Cross-chain bridges let you move your digital assets between different blockchains without selling them first.

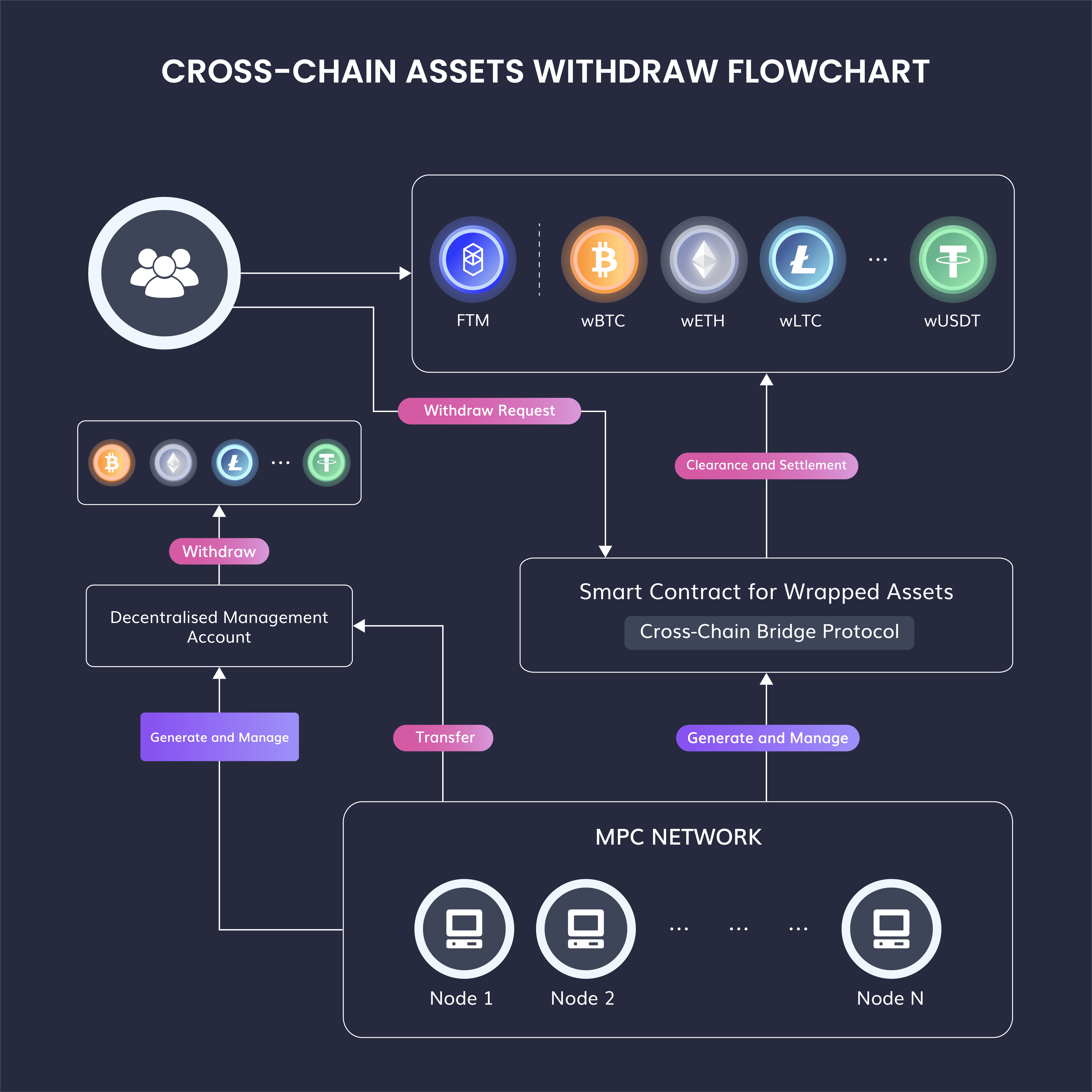

They typically lock your tokens on the source chain, issue equivalent tokens on the target chain, and reverse the process when you transfer back.

Speed, fees, and security are the main things to watch when choosing a bridge.

In 2025, the leading bridges offer faster confirmations, support for multiple networks, and competitive transaction costs.

Baltex.io stands out as a top cross-chain swap hub because it simplifies bridging and trading in one place.

A cross-chain bridge is a mechanism that connects two or more separate blockchain networks. Think of it like a digital highway system that allows you to travel between cities (blockchains) without losing what you carry. You lock up your tokens on the blockchain you are leaving, then receive newly minted or wrapped tokens on the destination blockchain. When you want to return, you simply burn or redeem the wrapped tokens to unlock the originals.

Bridging used to be a hassle if you needed to switch from, say, Ethereum to Binance Smart Chain, or from Avalanche to Polygon. In 2025, new solutions have made it easier than ever to swap your assets across multiple networks. This means you can hunt for the best DeFi yield opportunities, explore different NFT marketplaces, or just diversify your portfolio without being limited to a single chain.

You might wonder why you should bother with cross-chain bridging at all. After all, you can buy assets directly on your preferred chain or even manually convert them using a centralized exchange. But using a dedicated cross-chain bridge can give you distinct advantages:

Cost efficiency. A good bridge can minimize the fees you pay compared to moving your funds through multiple wallets or exchanges.

Time savings. Instead of waiting days for a bank transfer or dealing with complicated exchange procedures, you get near-instant transfers between major chains.

Wider access to DeFi. With bridging, you can reach high-yield farms and exclusive NFT drops on other networks without missing a beat.

Flexibility. If one chain becomes too congested or expensive, bridging lets you easily move your assets to a cheaper, faster chain.

Bottom line: bridging is about freedom. It ensures you are not stuck on a single blockchain with its limitations. You can explore, invest, or build on multiple platforms at once.

Before choosing a cross-chain bridge, it helps to look at the bigger picture. You will want to research the major points below so that your bridging process is both profitable and safe.

Speed. Some bridges confirm your transactions within a minute, while others can take 30 minutes or more. If you need quick transfers, keep an eye on average confirmation times.

Fees. Bridge fees can vary widely, depending on both the protocol and the network. Ethereum gas fees, for example, can spike quickly. Look for a bridge that optimizes costs on the chains you plan to use the most.

Security measures. How is the bridge secured? Does it rely on trusted custodians, or is it governed by a decentralized group of validators? A more decentralized and audited bridge typically offers stronger security guarantees.

Supported networks. If a bridge only supports Ethereum and BNB Chain, it is not too helpful if you also need Avalanche, Polygon, or Solana. Double-check the list of supported blockchains before you commit.

User experience. You do not want to guess which wallet to use or how to finalize your transaction. The best bridges come with user-friendly interfaces, step-by-step instructions, and reliable support.

Once you have a handle on these factors, you are ready to explore the top cross-chain bridges that are making waves in 2025.

Below is a curated list of cross-chain bridges that shine in today’s market. Each has its own approach to speed, cost, and supported networks. You will find solutions for a variety of use cases, from quick swaps between top blockchains to advanced bridging scenarios involving multiple chains.

Baltex.io is not only a bridge, but a comprehensive cross-chain swap hub. You can think of it as a one-stop shop for all your bridging and trading needs.

Key features

Integrates bridging with a built-in decentralized exchange. This means you can transfer assets between chains and trade them without leaving the platform.

Easy accessibility through web and mobile interfaces. You can bridge from your phone just as easily as from your desktop wallet.

Highly adaptable. Baltex.io developers frequently add support for new networks, so you are always on top of the latest DeFi hotspots.

Pros and cons

Pros:

Convenient combined swapping and bridging.

Quick confirmations on the most popular blockchains.

Clear fee structure that lets you see the cost before bridging.

Cons:

May charge a slightly higher service fee than standalone bridges.

Advanced trading features can be overwhelming if you only want basic bridging.

Baltex.io is ideal if you appreciate an all-in-one solution. Instead of juggling multiple dashboards or relying on separate exchanges, you can handle both bridging and token swaps under one roof.

Formerly known as Anyswap, Multichain has established itself as a go-to solution for connecting dozens of blockchains. Its large network coverage is its main draw.

Key features

Robust liquidity pools supporting assets across Ethereum, Binance Smart Chain, Avalanche, Polygon, Fantom, and many more, so you can swap tokens with minimal slippage.

Uses Fusion DCRM technology for better security. Assets remain protected during the bridging process by a network of independent nodes.

The platform has an intuitive interface that clarifies each step, from choosing your source chain to receiving the bridged tokens.

Pros and cons

Pros:

Extremely broad network support.

Competitive fees, especially if you move popular tokens.

Transparent bridging progress that tracks each phase of your transaction.

Cons:

Busy interface might be confusing for newcomers.

Fee spikes can happen on Ethereum-based bridges during peak congestion.

If you switch between multiple ecosystems, Multichain’s array of supported networks makes it a top candidate. New users will appreciate the guided transaction experience, plus the consistent reliability of its cross-chain mechanics.

Wormhole gained attention as a powerful bridge connecting Solana, Ethereum, and other cutting-edge blockchains. You will often see it used to move assets into Solana’s lightning-fast DeFi landscape.

Key features

High throughput. Wormhole is designed to bridge large volumes of assets while keeping the transaction times relatively short.

Developer-friendly. You will find a growing number of apps and NFT projects that rely on Wormhole’s core code for cross-chain interactions.

Unique guardians. An independent set of nodes, known as guardians, is responsible for verifying transactions, which decentralizes the process.

Pros and cons

Pros:

Proven record of bridging major assets from Ethereum to Solana.

Actively audited for vulnerabilities, aiming to keep funds secure.

Useful for NFT bridging into Solana’s thriving marketplace.

Cons:

Limited number of supported blockchains compared to some rivals.

Past security incidents led to improved audits, but also caused trust concerns for some users.

If you are active on Solana or frequently move between Solana and Ethereum, Wormhole is a proven tool. Just keep in mind that some of its expansions to other chains are still developing.

Synapse is a cross-chain protocol that focuses on speedy swaps and minimal slippage. If your priority is fast bridging between top DeFi platforms, Synapse is worth exploring.

Key features

Automated market-maker (AMM) approach. This approach includes liquidity pools that enable near-instant swaps, especially for stablecoins.

Supports cross-chain staking and yield earning. You can deposit tokens to earn returns, then bridge them to another chain without having to un-stake first.

Emphasis on stablecoin conversions. If you need to move liquidity in stable form, Synapse’s environment can help you avoid price fluctuations.

Pros and cons

Pros:

Fast settlement for stablecoins and major assets.

Clear interface that even beginners can handle.

Good track record of bridging reliability in various market conditions.

Cons:

Sometimes fewer tokens supported beyond popular stablecoins and main governance tokens.

Fee structure can vary by chain, so read the details for each transaction.

Synapse excels in delivering quick results when you want to move USDC, DAI, or other stablecoins between networks. The platform’s cross-chain yield options add a nice bonus for those looking to earn passive income while bridging.

Celer cBridge is part of the broader Celer Network’s suite of scaling solutions. It focuses on secure, low-latency cross-chain transfers through an off-chain transaction architecture.

Key features

Off-chain aggregator for transactions. Celer cBridge bundles multiple transactions off-chain, reducing the load on the main blockchain.

High liquidity. Thanks to the broader Celer ecosystem, cBridge can accommodate significant transaction volumes.

Smooth user experience. The dashboard guides you through choosing your source and destination chains, as well as handling the token input.

Pros and cons

Pros:

Low transaction fees compared to some on-chain bridging methods.

Robust security audits, with an active developer community.

Consistent addition of new chains, making the platform future-proof.

Cons:

Off-chain aggregator approach might be less intuitive for those used to pure on-chain bridging.

Liquidity can sometimes concentrate into certain token pools, affecting availability for others.

Celer cBridge stands out if you value speed and cost efficiency. By aggregating transactions off-chain, it can offer a smoother bridging process, particularly during busy market periods.

ChainPort focuses on bridging tokens to multiple networks while maintaining a user-friendly design. If you want a quick bridging route that does not require a lot of technical knowledge, ChainPort is a solid choice.

Key features

Simple bridging wizard. You choose your token, specify your target chain, and confirm details in just a few clicks.

Premium security with an array of smart contract audits. The platform’s “Port Shield” attempts to reduce potential vulnerabilities.

Governance-layer bridging for certain tokens. This means you can carry over not only the token, but also some protocol governance rights across chains where possible.

Pros and cons

Pros:

Beginner-friendly interface.

Multiple audits from reputable firms.

Support for a growing list of EVM-compatible networks.

Cons:

May not have as many chain choices as veterans like Multichain.

Some advanced bridging features are still in beta.

ChainPort is perfect when you are looking for a straightforward bridging tool that does not demand high technical skills. It might not be as richly featured as competing platforms, but it covers the essentials so you can move your tokens with minimal fuss.

AllBridge prides itself on bridging tokens across networks such as Ethereum, BNB Chain, Solana, Avalanche, Polygon, and more. It is known for bridging not only fungible tokens, but also stablecoins with relatively low fees.

Key features

Wide coverage for EVM and non-EVM blockchains. This is especially handy if you want to go from an EVM-based chain to something like Solana.

Constant updates. As new blockchains emerge or gain traction, AllBridge often includes them quickly.

Active community. DeFi users frequently share bridging tutorials and success stories, which helps new users get started.

Pros and cons

Pros:

Simple bridging flow that is easy to grasp.

Plenty of stablecoin options, making cross-chain liquidity movement straightforward.

Generally lower fees than older bridging solutions.

Cons:

Might require extra wallet setups for non-EVM chains.

Observers point out that bridging times can vary, especially during network congestion.

If your main goal is bridging stablecoins or you want to move funds between EVM and non-EVM chains, AllBridge offers an accessible route. Its community-driven support often makes it a pleasant experience for new DeFi explorers.

Hop Protocol specializes in bridging tokens across various layer-2 solutions, focusing on speed and minimal bridging costs. If you like to hop between layer-2 ecosystems for cheaper gas fees, this solution suits your needs.

Key features

Enables near-instant transfers between Arbitrum, Optimism, Polygon, and Ethereum mainnet.

Liquidity pools for major tokens, including stablecoins and L2 governance assets.

Hop “bonders” lock and relay liquidity, allowing you to receive bridged assets almost immediately.

Pros and cons

Pros:

One of the fastest bridging times for L2 networks.

Low fees since most transactions happen off the congested Ethereum layer-1.

Strong community involvement through governance tokens.

Cons:

Limited to a handful of layer-2 networks, so not for bridging to non-EVM chains.

Liquidity can fluctuate, leading to increased slippage or bridging delays.

If you frequently bounce between Ethereum layer-2 solutions, Hop Protocol lives up to its name by making these cross-chain transitions simple and quick.

You use a cross-chain bridge to transfer digital assets between two different blockchains. Instead of selling a token on one chain and rebuying it on another, you can lock your tokens on the original network, then receive a wrapped version on the target network. This saves both time and transaction fees.

Most cross-chain bridges rely on decentralized custody or multi-signature validation to avoid a single point of failure. However, no protocol is 100 percent risk-free. Some have been hacked in the past, prompting stricter audits and best practices. Research the security track record of each bridge, read user reviews, and consider bridging smaller amounts if you are uncertain.

Start by deciding which chains you want to connect. Then look into speed, fees, security, and user experience. A good bridge should support your target networks, provide transparent fee estimates, and offer quick confirmations. For example, Baltex.io is handy if you want an all-in-one swap hub, while Wormhole might be better if you are heavily involved in Solana’s ecosystem.

It depends on the chains you plan to connect. If you move tokens from Ethereum to Polygon, you can usually use the same MetaMask wallet that supports both EVM networks. But if you move tokens to Solana, you will need a Solana-compatible wallet like Phantom. Always double-check the wallet compatibility before bridging.

Bridging times depend on how many confirmations are needed on the source and destination blockchains. Congestion, validator delays, and security measures (such as extra confirmations to prevent double spends) can also affect how quickly your transaction finalizes.

If you lose tokens due to a user error (like copying the wrong receiving address) or a wallet security issue, recovering them can be extremely difficult. If the bridge fails on its end, many platforms provide support to help track or restore your funds. Always confirm addresses, networks, and token details before clicking “Send.”

Tax treatment varies by region. Some jurisdictions treat bridging transactions as crypto-to-crypto swaps, while others consider them non-taxable if you maintain full ownership of the tokens. Consult a tax professional who understands cryptocurrency laws in your country for precise guidance.

Yes, in many cases you can deposit tokens into a DeFi protocol on the destination chain. Some bridges, such as Synapse, even allow cross-chain staking so you do not have to manually un-stake before bridging. Just be sure to verify that the protocol on the destination chain supports the wrapped tokens you are sending.

Several platforms allow the bridging of NFTs, though it is usually a bit more complicated than bridging fungible tokens. Protocols like Wormhole have introduced NFT bridging capabilities, letting you move collectibles between Ethereum, Solana, and other chains. Always verify that the NFT is supported and you have the correct wallet to handle it.

Support for new tokens depends on the bridge’s governance and how quickly they can integrate new smart contracts. Some bridges, like Baltex.io or AllBridge, are proactive in adding trending tokens if there is user demand. Others may wait for community proposals. If your token is brand new, you might have to rely on smaller bridging solutions or wait for official listings.

By now, you can see how cross-chain bridges in 2025 are game-changers for crypto enthusiasts who want to move between ecosystems freely. Whether you are seeking cheaper gas fees, better yields, or access to niche NFT markets, bridging is the key to exploring beyond the boundaries of a single blockchain. Each solution has its pros and cons, so it is worth experimenting with a few to discover which best aligns with your goals.

If you want minimal fuss and an all-inclusive platform, Baltex.io could be perfect for your needs. If you need to connect dozens of networks, you might lean toward Multichain. For speed and easy stablecoin bridging, Synapse could be a top contender. From Hop Protocol’s layer-2 focus to Wormhole’s Solana emphasis, you have no shortage of specialized tools at your disposal.

The future of decentralized finance depends on bringing blockchains together. With the cross-chain bridges covered here, you can take advantage of each network’s unique strengths. Make sure you do thorough research—and possibly some small test transactions—before committing large amounts of funds. By doing so, you will navigate these digital highways with confidence, enjoying broader investment opportunities and a more flexible DeFi journey.