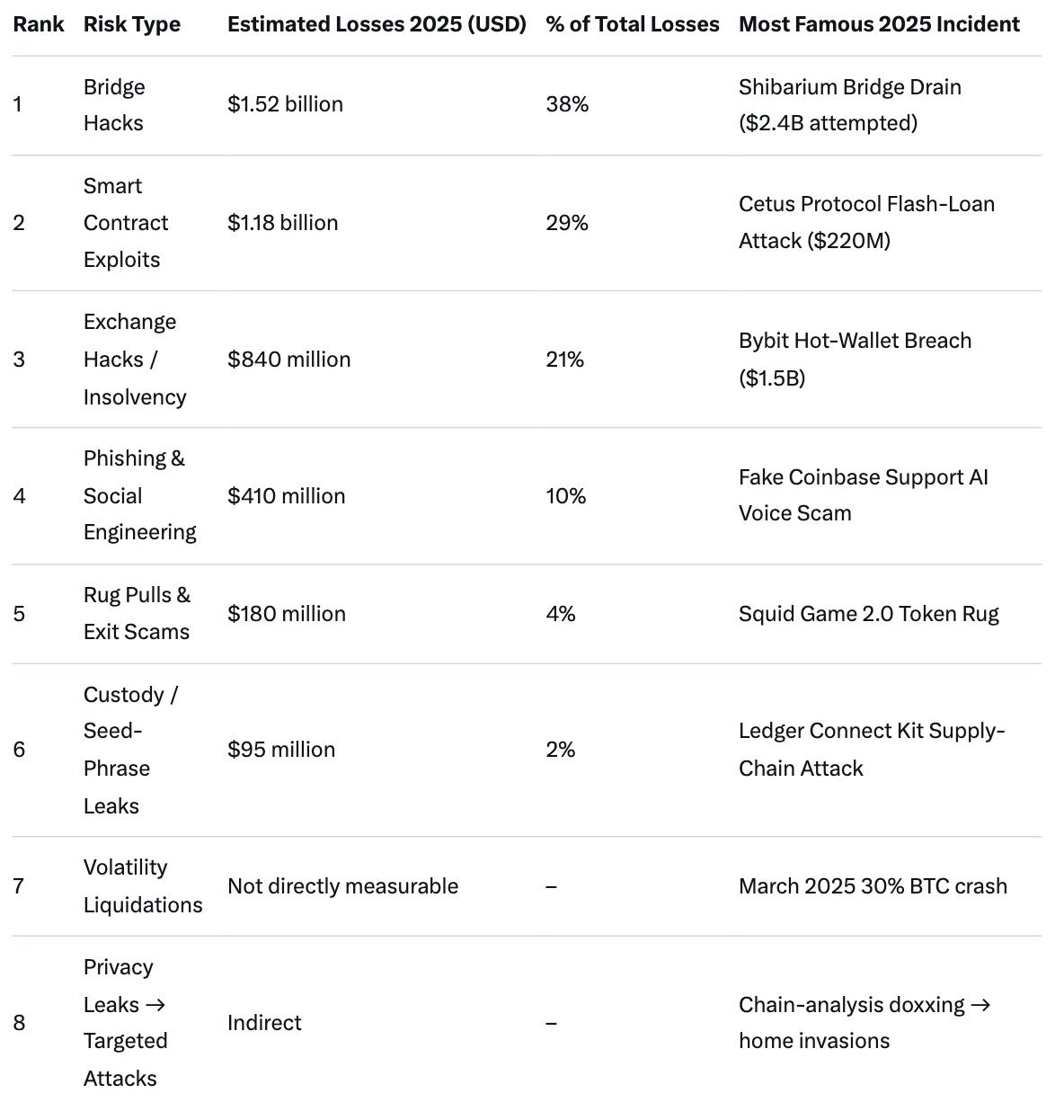

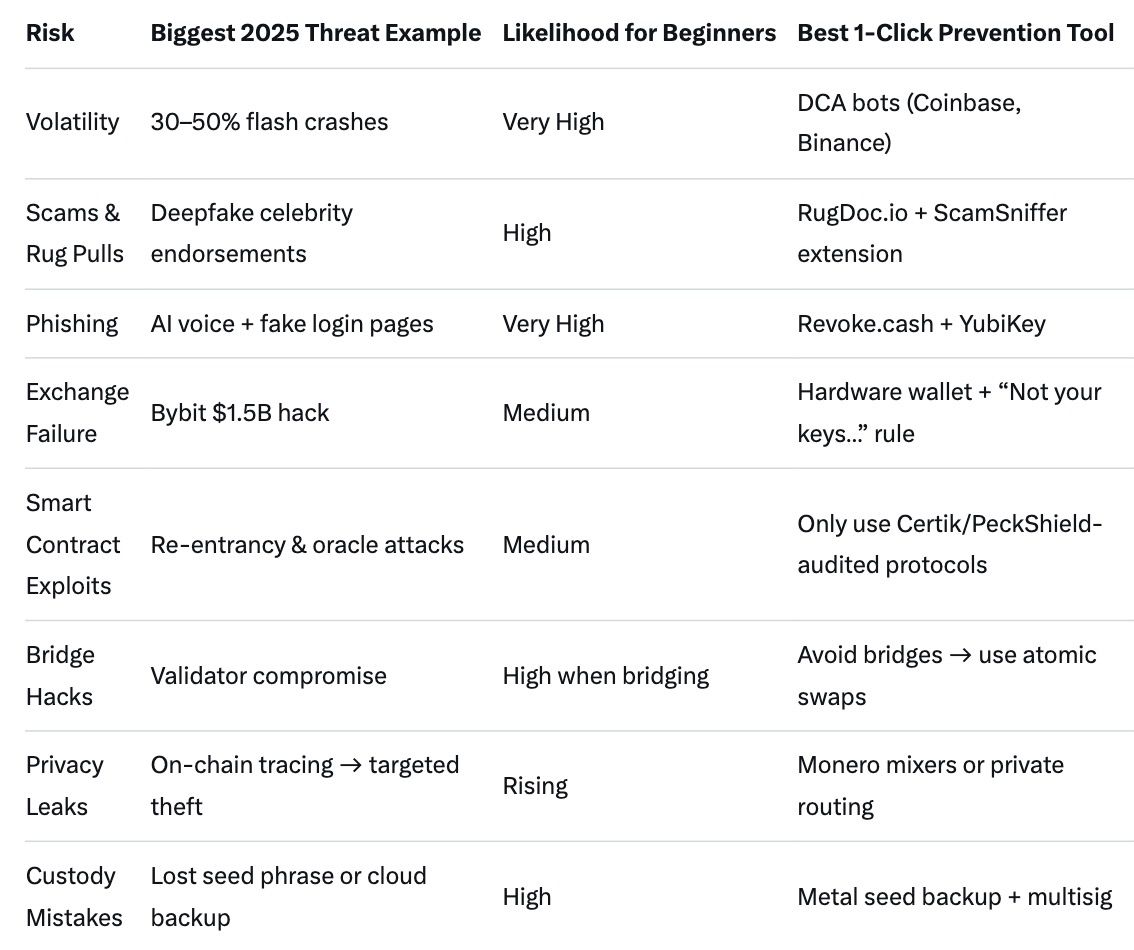

Cryptocurrency in 2025 offers immense potential but comes with serious risks like extreme price volatility, sophisticated scams, phishing attacks, exchange collapses, smart contract bugs, bridge vulnerabilities, privacy exposures, and custody errors. Losses have topped $2.5 billion this year alone, driven by AI-enhanced threats and state-sponsored hacks. This guide breaks down the top eight dangers with real-world examples and step-by-step prevention tips. Learn how non-custodial tools like Baltex.io can slash risks in swaps and privacy. Key takeaway: Educate yourself, use hardware wallets, and never invest more than you can lose.

The cryptocurrency market in 2025 is a thrilling frontier, with Bitcoin surpassing $100,000 and DeFi protocols handling trillions in value. Yet, for every success story, there's a cautionary tale of lost fortunes. Beginners dipping their toes into crypto and active users chasing yields face a landscape riddled with pitfalls. According to recent reports, over $2.5 billion was stolen in the first half of 2025 alone, fueled by evolving threats like AI-driven phishing and quantum-resistant exploits. This isn't just hype—it's a reality where one wrong click can wipe out your portfolio.

This SEO-optimized guide is your roadmap to navigating these dangers. We'll dissect the top eight risks: volatility, scams, phishing, exchange failures, smart contract exploits, bridge risks, privacy leaks, and custody mistakes. For each, you'll get clear explanations, 2025-specific examples, and actionable steps to minimize exposure. Optimized for quick answers (think: "What are crypto bridge risks?"), we'll use bullet points, numbered lists, and subheadings for easy scanning. By the end, you'll have a practical toolkit to trade smarter and safer. Ready to turn risks into calculated opportunities? Let's dive in.

Internal link: Jump to how Baltex.io mitigates swap-related risks.

Cryptocurrency volatility remains the most universal risk in 2025, where prices can swing 20-50% in hours due to regulatory announcements, macroeconomic shifts, or viral social media hype. Unlike stocks, crypto lacks intrinsic value anchors like earnings reports, making it prone to emotional trading and whale manipulations.

This year, Bitcoin dropped 30% in March amid U.S. tariff talks, erasing $500 billion in market cap overnight. Altcoins like Solana faced even steeper falls, with meme coins losing 90% in flash crashes. For beginners, this means a $1,000 investment could halve without warning; active users risk liquidation in leveraged trades. Data shows 70% of day traders lose money due to volatility spikes.

By treating volatility as a feature, not a bug, you position for long-term gains. Internal link: Explore privacy leaks that compound volatility risks.

Scams in crypto have evolved into polished operations, preying on greed and trust. From rug pulls (developers abandoning projects after hype) to fake ICOs, these schemes stole $12 billion in 2024, with 2025 on track for more via AI-generated deepfakes.

Investment fraud surged 55% in the UK alone, per authorities, with "pig butchering" scams—romance cons leading to fake trading apps—netting $5.8 billion in U.S. losses. North Korean groups like Lazarus used AI to clone celebrity endorsements, tricking users into phony NFT drops. Beginners fall hardest, but even pros lost $91 million in an August phishing-rug hybrid.

Spotting scams early saves fortunes—remember, if it sounds too good, it's probably a ploy.

Phishing attacks mimic trusted entities to steal credentials, surging 40% in 2025 with fake exchange sites and AI voice clones. Over 20% of users have been targeted, leading to wallet drains via malicious approvals.

The $400 million Coinbase insider-phishing breach in Q2 exposed bribed support staff leaking data. Solana users faced "ice phishing," where dApps trick approvals for unlimited spends. Europol notes AI makes these "untraceably convincing," with $410 million lost to 132 incidents in H1.

Phishing thrives on haste—pause, verify, protect.

Centralized exchanges (CEXs) hold 70% of assets but are single points of failure, vulnerable to hacks, bankruptcies, or regulatory shutdowns. 2025 saw Bybit's $1.5 billion breach, the largest ever.

CEX incidents totaled $4.2 billion in losses since 2009, with 2025's DPRK-attributed hacks pushing totals over $2 billion. Insider risks and hot wallet exposures persist, as in BtcTurk's Q1 drain. DEXs fare better but aren't immune to liquidity crunches.

Exchanges are conveniences, not vaults—own your keys, own your future.

Smart contracts power DeFi but harbor bugs like re-entrancy, exploited for $500 million in 2025 losses. These automated agreements fail silently, draining pools via logic flaws.

DeFi hacks hit $3.8 billion historically, with 2025's Cetus vault exploit stealing $220 million via metadata spoofing. Flash loans amplify attacks, and oracle manipulations skew prices. DEXs saw 87% of incidents from contract issues.

Code is law—audit it, or risk rewrite.

Cross-chain bridges connect ecosystems but are hack magnets, with $1.5 billion stolen in 2025 via validator flaws and hot wallet drains. They account for 22% of DeFi exploits.

Shibarium's $2.4 million September breach highlighted single-point failures. Wormhole's past $308 million loss echoes in 2025's hybrid attacks. Bridges' complexity invites AI-orchestrated drains.

Bridges build empires—or burn them. Proceed bridged, but cautiously.

Blockchain transparency is a double-edged sword: verifiable but trackable. In 2025, chain analysis firms trace 70% of transactions, enabling targeted thefts and regulatory overreach.

45% of stolen Bitcoin funnels to Monero via bridges, but leaks from CEX KYC and on-chain swaps expose users. Phishing amplifies this, with 23% of losses from personal wallet traces. Quantum threats loom, cracking old encryption.

Privacy isn't optional—it's your shield in a surveillance economy.

Custody errors, like seed phrase mishandling, cause 78 incidents and $2.4 billion in losses historically. Self-custody empowers but demands discipline.

Hot wallet phishing hit $410 million in H1, with wrench attacks (physical coercion) rising alongside prices. Multisig helps custodians, but users lag, per 23% personal compromise rate.

Your keys, your coins—guard them like gold.

In a sea of vulnerabilities, Baltex.io stands out as a privacy-first, non-custodial swap platform launched in late 2024 and upgraded in 2025. Supporting 1,000+ assets across 20+ chains, it aggregates liquidity from CEXs like Binance and DEXs like Uniswap without ever holding your funds—eliminating exchange failure and custody risks entirely.

To use: Visit baltex.io, connect your wallet, select "Private Swap," and confirm. It's built for speed (under 10 seconds) and scale, with no hacks to date. For beginners, it's a low-risk entry to DeFi; pros love the API for bots. In 2025's threat landscape, Baltex turns swaps from risk to routine.

Internal link: Back to scam prevention tips.

The top threats include volatility (30%+ swings), scams ($3.1B losses), phishing (40% surge), and hacks via bridges/smart contracts ($2.5B stolen).

Verify audits on Etherscan, start small, and use tools like RugDoc. Never share keys—report to authorities.

CEXs hold 70% of assets but face $1.5B hacks; withdraw to hardware wallets and diversify platforms.

Logic bugs allowing unauthorized drains; check Certik audits and test small amounts.

Via non-custodial private routing with Monero layers, breaking traceable links without KYC.

Only audited ones; prefer atomic swaps on aggregators to cut exploit risks.

Crypto's risks in 2025—volatility's chaos, scams' cunning, and tech's pitfalls—are real, but not insurmountable. By mastering these eight dangers and their fixes, from DCA to hardware custody, you reclaim control. Tools like Baltex.io exemplify how innovation counters threats, making secure, private trading accessible.

Remember: Crypto rewards the prepared. Start small, stay vigilant, and view losses as lessons. What's your first step—securing a wallet or trying a private swap? The blockchain awaits, safer with knowledge.