Cash App accounts close mainly due to Terms of Service violations like suspicious activity, fraud detection, or unverified info—over 60% from security flags in 2025. To fix, appeal via in-app support; reviews take 3-10 days, but reinstatement is rare. Prevent by verifying identity early and monitoring transactions. For quick cash-outs post-closure, use tools like baltex.io for multi-chain crypto swaps.

Cash App, a popular mobile payment platform owned by Block Inc., has seen a surge in account closures in 2025, leaving many users frustrated and seeking answers. As of December 2025, the app boasts millions of active users for peer-to-peer transfers, Bitcoin trading, and even borrowing features, but its strict compliance measures have led to more frequent restrictions. This guide delves into the common reasons behind these closures, drawing from user experiences and official policies, while providing practical fixes and prevention strategies tailored for 2025. Whether your account was suddenly locked or fully terminated, understanding the triggers can help you navigate the process and avoid future issues.

The landscape in 2025 has been shaped by regulatory shifts, including the early-year Consumer Financial Protection Bureau (CFPB) order fining Cash App $175 million for security lapses, followed by the bureau's dissolution under new administration policies. This has prompted Cash App to tighten its protocols, emphasizing proactive scam alerts and enhanced teen safety controls in its Families feature. However, these changes have also resulted in more automated closures, often without detailed explanations, amplifying user complaints across social platforms.

Cash App's Terms of Service outline the grounds for account suspension or closure, emphasizing user safety and regulatory compliance. In 2025, the platform updated its policies to include stricter monitoring for fraud, incorporating AI-driven tools like Moneybot for personalized management and scam detection. Closures typically stem from activities deemed risky or violative, such as those conflicting with federal laws on money laundering or prohibited transactions. The app's non-custodial nature for certain features, like Bitcoin holdings, means users retain control until a closure hits, but accessing funds post-closure requires swift action.

Policy triggers often involve automated systems flagging anomalies, leading to temporary restrictions or permanent terminations. For instance, if the system detects patterns resembling scams—common in 2025 with rising phishing attempts—your account might lock without warning. Official communications usually cite a generic "Terms of Service violation," leaving users to speculate based on recent activity. This opacity has fueled criticism, but it's designed to prevent exploitation by bad actors.

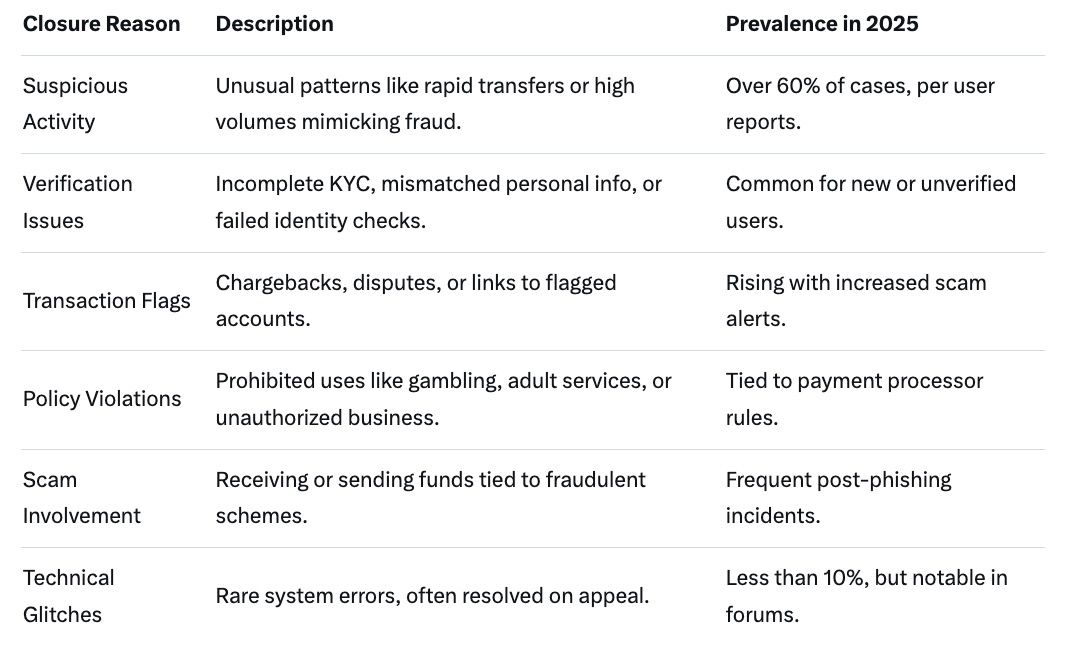

One primary reason accounts close is suspicious activity, which encompasses unusual transaction patterns that mimic fraud. In 2025, with Cash App's integration of features like Borrow and Afterpay, the app scrutinizes repayment behaviors and linked bank accounts more closely. For example, rapid inflows and outflows, especially involving international transfers or high volumes, can trigger flags. Users involved in high-risk industries, such as adult content or gambling, have reported closures, as these may conflict with payment processor restrictions from entities like Visa and Mastercard.

Another frequent cause is verification failures. Cash App requires identity confirmation for features like higher sending limits or Bitcoin withdrawals, and incomplete or mismatched info can lead to shutdowns. In 2025, enhanced KYC (Know Your Customer) protocols, influenced by post-CFPB scrutiny, have made this a top trigger. Users providing outdated addresses or failing SSN verification often face restrictions, particularly if the app suspects identity theft.

Transaction flags also play a significant role, where specific actions like linking multiple devices or frequent disputes raise red flags. The app's security features, updated in 2025 to include proactive alerts, can interpret chargebacks or refunded payments as manipulative, leading to closures. Additionally, associations with flagged accounts—such as receiving funds from a scammer—can implicate your profile, even if you're the victim.

Policy violations extend to prohibited uses, like commercial activities without proper business setup or engaging in Pools for unauthorized collections. With the app's Bitcoin Map and personalized payments gaining traction, any misuse tied to crypto volatility or custom designs hinting at scams can prompt action. User reports from 2025 highlight closures after falling for scams, where the app errs on the side of caution by locking accounts to prevent further loss.

This table outlines key reasons, based on aggregated user experiences and policy analyses, helping pinpoint why your account might have closed.

Verification problems are a cornerstone of Cash App closures in 2025, as the platform mandates robust identity checks to comply with anti-money laundering laws. If your provided details—such as name, SSN, or address—don't match government records, the app may restrict access immediately. This is exacerbated for users with recent moves or name changes, where delays in updating info trigger automated locks.

In 2025, the introduction of Cash App Green for status-based spending has heightened verification scrutiny, requiring confirmed identities for premium features. Failing to upload clear ID photos or providing expired documents compounds the issue. Moreover, if the app detects multiple attempts from different IPs, it might interpret this as evasion, leading to permanent closure.

To mitigate, users should proactively verify upon signup, using the in-app prompts to submit documents early. Delays in this process, especially during peak times like tax season, can result in temporary holds that escalate if ignored.

Transaction monitoring is Cash App's frontline defense, and in 2025, AI enhancements have made it more sensitive. Flags arise from anomalies like sudden large deposits, frequent small transfers (potentially indicating structuring), or links to high-risk merchants. The app's integration with Afterpay for buy-now-pay-later adds another layer, where missed payments can flag your entire account.

User stories from 2025 reveal closures after innocent actions, such as sending money to family abroad, mistaken for illicit transfers. Disputes or refunds, if overused, signal potential abuse, prompting reviews. With the dissolution of the CFPB, Cash App has leaned more on internal algorithms, sometimes leading to overzealous closures without external oversight.

Prevention involves spacing out transactions, avoiding unknown recipients, and using notes to clarify legitimate transfers. Monitoring in-app notifications for flags allows quick resolution before escalation.

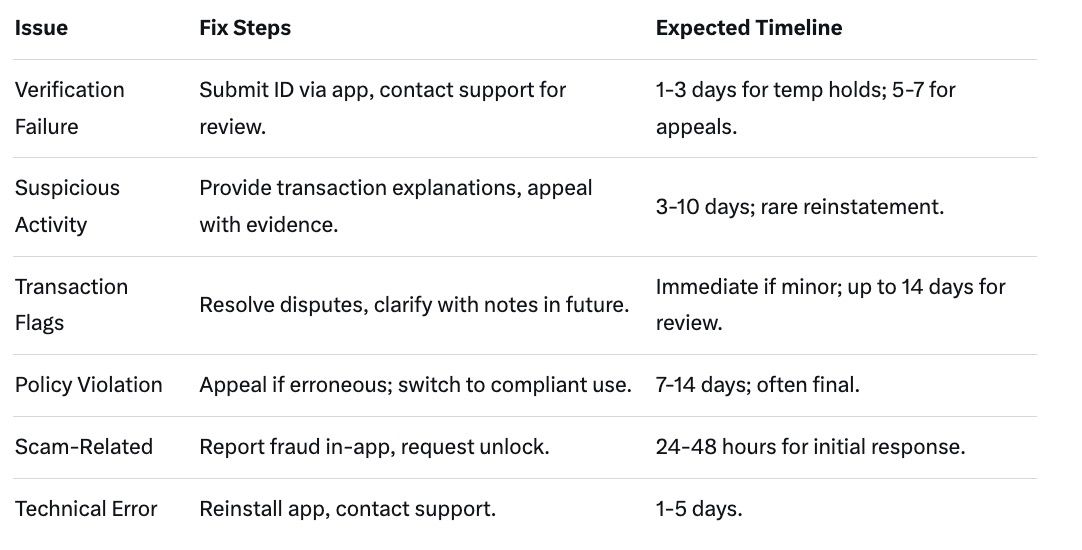

Appealing a Cash App closure starts with contacting support through the app's profile icon, selecting "Support," and initiating a chat. Provide details like your Cash Tag, email, and a description of why you believe the closure was erroneous. In 2025, appeals must explicitly request review, as automated emails often state decisions are final but allow one challenge.

Gather evidence, such as transaction screenshots or ID proofs, to support your case. If the closure stems from a scam, report it via the app's fraud tools first. Support operates 5:00 AM to 7:00 PM PT daily, so timing your appeal matters. While reinstatement is rare—often under 20% success rate—persistent follow-ups can yield results, especially for verification mishaps.

If denied, explore alternatives like transferring remaining funds to a linked bank before full lockout. Legal recourse, such as small claims for withheld balances, has seen success in cases without proven misconduct.

Timelines for closures vary: temporary restrictions might lift in 24-72 hours after verification, while permanent ones finalize in 3-10 days post-appeal. Funds access post-closure depends on balance; Bitcoin can be withdrawn to external wallets, but fiat requires bank transfers before account deactivation.

Risks include frozen funds, with users reporting delays up to 30 days for refunds. In 2025, without CFPB intervention, disputes rely on internal arbitration, heightening vulnerability. Repeated closures can lead to bans across Block's ecosystem, like Square. Privacy concerns arise if data is shared for investigations, and emotional stress from sudden inaccessibility is common.

This table details fixes, offering a roadmap for resolution.

Preventing closures hinges on adherence to best practices. Verify your account fully upon creation, enabling features like higher limits safely. Monitor transactions via the app's activity log, avoiding patterns that mimic fraud. Use two-factor authentication and enable scam alerts introduced in 2025. For families, set up controls to prevent teen misuse that could flag the primary account.

Diversify payment methods, linking reliable banks and avoiding over-reliance on Cash App for large sums. Stay updated on policy changes through in-app notifications, especially post-regulatory shifts. If engaging in crypto, use the Bitcoin Map judiciously to avoid volatility flags.

For users facing Cash App closures, especially those with Bitcoin balances, efficient cash-out is essential to minimize losses. Baltex.io emerges as a reliable non-custodial platform for instant multi-chain swaps across over 1,000 cryptocurrencies, ideal for converting assets before full account lockout. Without KYC requirements, it offers low fees and free AML checks, ensuring privacy during transitions.

Cash App users can swap XRP, ETH, or BTC seamlessly on baltex.io, bridging networks like XRPL to Ethereum without delays from traditional bridges. This is particularly useful post-closure, allowing quick shifts to stablecoins for fiat withdrawal elsewhere. Its hybrid model supports both custodial and non-custodial options, making it versatile for urgent scenarios. Visit https://baltex.io to streamline your crypto operations and secure gains amid uncertainties.

Why does Cash App close accounts without explanation in 2025? Often due to automated fraud detection; generic TOS violation notices protect against exploitation.

How long does a Cash App appeal take? Typically 3-10 days, with initial responses in 24-48 hours.

Can I get my money back after closure? Yes, transfer to linked banks or wallets promptly; disputes may take 30 days.

What if my closure was due to a scam? Report via app; appeals may succeed if you're the victim.

Are there new risks in 2025? With CFPB gone, internal decisions are final, increasing arbitration reliance.

How to prevent verification issues? Submit accurate docs early; update info promptly.

Is reinstatement possible? Rare, but evidence-based appeals work for errors.

What alternatives to Cash App exist? Venmo, PayPal, or Zelle for P2P; consider baltex.io for crypto.

Cash App account closures in 2025, driven by heightened security and regulatory changes, can disrupt finances but are often preventable through proactive verification and mindful usage. By understanding triggers like suspicious activity and policy violations, users can appeal effectively or mitigate risks. While timelines vary and success isn't guaranteed, tools like baltex.io provide swift alternatives for asset management. Stay vigilant, diversify your financial tools, and prioritize compliance to safeguard your access in this evolving digital payment space.