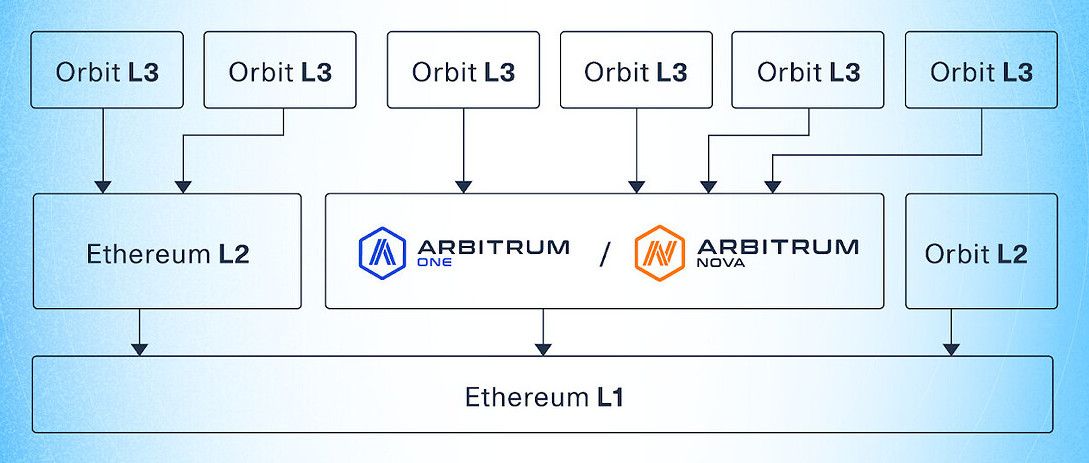

If you have been wondering what is Arbitrum, here is the short answer: Arbitrum is a Layer-2 scaling solution built on top of Ethereum. It processes transactions more efficiently than the Ethereum mainnet alone, making transactions cheaper and faster for you. By offloading much of Ethereum’s work to a secondary network (often called a “rollup”), Arbitrum helps ensure higher throughput and lower fees. As a result, you can enjoy the security of Ethereum without the usual transaction bottlenecks. Below, you’ll find a deeper look at how it works, why it’s useful, and how you can explore this ecosystem for your decentralized finance (DeFi) or crypto projects.

Arbitrum emerged as a response to Ethereum’s scalability challenges. When you use standard Ethereum, you may notice that transaction times slow down and fees spike during periods of high network activity. This is a limitation of the base layer. Layer-2 solutions like Arbitrum attempt to solve that by moving most of the computational work off the main chain (Layer 1) and confirming batches of transactions in “rollups.” Let’s explore why that matters to you.

On Ethereum, every transaction competes for limited space in a block. During busy periods, users bid up gas prices, leading to high fees. Arbitrum changes this dynamic by rolling transactions together on a separate network. The end result is:

More transactions processed in less time

Lower per-transaction fees

Minimal reliance on blind trust, because security still ultimately comes from Ethereum

If you are an Ethereum user, you no longer have to put up with exorbitant gas fees to participate in DeFi, mint non-fungible tokens (NFTs), or perform everyday transfers.

Ethereum’s popularity has made scalability a pressing concern. Imagine wanting to send a simple token transfer but having to pay a disproportionate amount in fees. Or maybe you are using a decentralized exchange (DEX) to trade tokens, and each trade costs more than the value of the tokens themselves. Arbitrum addresses these pain points by:

Handling large volumes of transactions off-chain

Letting Ethereum finalize these batches in a single, efficient proof

Ensuring compatibility with existing Ethereum smart contracts

This approach means you don’t have to abandon your favorite Ethereum-based tools. Arbitrum is designed to be developer-friendly and user-friendly—lowering the cost barrier for you to explore innovative DeFi applications.

At its core, Arbitrum uses optimistic rollups. The word “optimistic” implies that it expects every transaction to be valid unless proven otherwise. This reduces overhead in verifying each transaction. If a fraudulent transaction sneaks in, there’s a dispute resolution mechanism that allows honest participants to point it out, ultimately preserving the network’s security.

Here is the simplified flow:

You submit your transaction to Arbitrum.

Arbitrum processes it off-chain alongside other users’ transactions.

Arbitrum intermittently posts a compressed batch of transactions (plus state updates) to Ethereum.

Validators can challenge any batch they believe is invalid.

Under normal conditions, no one will dispute valid batches, so Arbitrum transactions are considered final. In exceptional cases where someone tries to include bad data, the dispute resolution process steps in, relying on Ethereum’s security to settle the disagreement.

“Rollup” means transactions aren’t individually settled on Ethereum. Instead, they’re packaged in batches, or “rolled up,” and posted to Ethereum in compressed form. This drastically reduces how much data hits the Ethereum chain. Because the rollups remain verifiable, if you see something suspicious, you can challenge it. This ensures the system’s trustworthiness even though more activity is occurring off-chain.

For you, this means you get the best of both worlds:

Lower gas costs

Faster confirmations

Decentralized security you can rely on

Arbitrum offers several distinct advantages that can make your experience with Ethereum-based apps smoother.

One of the biggest draws of Arbitrum is the reduced transaction cost. If you’ve tried to trade or send tokens on Ethereum during a high-activity period, you know how fees can spike to frustrating levels. With Arbitrum, the costs drop significantly because transactions are handled off-chain. You still pay some fees, but usually just a fraction of the fees on the Ethereum mainnet.

On Arbitrum, transactions confirm more quickly because they don’t have to wait on Layer 1 to finalize each step. This is especially handy when you participate in time-sensitive DeFi activities. Trades, yield farming deposits, or other complex operations can settle in a more predictable, swifter manner.

You might wonder if moving transactions off-chain compromises security. Arbitrum is built so that Ethereum remains the ultimate adjudicator for transaction data. If malicious activity occurs, Ethereum’s main chain can step in to resolve disputes. Essentially, Arbitrum borrows the robust security Ethereum has built over time, giving you confidence that your transactions remain safe.

Another sweet spot for Arbitrum is compatibility with the Ethereum Virtual Machine (EVM). Developers can deploy smart contracts on Arbitrum without rewriting extensive code. This makes it easy for your favorite decentralized applications (DApps) to offer an Arbitrum-based version. For you, it means the same toolset but improved performance and lower costs.

Fees often top the list of concerns for anyone active on Ethereum. While Arbitrum does not eliminate fees entirely, it does dramatically reduce them. Understanding how these fees work can help you use Arbitrum more effectively.

Arbitrum fees typically include:

L1 security fees: The cost for posting batch data to Ethereum.

L2 execution fees: The cost of processing transactions on Arbitrum itself.

Combined, these fees tend to be significantly lower than mainnet. Early adopters often find they can do multiple complex operations on Arbitrum for the cost of a single transaction on Ethereum’s base layer.

Because Arbitrum processes transactions in batches, a big part of the cost savings stems from splitting the Ethereum posting fees across many users. You don’t shoulder the entire burden alone. Optimizations in data compression also play a role. Whenever possible, Arbitrum excludes redundant data, keeping the footprint of each batch minimal.

If you come from a background using sidechains or other blockchains, you might wonder why fees exist on Arbitrum at all. The key is that Arbitrum remains tethered to Ethereum’s security model. Posting data to Ethereum in a compressed form ensures transparency and trust. The small fees you pay help maintain that robust environment, making it a worthwhile trade-off if you want to remain within the Ethereum ecosystem.

Arbitrum isn’t just about cheaper fees and faster transactions. It has attracted a growing ecosystem of DeFi and NFT projects. This means you can swap and lend tokens, stake assets, explore new yield-generating protocols, or even mint NFTs, all while benefiting from Arbitrum’s efficiency.

Many DeFi platforms you might already know on Ethereum have launched versions on Arbitrum. Examples include decentralized exchanges, lending platforms, and yield optimizers. By interacting with these on Arbitrum, you can:

Save on gas cost

Execute trades more quickly

Avoid congested network conditions

Plus, developers are often keen to innovate on Arbitrum because it offers the speed and affordability needed for more advanced financial products. For you, that can mean more choices for earning yield or diversifying your crypto portfolio.

If you’re into NFTs, Arbitrum-based marketplaces and games may catch your eye. While Ethereum mainnet NFT minting can be expensive, Arbitrum drastically reduces the costs, making NFT creation more accessible. This could open the door for smaller artists and collectible projects that previously avoided Ethereum due to high gas fees.

Arbitrum is designed to be EVM-compatible, meaning developers can generally deploy their existing contracts with minimal tweaks. Tooling around Arbitrum includes popular development frameworks like Hardhat or Truffle, plus block explorers tailored to Arbitrum’s rollup environment. If you are a developer or advanced user, you’ll find a familiar workflow.

Layer-2 solutions have become increasingly popular, and Arbitrum isn’t the only option out there. You might wonder how it stacks up against Optimism, Polygon, or zkSync. Each has its own approach and trade-offs.

Optimism is another optimistic rollup solution. Both Arbitrum and Optimism rely on posting transaction data to Ethereum and challenging fraudulent batches if necessary. However:

Arbitrum uses slightly different dispute resolution mechanisms, with an emphasis on efficient proof challenges.

Optimism aims for simplicity, which may make it quicker to develop on but can sometimes lag in advanced features.

Functionally, if you’re used to Optimism, you’ll find Arbitrum similar but with potentially different performance metrics. Fees and speed can vary depending on day-to-day network usage. It’s worth testing both to see which suits your specific needs.

Unlike Arbitrum, Polygon (previously known as Matic) started as a sidechain solution before expanding to multiple scaling approaches. Polygon still leverages its own set of validators, so its base security layer isn’t purely Ethereum. By contrast, Arbitrum is tightly integrated into Ethereum for security.

If your concern is absolute trust minimization, Arbitrum’s approach might feel closer to the Ethereum ethos. If you prefer a big ecosystem that includes separate proof-of-stake chains and other expansions, Polygon offers a broader range of tools and sidechains. For everyday usage, both solutions offer reduced transaction fees and faster settlements compared to mainnet Ethereum.

Zero-knowledge (ZK) rollups, such as zkSync, use cryptographic proofs to validate transactions. These proofs can be more complex but are often praised for their robust security. Optimistic rollups like Arbitrum generally have simpler assumptions but rely on a challenge window. ZK rollups don’t need that challenge period, so finality can be faster.

That said, deploying general-purpose smart contracts on ZK rollups is more complex. Arbitrum, being EVM-compatible, is easier for developers. If you need advanced smart contracts right now, Arbitrum might be more accessible. If you are after cutting-edge cryptography, zkSync might be appealing.

Ultimately, each solution has its strengths. The choice often comes down to your priorities—speed of finality, ecosystem support, or ease of development.

When it comes to cross-chain swaps and bridging assets, you’ll want to do so in a way that keeps fees low and transaction times fast. That’s where services like baltex.io come in. While Ethereum bridging can be slow and expensive, baltex.io supports Arbitrum in its cross-chain swap journey, making it simpler for you to move assets from other networks into Arbitrum.

Think of a cross-chain swap as a direct exchange of tokens on one network for tokens on another. In the old days, you might have had to manually convert tokens, transfer them, and then restore them in your wallet. With a service like baltex.io, the process can be streamlined. You specify the tokens you want to swap and the target chain—Arbitrum in this case. The platform handles the bridging and ensures your assets are delivered to your wallet on Arbitrum.

If you already have assets on Ethereum mainnet but don’t want to incur high fees repeatedly, bridging them to Arbitrum is often a one-time cost. After that, your day-to-day operations (like swaps and transfers on Arbitrum) become cheaper. Platforms like baltex.io can assist with bridging your tokens. The typical steps include:

Connect your Ethereum wallet.

Choose your source token (on Ethereum) and specify your destination as Arbitrum.

Confirm the transaction and, once it’s processed, your funds arrive on Arbitrum.

This means you can continue your DeFi or NFT activities on Arbitrum without regularly returning to the mainnet, saving you both time and money.

Below are some common queries that people have about Arbitrum and how it fits into the Ethereum landscape.

Q: Why is Arbitrum called a Layer-2 solution? A: Ethereum is considered Layer 1—its base protocol. Arbitrum, built atop Ethereum, offloads computations and data storage away from the main chain, making it “Layer 2.” It relies on Ethereum for security and final consensus, but it handles much of the day-to-day transaction processing independently.

Q: How do I move ETH from Ethereum mainnet to Arbitrum? A: You can use an official bridge or a third-party service that supports Arbitrum. Platforms like baltex.io offer cross-chain swaps, letting you deposit tokens into Arbitrum directly. This usually involves signing a transaction on Ethereum and waiting for the bridging contract to credit your account on Arbitrum.

Q: Are transaction fees on Arbitrum always cheaper? A: For now, Arbitrum fees are generally a fraction of Ethereum’s. However, if network usage on Arbitrum shoots up, fees can still fluctuate. They are typically still far lower than Ethereum mainnet, making them attractive for regular use.

Q: Can I deploy my existing Ethereum smart contracts on Arbitrum? A: Yes. Arbitrum offers EVM-compatibility, so you can often deploy applications without major code rewrites. The main difference is that users will pay fees in Arbitrum’s environment, rather than on Ethereum.

Q: Is Arbitrum fully decentralized? A: Arbitrum aims to be as decentralized as possible, but it’s still relatively new compared to Ethereum. The system relies on validators to post data to Ethereum and challenge incorrect batches. Over time, Arbitrum is moving toward more decentralized governance, but the process is gradual.

Q: How does the dispute resolution work? A: When a batch of transactions is posted to Ethereum, there’s a challenge window for validators to dispute any fraudulent transactions. If someone successfully proves fraud, that batch is rolled back, keeping the network honest. In practice, disputes are rare, but the mechanism is in place for security.

Arbitrum has quickly become one of the most popular Layer-2 solutions for Ethereum. It addresses the fundamental problem of high gas fees and slow transaction speeds by using optimistic rollups to group multiple transactions into batches that are then verified on Ethereum. This design lets you tap into Ethereum’s trusted security while enjoying faster, more affordable transactions.

If you’re looking to get into DeFi or NFTs without wrestling with unpredictable and often inflated Ethereum fees, Arbitrum can offer a smoother experience. You can bridge over your tokens, start exploring the many Arbitrum-native applications, and benefit from the ecosystem’s rapid growth.

Moreover, cross-chain swap services like baltex.io simplify the process of adding Arbitrum to your crypto toolkit. By transferring assets seamlessly from one network to another, you don’t have to worry about juggling multiple bridges or difficult workflows. Once you are set up, you will likely find that Arbitrum is efficient, user-friendly, and well worth the initial effort to bridge over.

As you continue your crypto journey, you’ll see more projects migrate or launch directly on Arbitrum to bypass network congestion on Ethereum. Whether you’re a casual user making small transactions or a power user deep into yield-farming strategies, Arbitrum can open new possibilities. The improvements in speed and cost give you more freedom to experiment and participate in the broader DeFi landscape. Give it a try, compare your experience to other Layer-2 solutions, and decide whether Arbitrum offers the balance of security and efficiency that meets your goals.