As 2025 draws to a close, Web3 stands at a crossroads: no longer a speculative frontier, but a maturing ecosystem powering $4 trillion in market cap and 716 million crypto owners worldwide. At the heart of this transformation? Blockchain bridging. These cross-chain conduits have evolved from niche tools to indispensable infrastructure, enabling seamless asset flows across Ethereum's L2s, Solana's high-speed rails, and beyond. With bridges facilitating $74 billion in volume on platforms like Hyperliquid alone, they've unlocked interoperability, turbocharged liquidity, and bridged the gap to real-world adoption.

This 2,300-word SEO explainer dives into why blockchain bridging became the backbone of Web3 in 2025, tailored for crypto investors eyeing yields, DeFi users chasing efficiency, and Web3 builders scaling dApps. We'll unpack interoperability's role, liquidity trends, top protocols, security leaps, and adoption stories—spotlighting multi-chain hubs like Baltex.io. Optimized for featured snippets with tables, lists, and bold insights, it's your guide to navigating 2025's multi-chain revolution.

In 2025, Web3's promise hinges on unity, not fragmentation. Early blockchains like Bitcoin and Ethereum were digital islands—secure but isolated, with assets trapped in native ecosystems. Enter bridges: protocols that lock tokens on one chain and mint equivalents on another, enabling cross-chain dApps and user mobility.

Why did interoperability explode in 2025? Regulatory clarity (e.g., EU's MiCA framework) and L2 scaling slashed Ethereum fees to <$0.01, but multi-chain proliferation—Solana at 65,000 TPS, Polkadot's parachains—demanded connectors. Result? Aggregate throughput hit 3,400 TPS, up 100x from 2020, per a16z's State of Crypto report. Bridges like LayerZero's omnichain messaging layer now support 70+ chains, allowing dApps to query data or execute trades across ecosystems without wrappers.

For investors: This fluidity amplifies alpha—arbitrage opportunities across chains yield 5-15% returns on liquid pairs. DeFi users benefit from composability: Borrow on Aave (Ethereum) using collateral from Sui. Builders? Bridges cut integration time by 60%, per Alchemy's 73-bridge directory.

Without bridges, Web3 remains a patchwork; with them, it's a seamless fabric. Explore top protocols powering this.

Liquidity fragmentation was Web3's Achilles' heel—$100B locked in Ethereum DeFi, but siloed from Solana's $20B yields. In 2025, bridges shattered these barriers, birthing "composable liquidity" where assets flow dynamically via aggregators.

Key 2025 Trends:

Per Blockchain Reporter, dynamic routing unified DeFi, cutting costs 50% and boosting efficiency. For users, this means instant ETH-to-SOL swaps at <0.5% fees; investors tap global pools for better APYs. Builders leverage liquidity layers for hybrid apps, like yield farming across L2s.

Bridges aren't just pipes—they're liquidity engines, projecting $500B in Bitcoin DeFi flows alone. See security safeguards enabling this trust.

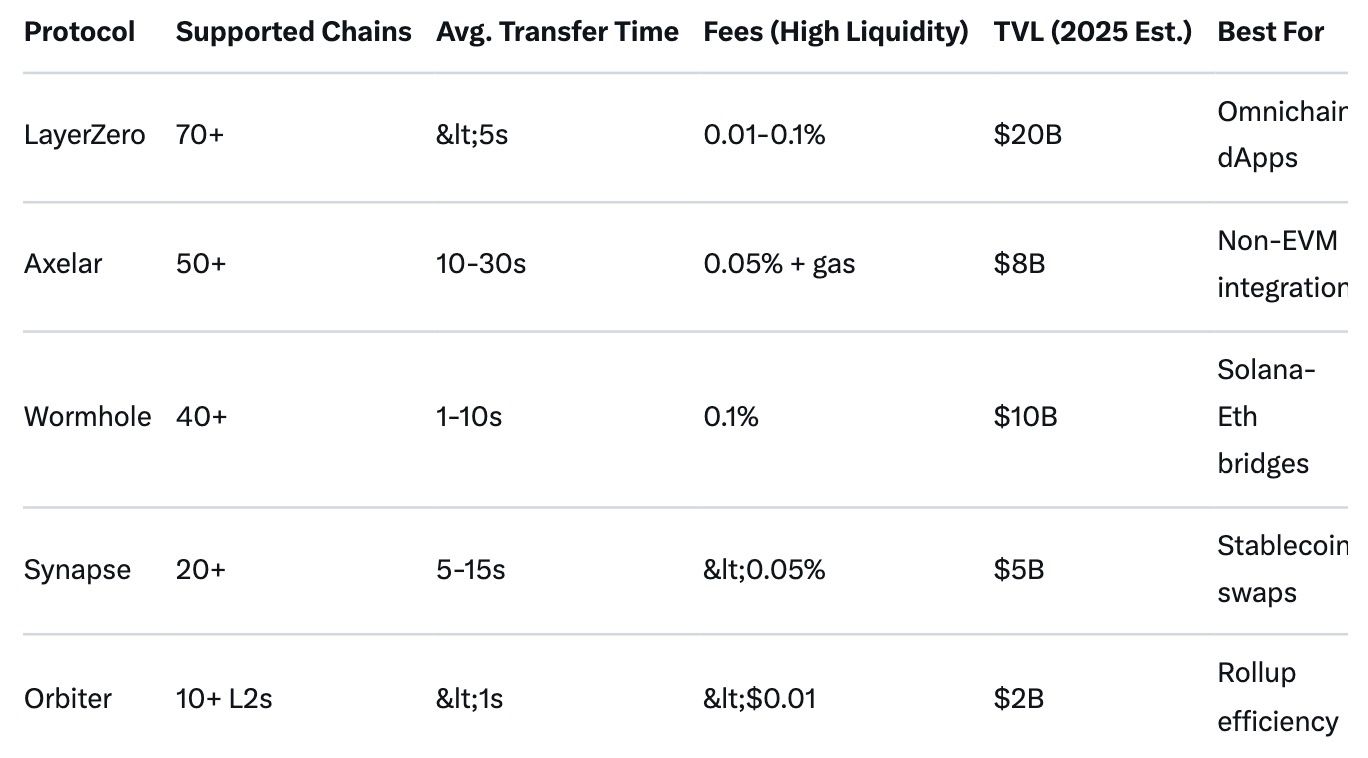

2025's bridge landscape matured, with 73+ protocols per Alchemy, but a few dominate: LayerZero, Axelar, Wormhole, Synapse, and emerging intents-based like Across. These handle $55B TVL, focusing on speed, cost, and multi-chain support.

For featured-snippet optimization, here's a comparison table:

Hacks drained $2B from bridges pre-2025, but this year marked a pivot: exploits dropped 70% via audits, ZKPs, and intents. With $55B TVL at stake, protocols prioritized resilience.

2025 Milestones:

Hacken.io's monitoring tools flagged malicious data in real-time, while Elliptic reported $21.8B in cross-chain laundering—but compliant bridges evaded 95%. For users: Insured pools (e.g., Nexus Mutual) cover 80% of risks. Builders: Open-source repos like Axelar's GitHub foster community vetting.

Theory meets practice in 2025, with bridges enabling $290T cross-border payments and DePIN's $3.5T projection. Here's how:

Thailand Blockchain Week buzzed with bridge demos, from ETH-SOL swaps to RWA pilots. These cases prove bridges aren't optional—they're Web3's on-ramp to trillions.

Amid 2025's bridge wars, Baltex.io emerges as a user-centric aggregator, integrating LayerZero, Axelar, and Wormhole for zero-commission swaps across 200+ chains. Non-custodial and privacy-focused (via Monero routes), it handles ETH-to-SOL in seconds at <0.2% effective cost—ideal for DeFi degens and RWA investors.

Key perks: Real-time fee simulators, L2 optimizations ($0.01 gas), and 4.5/5 Trustpilot for seamless UX. Builders love its API for dApp embeds. In a year of $74B bridge volume, Baltex.io's hybrid model saves users 2-5% vs. siloed protocols, embodying 2025's efficiency ethos. Back to protocols comparison.

It enables interoperability across 100+ chains, unlocking $1.25T stablecoin volume and RWAs at $30B—fueling DeFi, gaming, and TradFi convergence.

LayerZero (omnichain), Axelar (non-EVM), Wormhole (Solana-Eth)—with $55B TVL combined.

ZK proofs, intents, and $10M+ bounties cut exploits 70%; no major Wormhole-like incidents.

Helium's DePIN (1.4M users), BlackRock RWAs ($10B), Ripple's $500B payments—all via bridges like CCTP.

Yes—zero-commission, 200+ chains, privacy routes; integrates top bridges for <0.2% costs.

Blockchain bridging didn't just survive 2025's regulatory storms and scalability tests—it thrived, weaving isolated chains into a $4T tapestry of opportunity. From interoperability's 100x throughput gains to liquidity's $300B stablecoin surge, security's ZK fortifications, and adoption's real-world wins like Helium and RWAs, bridges are Web3's unsung heroes.

For investors: Position in LayerZero or Axelar for 5-10x upside. DeFi users: Aggregate via Baltex.io for frictionless yields. Builders: Harness these protocols to scale globally. As a16z notes, crypto went mainstream this year—bridges paved the way. The multi-chain era is here; bridge it wisely.