You’re probably here because you want a bitcoin price prediction 2030 and wonder if it’s going to skyrocket, fizzle, or land somewhere between. The truth is, nobody can say for sure—but there are some educated guesses. In this listicle, I’ll walk you through key questions about Bitcoin’s potential price trends by 2030. We’ll discuss topics like mainstream adoption, government regulation, and advancing technology. Think of it like a friendly, slightly geeky Q&A session that shines some light on where Bitcoin could be in less than a decade.

Whether you’re a casual enthusiast or a seasoned trader, the goal here is to help you understand major factors that might (or might not) put Bitcoin at jaw-dropping price points. So let’s get comfortable, talk through each question, and see what you can watch out for on your Bitcoin journey.

Many analysts think Bitcoin’s price in 2030 could be several times its current value, but predictions vary wildly.

Factors like mainstream adoption, regulatory clarity, and technological upgrades will likely drive demand.

Market sentiment (human psychology), institutional interest, and macroeconomic conditions (think global recessions or booms) can all play a huge role.

No forecast is perfect. Keep risk management and your personal timeframe in mind when making decisions.

Now, let’s tackle 12 common questions about Bitcoin’s possible future. Feel free to skip around, but if you’re hungry for detail, ride along from start to finish.

By 2030, Bitcoin will have existed for over two decades, making it not just a shiny newcomer but a fully established asset class. For you, that means there is ample time for the technology to mature, for governments to figure out regulation, and for big institutions to go all in—or back out.

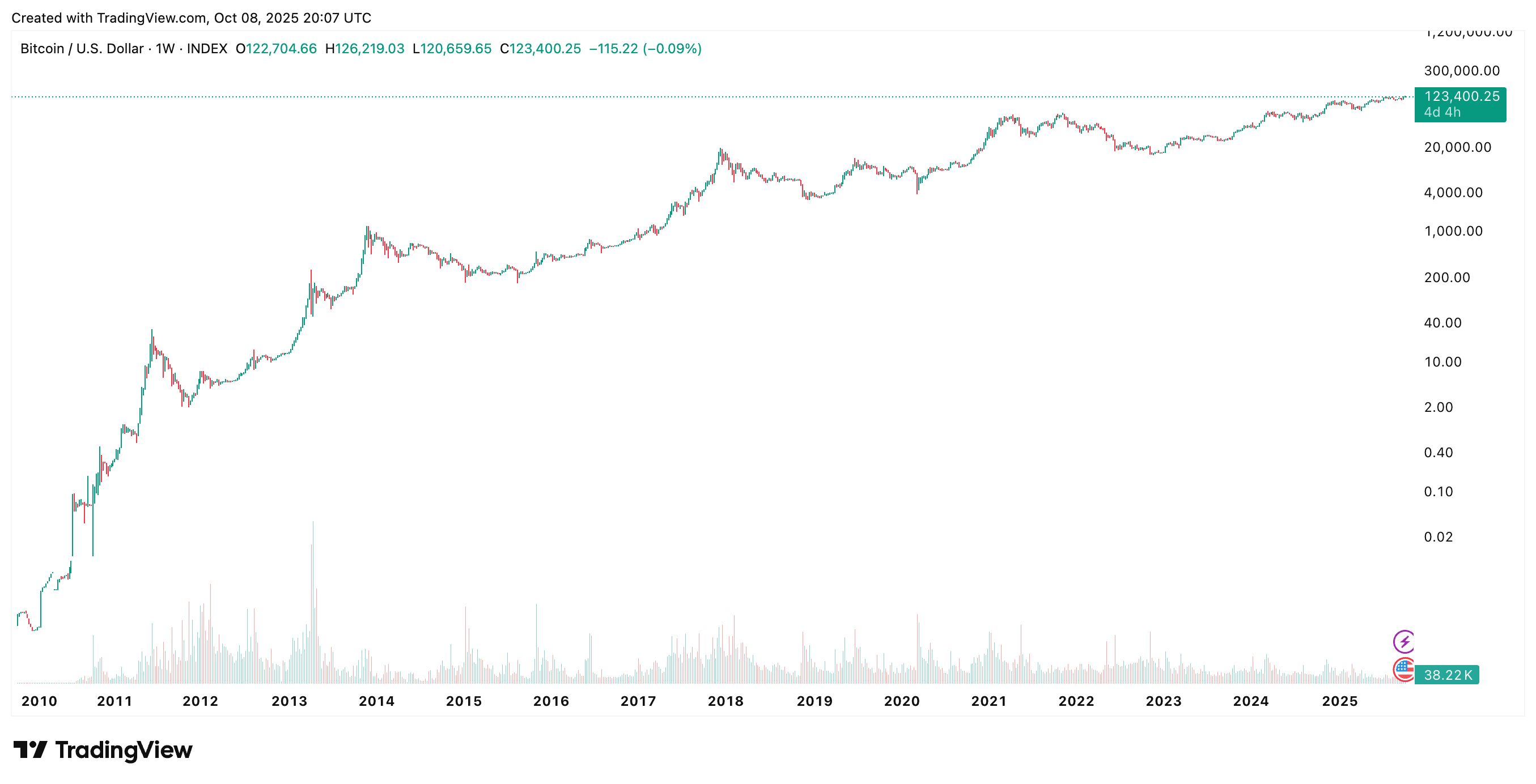

A lot can happen in seven or eight years, especially in a rapidly changing digital economy. The 2030 milestone is also significant because of Bitcoin’s halving cycles. Every four years, the reward paid to Bitcoin miners gets cut in half, reducing supply pressure. By 2030, we’ll have gone through a couple of these halvings. Historically, halvings have led to supply constraints and, in some cases, new price surges.

Another reason? Widespread public awareness. Even if you’ve never owned a single satoshi (the smallest unit of Bitcoin), you likely know someone who does. Daily headlines, celebrity endorsements, and institutional moves could amplify that interest by 2030.

There’s a strong possibility. Bitcoin’s journey began mostly with tech enthusiasts and contrarians. Over the years, we’ve witnessed entire countries (like El Salvador) adopting Bitcoin as legal tender. Payment gateways increasingly allow you to buy coffee or groceries using Bitcoin, though it’s still not as smooth as swiping a debit card.

Mass usage depends, in part, on user-friendly platforms. If you can send Bitcoin across borders on intuitive apps, the friction of adopting crypto goes down. Furthermore, businesses might begin to see crypto as less of a novelty and more of a necessity, especially if customer demand shifts.

We also have mainstream financial players—think payment giants and global banks—jumping on the crypto bandwagon. They’re setting up custodial services (secure, institutional-grade storage) and developing Bitcoin-based investment products. Should this momentum persist, mainstream usage could expand significantly, potentially pushing Bitcoin’s 2030 price to unexpected heights.

Regulations are the double-edged sword of the crypto world. Clarity in legal frameworks can attract more serious investors, while harsh or uncertain rules might scare them away. Some nations embrace Bitcoin (light taxes, fewer restrictions); others crack down, seeing it as a threat to monetary control.

The big question is how strict or friendly many governments will be by 2030. If you’re worried about clampdowns, keep an eye on financial watchdog announcements. New licensing requirements or heavy transaction taxes can reduce market enthusiasm. On the flip side, supportive legislation—such as recognizing crypto assets in pension funds or clarifying tax breaks—could spark a flood of new investments.

Readers often wonder where to learn more about navigating these policy shifts. You might find our in-house guide on emerging crypto regulations helpful: Discover important crypto regulations. Always stay updated and prepare to adapt to new legal landscapes. After all, regulation shapes adoption.

Large institutions—from asset managers to pension funds—have the capital to swing Bitcoin’s price in dramatic ways. Over the years, you’ve probably heard of major companies adding Bitcoin to their balance sheets. This kind of headline can spark mass interest and new waves of retail buying.

Institutional investors bring more than just money; they bring legitimacy. When big banks or publicly traded companies start dealing in Bitcoin, it signals to everyday folks that the asset is legitimate. By 2030, many experts project that big institutional players will treat Bitcoin as a core position in diversified portfolios.

However, institutions can also cause volatility if they pivot quickly. Picture headlines that say an influential hedge fund sold off millions in Bitcoin overnight. That could rattle the market short term. Still, the overall trend since 2017 or so suggests growing institutional acceptance, which often nudges Bitcoin’s value upward.

Absolutely—it’s not alone in the crypto universe. Ethereum, for instance, powers smart contracts, decentralized applications, and non-fungible tokens (NFTs). Then you have altcoins focusing on faster transaction speeds, privacy, or specialized niches (like supply chain tracking).

Some crypto die-hards argue that Bitcoin’s first-mover advantage and global brand recognition are enough to keep it on top for decades. Others see a future where next-gen blockchains overshadow Bitcoin’s older technology. While Bitcoin is working on improvements (via layers like the Lightning Network), it’s arguably slower than some of its counterparts.

By 2030, a handful of newer coins might compete more intensely. But from an investor standpoint, Bitcoin remains the “gold standard” of crypto. Competitors may erode some interest, but that doesn’t necessarily mean Bitcoin’s price will shrink. Instead, competition might spark healthy innovation. If you’re a savvy investor, you’ll likely consider multiple coins—just like diversifying stocks.

One big complaint you might hear is, “Bitcoin transactions can be slow and costly during peak times.” Enter the Lightning Network, sidechains, and protocol upgrades. These tech solutions aim to scale Bitcoin for everyday use. If these fixes are successful by 2030, you could see near-instant, near-free Bitcoin transfers—a game-changer for real-world adoption.

Still, technology is only as good as its user adoption. Even if the infrastructure gets built, do enough people switch from legacy banking to this new digital economy? Early adopters will. Others might be hesitant until the user experience is simpler or incentive is high enough.

At this midpoint of our discussion, it’s worth noting that advanced trading platforms often integrate new forms of payment or bridging solutions faster than traditional exchanges. For example, specialized players like Baltex.io could offer cutting-edge tools that keep pace with Bitcoin’s evolving tech. If these solutions deliver security, speed, and simplicity, mass adoption could accelerate.

Bitcoin’s supply is capped at 21 million coins, making scarcity part of its fundamental allure. By 2030, nearly 94% of that total supply will be mined. After each halving, miners receive fewer new Bitcoin, tightening new supply. If demand remains the same or rises, restricted supply could spell higher prices.

Gold is often used as an analogy—even if new gold deposits are discovered, gold is finite on Earth. Bitcoin’s code ensures no new supply can be generated beyond 21 million. But scarcity alone doesn’t guarantee an endless price climb. Demand must be present to push prices up.

Investor sentiment plays a huge role. If people lose faith in Bitcoin for any reason, scarcity may become less relevant. But historically, strong “HODL” (hold on for dear life) communities believe in scarcity’s power to drive up long-term value. If you want more tips on how to manage your Bitcoin stash, check out our tutorial: Get tips on secure crypto wallets.

In the early days, Bitcoin was mainly for newcomers to finance or tech gurus who saw it as a revolution. Today, it’s gone mainstream, with financial advisors tentatively recommending small Bitcoin allocations. By 2030, you might see an entire generation that grew up with crypto as a normal part of investing.

Demographics matter. Younger adults are often more comfortable with digital assets. As they move into peak earning years, they could funnel more money into Bitcoin. Meanwhile, older generations might remain skeptical, or they might come around if they see stable gains. A global shift toward digital payments—spurred in part by smartphone usage—could also push investors to see Bitcoin as an essential portfolio component.

If these shifts occur at scale, demand will climb, and so might price. But don’t forget, investor emotion can swing. A major scandal or technology meltdown could spook everyone, at least temporarily.

Mining Bitcoin requires considerable electricity and specialized hardware. Critics argue that this energy consumption harms the environment, especially if the electricity comes from fossil fuels. As the climate crisis intensifies, countries might clamp down on high-carbon mining operations or tax them heavily.

That said, an increasing portion of Bitcoin mining uses renewable energy sources, like hydropower or solar. By 2030, if the industry embraces greener solutions, that PR issue could fade. Alternatively, if environmental activism intensifies, we might see global pressure to reduce Bitcoin’s carbon footprint.

Market watchers also note that crypto-friendly laws sometimes hinge on environmental performance. A region might ban or penalize Bitcoin mining unless it’s powered by clean energy. From an investment standpoint, environment-based decisions could shape supply costs and thus the price. Remember that adopting greener mining could also bring positive public sentiment and more investor confidence over time.

Remember 2008? The stock market tanked, central banks reacted, and faith in traditional finance crumbled. Bitcoin was created soon after, with its decentralized design viewed as a hedge against the system. Now, if by 2030 the world experiences another massive financial meltdown—hyperinflation, sovereign debt crises, or forced bank shutdowns—people may seek alternative assets like Bitcoin.

We’ve seen hints of this behavior when certain national currencies collapsed. For instance, individuals in countries impacted by high inflation sometimes turned to Bitcoin as a store of value or a way to circumvent capital controls. But the effect is still uneven—Bitcoin can also drop in a crisis if people panic and need to liquidate everything.

By 2030, we might witness broader acceptance of Bitcoin as a “safe haven” asset. That would require more stable trading volumes and consistent usage. But if you’re investing for the long haul, keep macro trends on your radar. They can catapult Bitcoin’s price well beyond expectations—or cause short-term dips.

In a sense, yes. The crypto market often moves in synchrony. When altcoins surge, people sometimes rotate profits back into Bitcoin, boosting its price. Conversely, if altcoins crash due to a major scandal or hack, it can temporarily dent overall crypto sentiment and drag Bitcoin down too.

Altcoins can also fuel competitive innovation. Ethereum’s shift to a more energy-efficient model has raised eyebrows about Bitcoin’s energy usage. Meanwhile, altcoins focusing on privacy or faster transactions remind people that Bitcoin might lag behind in certain features.

Despite that, Bitcoin typically remains the largest crypto by market cap. Even if altcoins distract some investors, Bitcoin’s brand recognition and liquidity keep it attractive. If you’re looking to broaden your crypto horizon, make sure you understand the interplay between Bitcoin and smaller coins: Explore advanced trading strategies.

Short answer: not always. For every analyst saying Bitcoin could hit $1 million by 2030, another might predict a crash to near zero. Price models commonly reference historical data, supply-and-demand curves, or macro trends, but black swan events and emotional markets can toss these models aside.

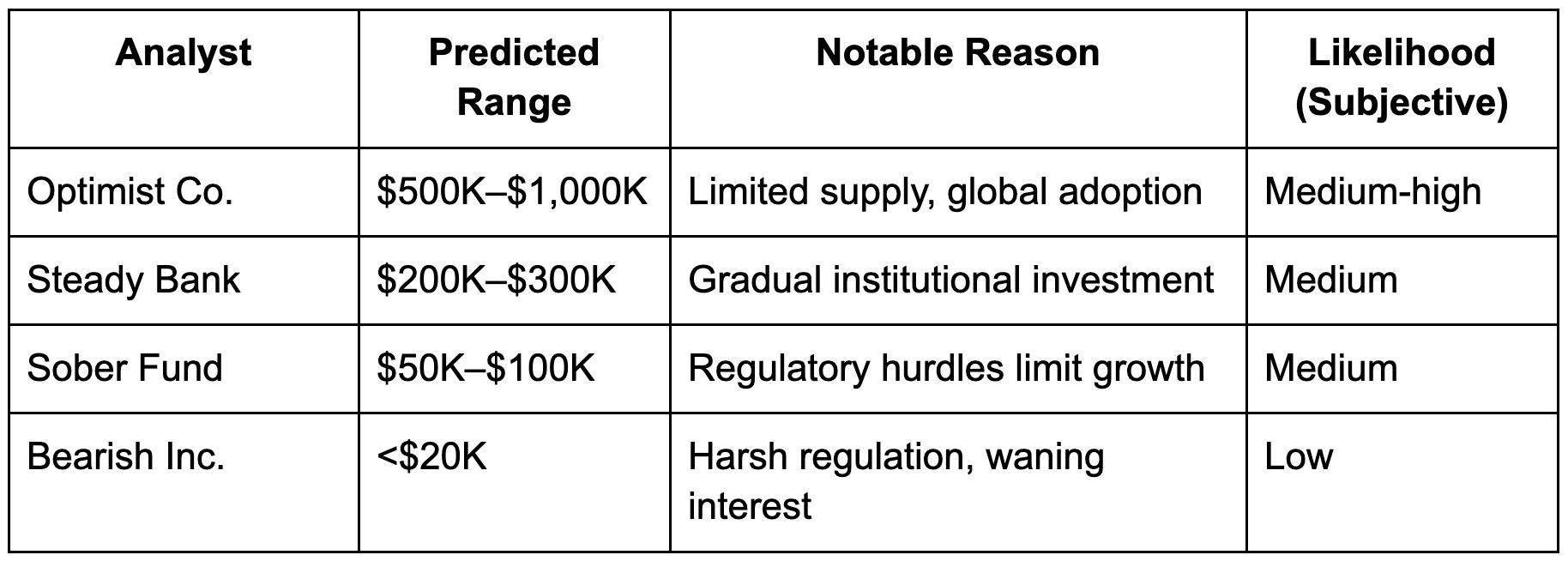

Below is a quick table of hypothetical 2030 predictions. Note these are purely illustrative examples, not endorsements:

While these guesses can be fun, real-world outcomes may land outside these ranges. Use price predictions as a starting point, but do your own research and risk assessment. If you want advanced tools for in-depth analysis, platforms like Baltex.io aim to provide feature-rich charting, liquidity, and possibly some advanced forecasting capabilities to help you manage your Bitcoin exposure wisely.

Below are some frequently asked questions about Bitcoin’s future and price movements. If you want a quick read, here you go:

Is Bitcoin guaranteed to rise eventually? Nothing is guaranteed. While many watchers believe in Bitcoin’s growth trajectory, unpredictable events can derail even the strongest asset.

Should I invest everything in Bitcoin by 2030? Diversification is key. It might be tempting to go all in, but it’s generally wiser to manage risk across multiple assets—crypto and otherwise.

Will Bitcoin replace fiat currency altogether? Completely replacing traditional money in all countries seems unlikely. However, it could coexist as a popular alternative or complement for specific use cases, such as cross-border payments.

Is it too late to jump in now? Some people claim it’s “too late” every time Bitcoin’s price climbs. Historically, Bitcoin has crashed and rebounded multiple times. Ultimately, the best time to invest depends on your personal strategy and risk appetite.

So, how much will Bitcoin be worth in 2030? The range of possibilities is vast, from conservative estimates to extremely bullish outlooks. By now, you’ve seen how multiple factors—mainstream adoption, regulation, technology upgrades, environmental considerations, and investor psychology—all intertwine to shape Bitcoin’s price.

If you plan on sticking around for the next decade, it’s wise to keep educating yourself. Always keep an eye on global trends, regulatory updates, and market sentiment. Prepare for volatility, but also understand that Bitcoin has historically rewarded patient holders.

Lastly, if you’re looking for an exchange with robust features for both casual and advanced traders, take a peek at Baltex.io as you refine your crypto strategy for the years ahead. Don’t forget to spread your investments around to better weather whatever storms—and opportunities—come your way. Remember, the best plans combine knowledge, timing, and a steady approach to risk. Best of luck navigating the ever-evolving world of Bitcoin!