Bitcoin's 21 million supply cap will be reached around 2140, ending new coin issuance. Miners will then rely entirely on transaction fees for revenue, fostering a mature fee market. Network security remains viable if adoption drives sufficient transaction volume, supported by Layer-2 solutions like Lightning Network. Halvings gradually prepare this transition; realistic outcomes include consolidated mining and higher fees for priority, sustaining Bitcoin as a deflationary store-of-value.

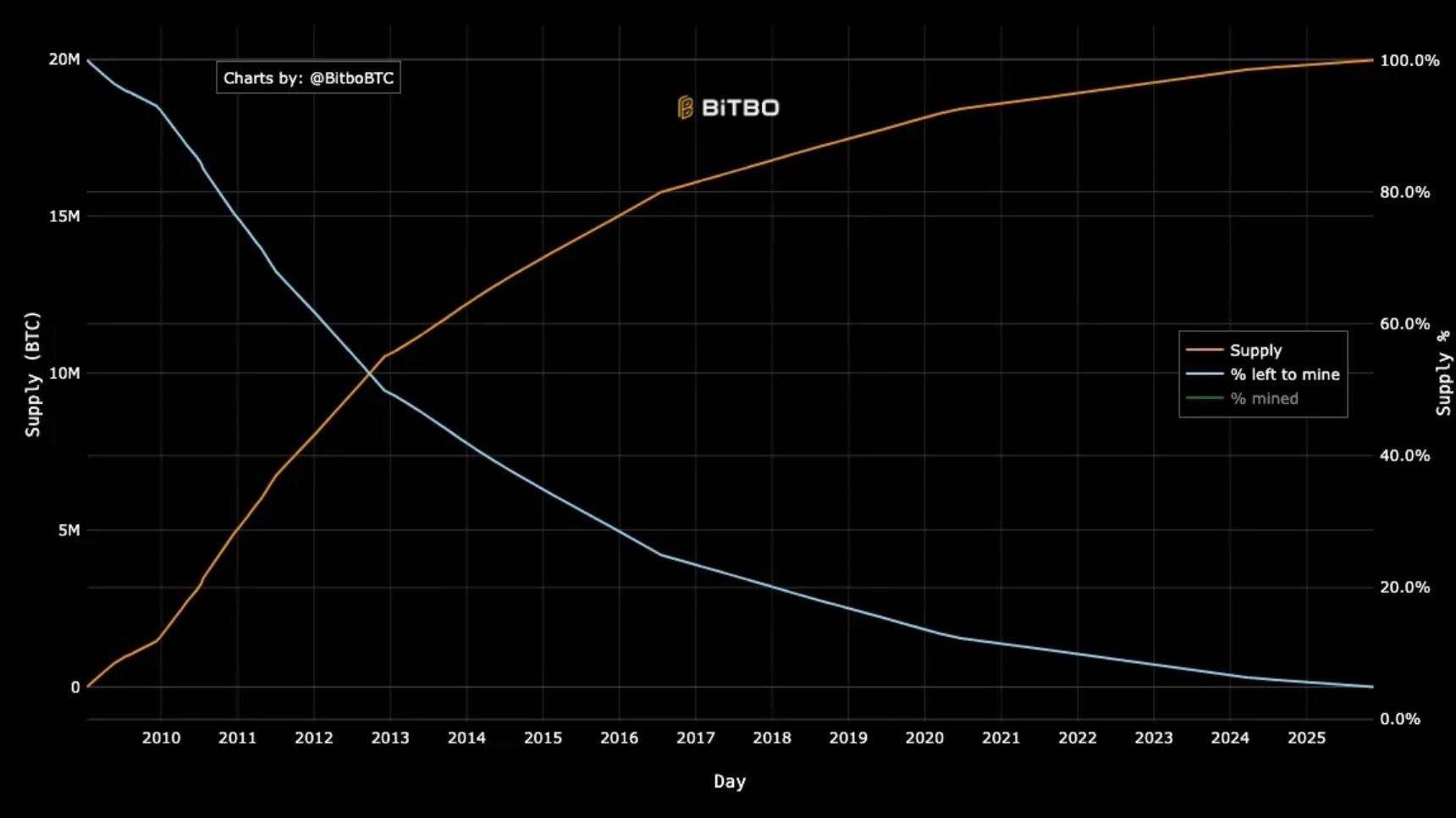

Bitcoin's protocol limits total supply to 21 million BTC. As of December 2025, approximately 19.8 million BTC have been mined, leaving about 1.2 million remaining. The last fractions will be issued around 2140 after 33 halvings.

Halvings reduce the block reward every 210,000 blocks (~4 years):

This predictable schedule ensures scarcity, transitioning incentives from new issuance to fees.

Halvings cut new supply, historically correlating with price appreciation due to reduced inflation. Post-halving, inefficient miners exit, hash rate dips temporarily, then recovers as difficulty adjusts.

In 2025, current hash rate fluctuates around 900-1,000 EH/s, down from peaks due to regional factors, but resilient overall. Daily issuance: ~450 BTC (3.125 × 144 blocks).

Long-term: Halvings force efficiency, consolidating mining into professional operations using advanced ASICs and renewable energy.

After the final halving, block subsidies end—no new BTC. Miners earn solely from transaction fees included in blocks.

Current (2025): Subsidies dominate revenue (>80-90% in low-activity periods), fees variable but spiking during congestion.

Realistic transition: Fees must cover operational costs for sustained hash rate. Models show viability if transaction demand grows with adoption.

Bitcoin's fee market is auction-based: Users bid fees for inclusion; miners prioritize highest.

Today: Average fees low (~$1-5), but peaks drive revenue (e.g., past Ordinals surges made fees > subsidy temporarily).

Post-2140: Fees rise with demand. Layer-2 (Lightning, Ark) batches transactions, settling on-chain periodically—generating fees without congesting base layer.

Bitcoin security relies on economic cost of attacks exceeding benefits. Post-2140:

Realistic: Consolidation reduces 51% attack risks (fewer actors, higher coordination cost). Layer-2 inherits base security.

Challenges: Low usage could weaken security—but failure of adoption would devalue BTC anyway, self-resolving.

In a post-2140 fee-focused Bitcoin, maintaining liquidity across ecosystems is key—high on-chain fees may push activity to L2 or cross-chain.

Baltex.io enables non-custodial, instant swaps for BTC and wrapped variants:

For holders/investors: Seamlessly move BTC for yields or payments, preserving value in fee-variable environments. Explore at https://baltex.io.

Q: When will the last Bitcoin be mined? A: Around 2140, after final halving fractions.

Q: Will Bitcoin be secure without new rewards? A: Yes, if fees from adoption sustain mining; Layer-2 aids.

Q: How do halvings affect price? A: Historically upward pressure from scarcity.

Q: What role does Lightning Network play? A: Off-chain scaling, generating on-chain fees.

Q: Could fees become too high? A: Market balances; priority for valuable txns.

Q: Is tail emission needed? A: No—design intends fee-only; changes unlikely.

By 2140, Bitcoin evolves into a fully mature, fee-sustained network—scarce, secure, and deflationary. Halvings prepare this shift; realistic outcomes hinge on continued adoption driving fees and innovation like Layer-2. For holders and investors, this reinforces Bitcoin's store-of-value thesis, with tools enhancing liquidity in evolving economics.