If you have been looking into cross-chain bridges, you have probably come across the term “gravity bridge tokenomics.” The Gravity Bridge protocol is a solution that aims to connect Ethereum and the Cosmos ecosystem in a cost-effective, scalable way. It allows you to move digital assets across two very different blockchain networks without losing value or efficiency. This transfer capability opens new doors for decentralized finance (DeFi) traders like you, especially those who want to tap into the liquidity, speed, and unique features each network can offer.

Before diving deep, here is a concise summary of why Gravity Bridge matters:

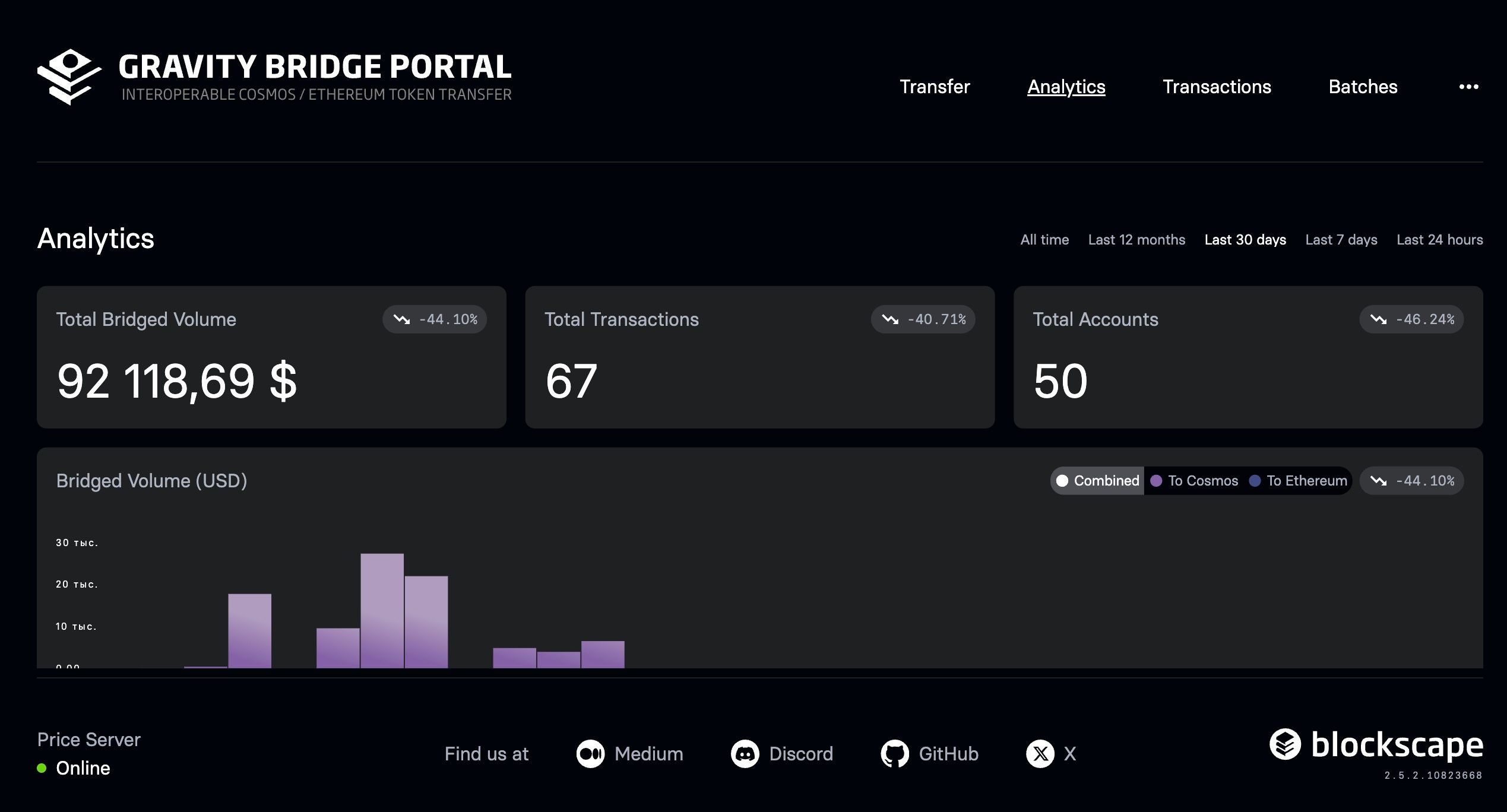

It allows you to move millions in value between Ethereum and Cosmos seamlessly, expanding your access to diversified DeFi platforms.

It is focused on efficient token transfers with minimal fees, so you do not waste funds on transaction costs.

In the realm of interoperability solutions, Gravity Bridge is often compared to Axelar and Wormhole, but with a stronger emphasis on simplicity and direct asset movement.

Baltex.io, a swap hub connected to Gravity Bridge, helps you exchange tokens easily and take advantage of cross-chain liquidity.

A clear tokenomics model underpins everything, from validator incentives to governance, ensuring the protocol remains stable even when market conditions fluctuate.

Keep reading to understand exactly how Gravity Bridge achieves these goals, what it means for you as a DeFi participant, and why 2025 could be a breakthrough year for cross-chain integrations.

Gravity Bridge tokenomics refers to how the network manages, distributes, and controls its native governance and validator incentives. At its core, tokenomics is the economic system that rewards participants, secures the bridge, and governs future upgrades. When you look at Gravity Bridge, you will see real-world economic principles in action, shaped by a governance process that includes validators, delegators, and community members.

Every blockchain needs a clear, transparent governance process to ensure participants can vote on important proposals, such as parameter changes or system upgrades. Gravity Bridge uses a governance token that grants voting rights to its holders. You, as a token holder, can either vote directly on proposals or delegate your tokens to a validator to vote on your behalf. This design ensures decentralization in the decision-making process.

Governance proposals can include network settings, fee adjustments, or even new features to keep Gravity Bridge adaptive to market demands.

By involving validators who stake tokens and users who delegate tokens, the system distributes power across the community.

Token emissions refer to how many new tokens are minted over time. In Gravity Bridge’s design, emissions are used to reward validators. The more tokens a validator or delegator stakes, the higher the share of rewards they can earn. This helps maintain security because attackers would need to control a majority of staked tokens, which becomes increasingly difficult and expensive as the network grows.

Staking inflows: When more users stake, the network’s security increases, making it harder for potential attackers to gain control.

Inflation and deflation balance: Gravity Bridge’s mechanisms adjust token supply to maintain a healthy balance between inflation (rewarding stakers) and deflation (reducing supply if needed).

Strong tokenomics creates stability that DeFi users and liquidity providers can rely on. If you want to bridge assets and deploy them on the Cosmos side or the Ethereum side, you want to be sure that:

Fees remain predictable.

Validators are properly incentivized to secure the network.

The governance process does not get hijacked by a small group.

Gravity Bridge addresses these issues by tying security directly to staked tokens and giving the community a transparent governance structure.

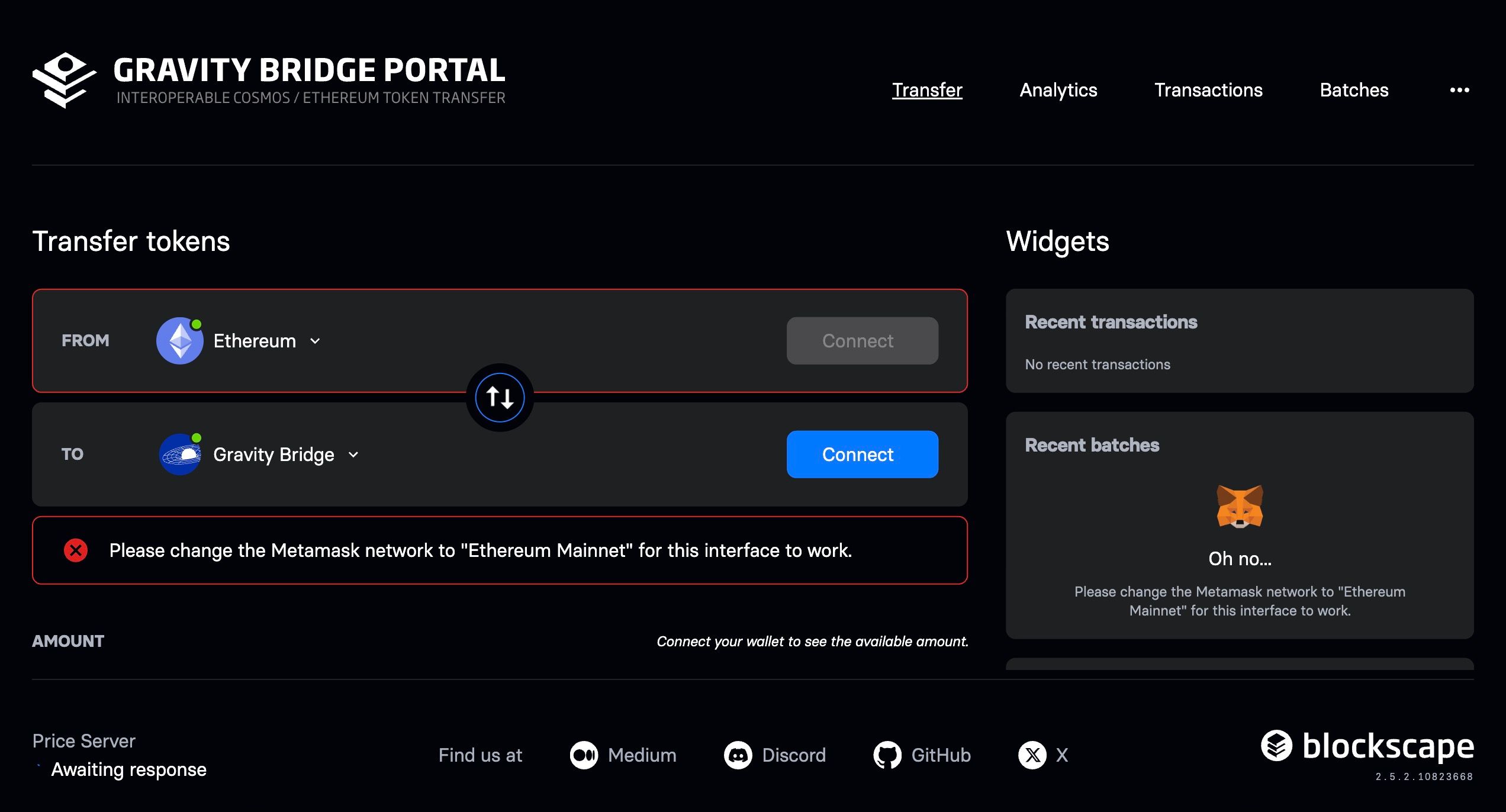

The essence of Gravity Bridge is that it connects two major ecosystems: Ethereum and Cosmos. Each network has distinct features, user bases, and DeFi protocols. However, bridging them can sometimes be complicated. Let’s break down how Gravity Bridge manages this process.

When you send an asset from Ethereum to Cosmos via Gravity Bridge, the token is locked in a smart contract on the Ethereum side. This contract is audited and designed to be tamper-proof. In return, the Cosmos network mints a corresponding representation of that token. Thus, you still hold the same value on Cosmos without permanently losing it on Ethereum.

Lock-and-mint mechanism: Lock assets on Ethereum, mint matching tokens on Cosmos.

Redemption: When you decide to move your assets back, you burn the minted tokens on Cosmos and release your original tokens on Ethereum.

Bridging requires verifying transactions happened as intended on both sides. Here, Gravity Bridge depends on a set of validators who observe the Ethereum network. When your Ethereum transaction is finalized, these validators attest to that event on Cosmos, triggering the mint of your bridged tokens. The system is trust-minimized because it leverages the security of a collective validator set, and any malicious attempt is countered by the potential loss of staked tokens.

Cost-effectiveness: Lower fees compared to some bridging solutions that rely on more complex architectures.

Speed: Transfers happen relatively quickly, improving your user experience, though finality may still be subject to each chain’s block times.

Flexibility: Almost any ERC-20 token can be bridged, enabling diverse strategies for yield farming, liquidity provision, and more.

By 2025, the lines between different blockchain ecosystems may become even blurrier than they are today. As a DeFi trader, you might hold assets on Ethereum, store NFTs on independent sidechains, and provide liquidity on Cosmos-based DEXs. This growing multichain environment offers a wealth of opportunity, yet it also introduces new complexities:

Fragmented liquidity: Different blockchains have their own DeFi protocols. Without bridges, liquidity remains siloed, and your trading options become limited.

Governance overlap: When you hold tokens on multiple chains, you face multiple governance frameworks. Aligning these frameworks might not be straightforward.

Evolving chain capabilities: Different networks will upgrade their technologies, making some bridges obsolete if they can’t keep pace.

Gravity Bridge aims to remain at the center of 2025’s cross-chain DeFi landscape by continually updating its smart contracts and chain-level logic. It hopes to serve not just as a one-off token bridge but as a robust pipeline for diverse types of data and transactions. You can expect more advanced features like cross-chain smart contract calls, which would let you trigger a function on Ethereum directly from the Cosmos side, or vice versa, without needing to juggle multiple platforms manually.

This evolving environment can be overwhelming. If you want to keep taking advantage of early opportunities in cross-chain DeFi, you should:

Monitor upgrades on Gravity Bridge, Axelar, Wormhole, or any other bridging solutions you use.

Participate in governance votes if you hold bridging tokens, because these votes often affect fees, speeds, and bridging features.

Keep track of emerging protocols that might use Gravity Bridge under the hood for advanced cross-chain functionalities.

By 2025, bridging solutions like Gravity Bridge will play a pivotal role in shaping how you move assets around the multichain world. With better speed, lower fees, and more stable security, it becomes easier for you to execute complex cross-chain trades or lock tokens in yield farms across multiple ecosystems.

Axelar is another bridging and interoperability project that aims to connect several blockchains beyond just Ethereum and Cosmos. On paper, Axelar and Gravity Bridge share a goal: streamline cross-chain transfers with robust security. However, the two differ in scope, cost structures, and approach.

Gravity Bridge focuses primarily on linking Ethereum and Cosmos, aiming to handle large volumes of ERC-20 token transfers with minimal complexity.

Axelar positions itself as a universal overlay network that aims to connect an even broader range of blockchains, including Bitcoin, EVM-compatible chains, and more.

Gravity Bridge secures its operations through a validator set tied to the Cosmos-based side of the protocol, leveraging a proof-of-stake mechanism. Axelar similarly uses a proof-of-stake model but frames itself as a universal message-passing network. If you are looking to move tokens between Ethereum and Cosmos specifically, Gravity Bridge might be simpler to use and potentially cheaper. If your strategy involves a more diverse set of blockchains or if you are building cross-chain dApps, Axelar might be more appealing.

Comparing fees on Axelar vs. Gravity Bridge can be tricky because both rely on each network’s base transaction costs plus their own bridging fees. However, DeFi traders often find that Gravity Bridge offers relatively lower total costs for transfers between Ethereum and Cosmos specifically, thanks to optimized contract interactions.

Transaction speed can be similar, though actual times vary based on each network’s block confirmations.

Axelar might introduce additional overhead if you are bridging from Ethereum to, say, a lesser-known chain.

Both solutions have user-friendly interfaces, but your experience will depend on which wallet you use and how you manage your bridging transactions.

Wormhole is another top contender in the bridging race, connecting several popular blockchains like Ethereum, Solana, BNB Chain, and others. Although it shares similarities with Gravity Bridge, there are some clear distinctions that might matter to you:

Wormhole is well known because it supports many chains, especially those with large NFT marketplaces or unique DeFi ecosystems. If you are strictly focusing on Ethereum-Cosmos transfers, Wormhole might feel like a broader tool than you need. It can be costlier or more complex for simpler bridging tasks, depending on how well you navigate the interface and associated fees.

Wormhole operates via a guardian network that observes transfers on each chain, signing off on cross-chain transactions. Gravity Bridge, on the other hand, uses Cosmos validators that also watch Ethereum. Your preference might come down to which security model you trust more.

Guardian-based approach: Many top ecosystem participants typically serve as guardians, providing a decentralized mechanism but still reliant on a select set of entities for security.

Cosmos validator-based approach: This leverages a broader PoS ecosystem, distributing trust among different validators and delegators.

Wormhole focuses on fast bridging speeds, which is useful if you are trading frequently or capitalizing on arbitrage opportunities. Gravity Bridge prioritizes cost efficiency and reliability, ensuring your bridged tokens accurately represent the value you lock on Ethereum.

Which solution is better for you? It depends on your risk tolerance, your need for multi-chain coverage, and your budget for transaction fees.

When considering any bridge, you should pay close attention to fees and transaction speeds. After all, bridging is only useful if it is cost-effective and quick enough to keep pace with your trading or liquidity strategies.

Ethereum gas fee: When you lock tokens on Ethereum, you pay the standard gas fees. These can fluctuate widely based on network congestion.

Gravity Bridge fee: The protocol takes a small cut to reward validators and cover operational costs.

Cosmos transaction fee: On the Cosmos side, you pay a fee to broadcast transactions on the Gravity Bridge chain.

In many cases, the total cost ends up being lower than bridging solutions that require multiple smart contract calls or complex wrapping procedures. Competitively low fees make mid-sized and large transfers more practical, appealing to traders who want to move high-value tokens efficiently.

Bridging speed depends on block times and finality. Ethereum’s block time hovers around 12-15 seconds, but you need multiple confirmations to ensure a finalized transaction. Cosmos blocks typically finalize in around 6-7 seconds, but again, a certain number of confirmations is required.

In general:

Ethereum to Cosmos: The process can take a few minutes. You lock tokens, validators confirm this event, and Cosmos mints your tokens.

Cosmos to Ethereum: You burn tokens on Cosmos, validators confirm, then the Ethereum contract releases your originally locked tokens. This also usually wraps up within a few minutes, although peak network congestion can cause delays.

Speed is thus decent, particularly for larger transactions. If you are bridging small tokens or chasing second-by-second arbitrage, it might feel slow, but for most DeFi strategies, it strikes a reasonable balance between security and timely confirmation.

Gravity Bridge supports practically any ERC-20 token with straightforward bridging steps, meaning your favorite DeFi assets on Ethereum are likely transferable to Cosmos-based platforms. Likewise, certain Cosmos tokens can move to Ethereum if they have an ERC-20 representation. This flexible asset flow creates interesting possibilities.

Whether you hold stablecoins like USDC, governance tokens like COMP, or LSD (liquid staking derivatives) tokens, bridging them to Cosmos ecosystems allows you to:

Provide liquidity on Cosmos-based DEXs.

Stake or lend tokens in Cosmos lending platforms.

Earn cross-chain yield through specialized services that might only be available on Cosmos.

On the flip side, you can move tokens native to certain Cosmos-based networks over to Ethereum to tap into Ethereum’s massive DeFi liquidity. For instance, if you hold some Cosmos Hub-based assets, bridging them to Ethereum could let you provide liquidity on large Ethereum DEXs, or trade them on well-known decentralized exchanges you already trust.

Yield farming: Move tokens from Ethereum to Cosmos to participate in newly launched yield farms with potentially higher interest rates.

Cross-chain swaps: Take advantage of pricing differences in tokens between Cosmos DEXs and Ethereum-based DEXs, a tactic known as arbitrage.

Governance: If you hold governance tokens that exist in wrapped forms across both chains, you can influence decisions in multiple communities.

Baltex.io is a cross-chain swap hub that leverages bridges like Gravity Bridge to make token swapping more seamless. If you are tired of juggling multiple wallets, bridging tokens in one place and then having to swap them in another, platforms like baltex.io can help you streamline that process.

Single interface: Baltex.io aims to aggregate best prices from different liquidity sources.

Reduced friction: By integrating bridging solutions directly, the platform minimizes the extra steps typically involved in cross-chain transfers.

Potential future expansions: Baltex.io may continue adding new bridging options as cross-chain DeFi solutions evolve, giving you a one-stop shop for interchain swaps.

While it is always crucial to do your own research before relying on any third-party platform, you might find value in a single interface that simplifies bridging and swapping. If you actively trade across multiple networks, a hub like baltex.io saves time and reduces possible mistakes in a multi-step bridging process.

Below are some common questions DeFi traders often have about Gravity Bridge.

Yes. No one can stop you from using the bridge. As long as you can interact with the Ethereum or Cosmos chains, you can send tokens across. Validators do not have the authority to censor specific transactions; their job is to validate all proposals and bridging events in accordance with the protocol rules.

Gravity Bridge’s security model relies on a substantial validator set staking tokens. An attacker would need to control a majority of staked tokens to manipulate the bridge, which becomes more difficult as the network grows. Additionally, audited smart contracts on Ethereum help secure the lock-and-mint mechanism.

Ethereum gas fees are a variable cost. If you make multiple small transfers, the bridging fees could add up, especially when Ethereum is congested. However, if you batch your transfers or move large amounts at once, you can often offset the high gas costs.

Gravity Bridge is primarily designed for ERC-20 tokens, although the concept could be extended to other token standards with further development. For now, if you want to move NFTs on or off Ethereum, you might have to look at specialized NFT bridges.

Gravity Bridge allows direct, non-custodial transfers between Ethereum and Cosmos. A centralized exchange, in contrast, requires you to deposit your tokens under the exchange’s control, then withdraw them to a different chain. By using Gravity Bridge, you retain control of your private keys and do not have to trust a third party with your assets.

Gravity Bridge has positioned itself as a reliable, community-driven solution for bridging Ethereum and Cosmos. By focusing on efficient token transfers, transparent governance, and robust security, it caters to DeFi users who need a stable connection between these two major ecosystems. Whether you are a yield farmer, a token holder, or a project developer, Gravity Bridge can open up new avenues for you to explore cross-chain opportunities without sacrificing control or paying exorbitant fees.

With cross-chain DeFi poised to flourish even further into 2025, staying informed about Gravity Bridge updates can be a smart move. You will also want to keep an eye on other interoperability solutions like Axelar and Wormhole, especially if your investment or development plans span multiple blockchain networks. Baltex.io is one example of a swap hub that is actively integrating bridging solutions to streamline your trading experience, offering a glimpse into the evolving landscape where bridging becomes second nature.

Ultimately, gravity bridge tokenomics underpins a system that rewards validators to keep your funds secure, while ensuring no single entity can dominate governance. If you value decentralization, flexibility, and the potential for high-volume asset transfers, Gravity Bridge deserves a spot in your DeFi toolkit. By tapping into this protocol, you could optimize your liquidity strategies, arbitrage opportunities, and overall presence in the cross-chain era.