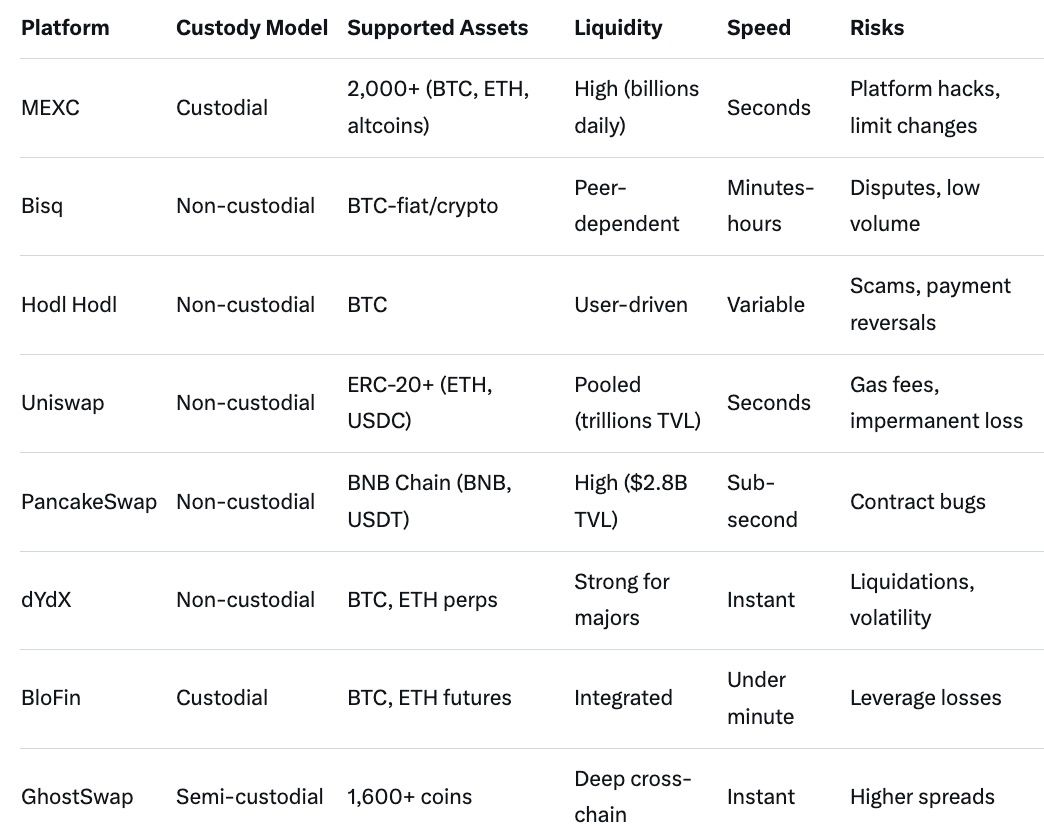

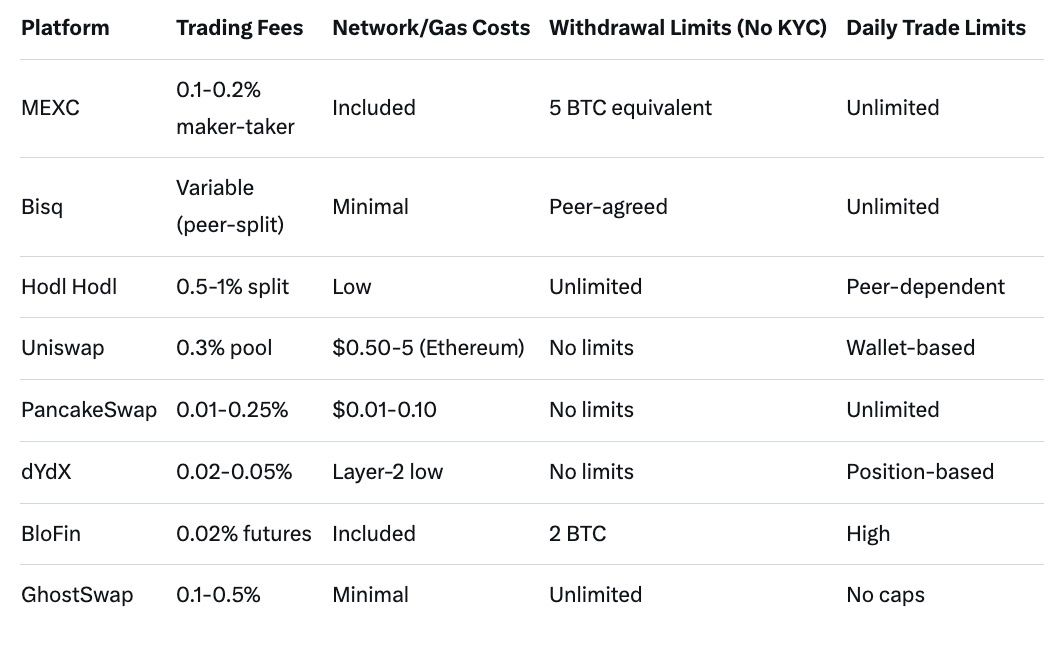

The best non-KYC crypto exchanges in 2026 include MEXC for centralized trading with high liquidity and no mandatory verification, Bisq and Hodl Hodl for peer-to-peer privacy-focused deals, Uniswap and PancakeSwap for decentralized swaps on Ethereum and BNB Chain, dYdX for perpetuals without custody, BloFin for futures trading, and GhostSwap for ultimate anonymity. These platforms offer custody models from non-custodial DEXs to optional-custodial CEXs, with fees averaging 0.1-1%, limits up to unlimited on P2P, high liquidity on popular pairs, speeds from seconds to hours, and risks like volatility or scams mitigated by escrows. Compare details in the exchange comparison table and fees and limits table. Baltex.io integrates seamlessly for multi-chain routing before cash-outs, enabling efficient, private swaps.

In 2026, the demand for non-KYC crypto exchanges remains strong among users prioritizing privacy and autonomy in trading, swapping, or cashing out digital assets. These platforms allow interactions without submitting personal identification, appealing to those navigating increasingly stringent global regulations while avoiding data exposure. Non-KYC options span centralized exchanges (CEXs) with optional verification, decentralized exchanges (DEXs) that operate via smart contracts, and peer-to-peer (P2P) networks where users deal directly. Key considerations include custody models—whether the platform holds your funds—supported assets like Bitcoin, Ethereum, or altcoins, fees that can eat into profits, limits on trades or withdrawals, liquidity for smooth executions, speed of transactions, and operational risks such as hacks or counterparty defaults. This guide reviews top performers, comparing them across these metrics to help you select the right fit for spot trading, derivatives, or fiat conversions. By understanding these elements, crypto users can minimize fees and risks while maximizing control in a landscape where privacy tools evolve rapidly.

Regulatory environments in 2026, including updates to frameworks like the EU's MiCA and U.S. clarity on stablecoins, have pushed many centralized platforms toward KYC compliance, making true non-KYC options scarcer but more valuable. DEXs and P2P setups dominate for pure anonymity, as they avoid central points of control. However, even these carry trade-offs, such as lower liquidity on niche pairs or reliance on peer trust. We'll explore who each exchange suits best, from beginners seeking simple swaps to advanced traders handling high volumes, and highlight common pitfalls like ignoring escrow protections or overlooking network fees during congestion. Whether you're rebalancing a portfolio or entering crypto without legacy banking ties, these exchanges empower seamless operations in 2026's dynamic market.

Non-KYC crypto exchanges are platforms where users can trade, swap, or convert digital assets without providing identity documents, such as passports or addresses, which traditional exchanges require for anti-money laundering compliance. In 2026, these fall into three main categories: CEXs like MEXC that offer no-KYC tiers with limited but functional access, DEXs like Uniswap that run on blockchain protocols without any user data collection, and P2P networks like Bisq where individuals negotiate directly via escrow. The custody model varies—non-custodial options ensure you retain key control, reducing hack risks but requiring wallet management, while custodial ones handle funds during trades for convenience, albeit with counterparty exposure.

Supported assets range from major coins like BTC and ETH to thousands of altcoins on versatile platforms, with liquidity dictating how quickly and at what price trades execute. Fees typically include trading commissions, network gas, or maker-taker spreads, often lower on DEXs but variable on P2P. Limits can be generous without KYC, such as daily withdrawals up to 5 BTC on some CEXs, while DEXs have no caps beyond wallet balances. Speed benefits from layer-2 solutions in 2026, enabling near-instant swaps, though P2P may take hours for peer confirmations. Risks encompass volatility, scams, or regulatory shifts that could restrict access, making non-KYC ideal for privacy enthusiasts but demanding vigilance. These exchanges suit users avoiding surveillance, though they're not for everyone—novices might prefer user-friendly interfaces over raw decentralization.

Centralized non-KYC exchanges in 2026 provide a familiar trading experience without mandatory verification, though some impose lower limits or restricted features for unverified accounts. MEXC leads here, supporting over 2,000 cryptocurrencies including BTC, ETH, SOL, and emerging tokens, with a custodial model where the platform temporarily holds assets during trades. Its liquidity is robust, boasting daily volumes in the billions, ensuring minimal slippage on major pairs. Speeds are fast, with spot trades settling in seconds and futures up to 200x leverage available without KYC. Risks include potential platform hacks, mitigated by cold storage and insurance funds, but users should enable 2FA. MEXC suits high-volume traders seeking altcoin diversity, though pitfalls like sudden limit reductions during market stress can occur.

BloFin emerges as another strong CEX contender, focusing on futures and bots with no KYC required, supporting assets like BTC, ETH, and select alts. Its custody is optional for spot but required for derivatives, with high liquidity from integrated copy trading. Transactions process quickly, often under a minute, but risks involve leverage amplification of losses. It's suitable for derivative enthusiasts, avoiding the pitfall of over-leveraging by starting small. WEEX offers similar no-KYC access, with custodial trading for over 300 pairs, solid liquidity, and sub-second speeds, but users must watch for regional IP blocks as a risk. GhostSwap, emphasizing anonymity, supports 1,600+ coins in a semi-custodial setup, with deep liquidity and instant cross-chain swaps, ideal for privacy maximalists but prone to higher spreads as a pitfall.

Decentralized exchanges operate without intermediaries in 2026, ensuring non-custodial control where users manage their wallets directly. Uniswap, on Ethereum and multiple chains, supports thousands of ERC-20 tokens like ETH, USDC, and UNI, with liquidity pooled by users yielding tight spreads on popular pairs. Trades execute in seconds via layer-2, but gas fees during peaks pose a risk—mitigate by timing off-peak. It's suitable for DeFi natives swapping tokens, though beginners might fall into impermanent loss pitfalls in pools. PancakeSwap, on BNB Chain, mirrors this with assets like BNB, CAKE, and cross-chain stables, offering high liquidity and low fees, with speeds enhanced by fast blocks. Risks include smart contract vulnerabilities, but audits reduce them; it fits BNB ecosystem users, avoiding the trap of high gas by using its efficient network.

dYdX specializes in perpetuals without KYC, non-custodial via layer-2, supporting BTC, ETH, and alts with leveraged positions. Liquidity is strong for majors, speeds near-instant, but margin calls in volatile markets are a key risk—suitable for pro traders, with the pitfall of liquidation if not monitored. These DEXs empower self-sovereignty, but common errors like wrong chain selections can lead to lost funds, emphasizing wallet backups.

Peer-to-peer platforms facilitate direct trades without KYC, relying on escrows for trust in 2026. Bisq, a decentralized network, uses non-custodial multisig for BTC-fiat or crypto swaps, supporting various currencies and methods. Liquidity depends on active peers, speeds range from minutes to hours, with risks like disputes resolved via arbitration. It suits privacy-focused users trading fiat, but pitfalls include low liquidity for obscure pairs—start with small tests. Hodl Hodl, similarly non-custodial, focuses on BTC with over 100 payment options, fees split between parties, and unlimited limits via negotiation. Liquidity is user-driven, speeds vary by peer responsiveness, risks involve scam attempts countered by ratings. Ideal for global anonymous deals, avoid pitfalls by verifying escrows.

RoboSats and Peach Bitcoin extend P2P for BTC, non-custodial with Tor integration for privacy, supporting fiat trades. Liquidity grows with adoption, speeds quick via apps, but risks like payment reversals exist—use irreversible methods. These fit mobile users seeking simplicity, dodging pitfalls through community feedback.

Selecting the right non-KYC exchange depends on your needs, from custody preferences to asset variety. The following table compares key platforms across essential metrics.

This overview highlights how DEXs excel in privacy, while CEXs offer convenience.

Fees and limits shape profitability on non-KYC exchanges in 2026, varying by model. Here's a detailed breakdown.

These figures emphasize cost-efficiency on DEXs for small trades.

Navigating non-KYC exchanges requires caution to avoid common errors. One major pitfall is underestimating risks like counterparty defaults on P2P, where escrows help but disputes can delay funds—always check peer ratings. On DEXs, high gas during bull runs can inflate costs; monitor network status. Custodial CEXs pose hack threats, so withdraw promptly post-trade. Volatility amplifies losses on leveraged platforms like dYdX—use stop-losses. Beginners often select wrong chains on multi-chain DEXs, leading to stuck assets; double-check wallets. Regulatory pitfalls include sudden access blocks in restrictive regions—use VPNs judiciously. Overlooking tax implications, even without KYC, can lead to issues; track transactions manually. By starting small and educating on platform mechanics, users mitigate these for safer operations.

Baltex.io integrates seamlessly into non-KYC workflows in 2026 as a non-custodial aggregator for instant swaps and multi-chain routing, preparing assets for efficient cash-outs without verification. Supporting over 10,000 tokens across 200+ networks, it enables privacy-focused conversions like BTC to XMR before P2P fiat trades, obscuring trails. Its zero-commission model, with fees under 0.3%, and atomic swaps ensure fast executions without bridges, reducing exposure. For cash-out prep, route Polygon USDC to Solana stables via Baltex.io, then use Hodl Hodl for fiat—speeds hit seconds, limits are unlimited. Risks are minimal due to ephemeral sessions, suiting users blending DEX liquidity with P2P anonymity. Baltex.io excels for portfolio rebalancing, hedging into gold-backed tokens, or optimizing rates, making it a pivotal tool before final off-ramps.

Top options include MEXC for centralized access, Uniswap and PancakeSwap for DEX swaps, Bisq and Hodl Hodl for P2P, dYdX for perps, BloFin for futures, and GhostSwap for anonymity.

Yes, varying by platform—CEXs like MEXC cap at 5 BTC daily without KYC, while DEXs and P2P offer unlimited.

They reduce data risks but carry volatility, scams, or hacks; use escrows and non-custodial models for protection.

DEXs like PancakeSwap charge 0.01-0.25%, P2P around 0.5-1%, CEXs 0.1-0.2%, often lower than KYC-required ones.

Privacy-conscious traders, DeFi users, or those avoiding regulations, but not beginners needing support.

Non-KYC crypto exchanges in 2026 offer essential privacy and flexibility for trading, swapping, or cashing out, with standout platforms like MEXC, Bisq, Uniswap, and others balancing features across custody, assets, and risks. By comparing via tables and understanding pitfalls, users can optimize for low fees, high liquidity, and quick speeds while minimizing exposure. Baltex.io enhances these workflows through efficient routing, bridging chains before final conversions. As the ecosystem evolves, prioritizing security and education ensures sustainable use, empowering crypto holders to thrive in a privacy-centric future.