TL;DR key takeaways

- DEX aggregators are platforms that hunt for the best token swap prices across multiple decentralized exchanges (DEXs).

- They optimize routes to help you save on fees and slippage while trading crypto assets.

- Most aggregators support cross-chain swaps, letting you move tokens across different networks or blockchains.

- Watch out for transaction fees, protocol fees, and gas—those can add up if you trade frequently.

- Popular picks include 1inch, Matcha, ParaSwap, OpenOcean, Orion Protocol, Balancer, Baltex.io, and KyberSwap.

- Baltex.io stands out as a hybrid exchange that combines centralized-style speed with decentralized security.

- Always check the fine print on fees, and consider aggregator features like price transparency and multi-chain compatibility.

You can use this guide to dive deeper into how aggregator platforms work, compare top contenders, and figure out which one suits your trading style.

Introduction

Picture this: you have tokens on one blockchain, you’re eyeing a brand-new DeFi project on another chain, and you want the best possible rate for the swap. That’s where the best DEX aggregators can really help. Rather than opening multiple tabs and comparing prices on your own, a DEX aggregator does the homework for you. It scans various exchanges simultaneously to find the best route for your trades.

Still, it’s easy to get overwhelmed by all the aggregator options out there. Each platform brags about low slippage, cross-chain capabilities, or special liquidity pools. So how do you cut through the noise? In this article, you’ll learn exactly what DEX aggregators are, how they find your best trades, how fees might impact your bottom line, and which platforms stand out. By the end, you’ll be able to pick the aggregator that fits your needs, whether you’re a casual trader or a hardcore DeFi enthusiast.

DEX aggregator basics

Let’s start with the big picture. A “DEX aggregator” is a tool or platform that searches across multiple decentralized exchanges to find the best token swap rates. It looks at a host of factors, including:

- Liquidity: Does the aggregator have access to various pools so you can trade large amounts with minimal price impact?

- Routes: Sometimes a direct token swap isn’t the cheapest. Aggregators can hop between pairs to minimize fees.

- Fees: Aggregators might charge their own fees, or they might simply pass through fees from the underlying DEXs.

The main upside is convenience. Instead of manually checking multiple exchanges, you get near-instant price comparisons. For you, it feels like a single-stop shop that seamlessly fetches the most cost-efficient trade. Some aggregators even support cross-chain bridging, meaning you can swap tokens between networks—like Ethereum and Binance Smart Chain—without messing around with bridging protocols on your own.

How DEX aggregators work

At a high level, DEX aggregators are like travel comparison websites. Think of them as a site that’s comparing flights across many airlines, except here it’s token trades across different decentralized exchanges.

- You choose the token you have and the token you want.

- The aggregator checks a bunch of DEXs, possibly including big names like Uniswap, SushiSwap, or PancakeSwap.

- In many cases, it may break your swap into smaller chunks across multiple DEXs to get you a better overall price or lower slippage.

- The aggregator quotes you a final price, including any relevant network or aggregator fees.

- Once you confirm, the aggregator either routes your order to the best path automatically or gives you the option to choose from price quotes.

In short, everything happens behind the scenes, sparing you from rummaging around different exchanges. Keep in mind that these steps happen very quickly and rely on smart contracts, so it’s usually trustless—you send tokens to a contract, it executes the best route, and then you receive your swapped tokens.

Benefits and limitations

Let’s be honest: using a DEX aggregator feels like you’re leveling up your trading game. But, as with anything in crypto, there are a few trade-offs.

Benefits

- Better Rates: By comparing prices across multiple exchanges, aggregators often deliver more competitive swaps.

- Time-Saving: You avoid visiting multiple DEXs manually.

- Reduced Slippage: Aggregators can split your order among several pools, lowering the risk of big price moves during your trade.

- Cross-Chain Potential: Some tools let you swap tokens across different blockchains and layer-2 solutions without complicated bridging.

Limitations

- Additional Fees: Some aggregators charge platform fees or require you to hold certain tokens for reduced fees.

- Complexity: More advanced aggregators have features like limit orders, partial fills, or bridging steps, which can be confusing if you’re new.

- Gas Costs: If it splits your trade across several DEXs, you might end up executing multiple transactions, increasing gas fees on certain chains.

- Reliability: If the aggregator’s underlying smart contracts or data feeds have issues, trades can fail or revert.

Key features to consider

Before comparing specific platforms, you’ll want to know which boxes you need your aggregator to tick. Not every aggregator operates the same way, so let’s highlight a few must-haves:

- Multi-chain support

- If you’re active on multiple blockchains (e.g., Ethereum, Polygon, Binance Smart Chain), an aggregator with cross-chain functionality can save you loads of headache.

- Some aggregators partner with bridging protocols so you can swap tokens from one chain to another in a single transaction.

- Fee structure

- Check whether there’s a platform fee. A small fraction on each trade might not matter for tiny swaps, but it can add up over time.

- Some aggregators use their own tokens—like 1INCH—to give you discounts on fees or extra governance perks.

- Liquidity sources

- The more DEXs that an aggregator taps into, the more likely you’ll find good rates.

- Different networks may have their own popular DEXs, so aggregator coverage can vary widely.

- Pricing transparency

- A clear breakdown of the final quote is crucial. Look for an interface that shows you the exact path your trade follows, each step’s fees, and the final cost.

- User interface and experience

- If the aggregator’s UI feels confusing, you’re more prone to making mistakes. Look for platforms that provide straightforward instructions.

- Some aggregators also offer features like limit orders, so you can wait for a certain price if you’re not in a hurry.

- Security and audits

- Smart contracts should be audited to ensure your funds are safe.

- Check for any known exploits or community feedback on reliability.

Review top DEX aggregators

Now that the foundations are set, let’s dig into some of the top aggregator choices. Each has slightly different strengths and quirks, so it helps to compare them side by side.

1. 1inch

When people think of DEX aggregators, 1inch often pops up first. It’s one of the older aggregators, and it has consistently expanded its features to stay relevant.

- Supported blockchains: Ethereum, BNB Chain, Polygon, Arbitrum, Avalanche, and more.

- Unique Selling Point: It connects to a broad range of liquidity sources, often ensuring minimal slippage.

- Fees: No direct aggregator fee, but you pay gas and associated DEX/trading fees. Holding the 1INCH token can reduce certain costs.

Pros:

- Access to deep liquidity across many networks.

- Advanced order types like limit orders.

- Trusted brand with a large community.

Cons:

- The interface can be overwhelming for new users.

- Gas fees can be high when using Ethereum, especially during peak times.

2. Matcha

Created by the team behind 0x Protocol, Matcha aims for a user-friendly swap experience. Its straightforward interface could be a boon if you prefer a simplified approach.

- Supported blockchains: Ethereum, Polygon, Binance Smart Chain, and more.

- Unique Selling Point: Known for minimal trading friction, plus the 0x Protocol aggregator logic under the hood.

- Fees: Generally, Matcha doesn’t add extra fees, relying on the 0x smart contracts to route trades.

Pros:

- Clean, intuitive design that’s great for beginners.

- Multiple liquidity sources for better prices.

- Good cross-chain coverage, especially with 0x expansions.

Cons:

- Fewer advanced features for power traders (e.g., fewer custom routing options).

- Limit order feature is not as robust as some competitors.

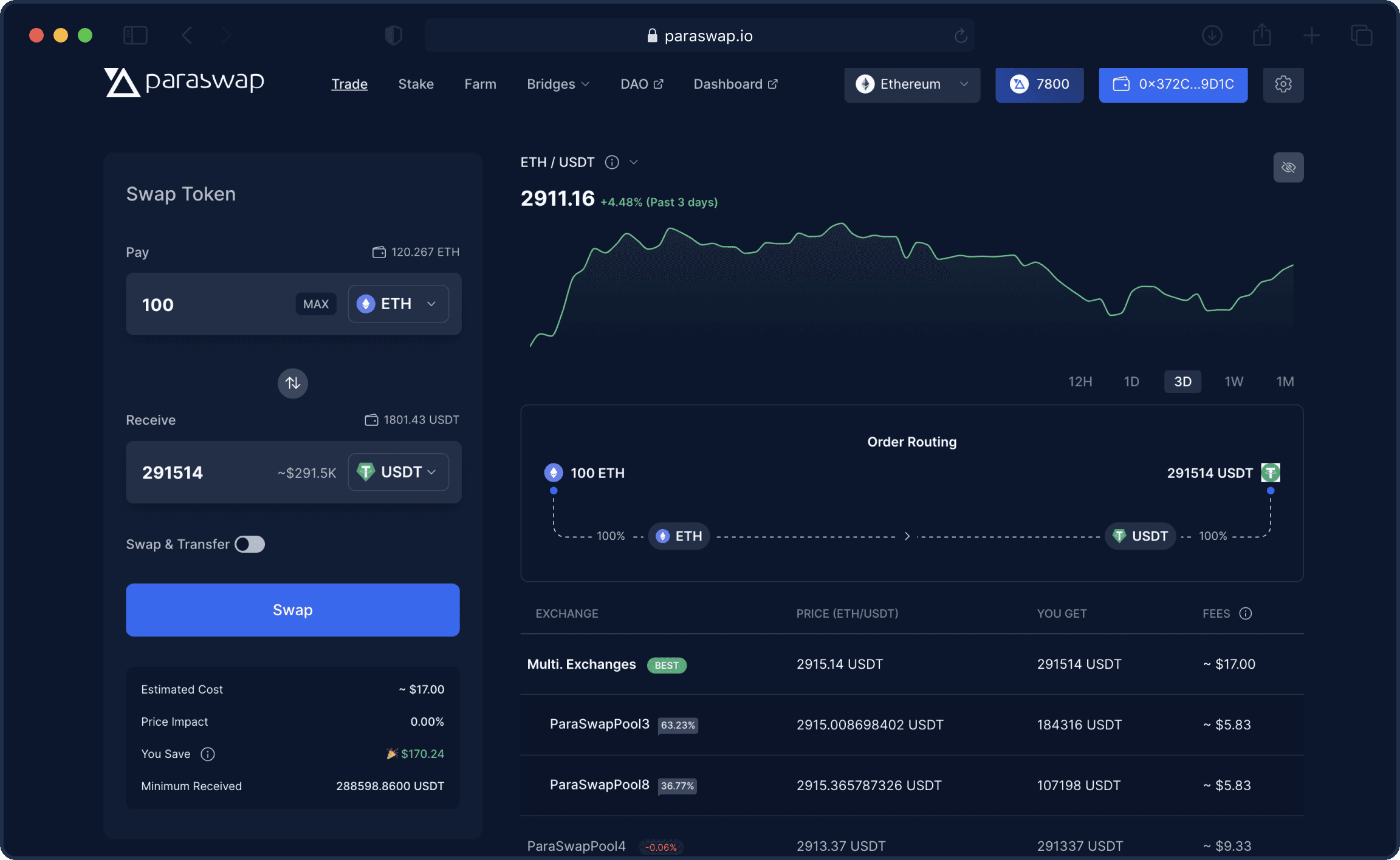

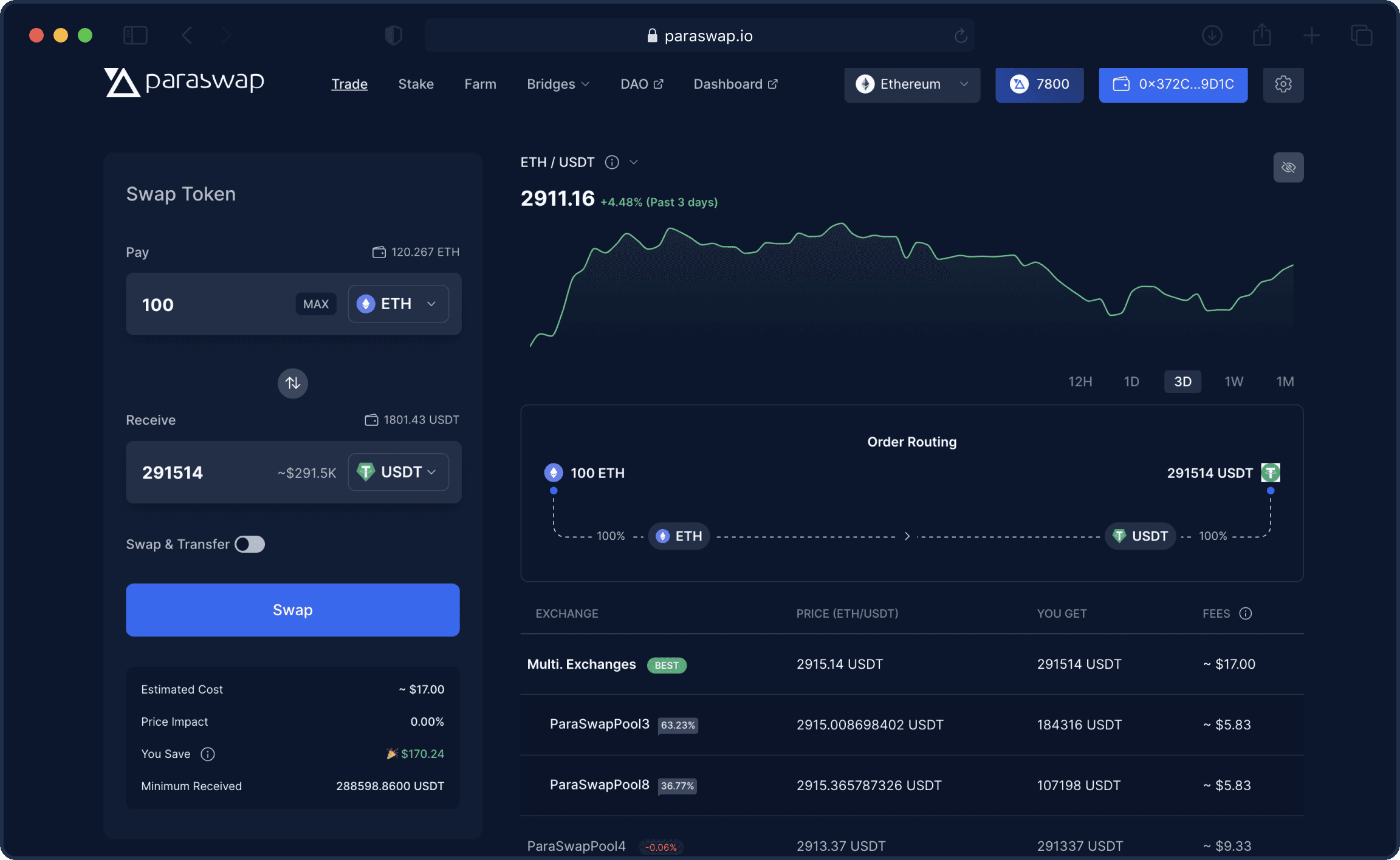

3. ParaSwap

ParaSwap has made a name for itself by emphasizing speed and flexibility. It aims to get your swaps done as efficiently as possible without sacrificing features.

- Supported blockchains: Ethereum, Avalanche, Polygon, BNB Chain, and Fantom.

- Unique Selling Point: ParaSwap’s aggregator logic can break your order into partial fills across multiple DEXs, optimizing for cost.

- Fees: Protocol fees are mostly integrated into the quote, so you see them upfront.

Pros:

- Excellent liquidity coverage on multiple chains.

- Some advanced trading options, including partial fills.

- ParaSwap token (PSP) can offer benefits to loyal users.

Cons:

- Interface might feel cluttered to newcomers.

- Governance token details can be confusing if you’re only there to trade.

4. OpenOcean

OpenOcean brands itself as a full aggregation protocol, meaning it doesn’t stop at DEXs. It also aggregates certain centralized exchanges (CEXs) for additional liquidity, although the full CEX integration may require KYC or special conditions.

- Supported blockchains: Ethereum, BNB Chain, Tron, Polygon, Solana, Fantom, Avalanche, and more.

- Unique Selling Point: Cross-chain and multi-chain aggregator that also explores some CEX liquidity.

- Fees: Typically no aggregator fee. You pay gas plus the underlying DEX or exchange fees.

Pros:

- Wide multi-chain support.

- The possibility of merging CEX and DEX liquidity in the future.

- Offers a range of advanced modes for traders who like custom routing.

Cons:

- Complexity can be high if you’re exploring both CEX and DEX options.

- CEX integration isn’t fully seamless—some aspects might be region-restricted.

5. Orion Protocol

Orion Protocol takes aggregation to another level by spanning both centralized and decentralized order books. You can access liquidity from major DEXs and top CEXs in a single terminal.

- Supported blockchains: Ethereum, BSC, Polygon, Fantom, and more via Orion Terminal.

- Unique Selling Point: Pioneers in bridging the gap between centralized and decentralized exchanges in one aggregator.

- Fees: Orion charges a small broker fee and a transaction fee. Fees can drop if you stake ORN tokens.

Pros:

- Deep cross-platform liquidity.

- Orion Terminal can feel like a complete trading platform, not just a simple swap.

Cons:

- More suited for advanced users who need both CEX and DEX coverage.

- Fees can be tricky to calculate because they vary with different brokers.

6. Balancer

While Balancer is commonly known as an automated market maker (AMM) protocol, it also has aggregator elements built into certain products. In 2025, Balancer expanded to incorporate more aggregator functionality, meaning you can route trades through various pools.

- Supported blockchains: Ethereum, Polygon, Arbitrum, and other EVM-compatible chains like Optimism.

- Unique Selling Point: Liquidity pools that can hold multiple tokens in flexible ratios, sometimes reducing impermanent loss.

- Fees: The platform fee is built into each pool’s parameters, and routing might require extra gas if you split trades across different pools.

Pros:

- Innovative liquidity pools that can improve swap efficiency.

- Option to earn yield by providing liquidity.

- Community-driven governance.

Cons:

- Advanced pool mechanics can be confusing.

- Not strictly a pure aggregator—it’s more like an AMM that also routes trades.

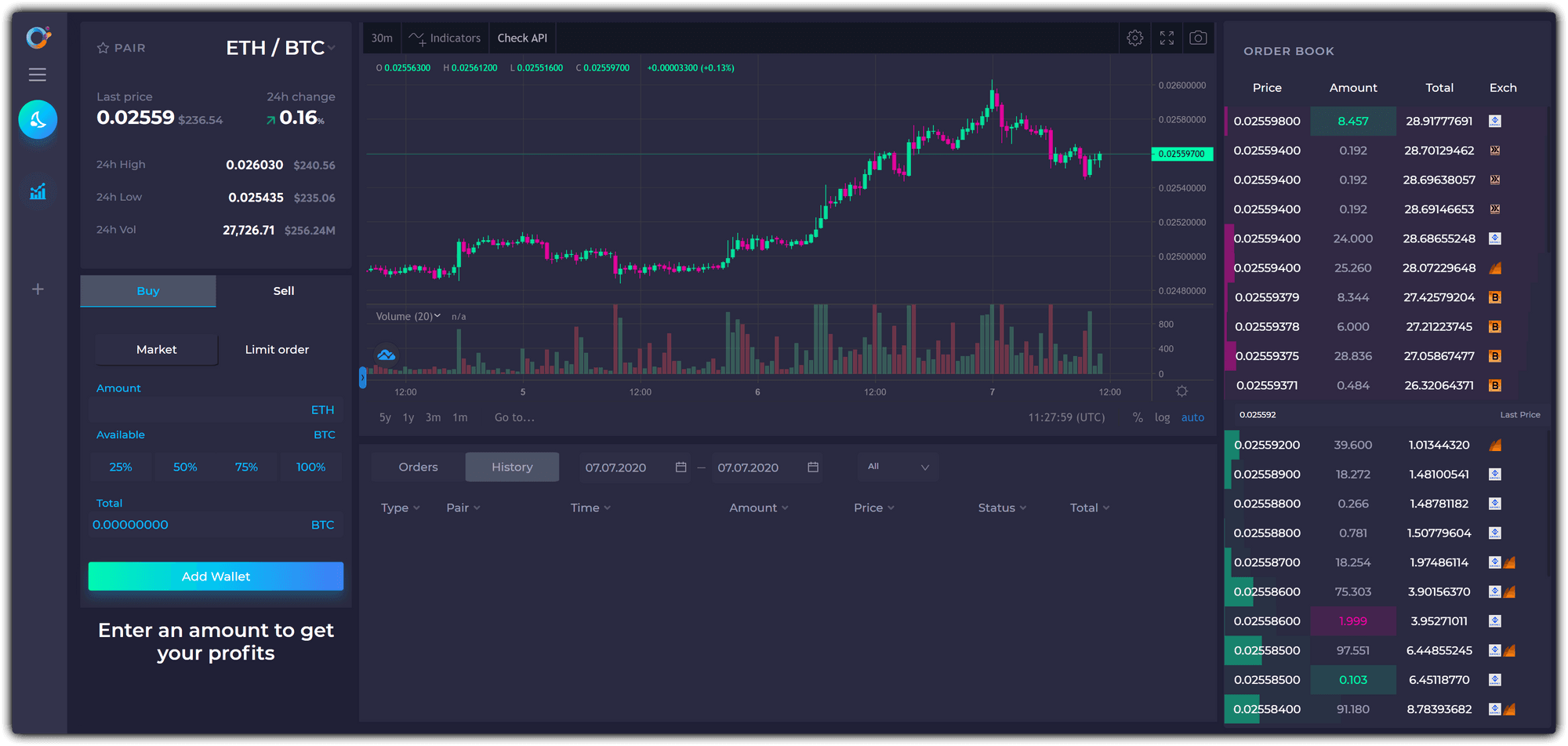

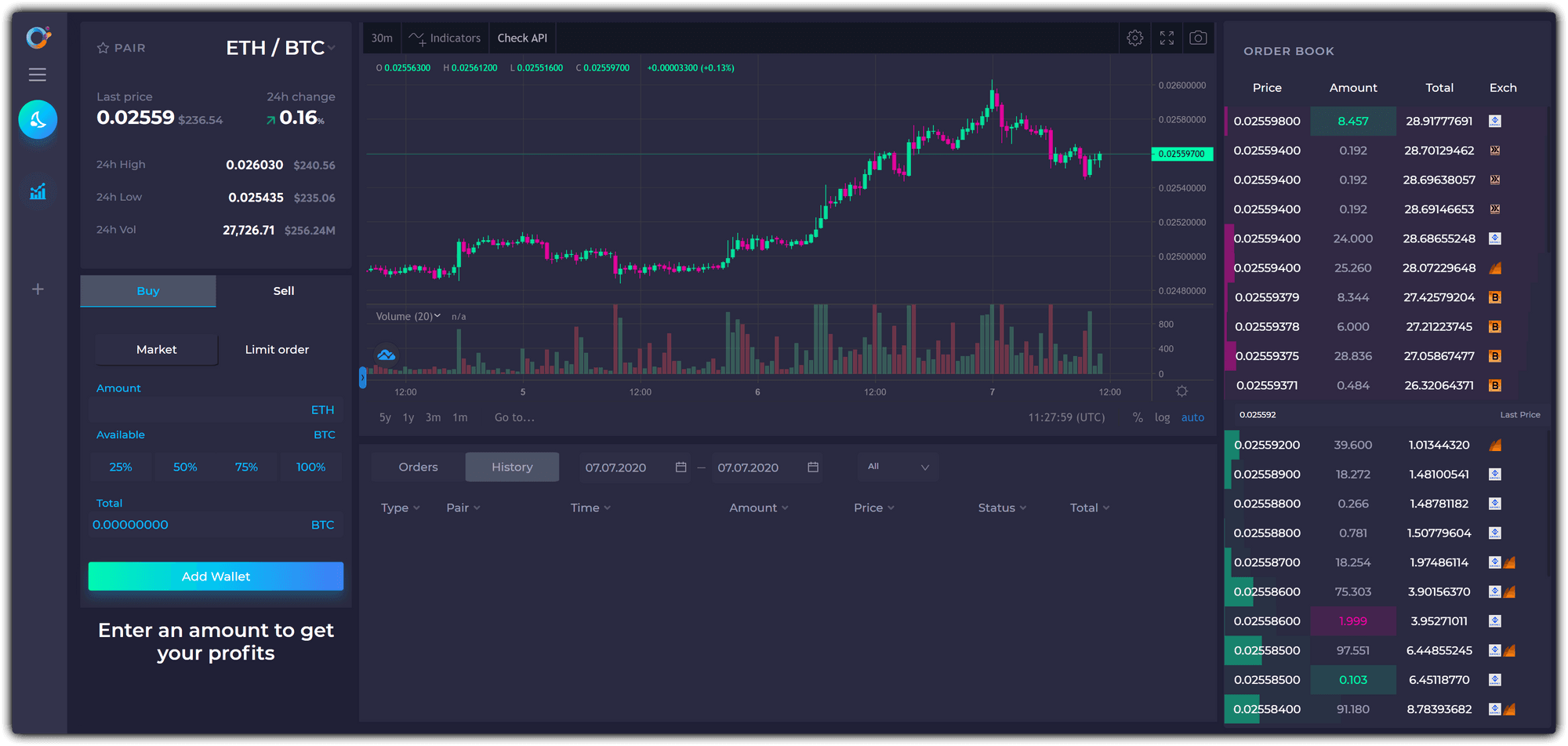

7. Baltex.io

Baltex.io positions itself as a hybrid exchange that merges the speed of centralized trading with the security of decentralized protocols. That means you can approve or reject transactions on-chain, but the order matching engine handles trades more efficiently than standard on-chain solutions.

- Supported blockchains: Focuses on Ethereum and several layer-2 networks, with bridging options to popular alt-L1 chains.

- Unique Selling Point: Faster transaction matching, similar to a centralized exchange, without compromising custody of your tokens.

- Fees: Baltex.io may charge a flat trading fee, but it reduces dramatically if you hold their membership tokens or stake on the platform.

Pros:

- Potentially better rates because of the quick matching engine.

- Less slippage compared to some fully on-chain swaps.

- Cross-chain bridging that simplifies token movement.

8. KyberSwap (Aggregator Mode)

KyberSwap has pivoted multiple times over the years. Initially just a DEX, it now offers aggregator services that plug into various liquidity sources to ensure better swap prices.

- Supported blockchains: Ethereum, Polygon, BNB Chain, Avalanche, Fantom, and more.

- Unique Selling Point: A proven track record in providing aggregated liquidity and a robust developer ecosystem.

- Fees: No direct aggregator fees, though some partner protocols might add a small premium.

Pros:

- Reliable brand with years of experience in DeFi.

- Ramping up multi-chain coverage, so it’s easy to find cross-chain routes.

Cons:

- UI can be less intuitive for completely new traders.

- Fees are not always crystal clear, especially if bridging is involved.

A quick comparison table

To help you see the differences at a glance, here’s a simplified table comparing key features among these aggregators:

Factors that affect your final rate

Even though these aggregators do their best to secure favorable swaps, there are a few factors you should always keep in mind:

- Gas costs

- On Ethereum especially, gas can get pricey when the network is busy. If the aggregator chooses to split your trade across multiple DEXs, expect multiple on-chain transactions.

- Slippage tolerance

- If you set your slippage tolerance too low, your trade might fail in a volatile market. If you set it too high, you might end up paying more due to sudden price changes.

- Liquidity depth

- Some tokens simply don’t have large liquidity pools, no matter how many exchanges you check. Keep an eye on the trade size relative to the available liquidity.

- Exchange or aggregator fees

- Always read the fine print on aggregator websites. While some claim zero aggregator fees, they might have other hidden costs such as bridging or deposit fees.

- Cross-chain bridging overhead

- When an aggregator offers cross-chain swaps, it often relies on bridging protocols. That can introduce extra fees or require multiple transactions.

Security tips when using aggregators

It’s easy to jump straight into a new aggregator, especially when the rates look good. But never skip security steps:

- Double-check the aggregator’s official domain or URL to avoid phishing sites.

- Look for audits of the smart contracts (although an audit alone isn’t a guarantee).

- If you’re testing a new aggregator or new chain, start with a small swap before committing large amounts.

- Read user reviews or community feedback to see if anyone has had issues with failing trades or missing funds.

- Keep your wallet security strong—never sign random transactions you don’t understand.

Deployment on multiple chains

One of the biggest evolutions in aggregator technology has been cross-chain deployment. In 2025, you can find aggregators that seamlessly jump between Ethereum-compatible networks (Polygon, Arbitrum, Optimism) and even alt-L1s like Avalanche and Fantom. But keep in mind:

- Each chain has its own gas token. For example, you need MATIC for gas on Polygon. So be prepared with the right tokens.

- Some markets are more liquid on certain chains. For instance, a token might have better depth on Ethereum but cost less to trade on BNB Chain.

- Aggregators typically integrate bridging protocols from major providers. Make sure the bridging logic is trustworthy.

When to stick to a single chain

If you mostly trade stablecoins or major tokens like ETH or WBTC, you might be fine trading on a single chain, especially if you have a preference for lower gas fees. In that scenario, a simpler aggregator like Matcha or ParaSwap might be enough to get great rates on that one network.

When to go multi-chain

If you’re always jumping into new yield farms or new NFT-based tokens that live on sidechains or other L1s, a multi-chain aggregator (OpenOcean, Orion, or Baltex.io) can be a lifesaver. They connect you to varied ecosystems and skip the manual bridging steps that can chew up your time.

Tips for optimizing your trades

- Check aggregator quotes at different times of day. If you trade during peak hours, gas fees could spike.

- If you’re using an aggregator with advanced settings, investigate limit orders. That way, you can set a desired price and let your trade fill only if the market meets your conditions.

- Keep an eye on aggregator governance tokens. Some platforms let you stake or hold aggregator tokens to lower your fees.

- Always confirm your transaction details in your wallet. Make sure the contract addresses for the tokens match up with official sources to avoid token impersonators.

The future of DEX aggregators

The aggregator scene is moving fast. Here’s what might happen over the next couple of years:

-

More cross-chain expansions. We might see aggregator solutions that automatically route trades across half a dozen chains in a single click.

-

Mergers of DeFi services. Aggregators could bundle in yield-farming or staking opportunities so you can swap tokens and immediately deposit them in a yield pool.

-

L2-first solutions. Expect more aggregators to focus on layer-2 networks like Optimism and Arbitrum, helping you avoid high Ethereum gas fees.

-

Real-time bridging. Future aggregators may offer bridging as a background service, so you won’t realize you’re even bridging between networks.

Choosing your aggregator

Selecting the right aggregator is a personal choice based on your specific trading style:

- If you want maximum liquidity and advanced features, 1inch or ParaSwap might be your jam.

- If you want minimal fuss with cross-chain coverage, check out OpenOcean or Baltex.io.

- If you’re looking for a hybrid of centralized speed and decentralized security, Baltex.io or Orion could suit you.

- If you prioritize a clean UI to swap just a few tokens each month, you might love Matcha’s simplicity or KyberSwap’s aggregator mode.

In any case, it’s best to test a few small trades on multiple platforms to see which suits you best. Rates can vary from day to day, and each aggregator’s coverage evolves rapidly.

Final recap and next steps

When it comes down to it, the best dex aggregators bring convenience and potentially better prices to your token swaps. Whether you’re looking to trade on Ethereum, sidechains, or alternative L1s, these tools do the heavy lifting by comparing multiple exchanges in real time. Ultimately, you’ll save time, reduce slippage, and possibly even cut down on fees—assuming you do your homework on how each aggregator operates.

Next time you’re itching to swap tokens but aren’t sure if it’s a good moment or if there’s enough liquidity, consider firing up an aggregator. It’s like having a shopping assistant who scours every aisle in the store so you don’t have to. Start small, explore the aggregator interfaces to see which pricing details or multi-chain features you prefer, and keep an eye on fees. Knowing how these platforms work means you can trade with confidence and, hopefully, keep more of your profits in your own wallet.

Give one or two platforms a try. See which aggregator layout makes sense to you, and pay attention to gas fees and route breakdowns. Over time, you’ll figure out the aggregator that suits your style best. If you end up loving a specific aggregator, you might even stake its governance token to enjoy fee discounts. That’s the beauty of DeFi—you have options, and you can experiment until you find the perfect trading companion. Happy swapping!