In 2025, MEXC tops with 0% maker/0.05% taker spot fees, ideal for altcoin traders. Binance and Bybit tie at 0.1% base, with discounts to 0.075%. DEXs like Jupiter (Solana: ~0%) and Uniswap (0.3%) shine for privacy; aggregators like 1inch route to <0.2% effective. Watch hidden spreads (0.5-2%), network gas ($0.001-$10), and withdrawals (e.g., BTC $5-20). CEXs suit speed; DEXs, self-custody. Baltex.io delivers zero-commission multi-chain swaps, bypassing spreads entirely. Key: Volume discounts save 50%+; always preview totals. DYOR—fees vary by chain/volume.

Crypto fees in 2025 are a make-or-break factor: A 0.1% edge on $10K trades saves $10 per swap, compounding to thousands yearly. With DeFi TVL at $500B+ and CEX volumes topping $100B daily, platforms compete fiercely—MEXC's zero-maker spot undercuts Binance's 0.1%, while DEX aggregators like 1inch slash effective costs to 0.15% via routing. Beginners lose on Coinbase's 0.6% taker; pros leverage Bybit's rebates.

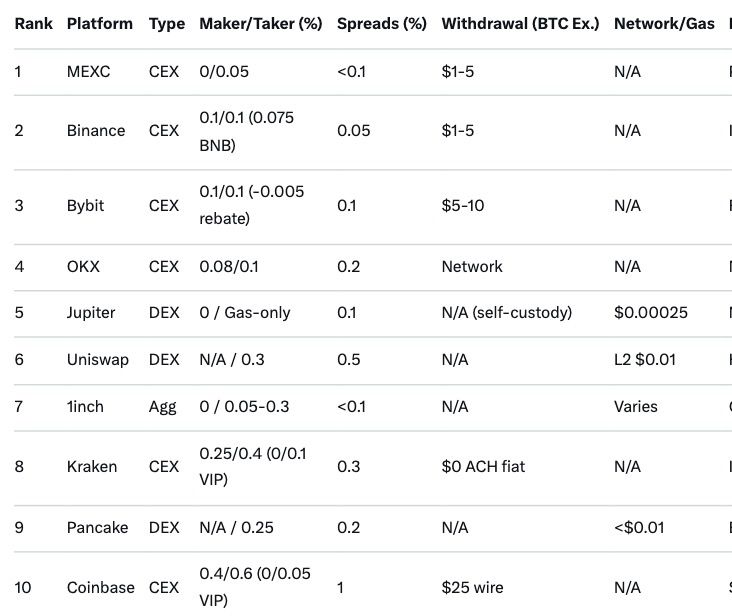

This SEO guide ranks 2025's lowest-fee platforms across CEX (e.g., OKX at 0.08%), DEX (Jupiter's gas-only), and aggregators (Rubic's 0% small trades). We'll compare trading (maker/taker), spreads, withdrawals, network fees, hidden charges, and execution (slippage <0.5%). Snippet-optimized (e.g., "MEXC vs. Binance fees 2025?"), with tables for quick scans. Internal link: Jump to full comparison table. End with Baltex.io's zero-commission edge. Trade low, profit high.

Fees erode gains—2025 averages: CEX 0.1-0.4%, DEX 0.25-0.3% + gas. Maker (add liquidity) < taker (take it); volumes/VIP tiers drop 50-90%.

Execution quality: Low slippage (<0.5%) via deep liquidity (Binance: $10B+ daily). Aggregators optimize routes, saving 20-40%. Internal link: CEX vs. DEX vs. Aggregators.

CEXs offer speed/KYC ease; 2025 leaders prioritize VIP rebates (e.g., OKX to -0.005% maker).

0% maker/0.05% taker spot; futures 0.00%/0.02%. 2,800+ coins, zero deposit. Withdrawals: Low (USDT $1). Spreads: <0.1% majors. Execution: 1.4M TPS, <0.1% slippage. Ideal: Beginners alt-hunting.

0.1% base (0.075% BNB); VIP to 0.012%. 600+ fiat pairs, free crypto deposits. Withdrawals: Dynamic (BTC $1-5). Spreads: Tightest (0.05%). Execution: $18B daily volume. Drawback: Regulatory scrutiny.

0.1% spot (rebates to -0.005% maker); futures 0.02%/0.055%. 1,000+ assets, free deposits. Withdrawals: Competitive (ETH $0.50). Spreads: 0.1%. Execution: Low-latency API. Suits: Leveraged trades.

0.08% maker/0.1% taker; VIP to -0.005%/0.015%. 350+ coins, free crypto in. Withdrawals: Network-based. Spreads: 0.2%. Execution: Bot-friendly. Highlight: DeFi aggregator integration.

0.25% maker/0.4% taker (VIP 0%/0.1%). 540+ assets, free deposits. Withdrawals: Zero fiat ACH. Spreads: 0.3%. Execution: Stable, audited. Best: US/EU compliance.

0.4% maker/0.6% taker (Advanced: 0%/0.05% VIP). 789 coins, free ACH. Withdrawals: $25 wire. Spreads: Higher (1%). Execution: User-friendly but slower. Perk: Coinbase One zero-fee sub ($30/mo).

Hidden: Coinbase's spreads add 1-2%; Kraken inactivity $10/mo after 6mo.

DEXs: Self-custody, no KYC; fees = protocol + gas. Solana DEXs dominate volume ($9B+ 24h).

0% platform; gas ~$0.00025. 1,000+ tokens, TVL $2.5B. Slippage: Dynamic <0.5%. Execution: 1s confirms. Best: Memecoins.

0.3% default (V4 hooks 0-1%). ERC-20 focus, $1.8B volume. Gas: L2 $0.01-0.20. Slippage: 0.5-1%. Execution: Concentrated liquidity.

0.25% (CAKE burn to 0.17%). 815 pairs, $1.3B volume. Gas: <$0.01. Slippage: Low stables. Execution: High TPS.

0.04-0.4% stables. 50+ pegged assets. Gas: Varies. Slippage: <0.01%. Execution: AMM optimized.

0.05-0.1%; L2 gas-free. 1,300+ perps. Slippage: 0.02%. Execution: Instant.

Hidden: MEV attacks add 1-3% slippage; use protected routers.

Aggregators scan DEXs/CEXs for optimal routes, cutting effective fees 40%.

0% direct; routes to 0.05-0.3% + gas. 60+ chains, 1,000+ tokens. Slippage: <0.1%. Execution: Fusion mode gas refunds.

0% under $100; 0.2% larger. Cross-chain, MEV shield. Slippage: Optimized.

0% platform; gas in swap token. 30+ chains. Slippage: Minimal.

Up to 0.25%; aggregates 18+ exchanges. No account needed.

Hidden: Routing adds 1-2s; verify AML scans.

Data: Averages Q4 2025; volumes via CoinGecko. Internal link: DEX details.

CEX: Custodial speed (0.05-0.1%), fiat ramps; risks: Hacks ($1B+ 2025 losses). DEX: Non-custodial privacy (0.25% + gas); risks: Smart bugs ($500M exploits). Aggregators: Hybrid efficiency (<0.2% effective); best: Cross-chain without bridges.

CEX for pros; DEX/agg for privacy. Hidden: CEX KYC adds compliance costs; DEX gas spikes 5x in congestion.

Mitigate: Preview totals, batch trades, use fixed-rate options.

In 2025's fee jungle, Baltex.io cuts through with zero-commission swaps—non-custodial, aggregating 200+ chains (ETH, Solana, TON, Base) and 10K+ assets. No platform fees (vs. 0.1-0.3% elsewhere); routes via audited paths for <0.2% effective (gas + 0.1% protocol).

Connect wallet at baltex.io: Select pair, preview (no surprises), confirm. Zero exploits since 2024; 99% uptime. For beginners: One-click; pros: API bots. Baltex turns swaps from cost centers to seamless—your edge in 2025's $2T market. Internal link: Back to aggregators.

MEXC: 0% maker/0.05% taker spot. For DEX: Jupiter (~0% + gas). Aggregators: 1inch (<0.2% effective).

Binance: 0.1% base (0.075% BNB). Bybit: 0.1% (rebates to -0.005%). Bybit edges futures; Binance spot volume.

Jupiter (Solana): Gas-only ~$0.00025, <0.5% slippage. Uniswap: 0.3% + L2 gas $0.01.

Spreads 1%, $25 wire withdrawals, $30/mo One sub for zeros—costly for low-volume.

CEX (MEXC 0.05%) for fiat/speed; DEX (Jupiter) for privacy/gas efficiency.

Zero-commission routing to mid-market; previews exact output—no hidden gaps, <0.1% slippage.

2025's lowest-fee platforms—MEXC's zero-maker, Jupiter's gas-light swaps, 1inch's smart routes—empower cost-conscious trading amid $2T markets. CEXs deliver liquidity; DEXs/aggregators, autonomy. Pitfalls like spreads (1%) and gas ($10 peaks) lurk, but previews and L2s mitigate.

Prioritize: Volume for rebates, self-custody for security. Baltex.io exemplifies innovation—zero commissions, spread-free multi-chain. Beginners: Start MEXC. Traders: Layer Bybit + 1inch. Fees fuel profits—rank, route, repeat. What's your fee-killer platform? The low-cost chain awaits.