Ondo Finance (ONDO) is a leading RWA protocol tokenizing institutional-grade assets like US Treasuries and stocks on blockchain. As of December 18, 2025, ONDO trades at ~$0.38 with a $1.2B market cap, down from $2.14 ATH but up 314% YTD amid RWA surge. Products like USDY (3.75% APY) and OUSG drive $1.8B+ TVL. Token utility includes governance; risks involve 2026 unlocks and regulation. Ideal for DeFi users seeking compliant yields—compare to Centrifuge for credit focus.

Ondo Finance is a blockchain-based platform bridging traditional finance (TradFi) and decentralized finance (DeFi) through real-world asset (RWA) tokenization. Founded in 2021, it enables institutions and individuals to access tokenized versions of high-quality assets like US Treasuries, money market funds, stocks, and ETFs—offering on-chain liquidity, yields, and transparency.

In 2025, Ondo has solidified as a top RWA player, with TVL exceeding $1.8 billion. Its protocol emphasizes regulatory compliance, institutional-grade security, and scalability via partnerships with custodians like Coinbase and BlackRock. Unlike speculative DeFi, Ondo focuses on low-risk, yield-bearing products backed by real assets.

For crypto investors: Ondo represents the "boring but profitable" side of RWAs—stable yields (3-5% APY) with blockchain efficiency. DeFi users value its seamless integration with chains like Ethereum, Solana, and BNB for composability.

The native ONDO token powers governance and ecosystem incentives, trading on major exchanges like Binance and Coinbase.

Ondo's protocol is modular, built on Ethereum with cross-chain expansions. Core design principles: Compliance-first (KYC/AML for restricted products), institutional custody, and omnichain interoperability.

This design supports phased evolution: From stablecoins to tokenized securities. In 2025, expansions include Solana for tokenized US stocks/ETFs (Q1 2026) and a liquidity fund with State Street/Galaxy.

For technical users: Ondo's stack leverages Cosmos SDK influences for interoperability, with APIs for dApp builders.

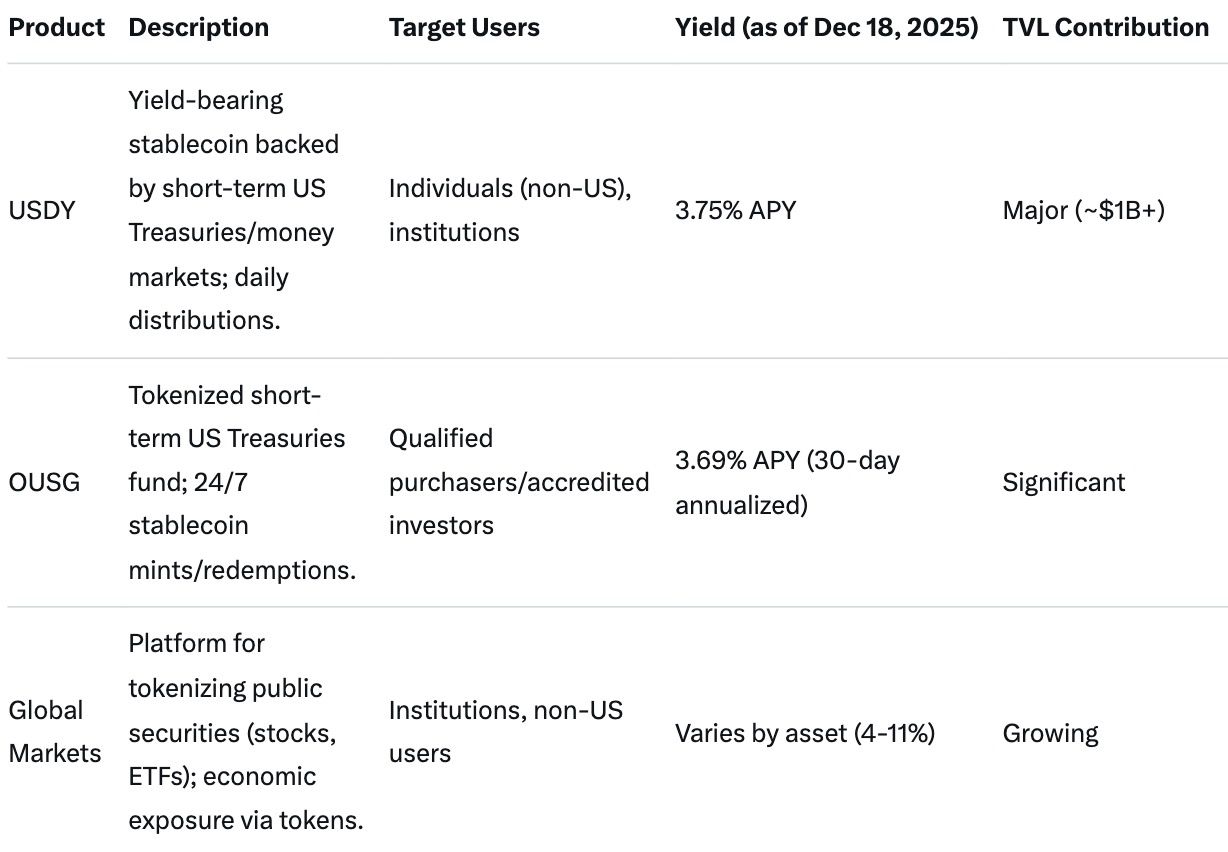

Ondo's products tokenize real assets for on-chain access, generating yields from underlying investments.

These products democratize access: No need for brokerage accounts; yields accrue on-chain.

ONDO, with ~3.2B circulating supply (total 10B), is the ecosystem's governance and incentive token.

No direct staking yet, but 2025 updates tie utility to AUM growth. Token unlocks (early 2026) could pressure price, but vesting aligns long-term holders.

Ondo DAO empowers ONDO holders with quadratic voting for balanced participation.

This model fosters community input while retaining core team veto for compliance.

Ondo's yields derive from tokenized assets, outperforming traditional savings (0.5-1%) with blockchain perks.

Investment angle: Low volatility (pegged or Treasury-backed); suitable for yield farming without high risk.

Despite strengths, RWAs face hurdles:

Mitigate: Diversify; focus on products over token for yields.

In 2025, Ondo thrives amid RWA boom—sector TVL hit $26B (5x since 2022). Key events: SEC clearance, BNB/Solana expansions, $108M ecosystem fund (wait, that's MANTRA—correct to Ondo's growth via partnerships).

Investment thesis:

Price prediction: $0.43 max Dec 2025; long-term $1-2 by 2030 if adoption scales.

Ondo excels in liquid, compliant products; peers vary in focus.

Ondo leads in Treasuries (19% market share); Centrifuge for credit (4%); MANTRA for developer tools. Ondo suits yield seekers; others for specialized RWAs.

ONDO's cross-chain presence (Ethereum, BNB, upcoming Solana) demands efficient liquidity management amid volatility.

Baltex.io, a non-custodial DEX aggregator, simplifies this:

For holders: Exit to stables during unlocks or bridge for DeFi yields. Enhances Ondo's composability without custody risks. Visit https://baltex.io.

Q: What is Ondo Finance's main product? A: USDY—a yield-bearing USD stablecoin backed by US Treasuries (3.75% APY).

Q: What is ONDO token used for? A: Governance voting in Ondo DAO; potential staking incentives.

Q: Is Ondo safe for investments? A: Yes for yields (Treasury-backed); token volatile—diversify.

Q: How does Ondo compare to Centrifuge? A: Ondo focuses on liquid securities; Centrifuge on credit tokenization.

Q: What are ONDO price risks in 2025? A: 2026 unlocks; regulatory shifts—monitor AUM growth.

Q: Can non-US users access Ondo products? A: Yes for USDY; OUSG restricted to accredited.

Q: What's Ondo's TVL in 2025? A: Over $1.8B, driven by tokenized Treasuries.

As of December 18, 2025, Ondo Finance stands as a RWA powerhouse, tokenizing Treasuries and securities for stable 3.5-4% yields via products like USDY and OUSG. ONDO token enables governance in a $1.2B ecosystem, with 2025 highs underscoring relevance amid sector growth. Investment merits low-risk yields but token risks (unlocks, volatility) demand caution—compare to Centrifuge/MANTRA for fit. For DeFi pros, Ondo's compliance bridges TradFi seamlessly; tools like baltex.io unlock multi-chain flexibility. Position for RWA's trillion-dollar future—research yields thoroughly.