UFT, or Universal Funds Transfer, refers to seamless, efficient methods for moving assets across platforms, chains, or accounts in trading—especially in crypto via cross-chain swaps and aggregators. It enables quick, low-cost transfers without traditional bridges or intermediaries. Standard transfers are slower and costlier; UFT-style routing minimizes risks like slippage while optimizing fees. Tools like baltex.io make practical UFT possible for multi-chain traders.

In modern trading, particularly cryptocurrency, UFT stands for Universal Funds Transfer—a concept describing the efficient, borderless movement of funds or assets across different platforms, exchanges, blockchains, or financial systems.

While not a strictly standardized term like ACH or SWIFT in traditional finance (TradFi), UFT has emerged in crypto communities to describe advanced transfer mechanisms that aim for universality: fast, low-cost, secure transfers regardless of the underlying network or asset type.

For beginner traders: Think of UFT as the "express lane" for moving money in trading. Instead of slow bank wires or chain-specific bridges, UFT uses smart routing to transfer value universally.

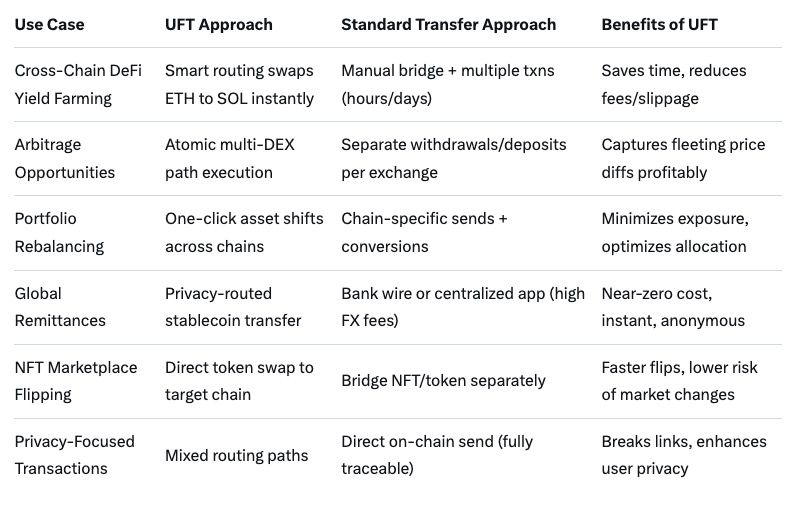

Intermediate traders often encounter UFT in contexts like cross-chain DeFi, where holding assets on one blockchain (e.g., Ethereum) but wanting to use them on another (e.g., Solana) requires seamless transfer.

In 2025, with multi-chain ecosystems dominating crypto, UFT represents the ideal: one-click asset movement without fragmentation.

UFT operates through intelligent routing and aggregation technologies rather than direct account-to-account debits.

In crypto:

This contrasts with basic on-chain transfers (simple wallet sends) or centralized withdrawals/deposits.

Advanced UFT incorporates privacy layers (e.g., mixing routes) and zero-knowledge proofs for enhanced security.

UFT shines in scenarios where standard transfers fall short:

In TradFi parallels: Similar to instant payment systems like FedNow or Pix, but decentralized.

Real-world crypto example: A trader spots a low-price NFT on Solana but holds ETH on Ethereum—UFT routes the swap instantly.

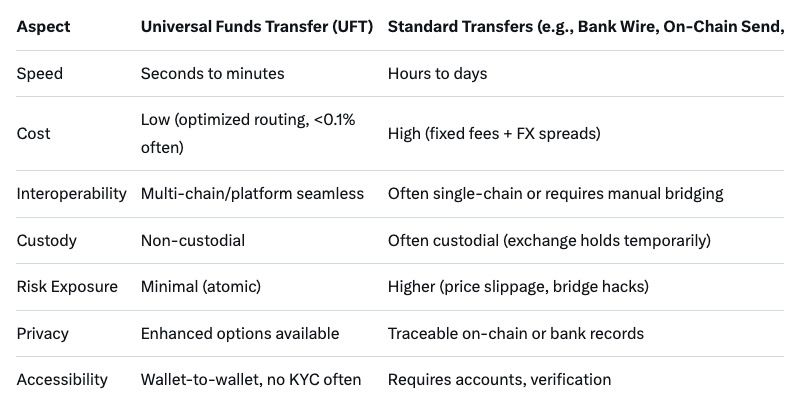

UFT prioritizes efficiency and user control over traditional reliability trade-offs.

While powerful, UFT carries risks traders must understand:

Mitigations: Use audited, reputable tools; start small; enable slippage tolerances.

In crypto history, bridge hacks (e.g., past wormhole incidents) highlight why non-bridged UFT routing is safer.

Fees vary but are generally lower than alternatives:

Average UFT cost in 2025: <$1 for $10,000 transfer vs. $20+ traditional.

Optimization finds zero-fee paths where possible.

Hybrid: Platforms blending TradFi rails with crypto for universal access.

Baltex.io exemplifies modern UFT in action—a non-custodial instant swap platform using advanced routing for universal-like transfers.

Key features:

For traders: Move funds universally—e.g., Bitcoin to Polygon tokens—in one click. Ideal for arbitrage, rebalancing, or cross-chain DeFi.

Baltex.io brings UFT practicality to everyday trading. Visit https://baltex.io for seamless transfers.

Q: Is UFT the same as a regular crypto transfer? A: No—regular is direct send; UFT uses smart routing for cross-platform efficiency.

Q: Are UFT transfers reversible? A: Generally no—blockchain finality applies; choose trusted tools.

Q: How safe is UFT compared to bridges? A: Safer—avoids bridge custody risks via direct aggregation.

Q: Can beginners use UFT? A: Yes—user-friendly platforms make it simple with previews.

Q: What fees should I expect? A: Typically <0.5% total, plus gas—far below banks.

Q: Is UFT available in TradFi? A: Emerging via instant payments; crypto leads adoption.

Universal Funds Transfer (UFT) transforms trading by enabling seamless asset movement across boundaries—essential in fragmented crypto markets. Faster, cheaper, and more flexible than standards, it empowers beginners to access opportunities and intermediates to optimize strategies. With risks manageable via reputable tools, UFT drives efficient trading in 2025. Platforms like baltex.io make it accessible, bridging to a truly universal financial future.