MANTRA (OM) is a Layer-1 blockchain built on Cosmos SDK, focused on regulatory-compliant tokenization and trading of real-world assets (RWAs). The OM token powers staking, governance, and fees. In December 2025, OM trades around $0.075 with ~$80M market cap after a 2025 peak of $9 and subsequent decline. Ecosystem includes RWA products, yield vaults, and a $108M fund, but faces volatility and competition in the RWA sector.

MANTRA is a dedicated Layer-1 blockchain designed for real-world asset (RWA) tokenization, emphasizing regulatory compliance, security, and interoperability. Launched as MANTRA Chain, it uses the Cosmos SDK to provide a permissionless environment where developers and institutions can tokenize assets like treasuries, real estate, private equity, and debt while adhering to global standards.

Unlike general-purpose chains, MANTRA integrates built-in compliance tools, such as KYC/AML modules and identity solutions, making it attractive for traditional finance integration. In 2025, MANTRA positions itself in the growing RWA narrative, aiming to bridge DeFi with institutionalized assets projected to reach trillions in value.

The native OM token migrated from ERC-20 to the native chain in 2025, unifying liquidity and adjusting economics for sustainability.

For investors: MANTRA appeals to those bullish on compliant RWAs, offering exposure to tokenized traditional assets with blockchain efficiency.

OM serves multiple roles in the ecosystem:

Utility expanded in 2025 with native migration, enabling better staking rewards and ecosystem participation.

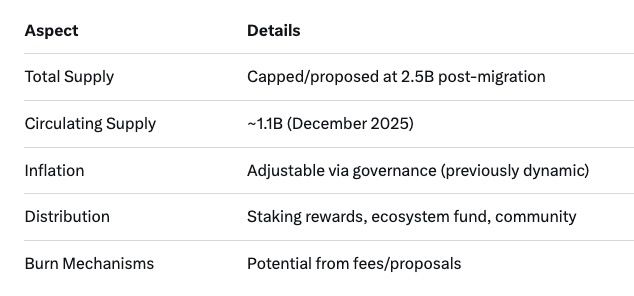

MANTRA updated tokenomics in 2025 with migration and adjustments.

Migration consolidated OM on MANTRA Chain, reducing fragmentation and enhancing security rewards.

Staking OM secures the Proof-of-Stake network:

Governance is community-driven: OM holders propose and vote on upgrades, fund usage, and parameters.

In 2025, staking participation supports growth initiatives like the ecosystem fund.

MANTRA's ecosystem centers on RWA tools:

Growth highlights 2025:

Despite tech progress, adoption tied to broader RWA momentum.

OM experienced extreme volatility:

Factors: Early pump from narrative, later correction due to market conditions, competition, and token adjustments.

Ondo often outperformed in stability; Centrifuge in niche credit.

OM's migration and RWA focus may involve cross-chain needs for diversification.

Baltex.io offers non-custodial instant swaps:

Useful for repositioning during volatility or accessing broader DeFi.

Q: What is MANTRA Chain? A: L1 blockchain for compliant RWA tokenization on Cosmos SDK.

Q: What is OM token utility? A: Staking, governance, fees in ecosystem.

Q: Why did OM price crash in 2025? A: Post-hype correction after February ATH.

Q: How to stake OM? A: Delegate via wallet on MANTRA Chain.

Q: Is MANTRA good for RWA investing? A: Strong compliance focus, but high risk/volatility.

Q: Comparison to Ondo? A: MANTRA more chain-focused; Ondo product-yield leader.

In December 2025, MANTRA (OM) remains a specialized RWA platform with compliant infrastructure and ecosystem initiatives, despite severe price correction from early highs. OM drives staking/governance in a maturing tokenomics model. For RWA believers, it offers unique exposure; risks demand caution amid competition. Tools like baltex.io aid flexible management in volatile markets.