You want to trade crypto fast without getting tangled in high fees or confusing interfaces. Maybe you’re new to the scene and just want a straightforward swap. Or maybe you’re already juggling multiple tokens and need a quick solution when markets get busy. In either scenario, top-rated crypto trading platforms can make a big difference in your experience.

Below, you’ll find a rundown of ten notable swapper platforms, each with a focus on transaction speed, user experience, and overall reliability. After that, we’ll dig into what sets Baltex apart, answer common questions in our FAQ, and wrap up with a final note on how to pick the platform that’s right for you.

Hope you’re excited to find your new go-to exchange. Let’s walk through each platform and see what makes them tick.

Binance is one of the largest cryptocurrency exchanges by trading volume, and it’s a favorite for both novices and power users. Its wide selection of coins, advanced trading features, and vibrant community make it a prime spot for swapping tokens quickly.

Q: Is Binance beginner-friendly? A: Most people find Binance’s interface manageable, though it can feel cluttered. A “Lite” version of the app helps you skip the more advanced charts if you just want to convert tokens with a few taps.

Q: How fast are Binance trades? A: Binance is known for high capacity, capable of processing over a million transactions per second in theory. In practice, trades typically go through almost instantly, especially for popular pairs like BTC/USDT. However, during extreme market volatility, you might experience short lags.

Coinbase is often the first stop for newcomers, thanks to a user-friendly design that resembles a standard fintech app. It’s well-regarded for handling fiat conversions, so you can easily top up your account with credit cards or bank transfers.

Q: What is Coinbase known for? A: Coinbase stands out for its super-clean dashboard and top-notch security track record. If you’re dipping your toes into crypto, Coinbase’s straightforward buy-and-sell tools are tough to beat.

Q: Are transaction fees high? A: Coinbase’s fees can be on the higher side compared to other platforms, especially if you use a debit card. However, you can get lower fees on Coinbase Pro (their advanced trading interface), which still has a decent learning curve but offers more control over your orders.

KuCoin originally gained popularity for listing smaller, up-and-coming tokens, making it a paradise for traders seeking hidden gems. Over the years, it has upgraded its interface and boosted liquidity, but it remains somewhat less regulated in some regions.

Q: How user-friendly is KuCoin? A: KuCoin’s interface isn’t quite as bare-bones as Coinbase, but you’ll find it easy enough to navigate. Their instant exchange tool is straightforward, allowing near-instant swaps for a streamlined set of pairs. If you need advanced options, a detailed Pro mode is also available.

Q: Is KuCoin safe? A: KuCoin has improved its security measures after a major hack a few years back. Now, it stores most customer assets in cold wallets and employs multiple authentication factors. That said, always make sure to enable 2FA and consider transferring large holdings to a secure personal wallet.

Kraken is based in the US and touts its strict regulatory compliance. It’s known for robust security, advanced trading tools, and support for fiat currencies like USD and EUR. While not the flashiest platform, it’s a regular contender for reliability.

Q: How speedy are trades on Kraken? A: Kraken processes trades quickly, though not quite at the breakneck speeds of Binance. For the majority of users, it’s more than enough. Wait times can increase during surges, but overall throughput is solid.

Q: What about deposit and withdrawal speeds? A: Fiats are deposited via SEPA or wire transfers, which can be a bit slow in some regions. Crypto deposits, on the other hand, are confirmed as soon as the required confirmations have passed. Withdrawals are typically settled in under an hour for most crypto assets.

Bybit started as a derivatives-focused exchange specializing in perpetual futures. Over time, it has expanded into spot trading and introduced fast swap features. This platform is popular among experienced traders who appreciate advanced tools and leverage options.

Q: Is Bybit beginner-friendly? A: If you’re just looking for a simple swap from one token to another, Bybit’s spot trading layout might feel more advanced than necessary. That said, they have introduced a quick swap tool that streamlines the experience. For derivatives, you’ll likely need a bit of background knowledge.

Q: Does Bybit require KYC? A: Bybit has historically allowed trading with minimal verification, but regulations have been tightening. Depending on your region, you may need to complete various KYC steps, especially if you trade larger volumes or want access to all platform features.

OKX (formerly OKEx) is another top-tier crypto exchange that provides a rich variety of tokens, margin trading, and other advanced features. Its quick “Convert” tool functions like a swap service, ensuring rapid token exchanges without complicated order forms.

Q: What speeds can I expect on OKX? A: Internal conversions happen swiftly, often in a second or two, and OKX claims high throughput for matching trades on the open market. Blockchain confirmation times still apply when withdrawing to external wallets, so keep that in mind.

Q: Are trading fees competitive? A: OKX has tiered fees that depend on how much you trade in a 30-day window. Newcomers might pay a bit more than on some other exchanges, but the difference isn’t huge unless you’re doing large daily volume.

Baltex is not as widely recognized as Binance or Coinbase, but it has been gaining traction quickly for its blend of speed, intuitive design, and competitive rates. The streamlined dashboard appeals to crypto newbies, while advanced traders can access more granular options.

Q: What appeals to newcomers on Baltex? A: Baltex’s quick swap module is straightforward. You select the token you have, pick the one you want, and confirm. The interface is uncluttered, making it easy for you to avoid the confusion of advanced trading charts.

Q: How does Baltex handle liquidity? A: Baltex aggregates prices from multiple sources, aiming to reduce slippage on trades. Users typically find the spreads quite reasonable, especially for mainstream coins. For lesser-known tokens, liquidity can be thinner but is often sufficient for moderate trades.

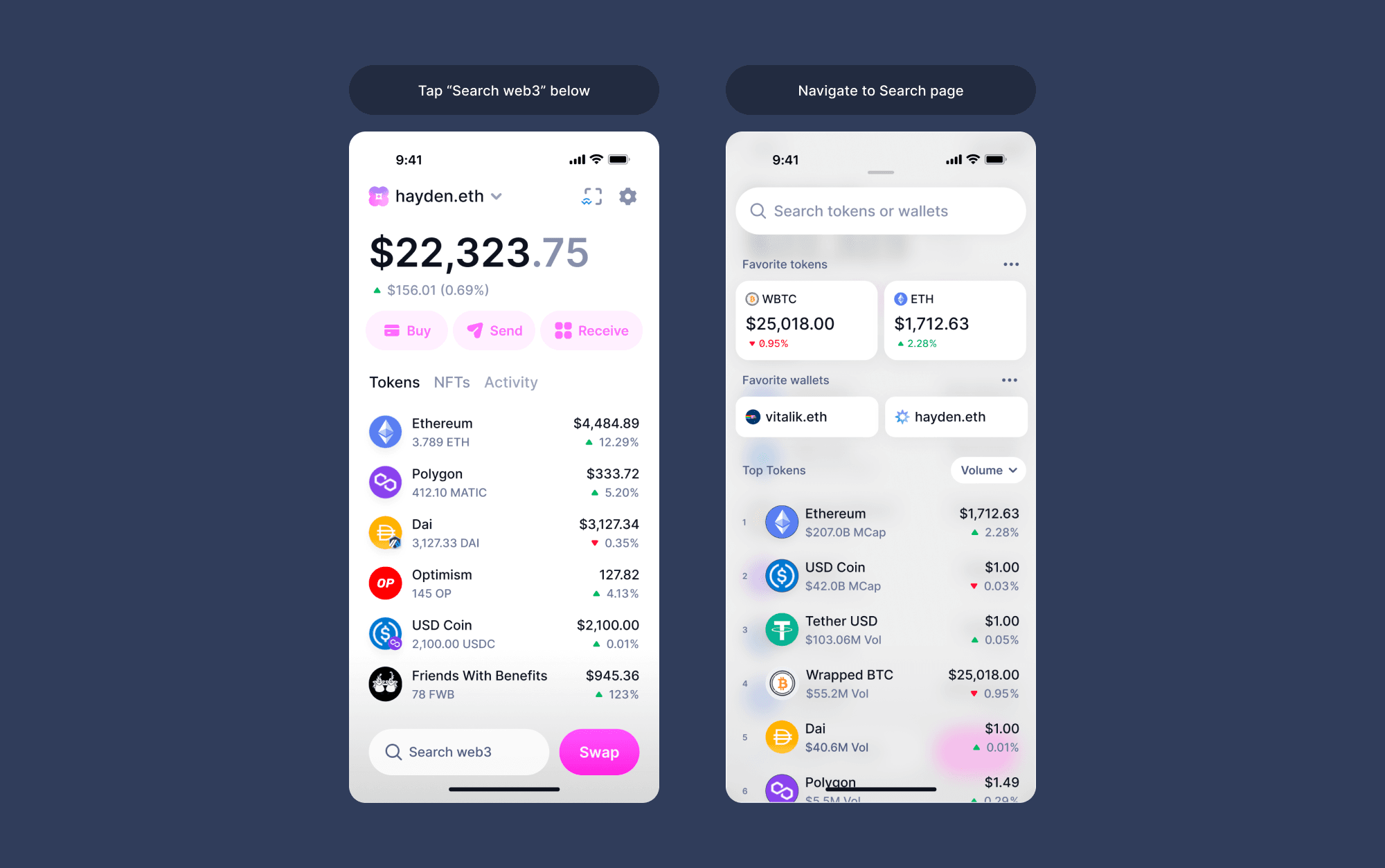

Uniswap is a leading decentralized exchange (DEX) on the Ethereum network. You trade directly from your personal wallet, maintenance is purely on-chain, and there’s no single entity holding your funds. This approach can be safer in principle, but gas fees can spike.

Q: How fast do Uniswap swaps process? A: Speeds depend on Ethereum network congestion. During busy times, a single transaction might take minutes unless you pay for a higher gas fee. When the chain is less congested, trades can go through in under a minute.

Q: Is Uniswap user-friendly? A: The front end is extremely simple, but you’ll need to connect a Web3 wallet like MetaMask. You also need Ether for gas fees, which can cause confusion for first-timers. Once you get the hang of it, though, it’s a breeze.

SushiSwap is another decentralized exchange that branched off from Uniswap’s code. It has since evolved with extra features like yield farms and staking. Many traders use SushiSwap to access tokens not easily found on centralized platforms.

Q: What about transaction speeds? A: Like Uniswap, SushiSwap relies on Ethereum, so your swap speed hinges on that blockchain. On layer-2 solutions (like Arbitrum or Polygon versions of SushiSwap), you may experience faster confirmations while paying lower fees.

Q: Does SushiSwap have a good reputation? A: SushiSwap had a dramatic launch process, but the community has stabilized and continues to enhance the protocol. Most security incidents related to bridging or third-party exploits, not SushiSwap itself. Still, remember that decentralized protocols come with their own risks.

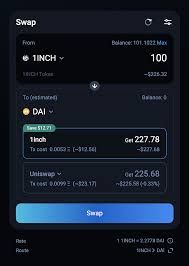

1inch operates as a DEX aggregator, scanning multiple decentralized exchanges to offer you the best price for your swap. It’s a great pick if you want maximum efficiency on ERC-20 trades, though you still face gas fees when the Ethereum network is at peak usage.

Q: Why use 1inch instead of a single DEX? A: 1inch routes your trades across various liquidity pools, often splitting the order to get the most favorable price. You could do that manually, but 1inch saves time and usually cuts costs on slippage.

Q: Any downsides to 1inch? A: You’ll need a Web3 wallet, as with other DEXs, and you remain subject to the blockchain’s transaction fees. Occasionally, 1inch’s routing can get complex, leading to multiple contract interactions that might slightly raise gas costs.

Baltex may be relatively new, but it’s winning over users who crave fast transactions and a straightforward swap interface. Let’s be honest: a lot of exchanges make big promises about simplicity, but sometimes you land on a homepage crammed with charts and confusing levers.

Baltex’s core philosophy hinges on clarity. You select the token you have, choose the token you want, and press “Swap.” That’s it. If you’re thinking, “But I’m no crypto wizard, can I still figure it out?” Absolutely. Beginners often find Baltex less intimidating than more established platforms.

Beyond user-friendliness, Baltex merges modern security protocols with multi-layer authentication. The platform frequently publishes updates about how they keep user funds protected, which is a breath of fresh air in an industry that’s sometimes opaque.

On the speed side, Baltex invests heavily in technology to match orders in near real-time. Swaps for high-volume coins typically finalize in a second or two. And for obscure tokens, Baltex taps liquidity from multiple sources to keep slippage to a minimum. If you’re swapping an altcoin that’s not commonly listed, you won’t always find large liquidity pools here. However, for top-tier tokens and many mid-range assets, Baltex’s aggregator approach tends to do the trick.

Finally, the future roadmap looks promising. Company updates mention the possibility of a built-in DEX aggregator for tokens not directly listed, plus potential expansions into futures trading. All of that signals that Baltex isn’t just a one-trick pony, but a platform aspiring to deliver robust, well-rounded services.

Below, you’ll find some of the most pressing questions about speed, fees, and general usage when choosing a platform to swap crypto.

Which platform is the fastest? Speed can be subjective. Binance and Baltex typically process trades in near real-time. On the decentralized side, Uniswap or SushiSwap speed depends on the blockchain.

How do fees work? Fees vary by platform and trade type. Centralized exchanges often charge a percentage or a flat fee. Decentralized ones charge network gas fees plus possible protocol fees. Always confirm the final cost before hitting “Swap.”

Do I need KYC on each platform? For many centralized exchanges (Binance, Coinbase, Kraken), you do need to verify your identity, especially if you want to deposit or withdraw large amounts. Some DEXs (Uniswap, SushiSwap) don’t require KYC because trades are purely on-chain. Bybit, KuCoin, and OKX may still offer partial no-KYC trading but with limitations.

Which exchange has the widest coin range? KuCoin is known to list tons of smaller tokens. DEXs like Uniswap essentially let you swap any ERC-20 token as long as there’s a liquidity pool. Baltex covers a wide spectrum of mainstream and mid-range tokens, aiming for balanced coverage.

Are decentralized exchanges safer? DEXs never hold your funds, which reduces custodial risk. However, you’re responsible for your own wallet security, and smart contract exploits can happen. Centralized exchanges typically insure user balances to an extent, but hacks remain a risk if wallets are compromised.

How do I choose the right platform for speed? If speed is your top priority, check the exchange’s typical transaction load and network congestion. Platforms like Baltex, Binance, and Bybit specialize in quick matching engines. If you prefer a DEX, you might try layer-2 solutions or alternative blockchains with faster block times.

Can fees eat up small trades? Absolutely, particularly on Ethereum-based DEXs during high network traffic. In that case, near-instant trades might cost more in gas than the tokens are worth. If you’re making a small swap, try a centralized exchange or a cheaper blockchain like Polygon.

Is it worth using aggregator platforms? Aggregators such as 1inch or Baltex’s aggregator (once fully available) can be handy if you want the best possible price with minimum fuss. They search multiple liquidity sources so you don’t have to.

Will I get better prices with limit orders? On centralized exchanges, a limit order lets you set your desired price, which can help you skip heavy market slippage. DEXs rely on liquidity pools, but some also offer limit-order functionality through specialized smart contracts.

Should I keep my coins on an exchange? It’s generally recommended to move large holdings to a private wallet for security. Exchanges are handy for quick swaps or active trading, but you risk losing funds if the exchange encounters a hack or insolvency.

How do I handle unexpected downtime? Big spikes in crypto trading can cause exchange overload. If you notice trading disruptions, log out, wait, and try again. Having multiple exchange accounts and a DEX backup ensures you can still make a swap if one service is overloaded.

Which platforms support direct fiat deposits? Coinbase, Kraken, and Binance accept common fiat currencies. Baltex plans to offer direct fiat access soon, but confirm the latest news on that front. DEXs don’t handle fiat directly; you need a separate on-ramp.

How can I protect myself from platform hacks? Use strong passwords, enable two-factor authentication (2FA), and be aware of phishing sites. Reputable exchanges (even if less flashy) typically invest heavily in cybersecurity. Baltex, for instance, shares regular updates on security audits.

What are typical wait times for first withdrawals? Many platforms, including Bybit, require you to complete essential KYC checks. Once you pass, withdrawals can happen within a few minutes to an hour, depending on internal review processes.

Is there a best platform for day trading vs. casual swaps? Day traders might appreciate advanced tools and high liquidity on Binance, Bybit, or Kraken. If your goal is a quick and straightforward swap, Baltex or Coinbase’s “Convert” feature might feel simpler.

Finding the right swapper platform can save you time, money, and a hefty dose of frustration. From the convenience of Coinbase to the deep liquidity of Binance, each exchange caters to different needs. If you’d rather skip feature overload and focus on speedy transactions, Baltex is certainly a platform worth exploring. It combines straightforward design with near real-time trade execution, ideal for both newcomers and experienced traders.

Ready to give Baltex a try? Head over to baltex.io and see if it fits your style. And if there’s one piece of wisdom to keep in mind, it’s to explore a few platforms before settling on one. Crypto is all about flexibility—so make sure you pick an exchange that aligns with your goals and keeps you moving at the pace you need. Always remember to practice good security habits, understand the fee structure, and stay informed about evolving regulations. Happy swapping!