20 form on Uniswap and other venues, increasing exposure to Ethereum users.

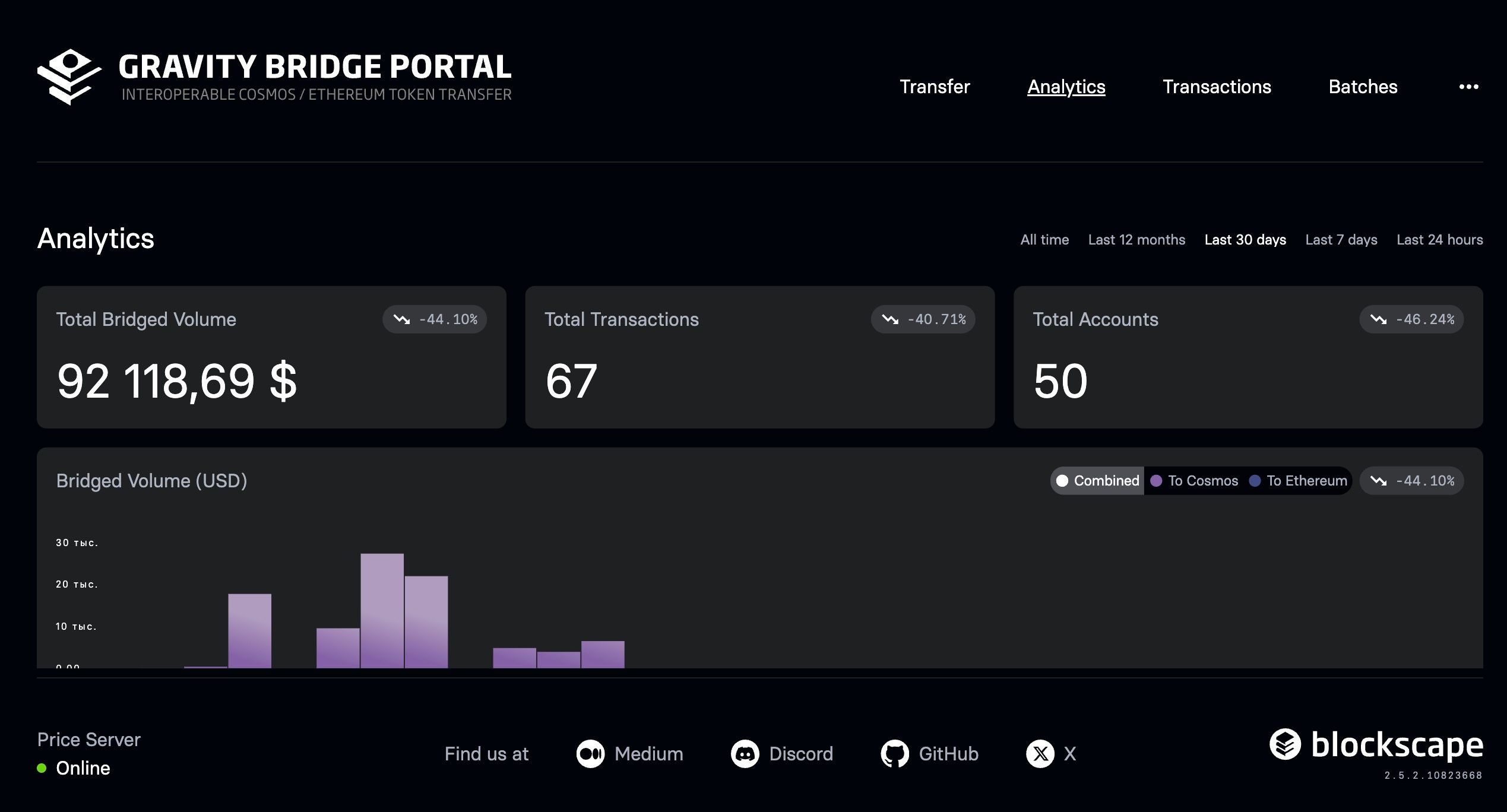

By 2023, Gravity had already funneled over $100 million in stablecoins into Cosmos, with cumulative volumes continuing to climb. For many Cosmos projects, Gravity assets became the default liquidity backbone.

Gravity is non-custodial, validator-secured, and neutral infrastructure. It does not compete with applications but serves them. This neutrality means every Cosmos chain can plug into it equally.

Its validator-based model aligns incentives. Misbehavior results in slashing, while honest participation yields rewards. This makes the system more resilient than bridges run by small custodial groups.

It also supports a wide range of assets out of the box. Any ERC-20 can be bridged, and any IBC-enabled Cosmos asset can move outbound. This flexibility is key for developers building new DeFi products.

Osmosis uses Gravity-bridged stablecoins to power its dollar pools. Traders arbitrage between Ethereum and Cosmos markets using the bridge. DAOs manage treasuries by diversifying through Gravity.

Cosmos-native tokens appearing on Ethereum DEXs owe their presence to Gravity. This exposure helped projects like JUNO and EVMOS reach new investor audiences.

Yield farmers use Gravity to move stablecoins into Cosmos lending protocols when rates are higher, then move them back to Ethereum when opportunities shift. This dynamic arbitrage is only possible because of Gravity.

Platforms like Baltex.io integrate Gravity invisibly, allowing users to perform cross-chain swaps in one step. Behind the scenes, the bridge is doing the heavy lifting.

By 2025, multiple bridging networks exist: Axelar, Wormhole, LayerZero, and Gravity each occupy niches. Gravity is the most Cosmos-aligned, operating as neutral, community-owned infrastructure. Axelar and Wormhole connect dozens of chains but use different trust models.

Gravity’s tight focus gives it stability and reliability. It is not the most feature-rich, but it remains the backbone of Ethereum↔Cosmos transfers. Market observers call it the “plumbing” of Cosmos because most users interact with its assets daily without even realizing it.

Fund both wallets before bridging: ETH for gas, GRAV for Cosmos fees. Always test with a small transfer. Check the official token registry to avoid duplicate versions of assets. Time your transfers for low Ethereum gas periods to minimize cost.

For large transfers, Gravity is cost-efficient. For smaller amounts, aggregators or centralized exchanges may still be cheaper.

Institutions are increasingly using Gravity. Funds that want Cosmos staking exposure bridge in stablecoins, buy ATOM, and stake for yield. Cosmos DAOs that want stable reserves bridge back to Ethereum.

Developers use Gravity to onboard Ethereum users into their Cosmos apps. By supporting bridged ERC-20s, they can tap into Ethereum’s liquidity pool without depending on centralized listings.

For DeFi builders, Gravity is often invisible infrastructure. Users deposit assets, and behind the scenes the bridge makes sure ERC-20s and IBC assets remain interchangeable.

Gravity’s future is tied to both Ethereum scaling and Cosmos growth. If Ethereum gas costs fall with scaling upgrades like proto-danksharding, Gravity will become more accessible for smaller users.

As Cosmos matures, Gravity will continue to serve as the main route for non-native assets like DAI and WETH. Even with Circle launching native USDC on Cosmos, Gravity remains relevant for other ERC-20s.

Developers are also exploring integrating Interchain Security, which would allow Cosmos Hub’s validator set to secure Gravity, further raising trust. Governance proposals continue to evolve incentives and parameters.

In the bigger picture, bridges remain critical infrastructure. Gravity’s neutral, validator-secured model has already proven resilient compared to custodial competitors. Its role as Ethereum↔Cosmos highway is unlikely to diminish.

Gravity Bridge is not glamorous, but it is foundational. It has transformed Cosmos from a closed ecosystem into one connected to Ethereum’s liquidity. Stablecoins, ERC-20s, Cosmos tokens, and DeFi applications all depend on its flow.

For users, it means access to more assets, more markets, and more strategies. For developers, it means composability and liquidity. For institutions, it means treasury management and yield diversification.

Bridges remain risky, but Gravity has delivered a neutral, audited, community-governed model that has operated securely for years. As of 2025, it stands as one of the most reliable arteries in crypto.

Is Gravity Bridge audited and governed? Yes. It has undergone independent audits and runs with validator governance on a sovereign Cosmos chain.

How long do transfers take? Five to fifteen minutes is typical. Cosmos-to-Ethereum may take longer due to batching.

What fees should I expect? Ethereum gas fees are the major cost. Cosmos GRAV fees are negligible.

Which assets can I bridge? Most ERC-20s inbound, and most IBC-enabled Cosmos assets outbound. Stablecoins dominate volumes.

How safe is it? Safer than custodial multisig bridges, but not risk-free. Smart contract bugs, pegged asset risk, and operational errors remain possibilities.