In 2025, spot ETFs exist for Bitcoin (BTC: 11+ funds, e.g., IBIT at 0.25% fee), Ethereum (ETH: 9 funds, e.g., ETHA), Solana (SOL: 8 live, e.g., VSOL 0.30%), and XRP (XRP: 7 approved, e.g., XRPC 0.50%). Pending: Litecoin (LTC), Dogecoin (DOGE), Cardano (ADA), with 90%+ approval odds by year-end. Custodians: Coinbase, Fidelity. Regions: US primary; Canada/EU for staking variants. Risks: Volatility, tracking errors. Baltex.io enables fast swaps of underlying assets for pre-ETF strategies. Key: ETFs simplify access but add fees—compare 0.20-0.95% ratios.

The crypto ETF boom of 2025 has transformed digital assets from niche speculation to mainstream portfolio staples, with spot ETFs for Bitcoin and Ethereum paving the way for altcoins. As of December 2025, over 150 crypto ETFs trade globally, holding $200B+ AUM—up 300% YOY—driven by SEC's September generic listing standards fast-tracking approvals. Beginners gain regulated entry without wallets; investors diversify via SOL/XRP funds; traders leverage staking yields in ETH/SOL products.

This SEO guide lists all cryptos with ETFs in 2025, focusing on BTC, ETH, SOL, XRP, and emerging like LTC/DOGE/ADA. For each, we'll explain mechanics (spot vs. futures), fees (0.20-0.95%), custodians (Coinbase/Fidelity), availability (US/Canada/EU), and risks (volatility 50%+). Snippet-optimized (e.g., "Solana ETF fees 2025?"), with tables for scans. Internal link: Jump to altcoin list. Before ETFs, swap assets via Baltex.io for agile positioning.

Crypto ETFs are exchange-traded funds tracking crypto prices via direct holdings (spot) or derivatives (futures). Spot ETFs physically hold assets in cold storage, mirroring gold ETFs; futures use contracts for indirect exposure. In 2025, spot dominates (90% AUM) post-SEC clarity.

Benefits: IRA eligibility, no keys; risks: Premiums/discounts (up to 2%). Internal link: BTC details.

Bitcoin spot ETFs launched January 2025, amassing $100B+ inflows—40% of BTC's $1.2T cap. They hold physical BTC, enabling institutional buys without exchanges.

Funds custody BTC via qualified providers, tracking CME CF Bitcoin Reference Rate. No staking; pure price exposure. APs create shares via in-kind (crypto-for-shares) redemptions.

Fees: 0.20-0.25% avg; waivers common (e.g., VanEck 0% on first $2.5B). Custodians: Coinbase (80%), Fidelity self-custody. Availability: US (NYSE/Nasdaq); Canada (Purpose BTC ETF, 1% fee); EU (Jacobi BTC, 1.75%). Risks: 50%+ volatility, custodian hacks (insured up to $320M), 1-2% tracking error.

2025 inflows: $50B net, boosting BTC to $120K peaks. Internal link: ETH comparison.

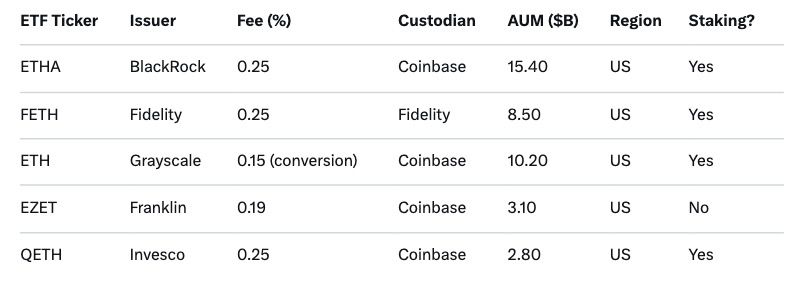

Ethereum spot ETFs debuted July 2024, surging in 2025 with staking approvals (March). AUM: $40B; yields 4-6% via restaking.

Hold ETH; post-Pectra upgrade, include staking rewards distributed quarterly. Track ETH/USD via CF Benchmarks. In-kind creations minimize slippage.

Fees: 0.15-0.25%; staking adds 0.10% admin. Custodians: Coinbase dominant; Fidelity internal. Availability: US primary; Canada (Evolve ETH, 0.75% + staking); EU (21Shares ETH, 2.50%). Risks: Gas fee volatility, slashing (0.1% chance), regulatory (SEC staking scrutiny).

Inflows: $20B YTD, ETH at $4,500 highs. Internal link: SOL ETFs.

Solana spot ETFs approved October 2025 (first altcoin wave), live November. AUM: $5B; leverage high TPS (65K) for DeFi/gaming exposure. Staking yields 6-8%.

Hold SOL; staking via validators (e.g., Jito). Track SOL/USD; atomic redemptions for efficiency. Post-shutdown delays, 8 funds launched.

Fees: 0.24-0.40%; waivers on $1B AUM. Custodians: BitGo/Coinbase; Anchorage for staking. Availability: US (Cboe); Canada (Solana Staking ETF, 0.90%); Asia (ChinaAMC, 0.50%). Risks: Network outages (2 in 2025), centralization (validator risks), 40% volatility.

Inflows: $2B since launch, SOL at $250. Internal link: XRP details.

XRP spot ETFs approved late 2025 (post-SEC v. Ripple resolution), trading November. AUM: $3B; focus remittances, low fees ($0.00003/tx).

Hold XRP; track XRP/USD via diverse oracles. No staking; emphasis on liquidity via RippleNet ties. 7 funds amid 99% Polymarket odds.

Fees: 0.35-0.55%. Custodians: Gemini/BitGo; Coinbase for most. Availability: US (Nasdaq); Canada (Purpose XRP, 1.00%); EU (21Shares XRP ETP, 1.49%). Risks: Regulatory relapse (post-lawsuit), low liquidity slippage (1%), 30% volatility.

Inflows: $1.5B debut week, XRP at $2.40.

Altcoin season exploded Q4 2025; 20+ approvals pending 90% odds. Focus: LTC (BTC-like), DOGE (meme), ADA (sustainable).

Approved Q4; AUM $1B. Work: Spot holding; track LTC/USD. Fees 0.30-0.50%; custodians Coinbase. US/Canada; risks: 25% vol.

Examples: Grayscale LTC ETF (0.40%), CoinShares LTC (0.35%).

Meme pioneer; approved November. AUM $0.5B. No staking; community-driven. Fees 0.45%; BitGo custody. US; risks: Hype cycles (50% swings).

Examples: Bitwise DOGE (0.50%), 21Shares DOGE (0.40%).

Pending Q1 2026 (90% odds); filings Grayscale. Staking yields 5%. Fees est. 0.25-0.40%; Fidelity. Global (Africa focus); risks: Slow upgrades.

Others: AVAX (80% odds, staking), HBAR (enterprise), LINK (oracles)—filings active.

ETFs mitigate custody but amplify systemic issues: Volatility (BTC -16% Q4), tracking errors (1-3%), counterparty (custodian fails, e.g., $320M insured max). Regulatory: MiCA/EU bans staking; US shutdowns delay. Liquidity: Altcoins <1% slippage. Fees erode 0.20-1% yearly. Mitigate: Diversify, monitor NAV.

Internal link: Baltex for swaps.

Pre-ETF, direct exposure rules—Baltex.io excels with non-custodial atomic swaps across 20+ chains, swapping BTC/ETH/SOL/XRP in <10s without bridges (1-2% fees).

Connect at baltex.io: Wallet, pair, swap. Ideal for agile investors timing ETF inflows. Internal link: Back to SOL.

BTC, ETH, SOL, XRP—US approvals; LTC/DOGE live Q4. Pending: ADA (90% odds).

0.24-0.40%; BitGo/Coinbase. Staking yields 6-8%; US/Canada availability.

Regulatory (post-lawsuit), 30% volatility; fees 0.35-0.55%, Gemini custody.

IBIT (BlackRock): 0.25% fee, $70B AUM, Coinbase custody—top liquidity.

US: Spot focus; Canada: Staking (e.g., Purpose); EU: ETPs (higher fees 1-2.5%).

Atomic multi-chain: <10s, 0.1% fees—position SOL/XRP without custody risks.

2025's ETF roster—BTC/ETH stalwarts to SOL/XRP newcomers, pending LTC/DOGE/ADA—democratizes crypto, channeling $100B+ inflows while curbing direct risks. Fees (0.20-0.55%), custodians (Coinbase-led), and regions (US-dominant) vary, but volatility persists—allocate 5-10%. Tools like Baltex.io bridge to direct plays.

Investors: Start BTC/ETH for stability, add SOL for yield. Beginners: ETFs via brokerage; pros: Blend with swaps. The ETF era matures crypto—trade informed, diversify wisely.