Picture this: you’ve been hearing all the buzz about Berachain, and you’re curious to dip your toes into its unique DeFi and Web3 ecosystem. If you’ve been looking for a berachain bridge tutorial, you’re in the right spot. In this guide, I’ll walk you through every step of transferring assets from another chain onto Berachain, so you can explore liquidity pools, staking, or any other on-chain adventure that catches your eye. Let’s jump right in.

To start, let’s clarify what “bridging” actually means in crypto. A bridge is basically a connection between two blockchains, enabling you to move digital assets back and forth. When you bridge your tokens (let’s say, ETH) over to Berachain, you’re trading them on the original chain for wrapped or cast versions on Berachain. Sound complicated? It’s like leaving your physical coat at the coat check and getting a ticket that acts as a placeholder. That “ticket” is the wrapped asset living on Berachain. Your original tokens remain locked in the smart contract on the starting chain.

Bridges come in many varieties, and each one has a protocol for verifying and relaying transactions. Some rely on trusted intermediaries, while others use decentralized or cross-chain validation. The end goal remains the same: to let you use your assets on another chain. Doing so is ideal when you want to take advantage of a chain’s unique features or ecosystem — in our case, Berachain’s DeFi environment.

If you’re curious about bridging concepts in general, check out our Crypto Bridge guide for more background. This will give you a solid foundation before you dive deeper into cross-chain adventures.

Wallet setup is a crucial step. You’ll need a wallet that supports both your origin chain (like Ethereum, Binance Smart Chain, or Gravity Chain) and Berachain. Most bridging solutions today are designed to be used with a browser extension or a mobile wallet.

Choose a wallet: A popular pick is MetaMask. If you already have MetaMask installed, you’re ahead of the game. Hardware wallets are also an option if you value extra security, but for simplicity, we’ll assume you’re using MetaMask or a similar browser wallet.

Create your account: If you’re new to crypto and have never created a wallet, the interface guides you through it. You’ll receive a recovery phrase — 12 or 24 words. Store this phrase offline in a safe place.

Add a custom network: Since Berachain might not be loaded by default in your wallet, you’ll need to manually add it. For MetaMask, head to “Settings,” then “Networks,” and fill in the relevant RPC details. If you don’t have them yet, keep an eye on official Berachain documentation or community updates.

Keep your wallet password-locked, and never share your seed phrase with anyone. Even the bridging interface you use won’t need it. They only require your wallet signature to confirm transactions.

Before you actually jump in and bridge to Berachain, ensure you have enough funds in your wallet for transaction fees and for the tokens you plan to transfer. Each chain has its own native coin (like ETH on Ethereum) for gas payments.

Start small to test the waters. Send a small amount over and verify that everything works properly. Once you’re confident, you can transfer bigger balances without anxiety.

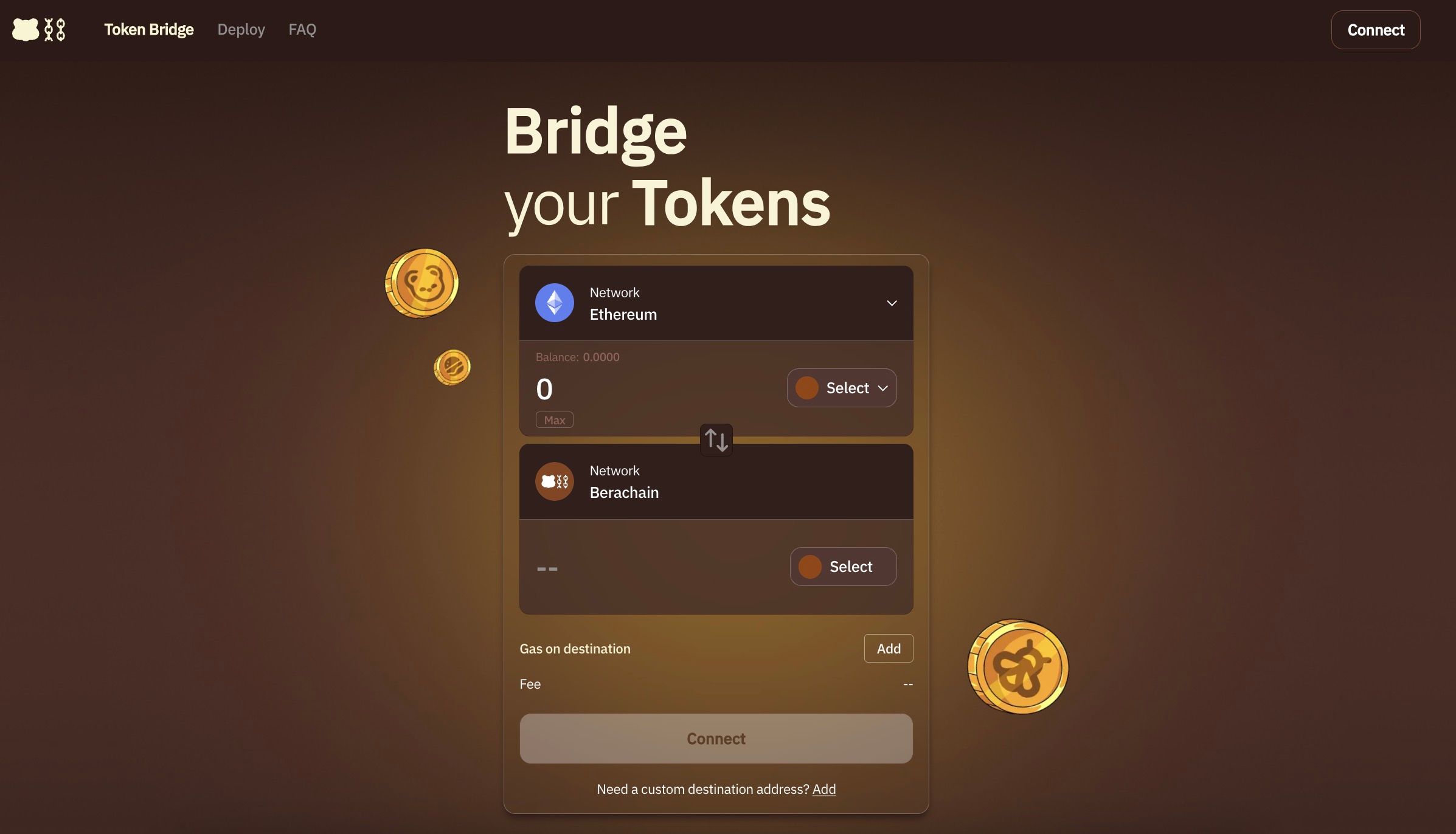

The bridging interface you use largely depends on the token you’re moving and how user-friendly you want the experience to be. You can think of bridging services like third-party tools that handle the cross-chain steps behind the scenes. Baltex.io, for instance, is known for its streamlined approach. It can simplify a lot of the manual steps, letting you connect your wallet and confirm a few details before bridging.

When you’re ready to proceed, your bridging interface outlines transaction fees, estimated wait times, and any bridging fees. Some platforms charge extra to maintain the network or pay watchers and validators that help secure the cross-chain movement.

You’ve set everything up, so now’s the moment to review. This is a critical step for ensuring your funds go where they’re intended.

If you’d like a second bridging option or you prefer a more advanced feature set, it’s worth comparing platforms. Some offer instant confirmations or liquidity pools that let you swap into other assets the moment you arrive on Berachain.

After confirming your transaction, you might wonder, “Now what?” Typically, the bridging interface shows a pending status for a few minutes. On certain networks, bridging can take anywhere from a few minutes to over an hour, depending on network congestion and the number of confirmations required.

If something seems off or your transaction is stuck, don’t panic. Contact the bridging service’s support, or look for community channels. It might be a small bug or a wallet setting you can fix easily.

Once your tokens appear in your wallet on Berachain, there’s a ton of potential fun in store. You can explore yield farms, staking, or liquidity pools aimed at Berachain’s tokens. If DeFi is your jam, bridging over was just the beginning.

And hey, if you ever decide to move your funds back to your original chain, the bridging process works in reverse.

Below are five common questions so you can troubleshoot potential snags and better understand bridging in general.

It depends on two fees: network gas fees and bridging protocol fees. On Ethereum, for example, gas fees can spike during busy times, driving up your total cost. Some bridging platforms also charge a small protocol fee. Plan for these costs by having extra ETH or the origin chain’s native token.

Not all wallets support bridging. You need a wallet that can connect to your origin chain and Berachain. MetaMask is frequently compatible, but check each bridging platform’s documentation to be sure. Hardware wallets can work via browser interfaces, but the process can be more advanced.

If the tokens arrived but remain invisible in your wallet, you probably need to import the token contract address. Double-check that you added the correct contract. If your bridging interface displayed a success message, your tokens are likely there. You just need to reveal them in your wallet.

Sometimes transactions linger if the network is clogged or if your gas settings were too low. Wait at least 30 minutes before taking any action. If it’s still unconfirmed, check your bridging service’s support resources for guidance on increasing gas fees or canceling the transaction.

Bridges can be a security risk if the smart contracts or the oracles responsible for validating cross-chain moves prove vulnerable. Stick to well-audited services. Major bridging protocols invest in regular security audits, and user feedback quickly flags any suspicious behavior. Stay vigilant, and you’ll likely have a smooth experience.

Baltex.io deserves a special mention if you’re seeking a frictionless bridging experience to Berachain. It automates many of the tricky steps. Once you’ve connected your wallet, Baltex.io fetches the best bridging routes, estimates fees, and typically finalizes your cross-chain move in minutes. Plus, it has a friendly user interface that guides you from start to finish without overwhelming you with blockchain jargon.

Within a short while, your newly arrived tokens should show up in your wallet on Berachain, paving the way for you to explore the chain’s DeFi realms.

Bridging failures can happen. Maybe your internet glitched or the bridging service had downtime. Here’s how to keep calm and carry on in such cases:

If your bridging service is reputable, their support should get you back on track, or they’ll clarify the final status of your funds.

Bridging isn’t just about jumping to a new chain and staying there. You can also juggle multiple chains to access different rates, unique DeFi products, or specialized NFT markets. Maybe you’ll bridge from Ethereum to Berachain for yield farming, then pivot from Berachain to another chain for cheaper gaming dApps.

If you’re someone who wants to keep tabs on multi-chain opportunities:

Cross-chain bridging can be a treat, but it pays to be extra cautious when dealing with untested protocols or suspicious token addresses. Sticking to the motto “Do your own research” helps you avoid unwelcome surprises.

Baltex.io, along with many other bridging services, invests in audits and frequent protocol checks. Keep an eye on their announcement channels for security news or scheduled maintenance.

You might be wondering, “I have a million bridging options. Why Berachain?” This network is garnering attention for its specialized approach to DeFi. By bridging over, you get access to:

Before you click the “bridge” button, here’s a final mini-checklist to ensure a peaceful crossing:

Concerned about bridging regrets? As in, “What if I move my tokens to Berachain but realize I need them back the very next day?” The nice thing about bridging is that it works in both directions. If you truly regret bridging, you can hop right back. Just remember that reversing the process means paying fees again. Planning ahead is the best approach.

If the bridging conversation has you worried about complicated steps, tools like Baltex.io are essentially bridging “assistants.” They reduce guesswork by bundling network fee estimations, route selection, and user prompts in one user-friendly workflow. Use them once or twice, and you’ll see why bridging no longer feels like a cryptic puzzle.

Bridging to Berachain may sound intimidating at first, but it’s a straightforward process once you get familiar with the basics. You’ll set up your wallet, fund it with enough gas for fees, pick a bridging interface like Baltex.io, and monitor your transaction as it finalizes. From there, you’re free to explore everything Berachain has to offer — from DeFi pools and NFT marketplaces to brand-new dApps that pop up every day.

If you’re uncertain at any step, reading bridging tutorials or checking in with the Berachain community can clarify any hiccups. And remember, always keep your seed phrase private, do small test transfers, and keep an eye on official updates from your chosen bridging provider. Now you’re well on your way to bridging success.

So go ahead and give it a try. Enjoy discovering new yield strategies, exploring fresh dApps, and maybe stumbling upon the next big crypto trend — all on Berachain! If you find an especially nifty bridging trick or a helpful resource, be sure to share it with your fellow crypto adventurers. It’s all part of what makes cross-chain exploration so exciting. Safe travels!