A crypto swap exchange is a service or platform that lets you trade one cryptocurrency for another right away, often without needing to convert to a government-issued currency first. Think of it like trading baseball cards: instead of selling your card for cash, then using that cash to buy a different card, you swap them directly.

Many traders love these services because they can be quicker, especially if you frequently exchange between multiple coins. Plus, some crypto swap exchanges do not require long sign-up procedures, which can be a breath of fresh air if you value privacy or want to avoid a lengthy approval process. However, not all swap exchanges are the same, so you’ll want to explore their differences to find the one that suits you best in 2025.

When deciding on the best crypto swap exchange in 2025, you’ll quickly notice that each platform boasts its own unique set of features. It can be overwhelming to compare them all, so here are five major factors to keep in mind. Spend a moment reflecting on which matters most to you—then use those details to shortlist potential platforms.

Fees can eat into your profits faster than you might think. Most swap platforms either charge a fixed percentage fee on each trade, or they build the fee into their exchange rate. Here’s what to watch for:

You might want to try smaller test transactions to see if the numbers add up. If a platform says it’s fee-free, you’ll likely find a spread that effectively means you’re still paying something.

Liquidity measures how quickly and easily you can swap one crypto for another without drastically affecting the price. A platform with high liquidity means:

If you’re trading popular coins like Bitcoin (BTC) or Ethereum (ETH), liquidity will rarely be a problem on major platforms. But if you’re swapping newly created or niche tokens, you’ll want an exchange that has strong liquidity pools. Decentralized exchanges (DEXs) often rely on something called automated market makers (AMMs), which use liquidity pools to quote prices. Centralized or hybrid platforms rely on order books—like a big chart of bids and asks.

No one wants to watch a spinning wheel for hours, especially if the market is moving. Swap speed and platform performance hinge on a few things:

In many cases, you’ll see near-instant trades, but the final settlement time can stretch to a couple of minutes or hours depending on the network.

Some traders value privacy above all else. Although many of the best crypto swap exchanges in 2025 may still ask for basic “Know Your Customer” (KYC) details, a few platforms let you trade smaller amounts with minimal verification:

Privacy is more than just ID checks, though. Consider how transparent the exchange is with your transaction history. Public blockchains display every transfer. If you want more anonymity, you may look for privacy-focused coin swaps or platforms that don’t store your data.

Security is a must when you’re dealing with digital assets. Here are the top points to keep on your radar:

Remember to store your coins securely after a swap by transferring them to your own wallet, if possible.

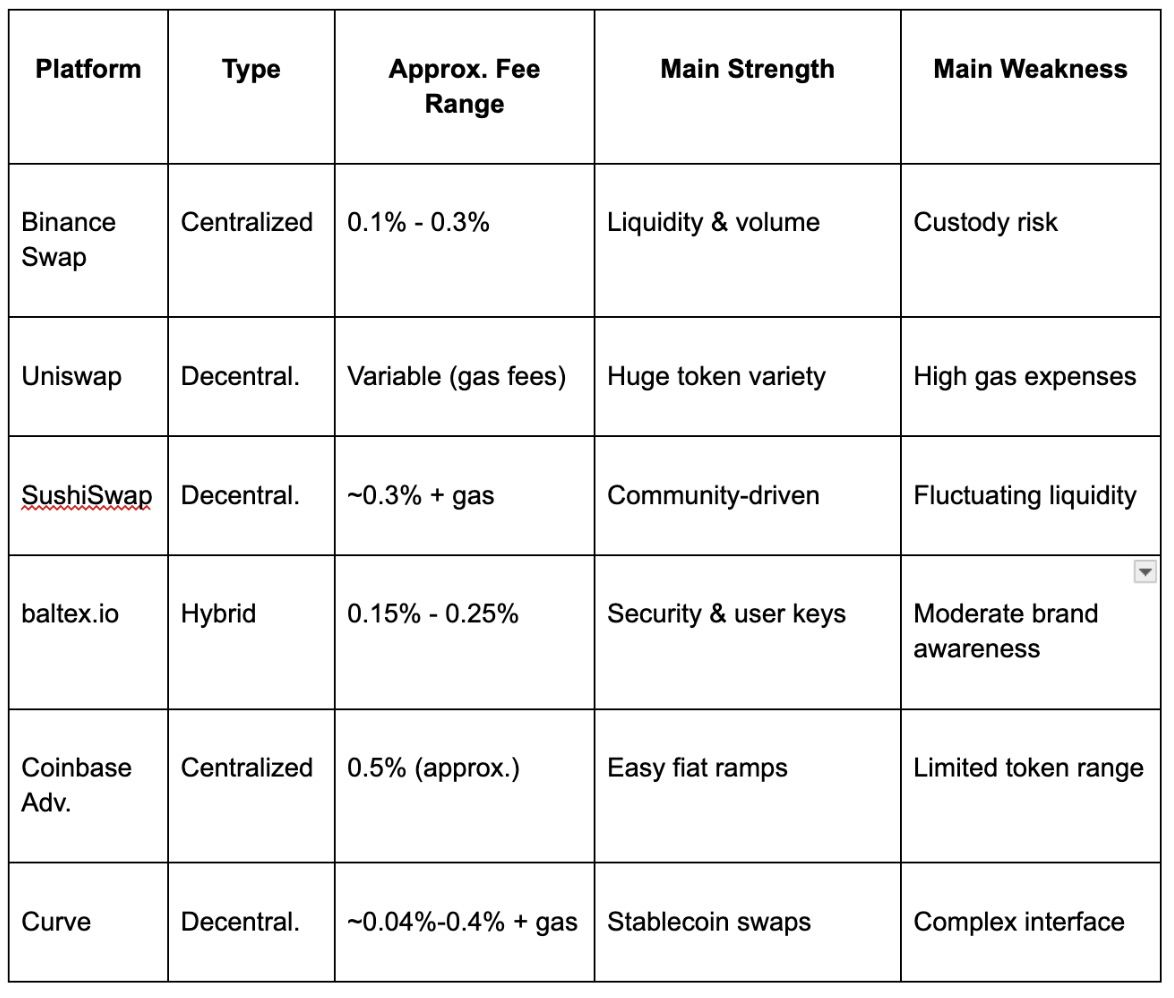

In 2025, the crypto space is more crowded than ever, with new platforms springing up and established names evolving to keep pace. Below is a brief list of exchanges and DEXs that many traders find effective. Note that actual fees and features can shift quickly, so always verify the latest details before trusting your funds to any platform.

Below is a succinct comparison of some prominent choices. The numbers shown (fees, swaps per second, etc.) are approximate and can change. Always check the official websites for exact info.

You might be wondering if there’s a middle ground between fully centralized services and decentralized ones. Hybrid exchanges like baltex.io aim to combine the best of both worlds:

In practical terms, a hybrid exchange might handle your trades quickly but never fully control your funds. That can help you sleep easier at night, knowing that a hack on the exchange’s servers won’t necessarily drain your wallet. Of course, no platform is 100% risk-free, so always confirm which coins are supported for self-custody, read user experiences, and keep your wallet software updated.

Below you’ll find some frequently asked questions that pop up when people are trying to choose the best crypto swap option. If there’s something on your mind that isn’t covered, consider looking at community forums or the support sections of your target platforms.

A: Traditional exchanges are fine, but they might force you to trade crypto for fiat, then fiat for another crypto. That might rack up fees, time, and complexity. A swap exchange eliminates the middle step, saving you money, especially if you do cross-crypto trades regularly.

A: Decentralized exchanges let you keep your private keys, which means you retain control of your coins. This reduces the risk of losing everything if the exchange is hacked. On the other hand, DEXs rely on smart contracts and can be vulnerable if the code has undetected bugs. Meanwhile, centralized platforms often have large security budgets but place control of your private keys in their hands.

A: Check online reviews, social media discussions, and official announcements. Be cautious with brand-new or obscure platforms promising unrealistically low fees or too-good-to-be-true token deals. If you see repeated red flags—like inconsistent withdrawal times or user reports of missing funds—steer clear.

A: Not anymore. While Ethereum hosts some of the most famous DEXs like Uniswap and SushiSwap, other chains like Binance Smart Chain, Polygon, and Solana have their own decentralized swap ecosystems too. Each chain has different transaction costs, speeds, and complexities.

A: It depends. Centralized platforms often require comprehensive identification details to comply with financial regulations. Decentralized ones typically do not. Hybrid exchanges fall somewhere in the middle, sometimes allowing lower-limit trades without KYC but requiring verification for higher amounts.

A: If you decide you don’t like a platform or find its fees too high, you can always move on. The beauty of the crypto world is that you can transfer your coins to another exchange, although you may lose a bit on network fees. It’s wise to test any exchange with a small amount of crypto first.

Choosing the right swap exchange involves balancing your priorities. Are you more focused on privacy, or would you rather have a big market with lots of liquidity? Are you comfortable with the do-it-yourself style and potential learning curve of decentralized platforms, or do you prefer user-friendly dashboards?

Below is a simplified decision approach you can follow:

Think of it like buying a car. Some want better mileage, others focus on horsepower, but rarely do you get both at the highest level. You compromise based on what matters most to you. Once you see the differences, you’ll feel more confident about moving forward.

Because security is such a critical point, let’s expand a bit on how you can safeguard your coins, regardless of the exchange type you choose:

Below are a few cautionary points for anyone entering the world of crypto swaps. Awareness of these can save you headaches (and funds) in the long run.

Imagine you’re holding a bag of altcoins, and the market is suddenly shifting. You decide to quickly move your altcoins into a stabler asset like a stablecoin (USDT or USDC). On a high-traffic day, networks might clog and fees can spike. If you’re on a fully decentralized exchange running on an expensive chain, you could end up paying high gas fees or waiting for hours if you set your gas fee too low.

Alternatively, a hybrid platform or a centralized system might handle your swap internally in seconds for a set fee. Of course, that means trusting the exchange with your private keys or at least letting them handle the transaction. The pleasant surprise is that with the right hybrid exchange (like baltex.io), you may keep control of your private keys for certain token pairs while still benefiting from quick, on-chain or near-instant settlement.

If you’re new to this, don’t worry. Here are some beginner-friendly ideas:

Below is a short Q&A addressing a few nuanced points that often emerge when you’re balancing all these choices.

A: Baltex.io typically supports major cryptocurrencies like BTC, ETH, plus a variety of ERC-20 tokens. It also offers cross-chain swaps for certain popular blockchains. Check their latest supported list to confirm your coin is on it.

A: If the blockchain network is undergoing a major upgrade (like a hard fork), some exchanges might pause trading to avoid chaos. You’ll usually see an announcement on the official site or social channels. During that time, you can’t swap those tokens until the exchange reopens the market.

A: Yes. Even though you’re swapping directly between two cryptocurrencies, market trends and technical analysis can help you anticipate favorable conditions. That being said, always remember that crypto markets can be extremely volatile. No chart can promise guaranteed outcomes.

Choosing the best crypto swap exchange in 2025 comes down to your personal preferences, risk tolerance, and desired level of control. Centralized giants provide liquidity and ease, but you might compromise a bit on anonymity or custody. Decentralized solutions put you in control of your private keys, but the user interface and potential for higher transaction fees can pose challenges. Hybrid solutions like baltex.io aim to balance these extremes, giving you both control and convenience.

Ultimately, there’s no one-size-fits-all solution. You’ll want to do your homework, test with small amounts, and keep track of each platform’s reputation over time. By focusing on fees, liquidity, speed, privacy, and security, you’ll find a platform that matches your swapping style. And when in doubt, remember that you can always diversify across multiple platforms to spread risk. With some research and realistic expectations, you’ll navigate the crypto swap space smoothly and confidently. Good luck with your trades!