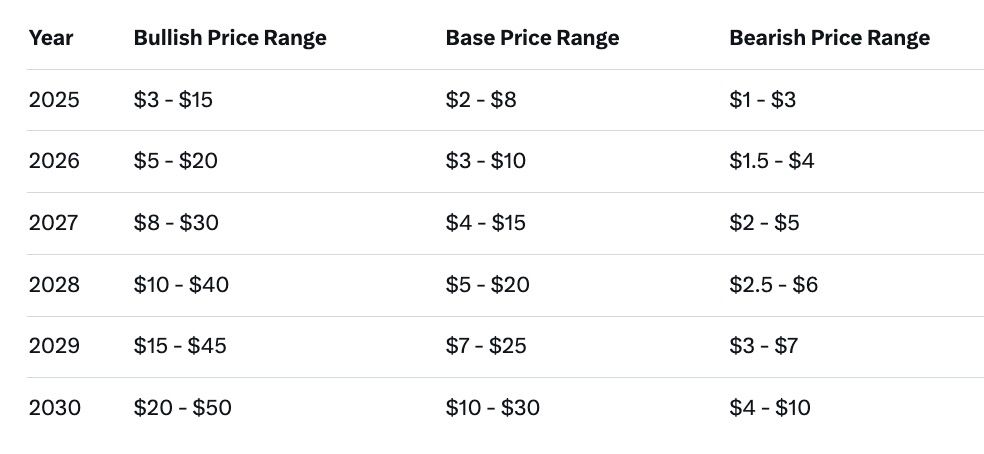

XRP could reach $3-$15 in 2025 under bullish scenarios driven by adoption and regulations, potentially climbing to $10-$50 by 2030. Base cases suggest $2-$8 mid-decade, while bearish outlooks hover at $1-$5 amid risks like market volatility. Key drivers include Ripple's payment networks and on-chain activity. Use tools like baltex.io for efficient multi-chain swaps.

XRP, the native token of the Ripple network, has long been a focal point for investors seeking exposure to efficient cross-border payments. As of December 2025, XRP trades around $1.86, reflecting a mix of regulatory wins and broader market pressures. This guide explores long-term price predictions through 2030, analyzing bullish, base, and bearish scenarios based on fundamentals, adoption trends, regulatory outlooks, and on-chain data. We'll outline clear assumptions, highlight risk factors, and provide scenario-based forecasts to help XRP investors and crypto traders make informed decisions.

The analysis assumes continued global economic growth at 2-3% annually, with cryptocurrency market capitalization expanding to $5-10 trillion by 2030. It factors in Ripple's ongoing partnerships but acknowledges uncertainties like geopolitical tensions or competing technologies. While predictions are speculative, they draw from technical indicators, expert forecasts, and historical patterns.

At its core, XRP powers the XRP Ledger (XRPL), a decentralized blockchain designed for fast, low-cost transactions. Unlike Bitcoin's proof-of-work, XRPL uses a consensus protocol, enabling settlements in seconds. Ripple, the company behind much of XRP's development, focuses on institutional use cases, such as remittance and liquidity provision through its On-Demand Liquidity (ODL) service.

Ripple's fundamentals remain strong, with over 1,200 institutions reportedly using its networks for payments. In 2025, Ripple processed $95 billion in payments, underscoring its utility in real-world finance. However, this hasn't always translated to price gains, as XRP's value is influenced more by speculative trading than direct utility. The token's total supply is capped at 100 billion, with about 56 billion in circulation, creating potential for scarcity if demand surges.

Key strengths include low transaction fees (under $0.01) and scalability, handling 1,500 transactions per second. Weaknesses persist in centralized perceptions due to Ripple's large XRP holdings, though escrow mechanisms mitigate sell-off risks. As blockchain interoperability grows, XRP's role in bridging fiat and crypto could drive long-term value.

Adoption is a critical driver for XRP's price trajectory. In 2025, Ripple expanded partnerships with banks in Asia and Europe, boosting ODL usage for cross-border transfers. Trends show increasing institutional interest, with XRP positioned as a bridge asset in tokenized economies. For instance, the resolution of the SEC lawsuit in 2025 clarified XRP's non-security status on secondary markets, encouraging more financial firms to integrate it.

Looking ahead, adoption could accelerate if Ripple's RLUSD stablecoin gains traction, potentially increasing XRP's liquidity role. By 2030, experts anticipate wider use in micropayments and DeFi, especially in emerging markets where remittances exceed $700 billion annually. However, competition from Swift's upgrades and other blockchains like Stellar (XLM) could cap growth. If adoption hits 20-30% of global remittances, XRP's utility demand might push prices higher, but slow enterprise integration remains a hurdle.

On-chain data supports moderate optimism. In 2025, XRPL velocity hit a record 0.0324, indicating efficient token circulation. Active addresses averaged 3,440 daily, though whale selling pressure eased mid-year. Transaction volumes surged during market rallies, correlating with price spikes. These metrics suggest building network health, but suppressed activity in bear phases highlights dependency on broader crypto sentiment.

Regulatory clarity has been pivotal for XRP. The 2025 SEC settlement, imposing fines but affirming XRP's utility status, removed a major overhang. This paved the way for potential U.S. ETF approvals and institutional inflows. Globally, frameworks like the EU's MiCA and Asia's pro-crypto policies could favor XRP's cross-border focus.

From 2025-2030, a supportive U.S. administration might integrate blockchain into finance, boosting XRP. However, risks include stricter AML rules or bans in key markets like China. If regulations align with innovation, XRP could benefit from tokenized asset mandates; otherwise, compliance costs might stifle growth. Assumptions here include no major crackdowns, with 70% of G20 nations adopting crypto-friendly laws by 2030.

XRP's price predictions vary based on scenarios. In bullish cases, driven by mass adoption and favorable macros, XRP could surge as a global settlement layer. Base scenarios assume steady progress, while bearish ones factor in downturns.

Under optimistic conditions, XRP leverages Ripple's expansions and crypto bull cycles. By 2025, prices could hit $3-$15 if ETF inflows and partnerships spike demand. Escalating to $20-$50 by 2030 assumes 50% remittance market share and DeFi integration. Assumptions: Bitcoin tops $200K, global adoption soars. Community pundits even forecast $100+ amid hyper-utility.

A balanced view sees XRP at $2-$8 in 2025, growing to $10-$25 by 2030. This reflects gradual adoption, with ODL volumes doubling annually. Assumptions: Moderate regulation, 3-5% yearly crypto growth.

In downturns, XRP might linger at $1-$5 through 2025-2030 if regulations tighten or competitors dominate. Assumptions: Economic recession, reduced on-chain activity.

This table summarizes potential prices, based on compounded annual growth rates of 50-100% (bullish), 20-40% (base), and 5-10% (bearish) from current levels.

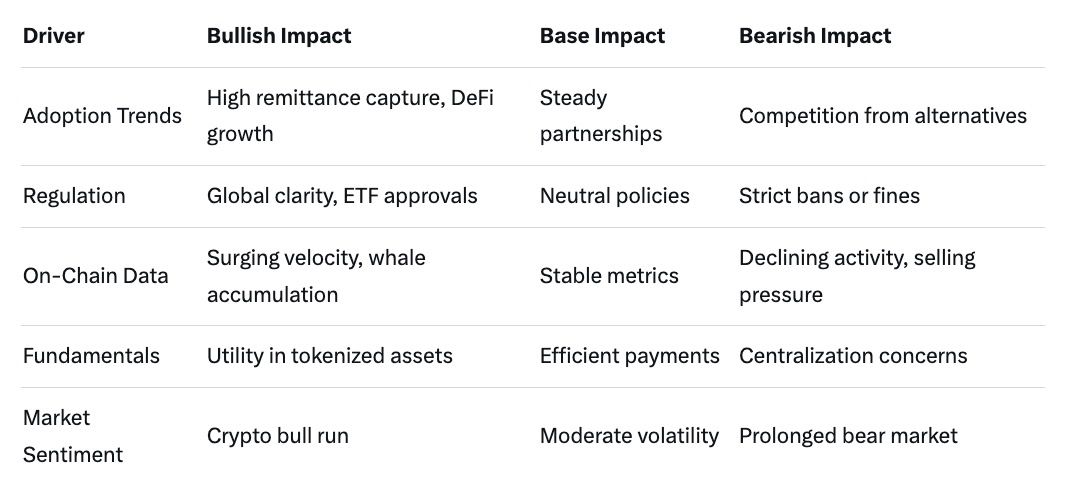

Several factors influence these scenarios, from macroeconomics to tech advancements.

These drivers highlight how interconnected elements could propel or hinder XRP.

No prediction is risk-free. Volatility remains high, with XRP susceptible to 50%+ drawdowns in bear markets. Regulatory reversals, like new SEC appeals, could erode confidence. Technological risks include ledger forks or security breaches. Macro factors, such as inflation spikes or recessions, might divert capital from crypto. Diversification is key; assume only 5-10% portfolio allocation to XRP.

As XRP investors plan exits or portfolio rebalances, efficient swapping is crucial. Baltex.io stands out as a non-custodial platform enabling instant, secure cross-chain swaps across 1,000+ cryptocurrencies. Unlike centralized exchanges, it requires no KYC, offering low fees and free AML checks for seamless transactions.

For XRP holders, baltex.io facilitates quick conversions to stablecoins or other assets before cashing out via fiat ramps. Its hybrid model supports both custodial and non-custodial options, ensuring privacy and speed. For instance, swap XRP on XRPL to ETH on Ethereum in seconds, bypassing bridges' delays. This is ideal post-rally, locking in gains without exposure to volatility. Visit https://baltex.io to explore how it streamlines multi-chain operations.

What is the most realistic XRP price in 2025? A base scenario points to $2-$8, assuming steady adoption and positive regulations.

Can XRP reach $50 by 2030? In bullish cases, yes, if Ripple captures significant market share in payments.

What are the biggest risks for XRP? Regulatory setbacks and competition from other blockchains top the list.

How does on-chain data affect XRP's price? High velocity and active addresses signal demand, potentially driving rallies.

Is XRP a good long-term investment? It offers utility in finance, but volatility requires caution.

What role does Ripple play in XRP's value? Ripple's partnerships boost adoption, indirectly supporting price.

Could XRP hit $100? Community forecasts suggest it's possible by 2030 under extreme adoption.

How to swap XRP efficiently? Use platforms like baltex.io for fast, cross-chain exchanges.

XRP's path to 2030 hinges on blending utility with market dynamics. Bullish scenarios could see it soar to $50+, base cases stabilize at $10-$30, and bearish ones limit gains to $4-$10. With strong fundamentals, growing adoption, and clearer regulations, XRP remains a compelling option for long-term holders. Monitor on-chain metrics and global trends closely. As crypto evolves, tools like baltex.io enhance accessibility, making strategic moves easier. Invest wisely, considering risks, and position for potential upside in this transformative asset.