In 2026, gold-backed tokens provide stable hedges with the tokenized gold market surpassing $4.5 billion amid gold prices at $4,300–$4,600 per ounce. Leaders PAXG ($1.62B–$1.77B market cap) and XAUT ($2.2B–$2.34B) dominate, offering regulated access to physical gold via Ethereum and multi-chain support. PAXG emphasizes transparency with monthly audits; XAUT excels in liquidity. Emerging alternatives like KAU ($347M, yield-bearing) add innovation. Risks include counterparty failures and volatility. Optimize with baltex.io for cross-chain flexibility. Check project overview and risk/utility comparison for details.

Gold-backed tokens are digital assets pegged 1:1 to physical gold reserves, blending commodity stability with blockchain utility. Issuers store LBMA-certified gold in secure vaults, minting tokens on networks like Ethereum to match holdings exactly. This enables fractional ownership, 24/7 trading, and DeFi integration without physical storage burdens.

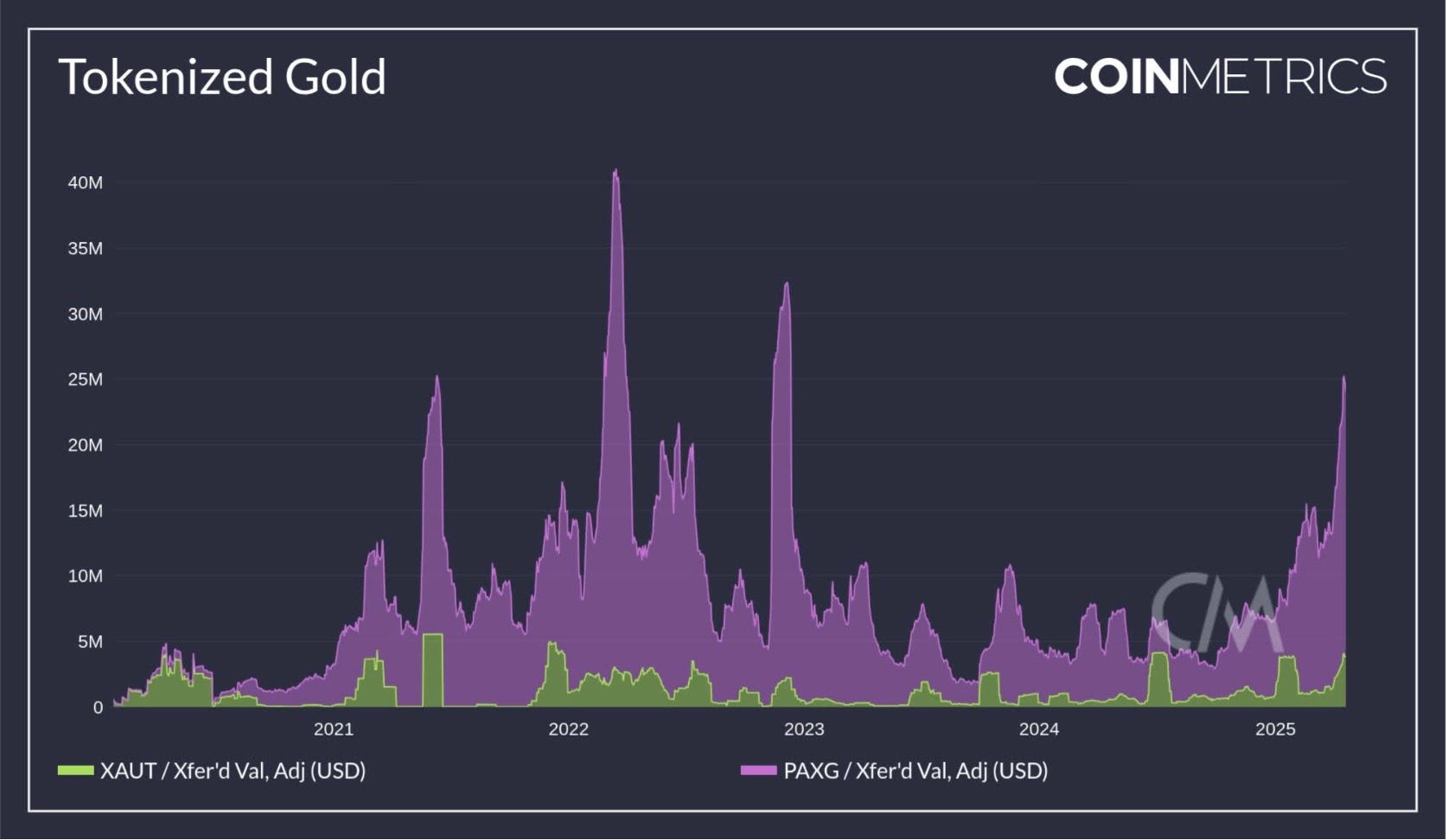

Holders verify reserves through on-chain transparency or issuer reports, trading tokens on exchanges while tracking gold's spot price. In 2026, these tokens appeal as hedges against inflation and crypto volatility, with the sector's market cap exceeding $4.5 billion. Unlike volatile altcoins, they offer real-world asset (RWA) exposure, projected to grow amid gold's rally to $4,300–$4,600 per ounce.

Economic uncertainty in 2026—driven by inflation, geopolitical tensions, and monetary policies—boosts gold's allure, with prices climbing from 2025's $4,500 peak. Tokenized versions enhance accessibility, allowing retail investors to diversify portfolios with low entry points and DeFi yields.

The RWA trend fuels adoption, as institutions seek verifiable on-chain commodities. Leading tokens like PAXG and XAUT provide liquidity and compliance, while emerging ones introduce yields or niches like Shariah compliance. However, risks like regulatory shifts demand careful positioning—allocate 5–10% for hedges.

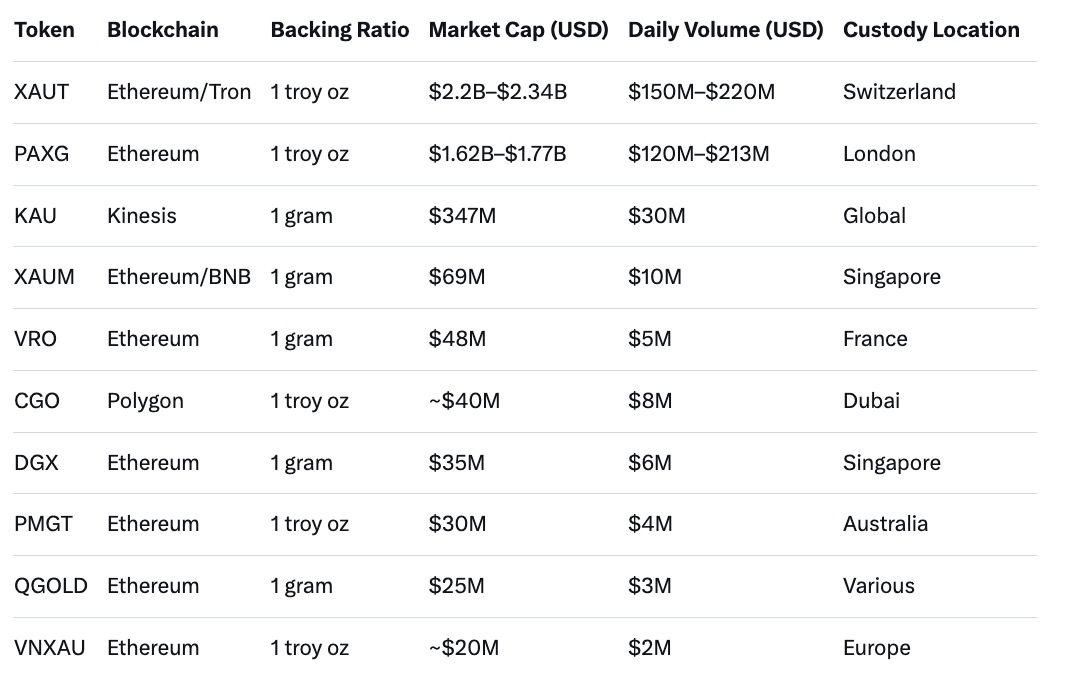

PAXG, issued by regulated Paxos Trust Company, represents one troy ounce of LBMA gold per token on Ethereum. It suits conservative investors seeking compliance and transparency in 2026's volatile markets.

PAXG positions as a secure, low-cost hedge for stable-asset users.

XAUT, from Tether's ecosystem, backs each token with one troy ounce of gold, emphasizing multi-chain flexibility and high liquidity for active traders.

XAUT excels for dynamic portfolios, leveraging Tether's scale.

Beyond leaders, emerging tokens innovate with yields, niches, or regional focus, appealing to specialized investors in 2026.

Kinesis Gold (KAU) introduces yields, backed by 1 gram of gold.

Matrixdock Gold (XAUM) targets Asia with multi-chain access.

VeraOne (VRO) focuses on eco-friendly recycled gold.

Comtech Gold (CGO) offers Shariah compliance.

Digix Gold (DGX), a veteran, emphasizes fractional Ethereum access.

These alternatives diversify beyond PAXG/XAUT, suiting yield-seekers or niche users.

Snapshot of leaders and alternatives based on early 2026 data.

Trade-offs for portfolio decisions.

Baltex.io redefines gold-backed token management through its innovative, privacy-first architecture for swaps, routing, and portfolio flexibility across chains, transcending basic cash-outs. This non-custodial hub integrates 10,000+ tokens on 200+ networks like Ethereum, Tron, Solana, and BNB, facilitating direct, bridge-free swaps—such as PAXG to XAUT in under 10 seconds with aggregated liquidity for sub-0.1% slippage.

Its routing engine stands out: Using AI-optimized paths, it combines DEX pools (e.g., Uniswap, PancakeSwap) for best rates, while private Monero routing conceals trades from trackers, preserving anonymity without KYC. This enables discreet rebalancing during gold volatility, like routing KAU yields to stablecoins across chains.

Portfolio tools elevate it: Wallet integrations (MetaMask, Phantom) support automated strategies—set thresholds to swap XAUT if gold drops 5%, or diversify PAXG into altcoins. Fiat ramps (100+ currencies via Apple Pay) add seamless entries, with pre-trade analytics on fees/gas. Unlike standard DEXs, baltex.io's RWA focus optimizes for tokenized assets, empowering 2026 investors to loop DeFi yields or hedge dynamically without custody risks. Visit baltex.io.

What's the difference between PAXG and XAUT? PAXG offers U.S. regulation and monthly audits; XAUT provides multi-chain liquidity and flexibility.

Are emerging tokens like KAU riskier? Yes, due to platform dependencies, but they add yields absent in leaders.

How do redemptions work? PAXG: Min 430 oz physical; XAUT: Any amount with fees.

What portfolio role do these play? Hedges (5–10% allocation) against inflation/volatility.

Why baltex.io for gold tokens? AI routing and private swaps enhance cross-chain flexibility.

In 2026, with gold at $4,300–$4,600/oz, PAXG and XAUT lead as reliable hedges, while alternatives like KAU innovate. Weigh custody transparency against liquidity needs; mitigate risks via diversification. Tools like baltex.io unlock efficiency. These tokens fit stable-asset portfolios, but monitor macro trends for optimal roles.