In 2025, Baltex and Bybit serve distinct crypto needs: Baltex provides private, non-custodial cross-chain routing for spot swaps with no KYC, instant execution, and unlimited limits across 200+ chains, emphasizing privacy via Monero and low aggregated fees for anonymous rebalancing and cash-outs. Bybit, a high-volume derivatives platform, offers custodial trading with deep liquidity, tiered fees (0.02% maker/0.055% taker for futures), KYC-required limits up to 60M USDT daily for VIPs, and leverage up to 100x, but with counterparty risks highlighted by a major 2025 hack. Baltex excels in user control and spot privacy; Bybit dominates derivatives and volume. See our tables for detailed comparisons.

Crypto enthusiasts in 2025 often grapple with the trade-offs between privacy-preserving platforms and those optimized for high-stakes trading. Baltex, through baltex.io, exemplifies private routing for spot swaps, enabling seamless, anonymous cross-chain movements without intermediaries. This appeals to users focused on sovereignty in trading, rebalancing portfolios, transferring funds across networks, and preparing for cash-outs. Bybit, conversely, stands as a centralized powerhouse for derivatives, boasting massive liquidity and advanced tools like perpetual futures, but demanding compliance and trust in its infrastructure.

This SEO guide examines Baltex and Bybit through the lens of private routing versus a high-volume derivatives exchange. We'll cover fees, spreads, execution speed, slippage risk, liquidity depth, limits, supported assets and chains, custody and counterparty risk, KYC and data exposure, derivatives versus spot workflows, and failure scenarios. Step-by-step flows with safety checks offer practical guidance, supplemented by tables for clarity. A dedicated section explores Baltex's multi-chain strengths. As market volatility persists, Baltex suits discreet operations, while Bybit caters to leveraged traders seeking scale.

The private versus high-volume divide underscores evolving priorities: Baltex minimizes exposure through decentralization, reducing risks like data breaches, whereas Bybit's centralized model enhances execution but introduces dependencies. Both platforms support diverse assets, yet their workflows and risk profiles influence choices for efficient crypto strategies.

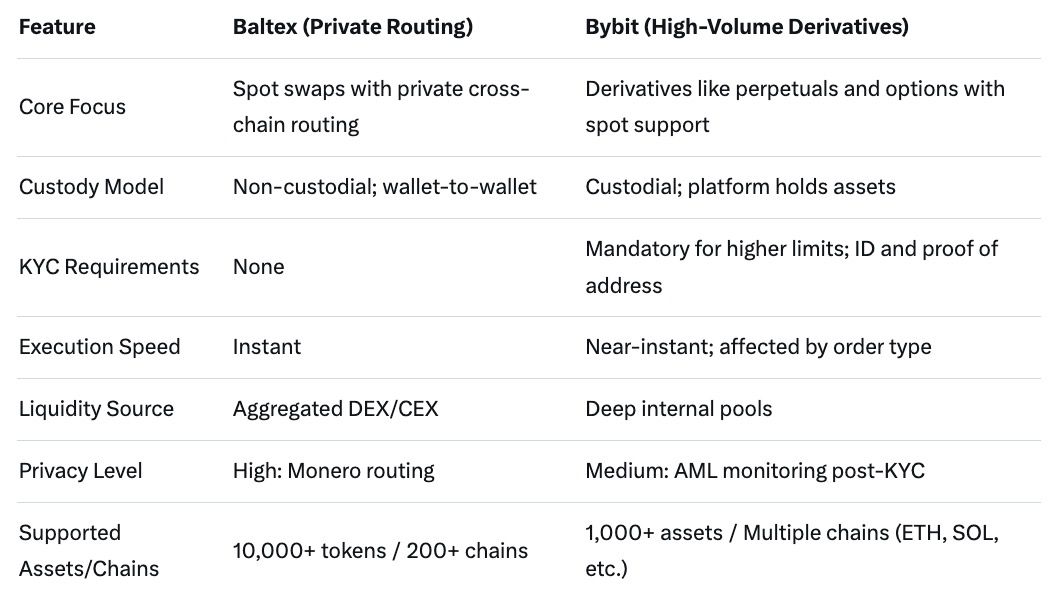

This table outlines key distinctions in 2025, highlighting private spot focus against derivatives dominance.

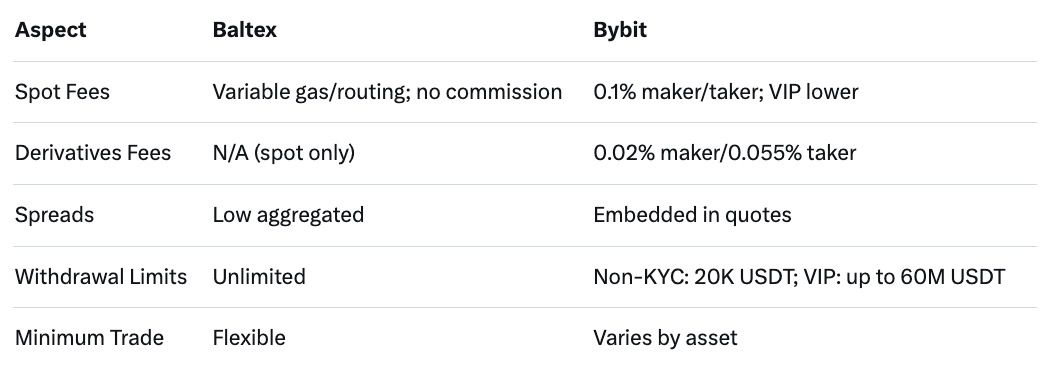

Fees shape cost efficiency for frequent users. Baltex avoids fixed commissions, opting for optimized aggregation where costs include network gas and minimal routing fees, displayed transparently during approval. Spreads are kept low through hybrid liquidity sourcing, benefiting private spot swaps in volatile conditions.

Bybit's structure varies by product: spot trades at 0.1% maker/taker for regulars, with VIP discounts; derivatives like futures at 0.02% maker and 0.055% taker, reducible via volume tiers. Spreads embed in quotes, and no deposit fees apply, but withdrawals incur asset-specific charges.

Private routing in Baltex favors low-overhead anonymity, while Bybit's tiered model rewards high-volume derivatives activity.

Speed determines opportunity capture in fast markets. Baltex achieves instant execution via bridgeless routing, with assets arriving post-wallet approval, minimizing slippage to under 0.3% through real-time aggregation.

Bybit offers near-instant trades, supported by 99.99% uptime, but slippage occurs in volatile derivatives; users set tolerances for market orders to control deviations.

Baltex's immediacy enhances private spot control, contrasting Bybit's reliable but order-dependent performance.

Liquidity ensures reliable fills. Baltex aggregates from DEXs and CEXs, providing sufficient depth for spot swaps across chains, though less for niche pairs.

Bybit's internal pools handle billions daily, excelling in derivatives with minimal impact on large orders.

Private routing prioritizes discreet liquidity; high-volume platforms like Bybit emphasize depth for leveraged trades.

Limits impact scalability. Baltex imposes none, enabling unrestricted swaps and movements for flexible private operations.

Bybit ties limits to KYC and VIP status: non-KYC at 20K USDT daily, regulars up to 4M USDT, and top VIP/Pro at 60M USDT.

Baltex offers boundless privacy; Bybit scales for derivatives volume.

Detailed costs and constraints in 2025.

Asset variety enables strategies. Baltex covers 10,000+ tokens on 200+ chains like ETH, SOL, TON, supporting direct cross-chain spot.

Bybit lists 1,000+ assets, with deposits on multiple chains; focuses on derivatives but includes on-chain trading.

Private breadth in Baltex aids routing; Bybit's selection suits high-volume pairs.

Custody defines security. Baltex's non-custodial model eliminates holds, reducing risks; users retain keys.

Bybit is custodial, with partnerships for off-exchange options to mitigate exposure, but a 2025 hack exposed vulnerabilities.

Private routing minimizes counterparty issues; centralized platforms require trust.

KYC affects privacy. Baltex requires none, using Monero for anonymity.

Bybit mandates ID and recent address proof for advanced access, with AML monitoring increasing exposure.

Baltex preserves data sovereignty; Bybit complies with regulations.

Workflows differ by focus. Baltex streamlines spot: select assets, connect wallet, approve for private routing.

Bybit's derivatives involve leverage selection, order types like market with slippage controls, and futures settlement.

Spot privacy vs. derivatives complexity.

Failures vary. Baltex: network delays or errors, fixed by retries; no holds.

Bybit: hacks like 2025's $1.44B loss, AML flags, or system outages delaying trades.

Private models reduce systemic risks.

Overview of potential issues.

Spot swap on Baltex: Choose tokens/chains on baltex.io. Connect wallet. Review rate, fees, slippage—key safety for terms. Approve; instant receipt. Safety: Hardware wallets, address checks.

Derivatives on Bybit: Fund account post-KYC. Select contract, leverage. Place order with tolerance. Monitor position. Safety: 2FA, limit orders.

Cross-chain Baltex: Integrated routing; select networks. Safety: Preview compatibility.

Bybit transfers: Deposit/withdraw via chains. Safety: Network match.

Moving funds: Baltex to Bybit—route, send. Reverse: Withdraw, route on Baltex. Safety: Small tests, trackers.

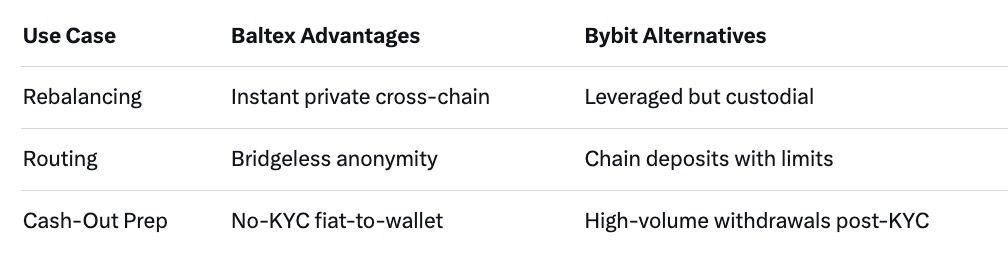

Baltex.io in 2025 accelerates multi-chain swaps, enhancing private strategies. For rebalancing, instantly shift ETH to SOL sans bridges, aggregating for optimal fills; privacy routing obscures moves.

Cross-chain routing directs funds like TON to Base efficiently, ideal for arbitrage without exposure.

Cash-out prep: Fiat buys to wallet, then anonymous swaps to stables; unlimited for accumulation.

Baltex fosters secure, swift sovereignty.

Scenario benefits.

Maker 0.02%, taker 0.055%, with VIP discounts.

No, focused on private spot swaps.

ID and recent address proof.

Handles billions daily for derivatives.

Major hack exposing $1.44B.

Baltex's private routing shines for discreet spot in 2025, while Bybit's derivatives platform excels in volume at custody costs. Prioritize based on needs—privacy or leverage. Explore privacy routing guides or derivatives platforms. Test workflows carefully.