In 2025, stablecoins dominate DeFi with a staggering $230 billion market cap, outpacing Visa and Mastercard in transaction volume and powering everything from cross-border remittances to yield farming. But in this $1.25 trillion monthly liquidity ocean, inefficient swaps can still nibble at your returns through slippage or fees—up to 1-2% on illiquid pairs. Enter stable swaps: specialized automated market maker (AMM) mechanisms designed for pegged assets like USDT, USDC, and DAI, minimizing price impact for near-pegg swaps.

This 2,500-word SEO guide demystifies what a stable swap is, breaks down how stablecoin AMMs like Curve and Balancer operate, and arms crypto users and DeFi traders with strategies to slash slippage and fees. We'll compare top platforms, explore liquidity models, and highlight Baltex.io as a multi-chain powerhouse. Packed with featured-snippet-friendly tables, lists, and pro tips, it's your blueprint for efficient stablecoin trading in 2025's multi-chain era.

A stable swap is a token exchange between stablecoins—cryptocurrencies pegged to fiat like the USD—optimized to maintain value stability during trades. Unlike volatile pairs (e.g., ETH/BTC), where constant product AMMs like Uniswap's x*y=k formula cause high slippage on large orders, stable swaps leverage specialized curves for assets trading near 1:1 ratios.

Why stable swaps matter in 2025: With stablecoin supply hitting $230B and transaction volumes at record highs, they're the lifeblood of DeFi. Users swap to access better yields (e.g., 5% APY on Aave vs. 3% on Compound), bridge chains, or dodge depegging risks. Per S&P Global, stablecoins now facilitate faster, cheaper cross-border payments, but without efficient swaps, even 0.1% slippage compounds to 10% annual losses on frequent trades.

Key Benefits:

Risks to Watch: Depegging events (e.g., USDT's 2022 scare) or oracle failures can amplify slippage. Always verify peg via tools like DefiLlama.

Stable swaps aren't new—Curve Finance pioneered them in 2020—but 2025's L2 boom and regulatory nods (e.g., GENIUS Act for payment stables) have made them ubiquitous. Learn how AMMs power this.

Automated Market Makers (AMMs) replace order books with liquidity pools and math. For volatiles, Uniswap's constant product works fine, but stables demand precision to avoid "toxic" slippage on near-identical assets.

Core AMM Mechanics:

Stablecoin-Specific AMMs:

2025 Evolution: Intents-based AMMs (e.g., CoW Protocol) use solvers to batch trades, reducing MEV and fees by 50%. For cross-chain, protocols like Symbiosis layer AMMs over bridges.

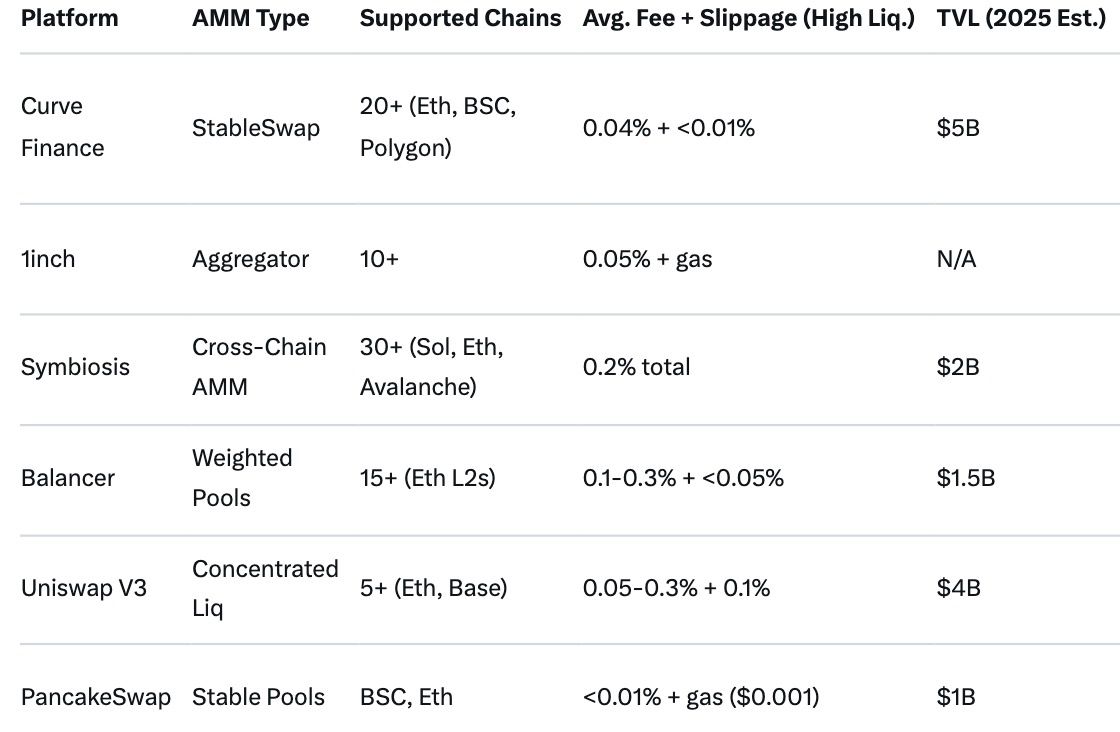

With 73+ DEXs, choosing the right one boils down to fees, chains, and liquidity. Here's a featured-snippet table of top stable-swap platforms, based on 2025 data from Koinly and TokenTax.

Curve leads for pure stables; 1inch aggregates for best rates. Explore liquidity models.

Liquidity underpins stable swaps—fragmented pools mean higher slippage. 2025 models evolve for efficiency:

2025 Trends: RWAs add $30B tokenized liquidity, per TRM Labs, with stables as collateral. Aggregators now use AI for predictive routing, minimizing 0.2% average slippage.

For DeFi traders: Prioritize TVL >$100M pools; check via Dune Analytics.

Slippage—the gap between expected and executed price—hits 0.5-2% on low-liq stables, per ChainUp. Fees (trading + gas) add another 0.1-1%. Here's how to cut them:

Slippage Mitigation:

Fee Reduction:

2025 Hack: Intents protocols like CoW execute at quoted prices, dodging MEV bots. Net savings: 1-3% per trade, compounding to 20%+ yearly.

In 2025's fragmented landscape, Baltex.io shines as a non-custodial aggregator for stable swaps, integrating Curve, 1inch, and Symbiosis across 200+ chains like Ethereum, Solana, TON, and Base. Supporting 10,000+ tokens including USDT/USDC, it optimizes routes for <0.2% effective costs—zero commissions, minimal gas via L2s, and slippage previews.

Why for Stables? Privacy routes (e.g., Monero-mixed) and instant execution without wrappers make it DeFi-trader gold. Users report 4x faster swaps than siloed DEXs, with real-time simulators dodging surprises. For cross-chain (e.g., USDC Eth to USDT Sol), it bundles AMMs + bridges, saving 2-5% vs. manual hops.

A low-slippage exchange between pegged stablecoins (e.g., USDC to DAI) using specialized AMMs like Curve to keep prices near $1.

They use hybrid curves (e.g., Curve's amplification) for <0.01% slippage on pegged assets, vs. Uniswap's higher impact.

Curve for on-chain; 1inch/Symbiosis for aggregation; Baltex.io for multi-chain efficiency.

Set 0.1% tolerance, trade high-liq pools, use aggregators, and split large orders.

No—0.01-0.3% trading + gas; aggregators like Baltex.io optimize to <0.2% total.

Yes—200+ chains, slippage minimization, non-custodial; ideal for efficient cross-chain trades.

Stable swaps aren't just a tool—they're the efficient engine driving $230B in stablecoin dominance, enabling seamless DeFi without volatility's bite. From Curve's precision AMMs to Balancer's flexibility, and aggregators like Baltex.io bridging chains, 2025 offers unprecedented efficiency.

Ditch high-slippage habits: Audit pools, leverage L2s, and aggregate routes to pocket 15-30% more yields. As IMF notes, stables are reshaping finance—swap smart to stay ahead. Ready to trade? Test a USDC swap on Baltex.io today.