Selling Bitcoin in 2025 is safer and simpler than ever—but scams and fees still lurk. This guide shows you how.

Bitcoin has matured. With spot ETFs, institutional adoption, and prices stabilizing around $90,000–$110,000, many early holders are ready to take profits or rebalance. But rushing to sell can cost you thousands in fees, taxes, or irreversible mistakes.

The goal isn’t just to sell—it’s to convert BTC to fiat securely, minimize costs, and protect your privacy where desired. In 2025, you have more options than ever: centralized exchanges, P2P apps, direct bank off-ramps, and non-custodial swaps. Each has trade-offs in speed, fees, limits, and risk.

This comprehensive guide compares the best methods, walks through step-by-step processes, highlights risks, and shows how tools like Baltex.io can optimize your exit strategy.

Before diving into platforms, understand what makes a selling method “safe” and efficient in 2025.

Speed matters if you need cash quickly, but rushing increases error risk. Fees can erode 1–5% of your proceeds—critical on large sales. Limits determine whether you can cash out $1,000 or $100,000 in one go. Regulatory compliance protects you with insurance and dispute resolution, while privacy-focused tools shield transaction history.

Market timing also plays a role. Bitcoin remains volatile; selling during high-liquidity hours (U.S./European overlap) often yields better prices. Finally, tax implications are unavoidable—most platforms report sales over certain thresholds to authorities.

The safest approach combines a trusted platform with strong personal security habits.

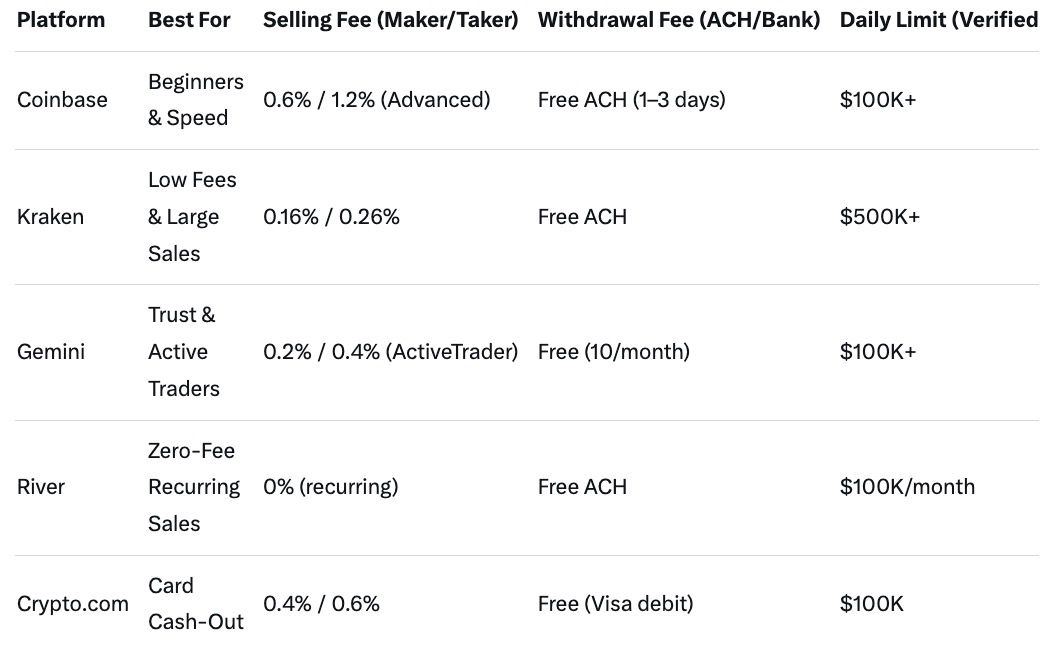

Here’s a side-by-side look at the top regulated options for most users.

Coinbase leads for ease, Kraken for cost efficiency on larger amounts, and Gemini for institutional-grade trust.

For smaller sales or avoiding KYC on portions, peer-to-peer platforms remain viable.

Cash App allows direct BTC sales to USD with instant bank transfer capability. Strike offers Lightning Network sales with near-zero fees and fast settlement. Both are regulated and user-friendly, though limits are lower ($10K–$50K weekly).

True no-KYC P2P (like LocalBitcoins successors) carries higher scam risk—only recommended for experienced users with escrow familiarity.

For most people in 2025, sticking with regulated exchanges or apps minimizes risk dramatically.

Coinbase remains the go-to for first-time sellers due to its intuitive interface and reliability.

Total time from deposit to bank: 1–4 days typically. For faster access, load the Coinbase Card (Visa debit) and spend directly.

Many beginners sell $5,000–$50,000 this way without issues.

Kraken excels when fees matter—ideal for $10K+ sales.

The process starts similarly: deposit BTC to your verified Kraken account (Tier 3+ for high limits). Navigate to Trade → New Order → Sell BTC/USD. Choose market for speed or limit for control. Kraken’s fee tier drops significantly with volume—most users pay under 0.2%.

Once sold, USD settles instantly. Withdraw via ACH (free) or wire ($5–$35 depending on bank). Kraken’s Pro app provides advanced charting if you want to time the market.

Users consistently report tighter spreads and lower total costs than competitors on mid-to-large sales.

For amounts under $10K, Cash App offers simplicity.

Send BTC to your Cash App wallet, tap the balance, select Sell, and convert to USD. Funds appear instantly and can be transferred to your bank (instant for 1.5% fee or free standard).

Strike uses Lightning for near-instant, low-cost sales settled directly to your bank. Both apps have raised limits significantly in 2025 and remain regulated.

Even on trusted platforms, mistakes happen.

The most devastating remains sending BTC to the wrong address—always verify fully. Phishing sites mimicking exchanges have grown sophisticated; bookmark official URLs and check HTTPS certificates.

Over-the-counter scams promising premium rates are rampant—never deal outside platform escrow. Tax evasion attempts via unreported sales trigger automated flags; proper reporting avoids penalties.

Finally, selling during extreme volatility can lock in poor prices. Consider dollar-cost-averaging your exit over weeks if taking large profits.

Strong habits—hardware wallet for storage, app-based 2FA, and small test transactions—eliminate 99% of risks.

One advanced yet increasingly popular strategy in 2025 involves converting BTC to stablecoins or altcoins via non-custodial tools before final fiat off-ramp.

Baltex.io stands out as a privacy-focused, multi-chain swap aggregator supporting over 20 networks including Bitcoin, Ethereum, Solana, Base, and TON.

Why use Baltex before selling?

First, swapping BTC to USDC or USDT on a low-fee chain (like Base or Solana) often yields better effective rates than direct BTC/USD pairs on exchanges, thanks to deeper liquidity pools. Second, it adds privacy—breaking direct on-chain links to your identity before cashing out via a KYC platform. Third, in bearish or uncertain markets, holding stablecoins preserves value while deciding final exit timing.

The process is straightforward and secure:

Once you hold USDC on a supported chain, sell via the same exchange (many now support direct USDC withdrawals) or transfer to a platform with tight stablecoin spreads.

This approach has become a staple for privacy-conscious holders and those optimizing large exits in 2025.

U.S. and many international users face capital gains tax on profits. Platforms like Coinbase, Kraken, and Gemini issue 1099 forms for significant activity. Track your cost basis meticulously—tools like CoinTracker or Koinly integrate directly.

Selling in installments across tax years can manage brackets. Consult a tax professional for your jurisdiction.

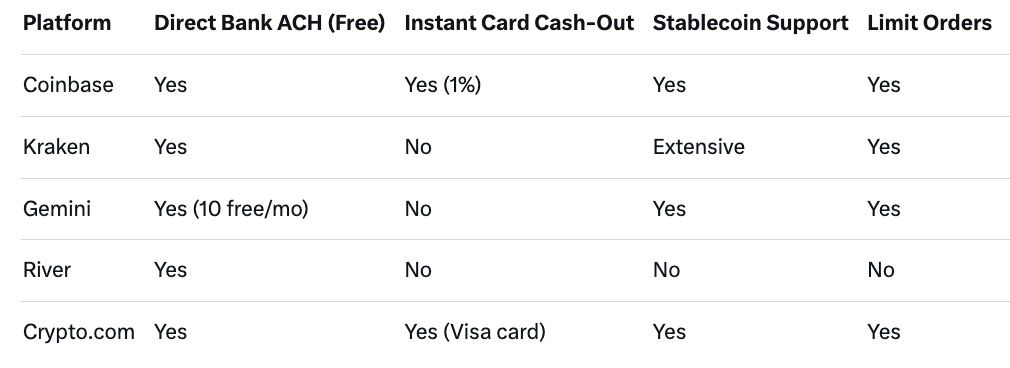

Quick reference for advanced features that impact selling experience.

Choose based on your priorities—speed, cost, or privacy.

Q: What’s the safest way to sell Bitcoin for beginners? A: Coinbase or Gemini—regulated, insured, simple interface, direct bank links.

Q: How long does it take to get money in my bank? A: 1–3 business days via free ACH; instant options cost 1–1.5%.

Q: Should I sell all at once or in parts? A: Dollar-cost-average out during uptrends to reduce regret risk.

Q: Are there ways to sell without KYC? A: Limited and risky—decentralized swaps exist but final fiat off-ramps usually require ID.

Q: Does selling Bitcoin trigger taxes immediately? A: Yes, it’s a taxable event based on profit/loss.

Q: Is it better to sell BTC directly or swap to stablecoin first? A: Swapping via tools like Baltex.io often improves rate and privacy before final sale.

Selling Bitcoin no longer carries the uncertainty of early crypto days. With mature, regulated platforms like Coinbase, Kraken, and Gemini, plus powerful non-custodial tools like Baltex.io, you can exit positions securely, efficiently, and on your terms.

Prioritize security at every step, choose the platform matching your amount and speed needs, consider tax implications, and execute patiently. Whether taking profits after years of holding or simply rebalancing, 2025 offers the safest environment yet to convert BTC to cash.

Start with a small test sale if unsure—build confidence, then scale. Safe selling!