Looking for a straightforward take on how much XRP you should buy between 2025 and 2030? The short answer is that it depends on your risk tolerance, personal goals, and ongoing XRP price trends. You’ll want to factor in data like historical returns, your timeline, the state of Bitcoin and Ethereum, and even your own investing psychology. By spreading your stake across different assets, planning regular portfolio checkups, and using reputable platforms, you’ll reduce guesswork and tilt the odds in your favor. Keep in mind this is a long-term journey, and sometimes you’ll revise your plan. Feel free to adapt as you go, especially when new market insights emerge.

When you first hear talk of an “XRP price prediction 2030,” it’s tempting to expect a simple number or a magic formula. But the reality is a bit more nuanced. Whether you’re a retail investor testing the crypto waters or a seasoned institutional player, you have to piece together your financial goals, market conditions, and risk appetite.

XRP, the digital asset closely associated with Ripple Labs, has gained a global following because of its vision for frictionless, cross-border payments. While it has faced its fair share of regulatory and market volatility, it remains one of the largest cryptocurrencies by market cap. This means that many people are curious about whether it can deliver a significant return over the coming years.

In this listicle, you’ll find ten key factors to consider when deciding how much XRP to buy for the 2025–2030 horizon. We’ll talk risk tolerance, compare XRP with established heavyweights like Bitcoin (BTC) and Ethereum (ETH), and touch on portfolio math that helps you figure out an allocation strategy. You’ll also see how human psychology can influence your decisions. By the end, you’ll have a clearer sense of whether you should grab a small stake or go all in with confidence (spoiler: the answer probably lies somewhere in the middle).

Your starting point is always risk tolerance. In other words, how comfortable are you with the possibility that prices could drop dramatically at any moment? Cryptocurrencies can be high-risk assets, experiencing double-digit swings in a single day. If you already feel uneasy just thinking about that kind of volatility, you may want to scale back your intended XRP purchase.

Risk tolerance isn’t a static thing, and it can change as you learn more about crypto or your financial situation evolves. If you realize you’re building more comfort with risk, you can increase your stake over time. If market conditions or personal circumstances shift for the worse, you might slow down or even exit some of your position. Flexibility is key.

If you’re curious about XRP’s place in a balanced portfolio, comparing it to BTC and ETH can offer powerful insights. Bitcoin is seen by many as “digital gold,” while Ethereum has become a hub for decentralized finance (DeFi), NFTs, and smart contracts. XRP tries to excel in cross-border payments and settlement speed, which is a different niche.

When deciding how much XRP to buy, weigh the asset’s correlation with BTC and ETH. If the broader market heads down, XRP often moves similarly, though not always with the same intensity.

By looking at these three giants side by side, you’ll see if XRP can round out your portfolio’s risk profile. Maybe you hold BTC for store-of-value reasons, ETH for DeFi exposure, and XRP for its role in international remittances. The idea is to create a cohesive lineup of assets that addresses multiple use cases.

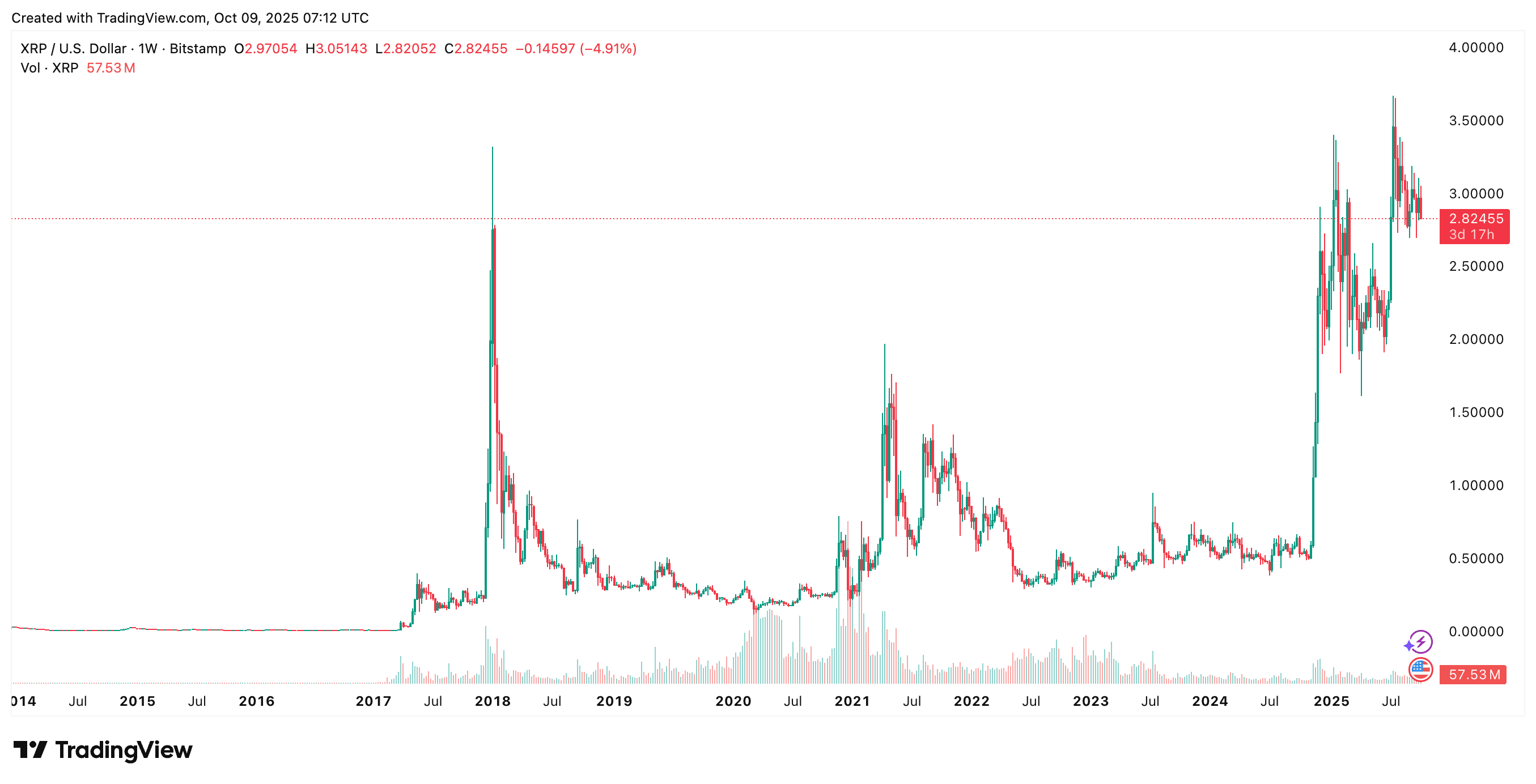

Although past performance is never a guarantee of future results, historical price data can provide clues about how XRP might behave under various scenarios. Studying historical chart patterns for XRP could reveal:

If you notice that XRP tends to bounce around a specific range, you might plan to buy on the lower end of that range or wait for a confirmed breakout if you believe it’s a robust uptrend. On the flip side, if you see a history of double-digit losses each time XRP hits a certain level, you may want to exercise extra caution around that price ceiling.

You can also compare these patterns with macroeconomic events. For instance, if the Federal Reserve announces interest rate changes, does XRP’s price react differently than BTC or ETH? Understanding what drives XRP’s movement can prevent you from making impulsive buys or sells. Keep in mind that the crypto market evolves quickly, and new catalysts may appear that render old patterns less relevant.

Return on Investment (ROI) drives most interest in crypto: People buy XRP because they believe it could deliver impressive gains. Still, it’s important to have a realistic view of ROI. Some analysts point to triple-digit or even quadruple-digit percentage gains by 2030, but nobody has a crystal ball.

To telescope potential ROI:

Map out each scenario with real numbers. For instance, if your investment is $1,000 and you expect about 20% growth per year over five years, you could see around $2,488 by year five (compounding included). But if XRP outperforms with 50% annual growth, your $1,000 could morph into more than $7,593. These are pure hypotheticals, so never base your decisions solely on best-case scenarios.

The key is to manage expectations. If you believe the fundamentals support higher demand for XRP in cross-border payments, expecting a moderate to strong ROI might seem reasonable. If not, a smaller stake might be a safer bet.

Perhaps you’re aiming to buy and hold XRP until 2030, expecting the price to climb steadily by then. Or maybe you’d rather swing trade, capitalizing on short-term price waves. Whichever approach you prefer, it’s essential to pick a timeframe and stick with it.

Your timeline also dictates how you respond to news events or regulatory updates. A long-term holder may ignore daily rumors and focus on the big picture: possible worldwide adoption of XRP for cross-border transactions. A short-term trader, on the other hand, will likely scramble to respond to price action if new developments rock the market.

Settling your timeframe helps manage stress. If you keep switching between short and long-term mentalities, you might buy and sell at inopportune moments. It’s okay to evolve your approach, but put a plan in place first and limit spur-of-the-moment changes.

“How much XRP should I buy?” is rarely asked in total isolation. In crypto, diversification is vital. Even if you’re bullish on XRP, it’s rarely wise to put all your eggs in one basket.

By diversifying, you reduce the potential pain if XRP undergoes a sharp drop. Plus, you capture opportunities in other segments of the crypto market. Remember, each asset has unique drivers. So, if XRP stumbles, Ethereum or another token might cover your losses, and vice versa.

Still, don’t over-diversify to the point that you can’t keep track of your holdings. Owning 40 different coins might spread your funds so thin that none of them leads to meaningful gains. Find a balance that fits your research bandwidth and your comfort level.

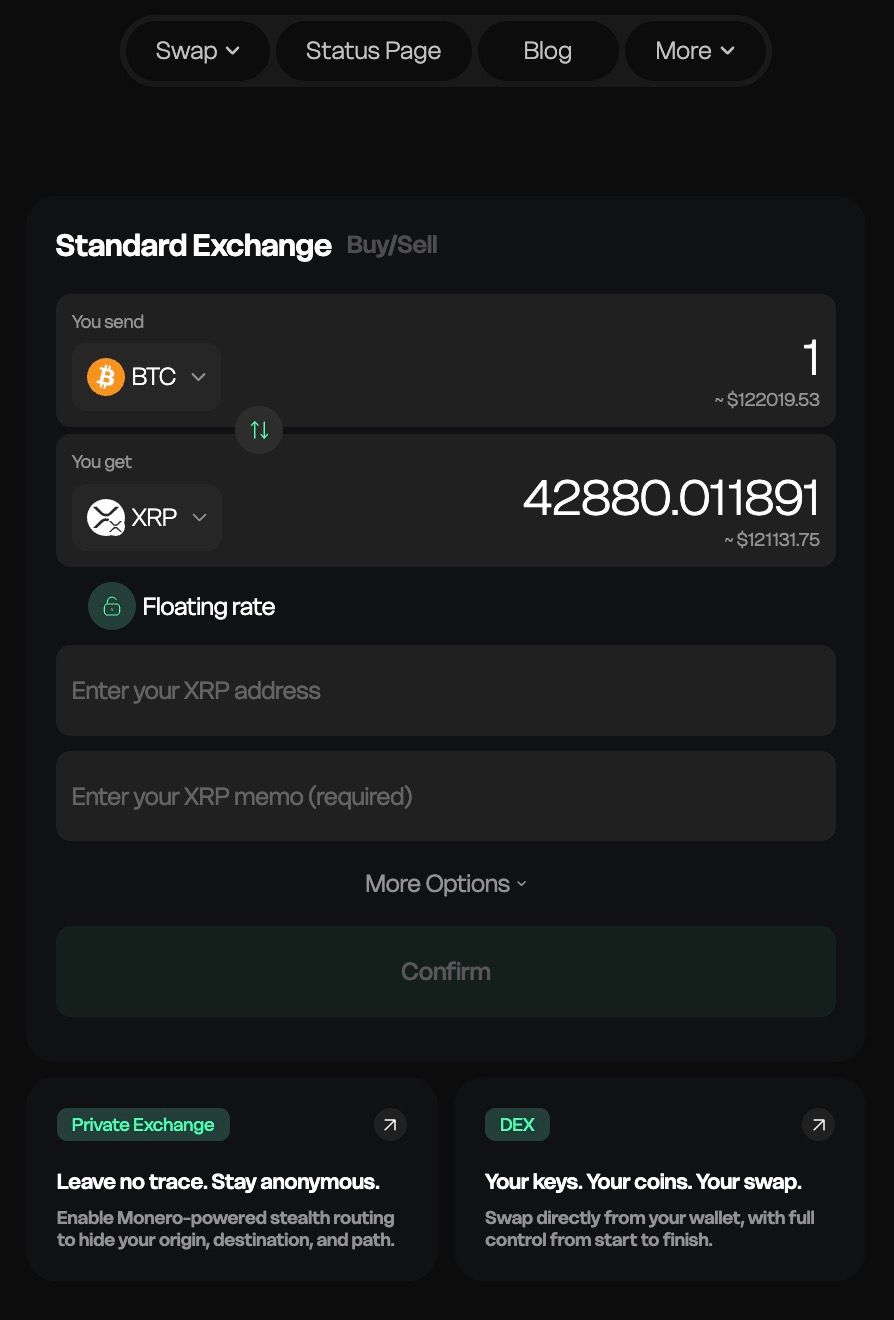

Some crypto enthusiasts prefer lump-sum investing, dropping a large amount of money at once. Others favor dollar-cost averaging, where you invest smaller, fixed amounts over time. For many, a monthly investment approach can help smooth out price fluctuations.

Suppose you decide to buy $200 worth of XRP each month. When the price is high, that $200 buys fewer coins, but when the price is low, it buys more coins. Over the long run, this usually averages out.

This strategy can also be psychologically easier. You’re less likely to freak out if the price plummets right after you buy. Instead, you’ll have an opportunity to acquire more XRP at a discount when your next monthly buy comes around.

If you’re looking for ways to automate your monthly investments, you might check out an exchange like Baltex.io, where you can set a recurring purchase plan. That way, you won’t have to time the market precisely. And let’s face it, trying to time the crypto market often leads to frustration.

Crypto investing isn’t just about numbers on a chart. It’s about how you feel when you see those numbers surge or plunge. Psychology can be a hidden factor in deciding how much XRP you should buy.

Let’s be honest: Fear and greed can spark impulsive decisions. If you find yourself chasing every price spike or selling during moments of panic, you could derail a well-crafted strategy.

The more you understand your emotional triggers, the better you can structure your portfolio. You might hold just enough XRP to benefit if the price surges, but not so much that you feel sick to your stomach if it drops 20% in a week.

Portfolio rebalancing means adjusting your positions back to a target allocation whenever market movements shift those weights. Let’s say you decide XRP should make up 20% of your crypto portfolio. If a bull run sends the XRP portion to 35%, you might choose to sell some XRP and put that money into other assets.

On the flip side, if XRP’s share drops below 10% after a price tumble, you might buy more to restore it to 20%. This strategy enforces a disciplined “buy low, sell high” approach—quite the opposite of reacting to hype. Not everyone rebalances by the same rules: Some do it quarterly, others do it whenever an asset moves more than 5 or 10% from their original target.

Rebalancing takes some math but is generally straightforward. The biggest emotional hurdle is trimming a winning asset, which can feel counterintuitive. Yet that discipline ensures you lock in gains instead of letting them vanish if the market retraces.

If you’re new to crypto, a small experiment might be best. You can always increase your position as you learn more and gain confidence. Maybe you start by investing $50 or $100 per month. You learn the ropes, see how the market behaves, and figure out how you react to volatility.

But if you’re an experienced trader or well-capitalized investor, you might decide to buy a larger amount if your analysis strongly supports XRP’s fundamental potential. Some institutional investors have been known to make substantial allocations to altcoins, sometimes in the millions. Whether or not that’s right for you depends on how sure you are of XRP’s prospects and your ability to weather a downturn.

At the end of the day, the size of your XRP purchase is about alignment with your overall financial strategy. You could go big, you could go small, or you could land somewhere in the middle. What matters is that you make a plan, stick with it as long as it serves you, and adjust it when the facts or your circumstances change.

Q: Is XRP still a good investment despite regulatory concerns? A: XRP faced uncertainty in the past due to regulatory challenges, especially in the United States. However, it remains a top-ten coin by market cap, and many investors still find value in it for cross-border payments. Keep track of ongoing legal developments when you evaluate your risk.

Q: What happens if I can’t keep track of daily crypto news? A: If you don’t have the bandwidth for daily updates, consider a longer-term “set it and forget it” approach. You can rely on dollar-cost averaging and periodic check-ins, like once a month or once a quarter, to ensure everything’s on track.

Q: Should I wait for a price dip to buy more XRP? A: Timing the market is tough. If you strongly believe in XRP’s long-term potential, dollar-cost averaging can reduce the stress of trying to pick the perfect moment to buy. If you see an obvious dip that aligns with your technical or fundamental analysis, you might increase your purchase slightly.

Q: Can XRP realistically outperform Bitcoin or Ethereum? A: Anything can happen in crypto, but BTC and ETH have historically led the market. XRP’s focus on cross-border payments serves a distinct niche. If XRP captures significant adoption in banking systems, it might outperform at times, but that’s not guaranteed.

Q: How often should I rebalance my crypto portfolio? A: Some investors rebalance quarterly, while others wait until their allocations drift by a certain percentage (e.g., 5% or 10%). Choose a method that fits your time availability and tolerance for transaction fees.

Q: Does XRP pay dividends like stocks? A: No, most cryptocurrencies, including XRP, don’t pay dividends in the traditional sense. Your gains come from asset price appreciation. Some crypto projects offer staking rewards, but XRP is not typically staked in that manner.

Q: Will I lose money if I invest at the top of a bull run? A: You might experience short-term losses if the market corrects. However, if your timeframe is several years, there’s still potential for recovery. Just make sure you only invest money you can afford to keep in the market for a while.

Q: What if I decide XRP isn’t for me after a few months? A: You’re never locked in. You can sell your XRP at any time. Just consider any trading or withdrawal fees on your chosen exchange. Before selling, it’s wise to reassess whether the underlying reasons for your original investment have truly changed.

Q: How can Baltex.io help with my investments? A: Baltex.io can be a user-friendly platform for automating recurring buys. This is especially handy if you plan to practice dollar-cost averaging. They also offer a range of altcoins, so you can diversify on a single platform if that’s more convenient.

Q: Do professional trading strategies apply to XRP? A: Yes. Many professional strategies—trend following, momentum trading, and swing trading—can apply to XRP. Still, don’t feel pressured to use advanced methods if you’re a beginner. Sticking to simpler strategies until you build confidence is perfectly fine.

What is XRP price prediction 2030, in a nutshell? There’s no universal consensus. Some analysts see strong growth from increased adoption, while others remain cautious. Studying supply, demand, and regulatory updates can help paint a clearer picture.

Is XRP better than BTC or ETH for beginners? “Better” is subjective. XRP’s transaction fees and speeds appeal to many, but BTC and ETH are more established. It depends on your investment goals and risk tolerance.

Where can I buy XRP safely? Well-known exchanges include Binance, Coinbase (depending on regional regulations), and Baltex.io. Always enable two-factor authentication and store your coins securely.

Should I invest all at once or in increments? Investing in increments, known as dollar-cost averaging, is a popular way to reduce stress and minimize bad market timing. If you’re more experienced, you might do a lump-sum approach based on your analysis.

Do I need a specific wallet for XRP? You can hold XRP in hardware wallets like Ledger or Trezor, or on software wallets such as Exodus. Each has different security and convenience factors. Choose based on your comfort level.

Deciding how much XRP to buy between 2025 and 2030 is a personal calculation mixing math, psychology, and changing market conditions. You’ll want to evaluate your risk tolerance, watch how XRP lines up with Bitcoin and Ethereum, and do at least a bit of homework on historical price trends. From there, it’s smart to map out your potential ROI—but with a dash of realism. You can invest monthly, rebalance when needed, and consistently check in with your own feelings about risk.

Even if the continuous talk of “XRP price prediction 2030” feels like noise, it holds a kernel of truth: People see potential in XRP’s unique use cases. If you share that optimism, a disciplined investment strategy can help you benefit from any price surge that might come along. Exchanges like Baltex.io are handy for regular purchases, and using them helps you automate part of your plan.

Above all, never lose sight of the fundamentals that guided your initial decision. If something changes drastically—like a major regulatory victory or setback—be ready to pivot. And if everything stays on a steady course, you might keep on dollar-cost averaging until you reach your target allocation. By combining data-driven strategy, emotional discipline, and a willingness to adapt, you’ll be in a strong position to navigate XRP’s future trajectory. Good luck, and happy investing!