In December 2025, buy Bitcoin safely via regulated exchanges like Coinbase or Kraken using credit cards (instant, 3-4.5% fees) or bank transfers (cheaper 0-1.5% fees, 1-3 days). KYC required for higher limits ($10K+/day verified vs. $150 no-KYC). Steps: Choose platform, verify ID, deposit fiat, buy BTC, withdraw to wallet (e.g., Ledger). Prevent fraud with 2FA and official apps. After purchase, store offline; use baltex.io for multi-chain swaps to diversify.

Bitcoin remains the premier cryptocurrency in 2025, with a market cap exceeding $1.6 trillion and widespread adoption as a store of value. As of December 19, 2025, BTC trades around $85,000, fueled by institutional ETFs holding over $100 billion and global regulatory advancements like the EU's MiCA framework. For beginners, buying online offers convenience, but safety is paramount amid rising scams and volatility (BTC can fluctuate 10-20% daily).

Mainstream users benefit from improved fiat on-ramps: Instant card buys and low-fee bank transfers make entry easy. Key motivations: Diversify portfolios, hedge inflation (with BTC's 21 million cap), or access DeFi yields. Risks include hacks (prevent with self-custody) and taxes (track basis for gains).

This guide covers safe methods, emphasizing KYC for protection, fees/limits, fraud tips, and storage. Payment Methods | Step-by-Step Flows | Fraud Prevention

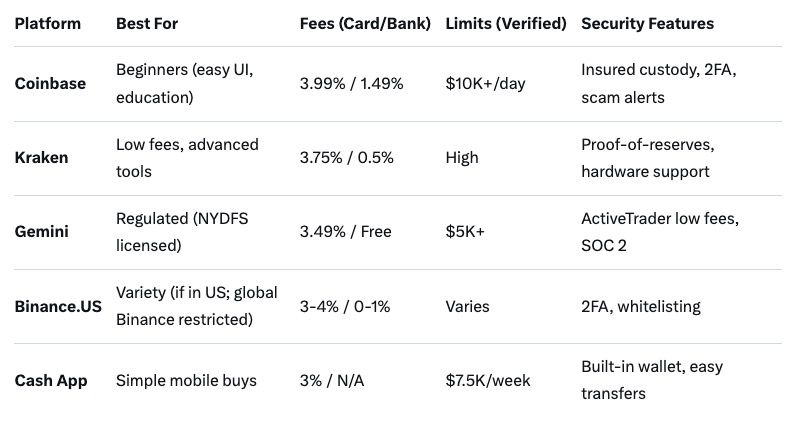

Select regulated platforms to minimize risks—avoid unverified P2P or obscure sites.

P2P options like LocalBitcoins or Paxful offer no-KYC but higher scam risks—use escrow. For safety, prioritize exchanges with proof-of-reserves audits (e.g., Kraken's quarterly).

Tip: Check reviews on Trustpilot (4+ stars) and ensure HTTPS/2FA.

KYC (Know Your Customer) verifies identity for compliance, enabling higher limits and safer transactions.

In 2025, no-KYC limited to P2P or decentralized options like Bisq (peer-to-peer, Tor-enabled). For beginners, KYC exchanges recommended—balances security with usability. EU users note MiCA mandates KYC for all fiat-crypto.

Choose based on speed vs cost.

Comparison Table:

Beginners: Start with card for $100 test; switch to bank for bulk.

Fees vary by platform/method—budget 2-5% total.

Limits scale with verification:

2025 Updates: EU caps at €10K/month unverified; US FinCEN raises to $10K reporting threshold.

Step-by-Step Credit Card | Step-by-Step Bank

Crypto scams peaked in 2025—prevent with:

If scammed: Report to exchange/FTC; recovery rare but possible via blockchain forensics.

Fastest method—use Coinbase example (similar on others).

Time: 5-10 min. Cost: $104 for $100 BTC (fees).

Cheaper for larger buys—Kraken example.

Time: 1-3 days deposit + instant buy. Cost: $501 for $500 BTC (low fees).

Post-buy, move BTC off exchange.

2025 Tip: Use wallets with BTC Taproot for cheaper, private txns.

After buying BTC, you may want to swap for altcoins, bridge chains, or optimize yields—baltex.io, a non-custodial aggregator, excels here.

For beginners: One-click conversions; intermediates: Arbitrage BTC volatility. Visit https://baltex.io to manage your BTC seamlessly.

Q: What's the safest way to buy Bitcoin in 2025? A: Regulated exchanges like Coinbase with 2FA and hardware wallet storage.

Q: Can I buy Bitcoin without KYC? A: Yes, low limits ($150-1K) on P2P like Paxful—higher scam risk.

Q: How much are fees for credit card buys? A: 3-4.5% on most platforms.

Q: What's the minimum Bitcoin purchase? A: $10-20 on beginner exchanges.

Q: How long does bank transfer take? A: 1-3 days for ACH/SEPA.

Q: Is Bitcoin taxable? A: Yes—report gains; use tools like CoinTracker.

Q: Best wallet for beginners? A: Trust Wallet (mobile) or Ledger (hardware).

In 2025, buying Bitcoin online is straightforward and secure with cards/banks on platforms like Coinbase/Kraken—KYC boosts limits, low fees for banks, and fraud prevention via 2FA. Follow steps: Setup wallet, verify, deposit, buy, withdraw to storage. Start small, prioritize safety. Post-purchase, baltex.io enhances management with multi-chain swaps. Embrace Bitcoin's potential responsibly—your entry to crypto awaits.