If you’re a crypto newcomer and have wondered “what is a crypto bridge” and how it fits into your trading journey, read on. This guide will walk you through the basics, show you how bridging works, explore the types of bridges, and answer the big questions about security and fees.

Imagine you have digital tokens on one blockchain, say Ethereum, but you want to explore a dApp (decentralized application) on another chain, such as BNB Chain (previously known as Binance Smart Chain). If those blockchains were two separate countries, you’d need a “bridge” to legally and safely bring your tokens over without losing them or going through a complicated exchange route. That is precisely what a crypto bridge does.

A crypto bridge, at its core, allows you to transfer tokens from one blockchain to another. It addresses the lack of interoperability in the crypto space, making sure your assets remain valid and tradable on the destination chain without forcing you to sell your tokens outright. In other words, you won’t have to liquidate your tokens on one chain and then rebuy them on a second chain. Instead, a bridge handles the process under the hood, enabling a smoother ride for cross-chain traders.

Below are the primary advantages of using a crypto bridge:

Once you grasp the broad idea, you’ll see that each crypto bridge typically follows a similar methodology, even though the actual code and interface can vary by provider. Broadly, bridging adopts one of two primary frameworks: lock-and-mint or burn-and-redeem. Let’s break each one down so you know what’s happening with your tokens behind the scenes.

Lock-and-mint is a popular model used in many decentralized bridges. Let’s say you hold Ethereum-based tokens but want to use them on a different network:

“Wrapped” tokens are essentially placeholders, representing the locked tokens on the new chain. They’re often labeled to indicate their origin, like WETH for wrapped Ether when moved to another network. Wrapped tokens can be freely traded or used in DeFi (decentralized finance) applications on the second chain without losing their underlying value.

Burn-and-redeem works in a nearly opposite manner. Instead of locking tokens on Chain A, receiving new ones on Chain B, and then unlocking them later, you burn the new tokens on Chain B and redeem the original tokens on Chain A. It goes like this:

This process ensures there is no duplication of tokens in circulation. It keeps the system balanced so you don’t end up with two sets of tokens that are supposed to represent the same value.

Not all crypto bridges function the same. Some are centralized, relying on a custodian or company to lock, mint, burn, or redeem your assets. Others are decentralized, distributing these tasks among smart contracts and a network of validators. Still others mix elements of both. Each type comes with trade-offs in terms of security, convenience, and potential fees.

These bridging platforms act more like traditional exchanges. They require you to trust a third party with your tokens. Although the user experience can be more straightforward (fewer steps on your end), you rely heavily on that central body’s security. If they experience a hack, your tokens could be at risk. Also, centralized solutions might require user registration or direct custody of your private keys, which some crypto enthusiasts prefer to avoid.

Pros:

Cons:

Decentralized bridges typically use a network of validators who collectively verify cross-chain transactions. In a way, it’s a trustless system: you don’t have to rely on one entity to safeguard your tokens. Instead, consensus-based security ensures the bridging function is fulfilled correctly. However, the user experience can be slightly more complex, and there may be higher transaction fees depending on network congestion.

Pros:

Cons:

As exciting as crypto bridging can be, it’s not without challenges. Before you dive into cross-chain activities, it helps to understand the typical pain points and potential pitfalls. After all, bridging is about expanding your reach, not losing precious tokens along the way.

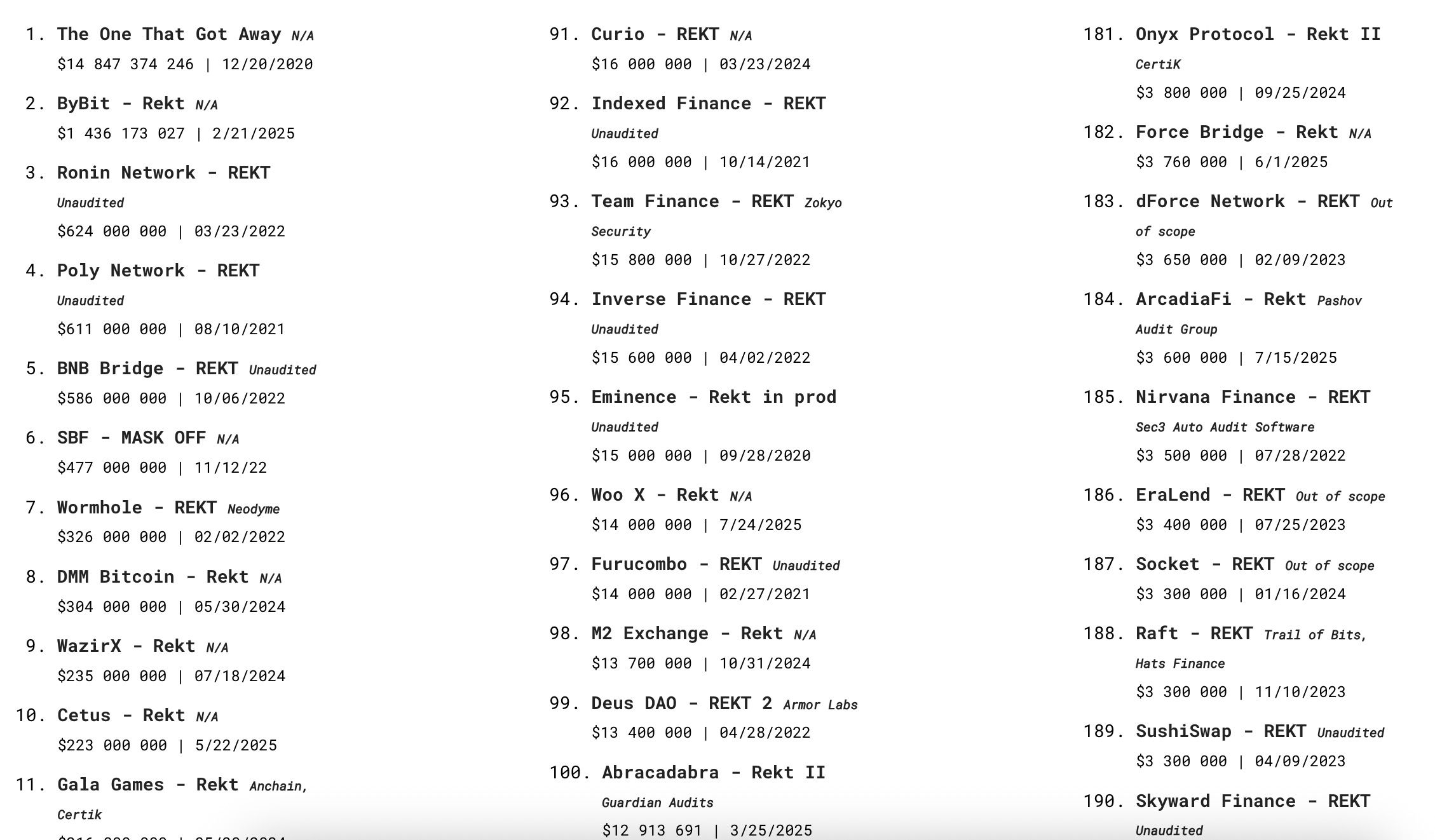

Bridges often aggregate large amounts of tokens in their smart contracts or custodial accounts. This makes them an attractive target for hackers. In a worst-case scenario, if the bridge’s code has a vulnerability, cybercriminals might exploit it and drain those locked tokens. Thorough auditing and reputable bridging solutions can lower this risk, but always remember no system is 100% hack-proof.

Other security factors to consider:

No one likes hidden or excessive fees. Some bridges charge you not only for transaction costs on each blockchain but also for bridging itself. With multiple blockchains involved, plus the cost of locking, minting, burning, or redeeming tokens, it pays to watch out for the final bill.

Liquidity can also be an issue. If what you want to bridge doesn’t have enough liquidity on the destination chain, it may be hard to swap your wrapped tokens or get a fair exchange rate. Thorough research on each token’s bridging volume and usage can help you avoid being stuck with tokens you cannot trade easily.

It’s one thing to talk about bridging in theory, but let’s look at two widely used scenarios to illustrate how it all works in practice. These examples demonstrate what your bridging journey might look like with real tokens on popular networks.

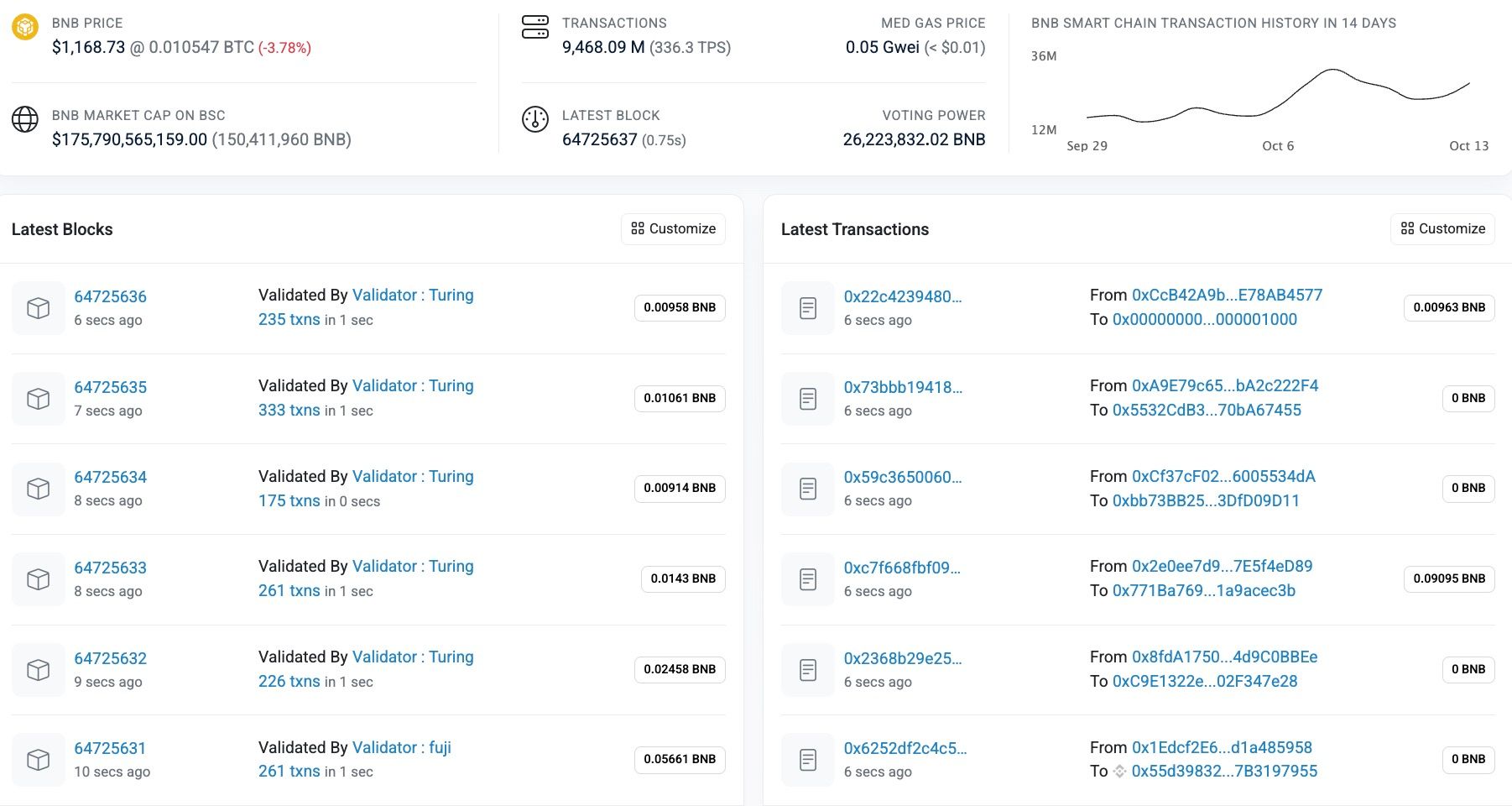

Ethereum to BNB Chain bridging is arguably one of the most common moves for cross-chain traders. Ethereum often has higher gas fees, while BNB Chain generally boasts cheaper transactions. By bridging ETH-based tokens to BNB Chain, you can still hold the same asset but take advantage of cheaper trades, yield farming, or other DeFi activities.

Basic steps:

Polkadot is a multichain network that aims to let different blockchains talk to each other natively. However, if you want your Ethereum-based tokens to interact with Polkadot’s relay chain or parachains, bridging solutions still come in handy. After bridging, the tokens become usable in Polkadot’s many parachains for DeFi or other dApps.

The big draw with Polkadot is scalability and specialized parachains, each optimizing for a specific function, like privacy, smart contracts, or interoperability. Bridging helps you tap into these specialized options without giving up the Ethereum assets you already hold.

If all this bridging talk feels a bit overwhelming—or if you simply want a more user-friendly approach—Baltex.io might be worth a look. Baltex.io essentially merges the benefits of both centralized and decentralized exchanges, giving you a place to swap assets across multiple chains with fewer steps. Instead of juggling different bridging platforms, you can manage cross-chain trading within a single interface that’s designed with everyday users in mind.

Baltex.io bills itself as a hybrid CEX-DEX solution, meaning you get the convenience of a centralized platform (like a more intuitive interface and quick order matching) combined with the non-custodial control of a DEX. You retain solid control of your funds, and bridging tokens is streamlined under one roof. If you’re trying to move from one chain to another without messing with multiple bridging dApps, having those trades unified can feel like a breath of fresh air.

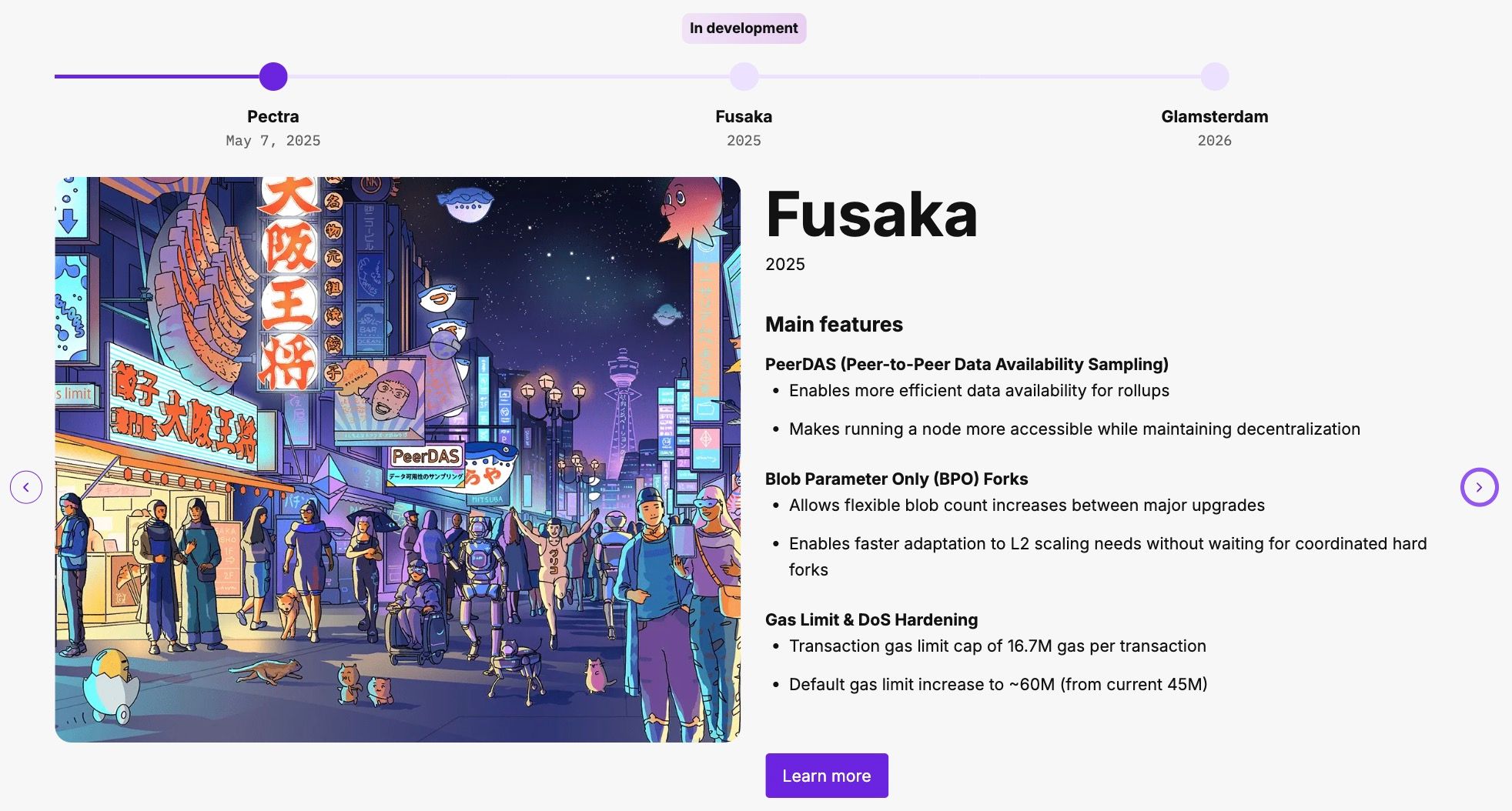

Bridges are a big deal today because we still live in a world where blockchains operate in silos. However, many projects are working to create more native interoperability. Future scaling solutions might eliminate the need for multiple bridging steps altogether. In addition, new technologies such as state proofs and zero-knowledge (ZK) proofs could ensure more robust security checks on cross-chain transfers.

Challenges remain, of course. Standardizing code and bridging practices across numerous chains is tough. Governance models also vary significantly. Nonetheless, we can expect improvements in user experience and security as the industry matures. More specialized bridging solutions are likely to appear, focusing on privacy, speed, or token-specific needs.

1. How do I choose a reputable crypto bridge? You’ll want to look for a solution audited by independent security firms and used widely by the crypto community. Check for reviews, user feedback on social media, and documentation on how the bridge handles locked funds. If they’re transparent about their code and processes, it’s usually a good sign.

2. Are bridging transactions usually fast or slow? It depends on the blockchain network conditions and the type of bridge. Some decentralized bridges can take longer due to on-chain confirmations. Centralized solutions might be faster but require more trust. Always monitor gas fees and network congestion when bridging.

3. Why do I sometimes see “wrapped” tokens on the destination chain? Wrapped tokens signify that the original tokens are locked in a smart contract on the source chain. The newly minted tokens represent your locked assets but operate within the new chain’s ecosystem. It’s how your original token value travels cross-chain without physically leaving its blockchain.

4. Can bridging help me save on transaction fees? Potentially, yes. If the target chain offers much cheaper transaction fees and supports the dApps you want, it can cut your overall costs. However, bridging itself has a cost, and you might pay bridging fees plus gas fees on both chains. Crunch the numbers before committing.

5. What happens if a crypto bridge is hacked? If the hack drains locked tokens, you can lose the assets you bridged. It’s important to use reputable bridges and not hold large amounts locked up for too long. Diversify your approach, and keep an eye on announcements or audits for your bridge of choice.

6. Is Baltex.io only for advanced traders? Baltex.io’s hybrid model can be helpful for both beginners and advanced users. The interface tries to be user-friendly, but like any crypto platform, there’s a learning curve. If you’re new, you can start with small swaps or practice on test networks, if available.

Bridges might feel complex at first, but they open up a world of cross-chain opportunity. By understanding how they work, staying mindful of security, and choosing tools that fit your risk tolerance, you’ll be well on your way to exploring multiple blockchains like a pro. If you find a solid bridging method or platform that suits your style, you can seamlessly hop among networks, harness unique dApps, and diversify your portfolio with confidence. Happy bridging!