What Is DAI? Understanding the Decentralized Stablecoin in 2025

In a crypto market worth $3.8 trillion in November 2025, one stablecoin stands apart from the rest: DAI.

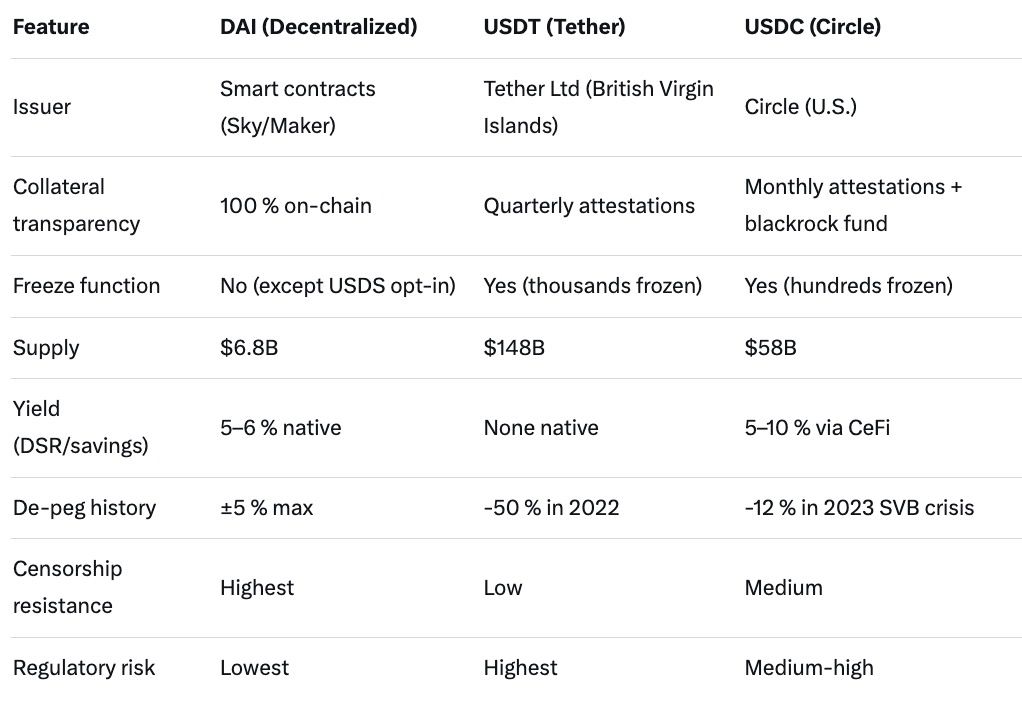

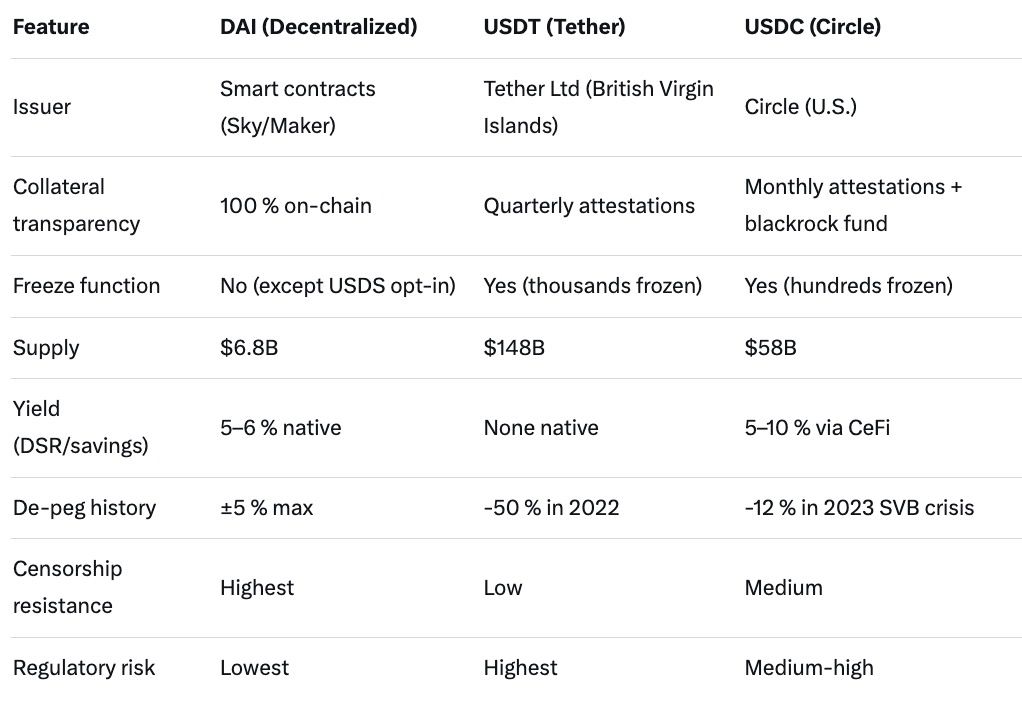

Unlike USDT or USDC that are issued by centralized companies (Tether and Circle), DAI is created and governed entirely by smart contracts on Ethereum and Layer-2s — no bank account, no CEO, no freeze function. It has maintained a $1 peg through black swan events, bear markets, and bank runs while staying over-collateralized and censorship-resistant.

This 2,400-word SEO guide is for beginners and intermediate users who want to finally understand what DAI actually is, how MakerDAO creates and destroys it, how the peg is defended, what collateral backs it in 2025, stability fees, real-world examples, and the risks you must know. We’ll compare DAI head-to-head with USDT and USDC and show you where it fits in today’s ecosystem.

(When you want to swap any token into DAI with zero commission across 200+ chains, Baltex.io is one of the cheapest routes in 2025 — more on that later.)

TL;DR: DAI in 2025 at a Glance

- What it is: Decentralized, over-collateralized stablecoin soft-pegged to $1, created by MakerDAO.

- Supply: ~$6.8 billion (3rd largest stablecoin after USDT & USDC).

- Collateral: 150–200 % over-collateralized with ETH, wstETH, rETH, cbBTC, real-world assets (RWAs), USDC (limited), and more.

- Peg mechanism: Stability Fee + PSM (Peg Stability Module) + DSR (DAI Savings Rate).

- Governance: MKR token holders (Sky → Maker rebrand completed 2024).

- 2025 upgrades: Spark Protocol, Sky Money, USDS (optional upgrade), $500M+ in tokenized T-Bills.

- Biggest advantage: No counterparty risk — truly decentralized.

- Biggest risk: Smart-contract exploits & liquidation cascades in extreme volatility.

Jump to how DAI is created | Peg defense | 2025 collateral | DAI vs USDT/USDC | FAQ

How DAI Is Created and Destroyed (Step-by-Step)

- User deposits collateral (e.g., ETH) into a Maker Vault (smart contract).

- System calculates max DAI you can generate based on collateral type and ratio (e.g., 175 % for ETH → borrow up to ~57 % of value).

- User mints DAI → DAI enters circulation.

- When user repays DAI + stability fee → DAI is burned → collateral released.

Example (Nov 2025 numbers):

You lock $17,500 worth of wstETH (Lido staked ETH) → generate 10,000 DAI → use it anywhere → later repay 10,000 DAI + ~5 % annual stability fee → get your ETH back.

How the $1 Peg Is Maintained — The Genius Mechanisms

When DAI > $1.01 → lower DSR → less demand → price falls.

When DAI < $0.99 → raise DSR → holders lock DAI → price rises.

Collateral Types Backing DAI in 2025 (The Basket Keeps Growing)

Total collateral value ≈ $11–13 billion → DAI supply $6.8 billion → average ~180 % over-collateralized.

MakerDAO → Sky Rebrand & 2025 Upgrades

- MakerDAO officially rebranded to Sky in late 2024.

- DAI continues unchanged, but users can upgrade to USDS (new version with optional freeze function for regulated entities).

- Spark Protocol — lending market that became the #1 DAI liquidity source (similar to Aave but native).

- Sky Money — DSR-focused product paying 5–6 % on DAI (competing with T-Bill yields).

DAI vs USDT vs USDC Head-to-Head (2025 Reality Check)

Real-World Examples of DAI in 2025

- DeFi Yield Farming — Deposit DAI into Spark → borrow against it → loop for 5–8 % net yield.

- Remittances — Send DAI via Gnosis Chain or Base → recipient swaps locally (cheaper than Wise in many corridors).

- Institutional Treasury — BlackRock’s BUIDL fund accepts DAI as collateral.

- Gaming & NFTs — DAI is default currency in Decentraland and many Axie-like games.

- Emergency De-pegging Defense — March 2025 memecoin crash → DAI dipped to $0.96 → DSR raised to 8 % → back to $1.00 in <48 hours.

Risks You Must Understand Before Using DAI

- Smart-contract risk — If Maker vaults are exploited (never happened at scale, but possible).

- Liquidation risk — If collateral drops faster than you can add more (2022 ETH crash liquidated $2B+).

- Oracle failure — Price feeds attacked → bad liquidations (mitigated by multiple oracles + delay).

- Governance risk — MKR holders could vote harmful changes (extremely unlikely due to token distribution).

- Regulatory grey zone — Some countries may target decentralized stablecoins.

How to Get and Use DAI in 2025

- Oasis.app or Spark.fi → deposit ETH → generate DAI (most popular).

- Swap any token → DAI on Uniswap, Curve, or Baltex.io (zero-commission multi-chain aggregator — often the cheapest route from Solana, Base, Arbitrum, etc.).

- Earn yield → lock in DSR via Spark or Sky Money (5–6 % paid in DAI).

FAQ: DAI Stablecoin 2025 Edition

Is DAI really decentralized?

Yes — no single entity can freeze or mint DAI without governance. USDS offers optional freeze for regulated users.

Can DAI lose its $1 peg permanently?

Extremely unlikely while over-collateralized and PSM exists. Worst historical dip: ~5 %.

Why would anyone use DAI instead of USDC?

Censorship resistance, native yield (DSR), and philosophical alignment with DeFi.

How much interest do DAI holders earn?

5–6 % via DSR in November 2025 (paid from stability fees).

Is DAI safer than USDT?

Most analysts say yes — transparent on-chain collateral vs. offshore attestations.

What happens if ETH crashes 50 %?

Mass liquidations → excess collateral auctioned → DAI remains over-collateralized (system survived 2022).

Conclusion: DAI Is the Only Truly Decentralized Dollar

In 2025, DAI is no longer an experiment — it’s the third-largest stablecoin on earth, powering billions in DeFi volume while staying fully transparent and censorship-resistant.

For everyday payments, USDC might be simpler. For yield and privacy, DAI + DSR wins. For ideological purity, nothing else comes close.

Whether you’re borrowing against your ETH, earning 6 % risk-free, or just holding a dollar that no government can freeze, DAI is the decentralized stablecoin that actually works.

Ready to try it? Swap any asset into DAI instantly and commission-free on Baltex.io, then deposit into Spark and start earning today.